As of this writing, the price of gold is up about 50% from a year ago. Silver is up over 69%. So, if you’re looking at investing in gold and silver, do you go with both? Or do you choose one over the other? And, how much do you allocate?

This article answers those questions and gives you all the details you need to get started.

Why invest in precious metals?

Both gold and silver have a track record of protecting wealth through wars, recessions, and currency resets in a way few other assets can match. Gold and silver have been used as currency and an investment for thousands of years. That’s why they are easy to buy and sell on global markets.

Here’s why you may want to add physical coins and bars to your portfolio:

- Wealth preservation: Both precious metals have a long history of holding purchasing power even when fiat currency weakens. Investors use gold and silver as hedges against inflation, protecting their wealth from the eroding effects of rising prices.

- Diversification: Gold and silver can move differently from stocks, real estate, or bitcoin. This helps you reduce risk in your portfolio during the volatility of other asset classes.

- Crisis protection: Gold is a key safe haven asset during economic uncertainty or times of crisis. Silver often holds up as well, especially since it also has industrial uses.

- Global recognition: People recognize gold or silver almost anywhere in the world, so it’s easy to sell when needed.

- Legacy value: Gold and silver coins and bars are tangible assets that you can pass on to your heirs.

Comparing gold and silver bullion

Gold and silver have different economic roles. This shows up in their behavior as investments. If you’re deciding between them or thinking about owning both, the main difference is demand. Gold prices tend to rise in times of financial market uncertainty. Silver prices rely more on industrial uses.

Gold: The steady store of value

Gold is primarily a monetary asset. People turn to it in times of financial uncertainty because it tends to hold value when currencies or markets are unstable. Investors use gold to balance out their portfolios and reduce exposure to stock market volatility or inflation.

Gold price increases come from investor, central banks, and government demand. The price of gold is usually steadier with less rapid changes than silver prices.

Silver: Dual purpose and more volatile

Silver has multiple uses. People keep as an investment, but it’s also in manufacturing industries like electronics, solar energy, and medical equipment. That gives it a different risk-reward profile than gold.

If there’s an economic downturn that reduces demand for products that use silver, prices can drop. This makes silver tied to economic growth, whereas gold does better during down times.

Silver costs less per ounce than gold. As of this writing, the gold-to-silver ratio is 80.02, which means it takes around 80 ounces of silver to buy one ounce of gold.

Here is a summary comparison between the two:

| Factor | Gold | Silver |

|---|---|---|

| Price volatility | Lower | Higher |

| Affordability | High cost per ounce | Lower cost per ounce |

| Industrial use | Minimal | Key driver of silver price |

| Market demand | Driven by investors, banks | Driven by investors and manufacturers |

| Historical stability | More consistent | More cyclical |

Why investors own both

Many investors have both in their portfolio. It’s a way of diversifying within your precious metals holdings. If you look at what’s happening right now, two major global banks just predicted gold to reach 5000 an ounce in 2026. They point to US monetary policies and concerns about the value of fiat money.

Over the past 15 years, gold has performed more strongly than silver, further solidifying its role as a stable investment. But, you can still balance gold out with silver. It continues to see demand because it’s in short supply.

- Gold to stabilize your portfolio.

- Silver to give you a more affordable option for growth.

How much should you invest in precious metals?

There’s no one-size answer as to how much, but most investors look at a 5% to 15% allocation to balance other risks in their portfolio. Work with your financial advisor to decide based on your:

- Risk tolerance: If you’re more of a conservative investor, you might start with a 5-10% allocation. But if you’re more aggressive, you might follow Ray Dalio’s recommendation of 15% or more.

- Time horizon: Like every investment asset class, you can be more aggressive if you have longer until retirement.

- Other holdings: Take into account your other investments and if holding precious metals can balance out risks.

