When you hear of people buying bullion coins, do you think of collectibles? Or do you think of an investment? Learn the differences between numismatic coins vs bullion gold, silver, or other precious metals.

The U.S. Mint helps new coin collectors get started every day. Those who buy coins as collectibles aren’t necessarily the same people investing in coins. In fact, collecting and investing are two different approaches.

It’s perfectly fine to be drawn to rare coins or special edition collectibles, but it’s not the same as buying bullion to hedge against inflation or protect your wealth.

Numismatic coins vs bullion

Numismatic coins and bullion both contain precious metals, but they differ in value and why people buy them.

What are numismatic coins?

Numismatic coins are primarily collector’s items and have value beyond their metal content due to factors like rarity, age, condition, and historical significance. They can include ancient coins, limited-edition coins, or coins with unique designs.

The value of each collectible coin can change depending on market demand for that specific coin. Examples include rare or limited-edition coins like:

British Sovereign

Swiss 20 Francs

In the Reddit r/Numismatics forum, collectors discuss different coins and options. Most of them understand that collecting numismatic coins bullion is a hobby and not an investment. Consider a post by BosJC sharing:

“The best investment you can make is educating yourself on the areas of the hobby where you’re interested (sounds like ancients, for you). Armed with information, you’ll be more likely to buy items that are more likely to appreciate in value over time. In general, rarer and sought-after items have historically done the best. Personally, I focus on enjoying the hobby, and any appreciation in value is simply a bonus.”

What are bullion coins?

Bullion coins have value strictly because of their precious metal content. Their price closely follows the spot price in the market, making them a great way to invest in the metal itself. Some popular examples are:

Canadian Gold Maple Leaf

South African Krugerrand

Australian Gold Kangaroo

Chinese Gold Panda

Why investors buy bullion coins

Investors may avoid numismatic coins because collectible items can be a more volatile investment. Most of the reasons why people buy bullion instead include:

1. Hedge against inflation

Investors consider gold, silver, and other precious metals an asset that can protect against inflation. When the purchasing power of paper money declines, the price of bullion usually rises. This is due to the limited supply, which makes these assets less susceptible to devaluation. People trust bullion as a store of value that retains its worth, even when inflation weakens other forms of investment.

As one Reddit user from the r/Investing forum, Squezeplay, points out: “Gold has scarcity, so its “appreciation rate” will just be its adoption as a store of value / money in relation to the availability of goods & services and the speculation around its value in the future. Speculation can be powerful making gold volatile. People view it as a hedge against inflation simply because its impossible to create gold, while its very easily to expand the supply of fiat currencies.”

2. Global liquidity

One of the most attractive features of bullion is its global liquidity. Countries and people recognize and value gold and silver coins around the world, which makes it easier to buy or sell.

This level of liquidity lets you convert bullion into cash quickly when needed.

3. Safe-haven investment

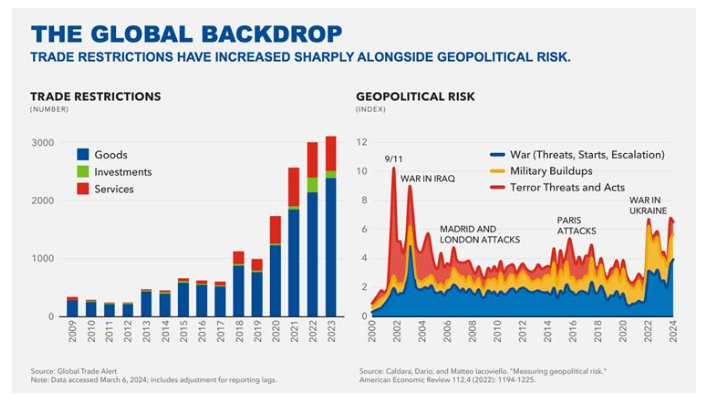

During times of economic or geopolitical uncertainty, people turn to bullion as a safe-haven asset. Investors tend to go for gold and silver when there are concerns about stock market volatility, currency devaluation, or political instability. We see this right now with rising conflicts and trade restrictions.

