In early October 2025, silver’s spot price hit over $50/ounce. If you want to buy some, how much does a silver bar weigh? And how do you decide what brand or type of bar to purchase?

These bars can weigh between 5 grams and 1000 troy ounces (62.5 lbs). But most people buy between 1oz and 10 oz bars. This article covers the various weights, bar types, manufacturers, and what to think about before you buy.

Silver bar weights and sizes

Silver bars are blocks of pure silver that come in different sizes. They’re rectangular bars with stamps showing their weight, purity, and manufacturer. For everyday investors, the most common sizes are:

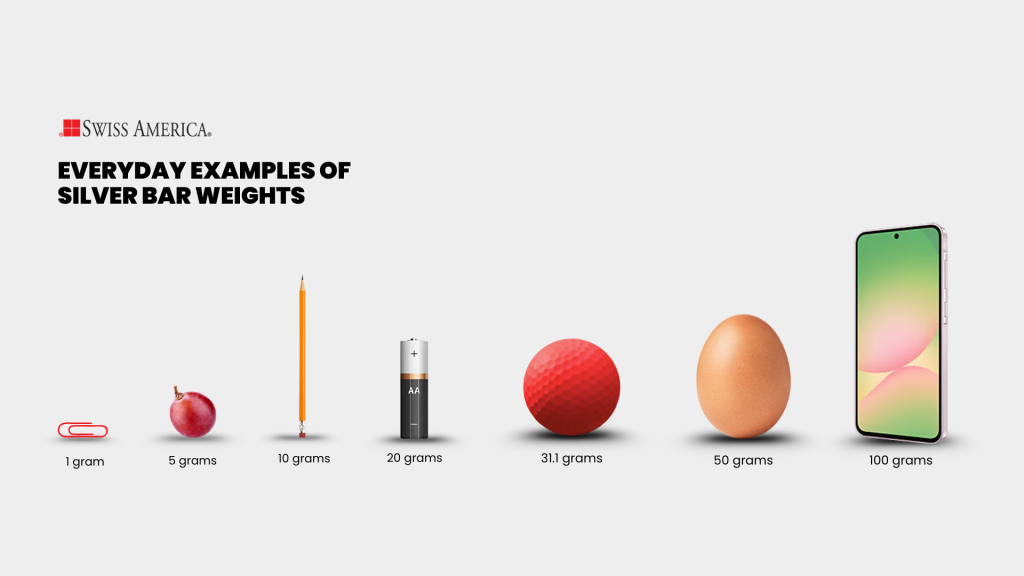

- 1 gram

- 5 grams

- 10 grams

- 20 grams

- 31.1 grams (one troy ounce)

- 50 grams

- 100 grams

Small silver bars are easier to trade or sell since they are in increments that are more affordable for other investors. Large silver bars have lower premiums because they cost less to manufacture per ounce.

Here’s how each silver bar’s weight compares to everyday objects:

Silver bar basics

Most bars are shiny minted bars, but the larger 100 oz silver bars are poured bars. The differences between the two are:

- Poured bars: The manufacturer makes these by pouring molten silver into molds or casts to shape the bar. Molten silver bars usually have a matte or rougher finish.

- Minted bars: These are made from thin sheets or strips of pure silver. The manufacturer then cuts the sheets, rolls them to the desired thickness, and stamps them with a design.

Here’s a quick comparision:

| Detail | Minted silver bars | Poured silver bars |

|---|---|---|

| Manufacturing | Stamped or pressed from a silver sheet | Molten silver poured into molds |

| Appearance | Smooth, shiny, highly detailed surface | Textured, rougher surface, less uniform |

| Design detail | Complex logos, inscriptions, security features | Simpler, less intricate designs |

| Cost | Higher premiums due to detailed finish | Lower premiums due to simpler process |

| Sizes | Bars up to 10 oz | Large bars like 100 oz and above |

Purity standards for silver bars

The purity level of a bar tells you the minimum amount of pure silver it has. Most popular silver bars have 99.9% pure silver, which is .999 fine or higher. You may find higher-purity bars from manufacturers like the Royal Canadian Mint or PAMP Suisse, which are 99.99% pure. These are rarer and carry a higher premium.

The manufacturer also stamps the bars with their purity, weight, manufacturer’s mark, and a serial number or batch identifier.

Why do different sizes matter for silver bullion bars?

Silver bullion bars come in different sizes to match the investor’s needs.

- New buyers: You can buy silver bars as small as 1 gram. As of this writing, the current spot price of silver is about $48/ounce, 1 gram at spot would be $1.54, so it’s a very affordable price point to start investing in silver.

- Storage and portability: Sometimes investors want small silver bars because of storage or portability. Maybe your home safe only holds so much, or maybe you want to be able to easily carry your silver bars with you.

- Liquidity when reselling: Because they’re at more accessible price points, smaller bars can be easier to sell to a larger market of buyers when the time comes.

- Premiums over spot price: Larger quantities like 10 oz silver bars and above can have a lower cost per troy ounce since you’re basically buying in bulk.

How are silver bars measured?

Silver and other precious metals use troy ounces instead of regular ounces. This measurement system goes back to medieval France and became the standard for trading valuable metals.

The troy ounce is slightly heavier than a regular ounce, and it’s what miners, refiners, and investors all use globally. It equals about 31.1 grams. When you Google “current price of silver,” that quote is the spot price per troy ounce.

This measurement differs from the avoirdupois ounce, which is used for most other products in the U.S., which weighs about 10% less than the troy ounce.

Which silver bars are best for your investment portfolio?

So, where do you start with adding silver products to your investment portfolio? The answer depends on your investment goals and current scenario:

- New investor: If you’re new to investing in precious metals like silver, you may want to start with smaller bars. You might also want to look at silver coins, which you can also buy in smaller amounts.

