No matter what asset class you are investing in, it’s always a good idea to compare options. Precious metals are no different and it’s good to ask if silver or gold is a better investment. Just like all the other major asset classes, you’ll want to consider your strategy and check how these investments perform during different market cycles.

This article compares gold and silver as investment options for 2026, breaking down key factors like price trends, risk, and market performance. It gives you details to help you decide which precious metal fits your investment strategy.

This article can help answer the question, is silver or gold a better investment for your portfolio in 2026?

Gold investing 2026

If you are looking to buy gold this 2026, expect prices 10–20% higher than late 2025. Why is that? There’s a combination of reasons, but it all comes down to demand. People consider physical gold to be a safe-haven asset and a store of wealth in an uncertain world.

We definitely have uncertainty right now. Here in the United States, the Federal Reserve battled rising inflation and has started lowering interest rates, but it’s unclear if we can avoid a recession. Meanwhile, the stock market reacts to every jobs report, major earnings call, and any sign things aren’t going well.

That’s why experts recommend holding a portion of your investment portfolio in gold bars and coins. It’s a way to hedge your bets in a tangible asset that reacts differently to bad news and actually shines in times of crisis. Goldman Sachs Research strategists Samantha Dart and Lina Thomas recently stated “In this softer cyclical environment, gold stands out as the commodity where we have the highest confidence in near-term upside.”

Silver investing 2026

Silver can be a store of wealth but it’s more tied to what is happening with the economy than gold. This is because silver prices depend more on industrial demand and the silver supply. When production slows because of less consumers purchasing electronics or solar panel cells, the silver price drops.

The Silver Institute forecasts show sustained global demand growth for silver amid ongoing supply deficits. This dynamic continues to support upward pressure, positioning silver prices for potential 20–40% gains in 2026 compared to late 2025 levels.

Gold vs silver

If you are looking at gold and silver coins or bars, which are the best precious metals investments for 2026? Here’s a few considerations:

Investment amount

You can buy almost 84% more silver than gold right now for your money. Say you have $10,000 to invest, you can buy 313.28 ounces of physical silver bullion or you can buy 3.73 ounces of gold.

To visualize this, a 1oz gold bar is about the size of a postage stamp so you’d have 3 of these bars. 313.28 ounces of silver would fill about 93% of a 1-liter water bottle. You could also buy larger silver bars if you wanted to reduce the bulk.

