As of this writing, silver prices are about 53% higher than the same time last year. Even so, it’s a more affordable precious metal. It’s also different than gold since it has industrial uses that drive demand.

If you’re wondering how to invest in silver, this article covers physical and paper options.

Overview of silver investing

We work with people all the time who want to buy silver to diversify their portfolio from the volatility of stocks and as a hedge against inflation. Lately, investors are also looking to hold silver or gold as a way to protect their wealth against currency debasement.

The interesting thing about silver is that it has industrial uses in electronics, electric vehicles, and solar panels.

Benefits of investing in silver

Key reasons why investors look at owning silver are:

| Reason for investing in silver | Benefit to investors |

| Hedge against inflation | Keep your purchasing power over time |

| Limited supply/growing demand | Scarce resource that can increase in value |

| More affordable than gold | Easier to purchase silver at around $48/oz vs gold which is about $4,000/oz |

| Portfolio diversification | Add precious metals to offset other investments like stocks, real estate or bitcoin |

Details on these benefits:

- Inflation hedge: Silver can be a hedge against inflation. Let’s look at November 2020 to November 2025. During that time, the Consumer Price Index rose by about 64%. Meanwhile, the price of silver rose about 71% during this same period. Silver has been a good investment during this time.

- Industrial demand: The renewable energy movement is a boon to silver. Many of the major products, like solar panels or parts in electric vehicles, use silver. This demand also comes at a time when silver is in short supply because of less mining activity.

- Affordability: Silver is one of the more affordable precious metals compared to gold or platinum. It’s a good way to gain exposure to the asset class without forking over $4,000 + per ounce.

- Portfolio diversification: You may not want to have all your savings tied to the stock market, real estate, or other traditional investments. Owning physical silver gives you a way to diversify and protect a portion of your portfolio to offset volatility in these investment types.

Types of silver investments

There’s a few different ways you can invest in silver.

Investing in physical silver

You can own the physical metal. This includes silver coins or bars and gives you a tangible investment that you control. Details include:

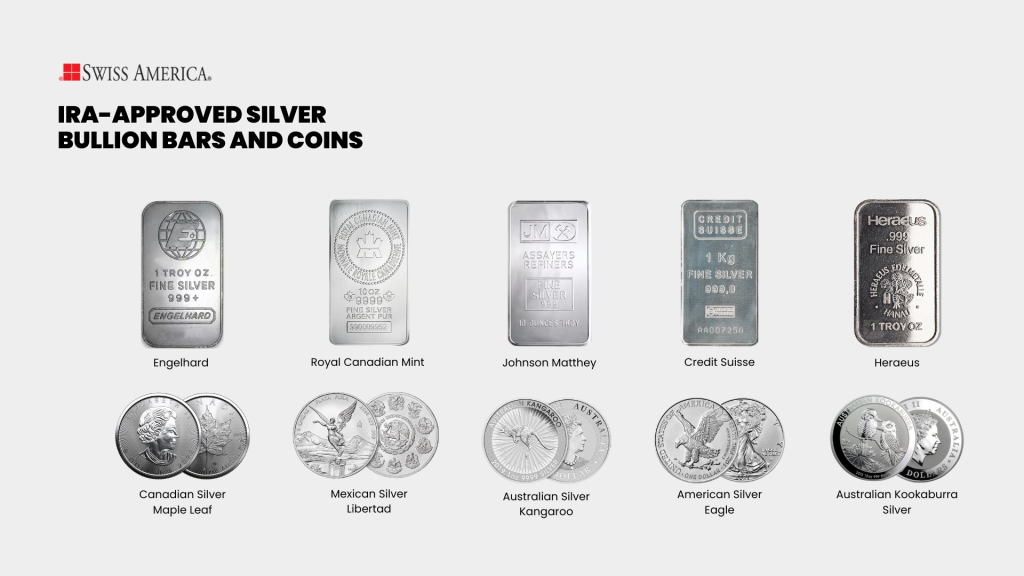

- Silver coins: Many investors like to own silver coins from government mints. Some of the most popular coins include American Silver Eagles and Canadian Silver Maple Leafs. You can buy them from dealers or directly from mints. Their value follows the current silver price.

- Silver bars: Another option for physical silver is bullion bars. They come in several different sizes and are usually less per ounce than coins. This is because they don’t have intricate designs, and you can benefit from buying in bulk.

With all physical precious metals, you will pay a premium over spot prices, which covers manufacturing and dealer margins. You’ll also have shipping fees and sales taxes depending on where you live.

Finally, you’ll also need to plan for storing your precious metals in a home safe, bank deposit box or a depository.

Examples of silver coins and bars include:

Investing in paper silver assets

If you don’t want to own physical silver, you can look at paper options like stock or mutual funds. Note that with some of these, your returns can vary unrelated to silver prices since you’re relying on the companies involved to run successful operations.

- Silver ETFs: Exchange-traded funds pool funds to buy silver at a value. You get a share that tracks the price of silver, and you can sell your shares on the stock market.

