What is gold bullion? It’s physical investment-grade gold in bars or coins that investors use to diversify their portfolios. This article covers the types of gold bullion,the pros and cons of gold investing and what taxes you can expect.

What is gold bullion?

If you’re just getting started with gold investing or any kind of precious metals investing, you might wonder what the term bullion means. It means high-purity investment-grade metals specifically for investing, versus decorative or collectible reasons.

Bullion comes in the form of bars, ingots, and coins. And, you can buy gold, silver, platinum, and palladium bullion. Purity levels are at least 99.5% or higher.

Understanding the bullion market

When you buy gold or silver bullion, you’re buying in an over-the-counter market where supply and demand drive prices. It’s a 24/7 commodity market that falls under the London Bullion Market Association’s standards for quality and market conduct. Demand for gold bars or coins comes from investors, central banks, and even speculative futures contracts.

If you look up the current price of gold or silver, you’ll see the spot price. But when you go to buy physical bullion, you pay more than that with premiums that cover manufacturing, shipping, and dealer costs.

Types of bullion investments

Here’s a quick at-a-glance comparison of bullion coins and bars.

| Detail | Bullion coins | Bullion bars |

| Examples | American Gold Eagle; Canadian Gold Maple Leaf; South African Krugerrand; Australian Gold Kangaroo | PAMP Suisse; Valcambi |

| Sizes | 1/20 oz; 1/10 oz; 1/4 oz; 1/2 oz; 1 oz | 1 g; 5 g; 10 g; 20 g; 1 oz; 10 oz; 100 g; 250 g; 500 g; 1 kg; 400 oz |

| Packaging | Tubes or capsules | Minted bars sealed; cast bars have paper certification |

| Appearance | Struck finish with artwork | Minted bars have sharp edges; cast bars look rustic |

Gold bullion coins

Governments mint gold bullion coins, which have legal tender status. The face value of these coins is usually lower than the actual gold they contain. Their worth comes from the precious metal content, rarity, design, and historical significance.

A few characteristics to know about gold coins are that they have different designs from different government mints, and they come in different sizes.

Popular bullion coins

Some common gold coins for investment purposes include:

- American Gold Eagle

- Canadian Gold Maple Leaf

- South African Krugerrand

- Australian Gold Kangaroo

Bullion coin sizes (weight)

One thing that’s interesting is you don’t have to buy a full 1-oz coin. You can get started in bullion investing with smaller-sized coins. Sizes include:

- 1/20 oz

- 1/10 oz

- 1/4 oz

- 1/2 oz

- 1 oz

Here is what these different sizes look like compared to each other:

Gold bullion bars

As for bars, you can buy two different types, and they also come in several different sizes/weights.

Types of gold bars

The types of bars you can buy include:

Minted bars: Manufacturers cut these from a sheet of rolled gold. A die punches the sheet into blanks of a certain size and weight. They then go through a minting press to create the design and information like the denomination, year of minting, weight, purity, and the country of origin.

These bars come sealed in a protective plastic case that includes the serial number and assayer details.

Cast bars: Manufacturers make them by pouring molten gold into bar-shaped molds and cooling them until they solidify. This creates a rustic finish with rounder edges than minted bars. Manufacturers print the solid bars with their name, weight, purity, and individual serial number.

Sizes of gold bars

The various weights and sizes of gold bars include:

- 1 gram

- 5 grams

- 10 grams

- 20 grams

- 1 ounce

- 10 ounces

- 100 grams

- 250 grams

- 500 grams

- 1 kilogram

- 400 ounces

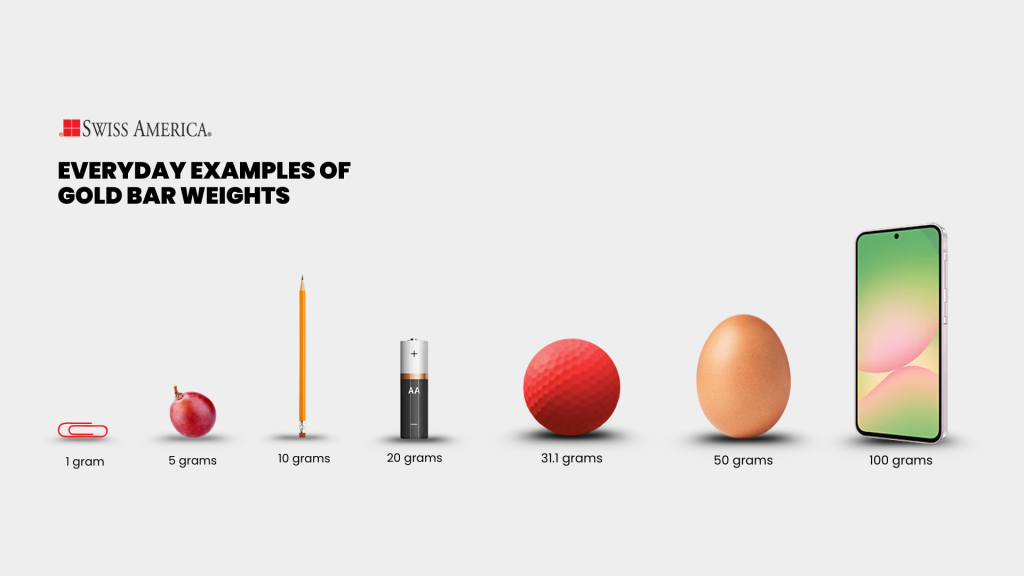

For some of the most common sizes, here is how bullion bars compare to everyday objects:

