Silver always comes after gold at the medal podium when you’re watching the Olympics. But, does this apply to the investment world as well? If you’re wondering is platinum better than silver, we’ll cover the differences and how to make the best choice for your investment portfolio.

As of this writing, platinum costs $1050/oz, and silver costs $33/oz. Does that mean platinum is better? Not necessarily. Pricing and overall value comes down to supply and demand, which we’ll cover for both metals.

Keep reading to get the information you need to make the best choice for your situation.

Platinum overview

Platinum is a shiny, silvery metal that is highly stable and resistant to corrosion. This precious metal has lots of commercial uses, and you can find it in industrial sectors like:

Electronics

Automotive

Lab equipment

Fine jewelry

Platinum is actually much rarer than both gold and silver. In fact, the National Physical Library estimates that all the platinum ever mined would fit in a 2000-square-foot home. Platinum’s rarity is one of the reasons why it has a higher cost per ounce than silver.

Investors like platinum because it’s known for holding value. But, it doesn’t necessarily have a history of surging in value like other metals. Take a look at the historical increases of platinum versus silver and gold from 2019 to late 2024:

Platinum 4.7%

Silver 20.32%

Gold 22.7%

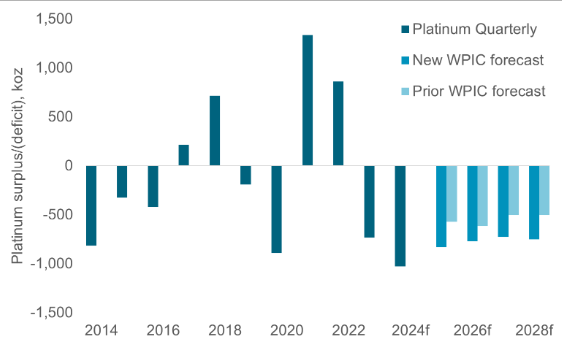

The Platinum Investment Council forecasted a 1,028 kilo ounce deficit in 2024.

Silver overview

Silver is a soft metal that has captured humanity’s interest for decades. Pure silver is too soft to be used by itself, so manufacturers combine it with other metals to form an alloy known as sterling silver. Both natural silver and sterling silver have a wide range of industrial uses like:

Solar energy

Electric vehicles

Medicine

Electronics

The Silver Institute estimates that we’re in a silver deficit for the fourth year in a row. This is due to continued demand and how difficult it is to actually mine silver.

Here’s a quick glance at how platinum and silver compare:

| Aspect | Platinum | Silver | Impact for investors |

|---|---|---|---|

| Rarity | Much rarer in nature | Far more abundant | Rarity tends to support a higher per-ounce value for platinum |

| Typical price (per oz) | Higher (~$1,050/oz) | Lower (~$33/oz) | Silver can be more accessible for newcomers |

| Industrial demand | Auto & industrial uses | Solar, EVs, electronics | Different demand drivers can affect performance |

| Historical return snapshot | Lower recent gains | Higher recent gains | Past performance doesn’t guarantee future results |

Benefits of investing in precious metals

Here’s why people invest in metals like platinum and silver:

Diversification

Prices for metals don’t always follow the same trends as other assets like stocks, bonds, or real estate. Putting a portion of your portfolio into these assets can help reduce your risk if there’s an economic crisis.

You can look at the history and see that during the COVID-19 panic in 2020 the stock market lost roughly 30% of value while gold and other metals actually increased.

Hedge against inflation

Many people look at metals as a way to protect their wealth from inflation. Gold, silver, and platinum can rise in price at a pace that’s consistent (if not higher) than inflation. This is because metals have real value due to their limited supply.

Independent asset

Many people like that these two metals are independent and tangible assets. If you own platinum or silver bars and coins, your investment doesn’t rely on any government, bank, or other institution for your asset to perform. This complete independence gives you peace of mind and de-risks your portfolio.

Platinum vs silver: which is the better investment?

This answer will ultimately depend on your financial goals, risk tolerance, and time horizon. We lean towards silver over platinum right now because of its cost, track record and its uses in sustainable energy which is a growing field.