How to invest in physical gold and silver

If you’re looking to own physical gold or silver, here’s how to get started:

Step 1: Decide which precious metal to buy

You can buy physical gold and silver:

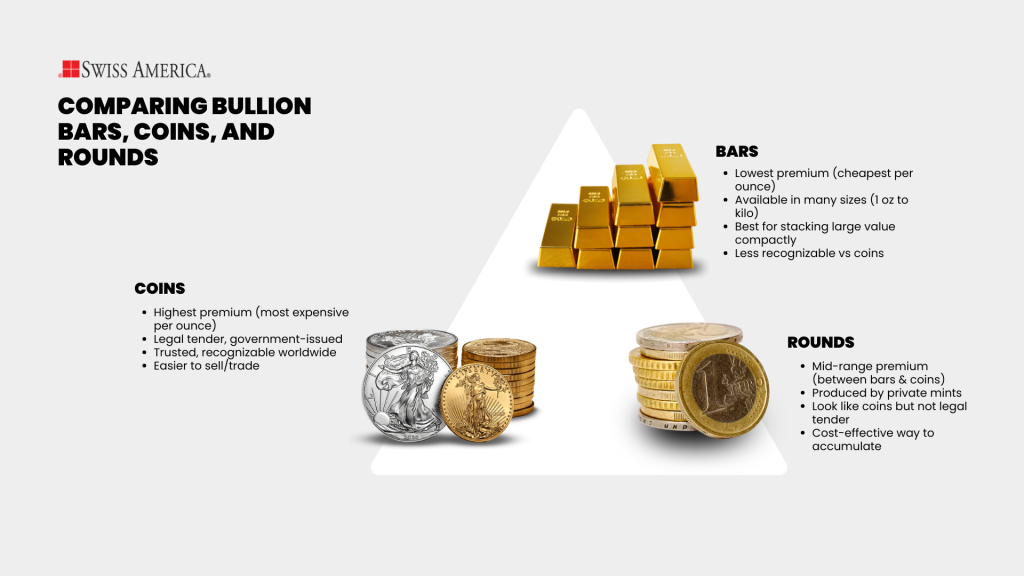

- Bullion bars: These cost less per ounce because they carry a smaller premium over the metal’s spot price. Gold and silver bars come in several different sizes, from small one-ounce bars to large kilogram bars. Bullion bars are a form of physical bullion that is easily recognizable and authenticated.

- Coins: Gold and silver coins are legal tender produced by national mints. Some of the most popular coins are U.S. Eagles and Canadian Maple Leafs. If you go the silver or gold coin route, they have higher premiums but can be easier to sell or trade later.

- Rounds: Rounds look like coins but aren’t legal tender. Private companies produce them, and they can also be a cost-effective way to own precious metals.

Step 2: Find a reputable dealer

Avoid precious metal scams by working with a reputable dealer. To make sure you’re buying silver or gold bullion from a legitimate dealer, look for:

- Dealers with long-standing reputations and a physical address in the U.S.

- They should be affiliated with trade groups.

- Look for positive customer reviews.

- Avoid high-pressure sales tactics. If someone’s pushing rare coins or “once in a lifetime” deals, walk away. Stick to widely known products with published precious metal prices.

Step 3: Verify authenticity and purity

Verify that you’re buying legitimate gold and silver by checking for:

- Mint marks and hallmarks: Coins should show their issuing mint and face value. Bars and rounds should be stamped with weight, purity (like .999 or .9999), and refiner info.

- Ask for a certificate or assay: Bars come with an assay card from the manufacturer that verifies purity.

- Buyback policy: Ask about the dealer’s buyback policy so you can sell your gold and silver if needed in the future.

Step 4: Verify your metals when you get them

Once your gold or silver arrives, inspect it immediately. Make sure the packaging is intact and not resealed. From there, check to see if the weight matches the size. Look for stamps, serial numbers, mint markings, and surface quality.

Finally, make sure you receive the right quantities of precious metals that you ordered. And, keep your receipts and shipping confirmations in case you ever decide to sell or need to prove ownership for insurance purposes.

Storage and security for precious metals

Once you’ve made your purchase, the next question is – where are you going to store it? Here are the best options.

Home storage

Many first-time investors decide to keep their metals at home. This gives you direct access and zero ongoing storage fees. Get a high-quality safe. Look for models that are fire-resistant and that you can bolt into concrete or a foundation.

The challenge with home storage is the potential for theft risk. You also might have limited space, and you’ll need to buy extra insurance to cover your gold and other precious metals.

Bank safety deposit boxes

You can also go with a safe deposit box at your bank. This is secure since only you have access, and your precious metals stay off-site, where no one knows your exact holdings.