- Silver mutual funds: These funds pool investor money to buy several silver-related assets, including mining stocks and physical silver.

- Silver futures: With these investments, you speculate on future silver prices. Futures contracts allow you to use leverage, but there’s a ton of risk and potential for losses beyond the initial investment.

How to buy silver coins or bars

Start by finding a reputable dealer to buy silver bullion. Look for a company that’s been in business for decades, has positive customer reviews, and provides helpful information about silver investing.

If you’re looking to buy silver with your retirement accounts, like an IRA or a previous employer plan, be sure to work with a dealer who can guide you on these options. Mainly, you’ll need to know the specific IRA-eligible silver coins and bars you can buy and the steps to get your investment account set up.

You’ll also want to watch what’s happening in the silver market. A good place to get the latest news is on the Silver Institute website. The site shares details on supply/demand, investor surveys, and what’s happening with silver industrial uses.

Risks and considerations of owning physical silver

Like all investments, there are risks and disadvantages to keep in mind with silver and other precious metals. Specifically:

- Volatility: Silver prices can be volatile. If there’s a decrease in industrial demand, this can drop the market price. You should keep watch on various trends and consider using dollar cost averaging to add to your silver holdings at different market rates.

- Economic factors: When the economy is doing well, silver, gold, and other precious metals generally become less attractive. This is because investors move into other assets that have a higher yield.

- No income: Silver doesn’t produce income. You won’t see cash flow or yield. Instead, your returns come from price appreciation.

- Storage and insurance: You’ll need to consider storage options and costs as part of your overall financial analysis. And, if you store your bullion at home or in a bank vault, you’ll also need to buy insurance coverage to protect against theft or damage.

Tax considerations of silver investing

If you sell precious metals at a gain after holding for one year, you’ll incur capital gains taxes, which could be as high as 28%.

An exception to this is if you have silver inside a gold or precious metals IRA. With that type of account, you can avoid capital gains as long as you follow the IRS rules.

How much silver should you own?

We get this question a lot about silver and gold investing. Check with your financial advisor to create a balanced portfolio that incorporates some precious metals to help reduce risks associated with traditional investments. Some of the approaches you can take include:

- 5%-15%: This helps you diversify and put a portion of your portfolio in precious metals.

- 1/3 rule: Within the precious metals category, you may want to allocate 1/3 to gold and the remaining amount to silver and platinum.

- Gold-to-silver ratio: Some investors use this ratio, which compares the number of ounces of silver it takes to buy one ounce of gold. If the ratio is between 50 and 70, it’s balanced. Anything higher or lower means that silver is either inexpensive or very expensive.

Here’s a quick review of these allocation scenarios:

| Approach | How much to put into precious metals |

|---|---|

| Basic diversification | Around 5-15% of your portfolio |

| 1/3 precious metals rule | One third in gold, the rest split between silver and platinum |

| Gold to silver ratio | Add more silver when the ratio is high, less when it’s low |

Are silver investments right for you?

To figure out if silver makes sense for you, take a look at your current portfolio and how much risk you’re carrying in stocks, bonds, and other traditional assets. Think about how much you’d want to allocate toward precious metals and how that aligns with what you’re trying to accomplish financially over the next few years.

If silver sounds interesting, connect with the Swiss America team today. We’ll review your situation and help you decide if precious metals should be part of your plan.

How to invest in silver: FAQs

What is the best way to invest in silver?

The best way is with physical silver bullion bars or coins. This gives you an asset you can control that has measurable, lasting value. The top five options for each include:

- Coins: American Silver Eagle, Canadian Silver Maple Leaf, British Silver Britannia, and Australian Silver Kangaroo.

- Bars: Royal Canadian Mint, PAMP Suisse, Perth Mint, Valcambi, and Credit Suisse.

Is it wise to invest in silver now?

As of this writing, silver is up over 50% from a year ago. So is it still a good time to buy? Timing the market is tough, but what you can do is look at what’s happening across the broader economy, global silver demand, and precious metals in general. Check out:

- Silver Institute: In-depth research reports on silver supply, demand, and market trends.

- U.S. Energy Information Administration: Data on renewables and energy trends that impact industrial silver demand.

You can also use dollar cost averaging to buy silver over time on a regular schedule. This spreads out the price you pay for it and takes some of the pressure off timing the market.

Is buying silver a good investment?

Yes, silver can be a good investment. Its price can be volatile, so you should look at it as a long-term investment to protect your wealth from inflation, crisis, or economic recessions. If we do a quick comparison of silver prices against inflation over the past 15 years, you can see:

- 2020-2025: Silver prices rose over 70% and outpaced inflation.

- 2015-2020: Silver prices were flat to slightly negative with lower inflation rates.

- 2010-2015: Crisis demand drove up the price of silver to a high point with 74%+ growth in 2011, but dropped by 2015.

The information in this post is for informational purposes only and should not be considered tax or legal advice. Please consult with your own tax professionals before making any decisions or taking action based on this information.