Both metals also have a wide range of industrial use cases which drives market demand for both metals outside of investors. That said, you’ll want to keep an eye on which metals have use in emerging technologies like artificial intelligence and self-driving cars.

If silver or platinum emerge as required metals for a growing technology, then their value could quickly skyrocket.

Buying platinum or silver

You can buy platinum and silver from reputable dealers. Both metals come in various forms, including:

Bars: Bars come in several sizes, from 1 gram to 400 ounces. The most common sizes are 1 oz bars, 10 oz bars, and 100 gram bars. Investment-grade bars have high purity levels and include a stamp with their weight, purity, and serial number.

Coins: Silver or platinum bullion coins come in smaller denominations than bars, which gives you more flexibility.

Rounds: Rounds are privately minted pieces of silver or platinum that resemble coins but are not legal tender. These investment products are a slightly more cost-effective way to invest in precious metals than coins.

Precious metals outlook

Regardless of whether you’re interested in platinum or silver, experts at Goldman Sachs expect a rosy future ahead for precious metals. The investment bank recently raised its price target for gold to $3000/oz by the end of 2025, which might also be a positive sign for both silver and platinum.

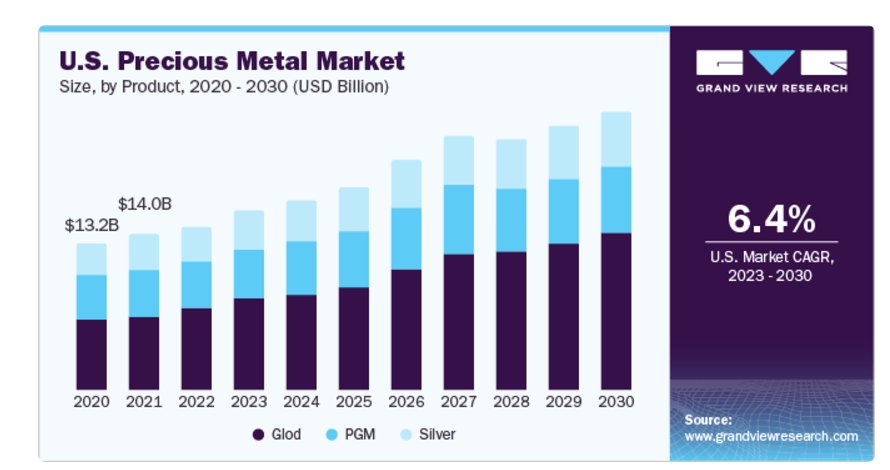

Precious metals have grown increasingly popular in recent years, mainly due to increased economic uncertainty and the continued conflicts in Europe and the Middle East. Grandview Research predicts this precious metal market to grow at a CAGR of 6.4% through 2030.

Why work with Swiss America

We’ve worked with thousands of happy customers over the past 40 years to help them choose the best precious metal investments for their needs. Reasons why customers rely on us for their platinum, silver, and gold include:

Education: Customers enjoy access to many educational resources like our in-depth guides, regular podcasts and daily news updates.

Transparency: Our upfront pricing and information on other costs like sales tax, insurance, storage and even how to leverage retirement funds to invest in gold, silver and platinum.

Credentials: Confidence in our commitment to industry standards and providing the highest quality metals.

Platinum vs silver final thoughts

Both platinum and silver can help protect your wealth against inflation or an economic recession. The metal that is right for you will ultimately depend on your personal investment preferences. To learn more, connect with the Swiss America team today.

Is platinum better than silver: FAQs

Is it better to buy silver or platinum?

This depends on many factors but if you think that demand for solar and EVs will grow, silver is the better investment.

What is a better investment, silver or platinum?

The answer depends on what you believe has the most potential. Silver demand continues to increase for use in solar and electronic vehicles. Platinum demand comes from catalytic converters in gas-powered vehicles. Both metals have limited supply and current forecasted deficits.

Note: The information in this post is for informational purposes only and should not be considered tax or legal advice. Please consult with your own tax professionals before making any decisions or taking action based on this information.