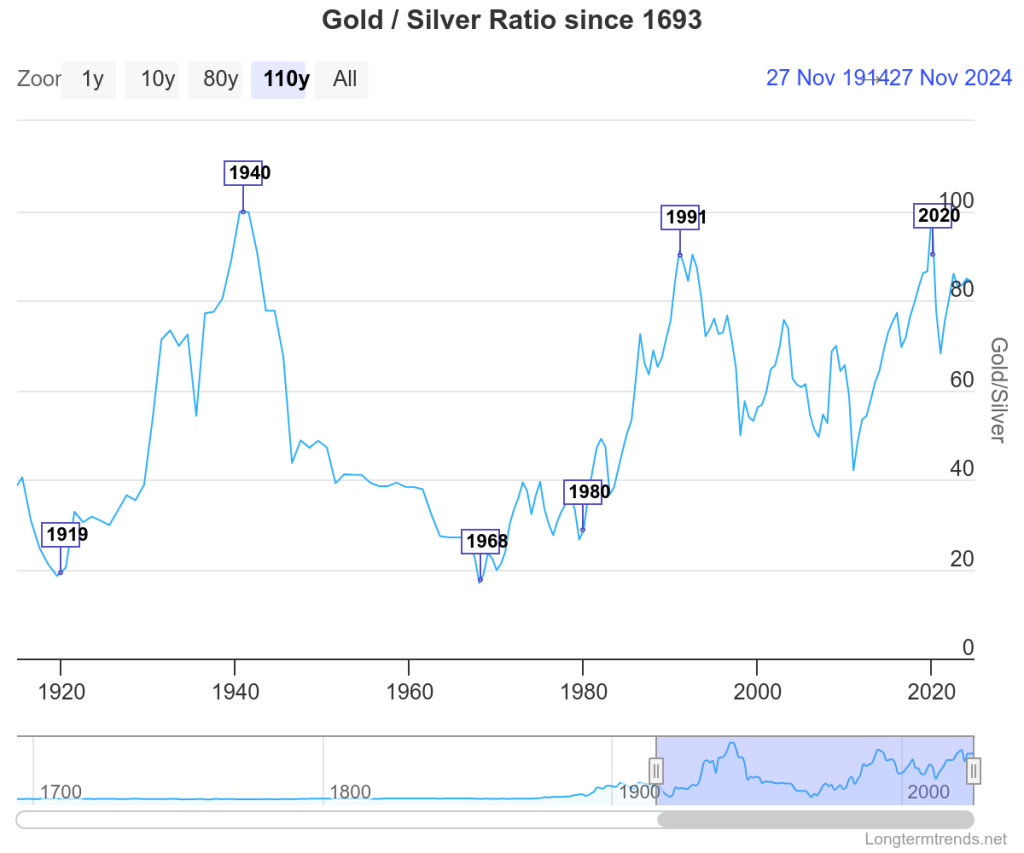

Some investors use a strategy of looking at the silver ratio to decide when to buy gold vs silver. With the current silver ratio to gold of 84, many investors consider silver undervalued so they’ll buy silver now and then switch to gold if the ratio drops.

Which is better – gold vs silver? It depends on how much you plan to invest and if you want to actively watch prices to trade between gold and silver.

Risk tolerance

You should also consider your investment objectives and risk tolerance. Gold investments are more of a store of wealth and you may not see shorter term high returns but you’ll have a steady asset. But silver’s volitatlity can mean that you make more on your investment if you buy during the right time.

You can see how other investors feel about the risk between gold and silver as user AndalusianChad shared on r/gold:

“Gold is always the ‘safest’ bet since it is easier to transport for its value/weight ratio and more people are willing to trade it. If every Central Bank and many private investors around the world are stacking it must be for a good reason. If you have no problem with space, then silver can be good too, plus it is heavily used in certain industries so it has an extra value that gold doesn’t have. In any case, there is no optimal ratio, silver swings more in price over time so if you are looking for a not so long-term investment you can focus on that. Gold is more stable and I see it as something to hold potentially for life and just sell it if you are in economic troubles.”

Which is better – gold vs silver? If you have a lower risk tolerance, gold is a better choice due to its stability. If you’re comfortable with more volatility and the potential for higher returns, then silver is the better option for you.

Market downturns

If you want a safer investment asset during market downturns, gold is your better bet. It’s less dependent on industrial demand, a trusted asset that people count on to protect their wealth, and easier to sell when the time comes.

Which is better – gold vs silver? If you want to create a diversified portfolio with physical precious metals and you worry about what might happen with the market, gold is your better bet.

Long-term performance

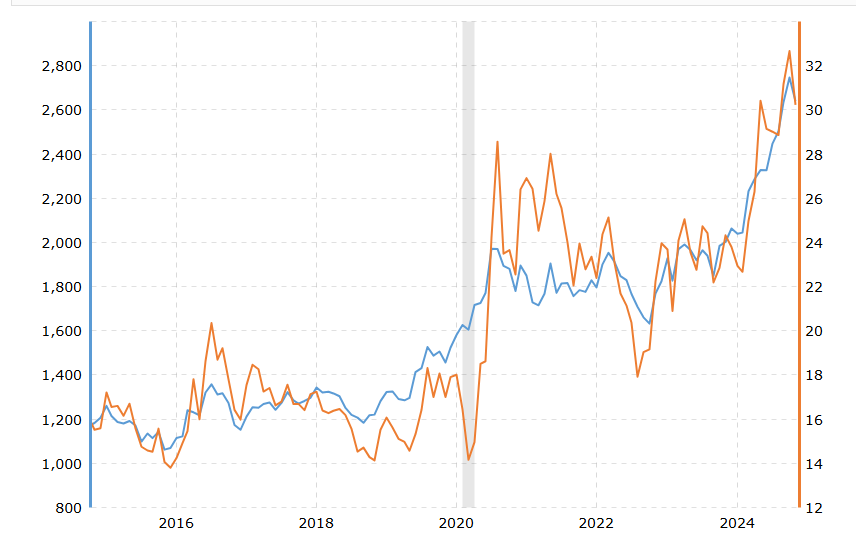

Gold performs better than silver for long term investors. This historical chart from Longtermtrends shows overall performance against other asset classes. As you can see, there was a major dip in silver prices in 2020, while investors who held gold saw more stability.