- Long-term stackers: Some investors buy small amounts of silver coins or bars over time in different increments. The goal here is to build up a reserve as a way to protect wealth and hedge against economic uncertainty.

- Investors preparing for bulk storage: If you’re looking to build up a bigger reserve of silver and other precious metals, this is when larger bars might make sense.

Popular silver bars

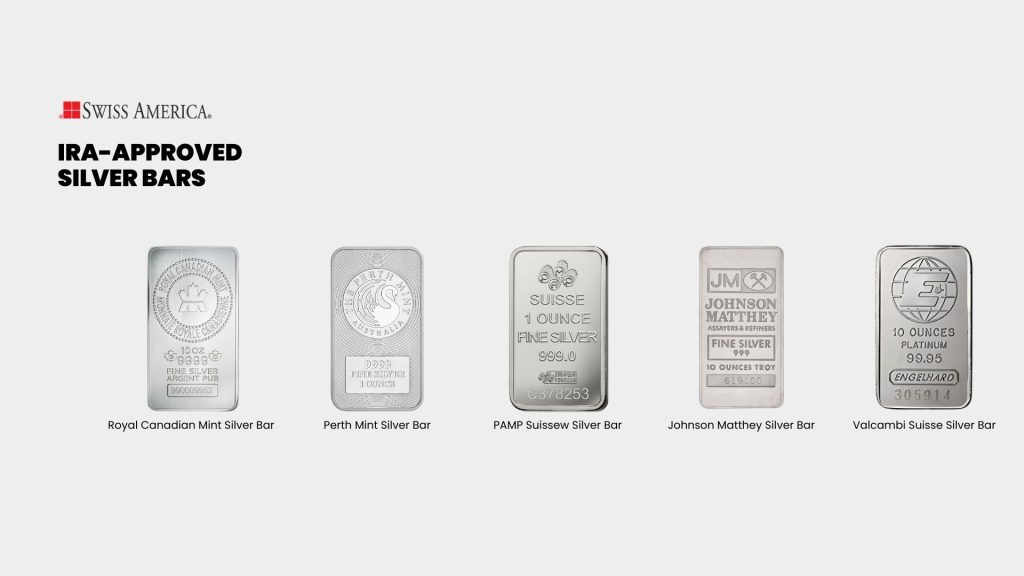

Some of the most popular silver bars that also meet IRS requirements for a Silver IRA include:

- PAMP Suisse: PAMP Suisse is a premium Swiss refiner. All of their silver bars include unique serial numbers, tamper-proof packaging, and Veriscan fingerprint technology.

- Royal Canadian Mint: This is a government-backed mint with high trust and security.

- Johnson Matthey: Manufacturer known historically for high-quality silver bars.

- Valcambi: This Swiss manufacturer also has its own brand and produces a large selection of bars for other brands like Credit Suisse.

- Perth Mint: Government-backed Australian mint that produces silver bars in various sizes.

All of these manufacturers produce quality bars that are IRA-eligible:

Where to buy silver bars in different sizes

You can buy silver bullion bars from reputable mints or gold dealers. Here are the differences between the two:

- Gold dealers: Dealers buy and sell precious metals like gold, silver, and platinum. A trusted dealer provides education and resources to help you decide which silver or other metals to buy. They can also provide guidance on leveraging retirement savings to set up a gold and silver IRA.

- Government mints: Mints produce gold and silver bars. They guarantee purity, weight, and quality. They’re also focused on maintaining the integrity of their brand in the market.

Common pitfalls when choosing silver bars

Some things to look out for when you buy silver bars, coins, or other precious metals:

- Overpaying for premiums: Work with a reputable gold dealer to make sure you get the best price on the metals you buy. Dealers that have been in business for decades with several customer reviews are your best bet.

- Ignoring storage and security: You’ll need a place to store your silver. Home safes or a bank deposit box can work for smaller bars, but for larger amounts, you may want to look at a precious metals depository.

- Buying unfamiliar private mints: It’s best to stick with well-known brands or government mints where you know you’re getting a quality product.

Which silver investment bars should you buy?

Start with how much you have to invest and where you’ll store it. Then look at different weights to fit your scenario.

Silver bars come in so many sizes and give you flexibility. You can start small with a one-ounce bar or go bigger if you want more value in less space. There’s no single right answer. It depends on your budget, your goals, and how you want to hold your metal.

To learn more about your options, connect with the team at Swiss America. They can help you find bars that fit your specific needs.

How much does a silver bar weigh? FAQs

What weight of silver bar is best for beginners?

For beginners, one-ounce silver bars are the best bet. This is because they’re:

- Affordable

- Easy to store

- Simple to sell

Why do some bars cost more than others?

When you purchase silver bars, there can be differences in the premiums. This is due to:

- Brands: Some brands have a higher premium than others. For example, PAMP Suisse bars have a higher premium than Valcambi.

- Sizes: Smaller oz silver bars have a higher premium because of the individual product costs compared to large silver bars.

How can I verify the weight and purity of a bar?

Always buy silver or other precious metals from a reputable dealer. Then, to verify the weight and silver content, you can:

- Check markings: Most silver bars have official stamps with the weight, purity, and manufacturer logo.

- Assay certificate: Bars from well-known refiners and mints usually come sealed with an assay certificate that verifies the weight, purity, and authenticity.

- Home scale: You can use a small digital scale to check the weight of the bar.

- Magnet test: Silver is not magnetic, so it should not stick to a magnet.

The information in this post is for informational purposes only and should not be considered tax or legal advice. Please consult with your own tax professionals before making any decisions or taking action based on this information.