A drawback is that you have to follow the bank’s schedule. If you need access after hours or on weekends, you’re out of luck. Also, the bank doesn’t insure your metals, and they don’t fall under the FDIC. You’ll need to add private insurance if you want coverage.

Professional vault storage

These are secure third-party facilities built specifically to hold precious metals. You can place your gold or silver holdings in commingled storage or segregated storage, which keeps your exact bars or coins separate from others.

Depositories also include insurance in their fees, and it can cover theft, loss, or natural disasters.

The downside is you’ll have annual storage fees plus extra paperwork when you want to make withdrawals.

| Storage Option | Pros | Cons |

|---|---|---|

| Home safe | Full control, instant access, no fees | Theft risk, limited space, not always insured |

| Bank safety deposit box | Secure, external storage, low cost | Limited hours, no insurance, crisis risk |

| Depository | Highest security, insured, good for large holdings | Annual fees, less direct access, and paperwork |

Using Gold and Silver IRAs

Silver and Gold IRAs are a way to invest in gold and silver for retirement. These precious metals IRAs are a type of self-directed individual retirement account that lets you hold physical metals instead of stocks and bonds. You’ll get all the same tax advantages as traditional or Roth IRAs.

There are some IRS rules to be aware of, including:

- You’ll work with a custodian to manage your account.

- There are specific approved metals.

- You can’t store your gold and silver investments at home.

What about buying gold or silver in a brokerage account?

Regular brokerage accounts give you access to paper gold and silver investments like gold ETFs or stocks in mining companies.

- Gold or silver ETFs: These exchange-traded funds hold physical gold or silver in a secure vault. You buy shares, but you don’t own the physical gold bullion.

- Gold or silver mining stocks: Regular stocks of publicly traded mining operations. You’re investing in the company’s ability to find gold, extract it, and sell it. Buying stock in gold and silver mining companies offers exposure with the potential for dividends and higher returns, but is more volatile than investing directly in metals.

- Gold and silver futures: Futures contracts and options let investors speculate on the future price of gold or silver. This route is complex and has significant leverage risk. Small price changes can create large gains or wipe out your position quickly.

Risks of investing in precious metals

There are downsides to investing in physical precious metals.

- No income: The biggest drawback is that gold and silver don’t produce income. The value of your investment depends entirely on appreciation and market prices.

- Volatile: Both gold and silver can be volatile, especially when investors start to feel better about the economy or investing in other assets.

- Storage: Owning physical bullion can incur ongoing costs for storage and insurance, which can affect your overall returns.

- Taxes: If you sell your precious metals at a profit, you’ll have capital gains tax unless you use a precious metals or Gold IRA investment vehicle.

Selling physical gold and silver

Gold and silver have a strong resale market, especially if you stick to well-known products like government-minted coins and name-brand bullion bars. Reputable dealers will buy back what they sell at a small markdown from the current market price.

You can sell silver or gold coins and bars to:

- Local coin shops or bullion dealers.

- Online dealers with buyback programs.

- Private buyers.

Taxes on precious metals

Depending on your state, you may pay sales taxes on gold or silver bars. And if you buy gold or other metals outside of an IRA, you may pay higher capital gains tax when you sell.

Here’s what to keep in mind:

- Short-term gains: If you sell in less than one year, your gains get taxed as ordinary income.

- Long-term gains: The IRS considers gold and silver collectibles and caps long-term capital gains at 28%.

You can deduct losses to offset other gains, just like with stocks.

Final thoughts on precious metals investing

No one knows what the future might bring. Adding precious metals to your portfolio gives you a defense strategy and a way to reduce risk. Gold and silver have different investment purposes, and holding both can be a great way to prepare for whatever comes next.

To learn more about gold or silver investing, connect with the Swiss America team today!

Investing in gold and silver: FAQs

Is gold and silver really a good investment?

They can be. Gold is a more stable investment but silver can have higher gains due to industrial demand.

How much will $10,000 buy in gold?

As of this writing, gold prices are about $4,500/oz, which means you can buy about 2.22 ounces of gold bars or coins.

Will silver hit $100 an ounce?

It’s possible. Silver is currently $50/oz, and growth in markets like solar panels and electronics could drive prices higher.

The information in this post is for informational purposes only and should not be considered tax or legal advice. Please consult with your own tax professionals before making any decisions or taking action based on this information.