Paper investments in gold and silver bullion

You can also invest in the bullion market with paper gold. Basically, this means investing in exchange-traded funds (ETFs) that pool funds to buy physical gold bars. The challenge with this approach is that you don’t own the tangible asset. Instead, you own shares that represent a claim on gold held within the fund.

This type of investment has drawbacks, including:

- Counterparty risk: You’re relying on someone else to control the physical bullion, which creates potential risk of mismanagement, or the fund could become insolvent.

- Management fees: You’ll pay fees to the fund’s management that can eat into your returns over time.

- Tracking errors: At times, the ETF’s share price may differ from the actual spot market price of gold.

Benefits of physical gold bullion bars or coins

Why do people look at adding physical gold to their investment portfolio? Key benefits include:

Portfolio diversification

One of the main reasons people invest in physical gold is to add diversification to their overall portfolio. Gold is a completely independent asset. It’s not tied to any currency, it doesn’t follow the stock market, and it doesn’t rely on anyone to perform.

So when you add an investment like gold, it gives you a way to protect a portion of your wealth outside of those normal investment channels.

Inflation hedge

Gold helps protect against inflation risks. The price of gold often rises during inflation, and in some cases, it rises even more than the rate of inflation. Since it’s a physical, tangible asset with real cost, it gives you a way to preserve your wealth when the prices of everything else go up.

Safe-haven asset

Gold is a safe-haven asset. It’s what people turn to when there’s economic uncertainty. It’s where they go when they’re worried about geopolitical risks or the value of the US dollar. Gold’s independence from any single country, and its acceptance around the world, is what makes it the ultimate asset you can hold to protect your wealth if things go wrong.

Drawbacks of physical gold bullion bars or coins

There are some drawbacks to owning physical gold. These include:

No income

Gold doesn’t produce income, so you won’t get dividends or cash flow. You’ll have to weigh that opportunity cost against other investments that do.

Storage

Since gold is a tangible asset, you need to store it somewhere. You can use a home safe, a bank safe deposit box, or a third-party depository. Either way, you just need to account for the storage costs.

Insurance

If you decide to keep gold in a home safe or a bank vault, you’ll also need to think about insurance. It’s just another cost to factor in when you look at the total return on owning gold.

Where to buy gold bullion

You can buy gold bullion and other precious metals from trusted dealers. Look for companies that have been in business for decades and have several positive customer reviews. The best dealers provide education to help you understand the options and details.

Taxes on gold bullion coins and bars

You’ll pay taxes on gold and silver bullion depending on a few scenarios:

Sales taxes

You might have state or local sales taxes depending on which state you live in.

Capital gains taxes

If you sell your gold for a profit in the future, you’ll owe capital gains taxes. That’s normal, but the IRS considers gold a collectible, which means long-term gains can be taxed at a maximum of 28%. One way you can avoid this is if you invest through a Gold IRA.

Taxes and Gold IRAs

You don’t really pay taxes on a Gold IRA while the gold sits inside the account. You may have taxes in the future, and that depends on which route you take. If you have a traditional Gold IRA, you’ll pay taxes when you reach the retirement age of 59.5, and those withdrawals are taxed at your income tax rate at that time.

If you have a Roth Gold IRA, you fund it with after-tax dollars, so you won’t owe additional taxes later.

Final thoughts on gold bullion

If you’re looking at investment-grade gold bars and coins, bullion is the right choice. And, if you are considering a Gold IRA, the IRS only allows you to buy bullion products with this type of account. So, it’s worth understanding what your options are and which precious metals meet your specific requirements.

To learn more about gold and silver bullion investments, connect with the Swiss America team today!

What is gold bullion: FAQs

What’s the difference between gold and gold bullion?

The difference is that gold bullion’s purpose is for investing, and it has a high purity level. Meanwhile, gold is a chemical element you might find in jewelry, electronics, and physical investments.

Is gold bullion real gold?

Yes, gold bullion is real gold. In fact, it’s some of the purest gold available because it’s specifically manufactured for investors. It has a high purity level of around 99.5% or higher. You can also verify the purity via the assay and the manufacturer’s certification.

Is gold bullion 100% gold?

Gold bullion is not 100% gold, but it’s close. Usually, you’ll find gold bullion products at 99.5% pure gold or higher. Most investment-grade gold bullion bars and coins range from 99.5% to 99.99% pure gold, which we refer to as 24 karat or “four nines fine” (99.99% purity).

The information in this post is for informational purposes only and should not be considered tax or legal advice. Please consult with your own tax professionals before making any decisions or taking action based on this information.