Which is better – gold vs silver? If your financial advisor says that you need to diversify with a long-term investment, gold is the better option.

Here’s a side-by-side summary to make it easier to compare at a glance:

| Factor | Gold | Silver | Investor insight |

|---|---|---|---|

| Price volatility | Lower, steadier store of value | Higher, more price swings | Gold is easier to hold during uncertainty; silver may offer bigger percentage gains with more risk |

| Affordability | Higher cost per ounce | Much lower cost per ounce | Silver allows larger physical ounces with less capital |

| Market drivers | Driven by safe-haven and central bank demand | Tied to industrial use and economic cycles | Silver’s performance links to both industry and investment demand |

| Best use case | Wealth preservation and stability | Growth-oriented with volatility | Choose based on risk tolerance and goals |

Paper vs physical assets

Most of our discussion so far is about owning gold or silver physical assets. If you’re looking at paper precious metals assets like stocks, bonds, or exchange-traded funds, these have different implications for investors. With paper assets like mutual funds or mining stocks, you don’t get the benefit of:

No counterparty risk

Part of the reason investors want to own precious metals is because they want an asset that doesn’t rely on anyone else to perform. If you invest in mining stocks, you need the company to perform. If you invest in ETFs, you need the market to perform. With gold and silver, you don’t rely on a third-party to meet their committment.

Stock market correlation

Both gold and silver have a moderately weak correlation with the stock market. Gold is especially considered a better diversifier than silver. If you own paper assets, an economic downturn can greatly impact its value.

No cyber risk

This is a growing area of concern for investors since cyberattacks, or just plain technology issues, continue to increase. If you own physical precious metals, you don’t need an internet connection, a secure password, or an internet portal to access, manage, or protect your assets.

Why Swiss America for precious metals

Whichever precious metals you decide to buy, you’ll want to work with a reputable dealer like Swiss Amercia. We’ve been in business for over 40 years and have helped thousands of happy clients buy gold and silver.

You can expect expert guidance including free resources and education on how precious metals investing works. It doesn’t matter if you are planning to buy physical assets inside of an existing IRA, rollover your 401(k) or buy outside of retirement funds, we can help guide you. We’ll also provide recommendations on storage options to protect your metal investments.

And, when you work with us, you can expect easy access to see the status of your gold and silver investments in real time. Our customer portal also provides investment recommendations and value estimates if you decide you want to liquidate your assets.

Silver or gold investing, which is better?

Whether gold or silver is the better choice really depends on your situation. We’ve outlined key differences to help you understand these investments and why some investors might prefer one over the other.

Now, it’s up to you to take the next step. Connect with our team today to get answers to your questions and the information you need to make the best decision.

Is silver or gold a better investment? FAQs

Will silver be worth more than gold?

It’s unlikely that silver becomes worth more than gold because of gold’s rarity and stronger demand as a store of wealth. Silver’s price depends more on industrial demand, which can fluctuate.

Does Warren Buffett invest in gold or silver?

Warren Buffett typically invests in assets that generate cash flow, like stocks and businesses. However, in the past, Buffett did invest in silver through Berkshire Hathaway because he saw an opportunity with supply and demand dynamics at the time.

Is there a better investment than gold?

The best investment depends on your goals and risk tolerance. Gold provides stability during uncertainty, but stocks, real estate, and bonds can provide higher returns in a strong economy. Diversifying across multiple assets is a solid strategy.

Note: The information in this post is for informational purposes only and should not be considered tax or legal advice. Please consult with your own tax professionals before making any decisions or taking action based on this information.