4. Supply and demand

The limited supply of gold and silver drives the value of bullion. These precious metals can’t be produced or inflated like paper money, which makes them a naturally limited resource. Combine this scarcity with consistent demand, and prices increase.

Buyers of gold include:

Industries like jewelry, electronics, aerospace, and dentistry.

Central banks.

Investors.

5. Wealth preservation

Bullion is one of the most reliable tools for preserving wealth over the long haul. Its value doesn’t depend on the performance of companies, governments, or economic systems. This is a key difference between bullion coins versus stocks, bonds, and real estate investments.

How to buy bullion coins

If you want to buy a tangible asset like gold, here are the steps to get started:

Step 1: Choose a dealer

Start by finding a trustworthy dealer. Consider companies like Swiss America, which has been in the business for several years with thousands of happy customers. Reputable dealers also belong to professional trade organizations that support ethical practices and quality metals.

Step 2: Buy coins

After you’ve chosen your dealer, it’s time to buy. The price of a bullion coin changes with the market, so check the spot price before making a purchase. Be sure to ask about any extra fees, such as shipping or taxes, so you don’t have any surprises.

Step 3: Decide on storage

If you buy coins in a rollover retirement account like a 401(k) rollover or a traditional IRA, your self-directed IRA custodian arranges for storage.

If you’re just buying silver or gold coins with other funds, you can store them wherever you want.

Step 4: Monitor your investment

Precious metal prices can go up and down depending on the economy and other factors. By checking the current value of your bullion from time to time, you can decide when to hold or sell.

Here’s a quick overview of what to focus on when purchasing bullion coins:

| Buying factor | What to check | Why it matters | Spot price plus a reasonable premium |

|---|---|---|---|

| Dealer reputation | Established dealers with transparent pricing | Reduces risk of overpaying or scams | Buying from unverified sellers |

| Coin type | Popular government-minted bullion coins | Easier to sell and widely recognized | Choosing obscure or thinly traded coins |

| Pricing | Reduces the risk of overpaying or scams | Helps you know what you’re paying for | Paying high collector-style premiums |

| Storage | Home safe or insured depository | Protects value after purchase | Leaving coins unsecured |

Why investors choose Swiss America

If you’re considering purchasing gold and silver coins, consider a trusted dealer like Swiss America. With over 40 years of experience, we’ve helped thousands of satisfied clients with their physical precious metal investments.

Here’s what you can expect when you partner with us:

Expert guidance: We offer professional advice on secure storage options, precious metals IRAs, and staying informed on market trends so you can make the best decisions for your investments.

Buy-back program: Our buy-back program lets you sell your metals back to us, making it easy to trade between gold and silver if needed.

Online access: You can view your account anytime to track the value of your holdings and review your purchase and sale history.

Bullion vs numismatic

Just as your house may not always be an investment, but you still enjoy it, numismatic coins may not always be an investment, either. While you might see a return, it’s not the same as buying purely for their gold or silver content. If collecting coins brings you joy, that can be reason enough to pursue it.

If you want to learn more about how to get started in precious metals investing, connect with the Swiss America team today!

Numismatic coins vs bullion: FAQs

Are coins considered bullion?

Yes, people consider coins as bullion if they are made from precious metals like gold or silver and trade primarily for their metal content. Investors use these for investment purposes rather than as collectible coins.

What’s the difference between bullion and proof coins?

People buy bullion coins as an investment for their precious metal content. Specially minted-proof coins have a higher level of detail and a mirror-like finish.

Do numismatic coins go up in value?

A numismatic coin can increase in value but it’s more unpredictable than bullion because it depends on collector interest, historical importance, and market trends.

Note: The information in this post is for informational purposes only and should not be considered tax or legal advice. Please consult with your own tax professionals before making any decisions or taking action based on this information.