Gold prices keep rising. If you’re looking to invest, should you buy gold coins or bars? This article covers both options and what to consider before you decide.

Our own data shows that 97.6 percent of investors prefer coins over bars, so coins are clearly the more popular choice. Even so, both options have a place depending on your goals.

Comparing gold coins to gold bars

Looking at both options, here’s a quick comparison and our detailed explanations of both:

| Area to consider | Gold coins | Gold bars |

| Premiums | Higher premiums | Lower premiums |

| Liquidity | Easier to sell | Harder to sell |

| Storage | Easy to store | Often need vault storage |

| Flexibility | Small, divisible sizes | Large sizes, less flexible |

| Taxes | Same tax rules | Same tax rules |

| Authenticity | Easy to verify | Require certificates |

Premiums

The price you’ll see online when you Google current prices of any precious metals is the spot price. When you go to buy from a dealer, you’ll pay a premium that covers the costs of production, refining, and distribution expenses.

Gold coins carry higher premiums compared to gold bars. This is due to more detailed manufacturing proceses, easier liquidity. legal tender status and government mint branding. Bars don’t have intrictate designs and have lower premimums as it’s kind of like buying gold in bulk.

Bottom line: Gold bars are more cost-effective than gold coins.

Liquidity

If you go to sell gold bullion coins and bars at the same time, it’s likely that the coins sell first. This is because dealers, collectors, and investors recognize and value them all over the world.

Bars aren’t as popular with retail investors. Large-scale investors, like central banks, dominate the gold bar market. So, you might see less quick selling opportunitites. The exception is that many dealers will buy back precious metals that you buy from them which gives you an option when it’s time to sell.

Bottom line: Gold bullion coins are more liquid than bars.

Storage and security

You can store your gold coins at home or in a bank safety deposit box. Since they are small and portable, it’s easy to transport them and even keep them in a few different places to minimize the risk of loss.

With bars, if you buy larger sizes, you’ll need to consider professional storage. This could be storing your assets with an insured bullion dealer or a high-security vault.

Bottom line: It’s more cost-effective to store gold coins safely compared to bars.

Size and divisibility

Both gold coins and bars come in several different sizes. You can get a 1-oz coin or even fractional sizes like 1/10 oz. If your investment strategy includes building through small incremental investments like dollar cost averaging, coins win here.

Gold bars come in sizes like 1 oz, 5 oz, 10 oz, and up to 400 oz. Depending on the size of bars you buy, you can’t sell portions of them when you want to liquidate part of your holdings. So, while gold bars give you bulk purchase lower premiums, coins give you flexibility for smaller transactions.

Bottom line: Gold coins are better for everyday investors who want flexible purchases and sales.

Tax and legal considerations

Precious metals purchases might be subject to sales tax, depending on which state you live in. You’ll also pay capital gains tax on gold bars and coins if you make money when you sell them. The IRS classifies precious metals as collectibles, which means you’ll have a maximum capital gains rate of 28%. If you don’t make a profit, you’ll have no tax liabilities.

Another government regulation to be aware of is reporting. If a single cash transaction for gold bars or coins exceeds $10,000, the precious metals dealer must report it to the IRS.

Bottom line: Both coins and bars can result in sales and capital gains tax.

Purity and authenticity

The highest purity for gold coins and bars is 99.99% pure gold. You’ll also hear people refer to this as 24-karat gold. If your investment goals for gold include adding it to your retirement funds, you can do this with a Gold IRA as long as the coins or bars have this level of gold content and meet other IRS requirements.

Government mints usually mark coins with anti-counterfeiting features like micro-engraving to make them easier to verify. This makes it easy to confirm the authenticity of gold coins through visual checks and weight comparisons.

Bars also have purity markings, but may require more sophisticated testing methods to confirm their authenticity. This is why bars come with assay certificates or a certificate of authenticity, which reduces the risk of counterfeit bars. These official guarantees provide verification of the gold bar’s purity, weight, and manufacturer.

Bottom line: It’s easier to verify the authenticity of gold coins yourself than bars.

Gold bullion bars and coins explained

Both bars and coins are forms of gold bullion. This is basically physical gold that you hold for investment purposes. Bullion has no numismatic value or what sometimes people say a “coin’s worth” to collectors. Instead, its value comes from its actual metal content rather than any collectible or historical significance.

Gold bars

For the basics, gold bars are rectangular pieces of gold. Reputable mints like PAMP Suisse, Valcambi, and Perth produce gold bullion bars in various sizes, from 1 ounce to over 100 ounces. Our chart below shows the various sizes of gold bars you can buy:

Gold coins

Gold coins usually come from government mints. Almost all of them contain one troy ounce of gold, but you can find exceptions. Popular products here include:

- American Gold Eagles

- Canadian Gold Maple Leafs

- South African Krugerrands

They also come in different sizes from 1/10 oz to a full 1-ounce coin:

The benefits of buying gold coins and bars

Why would you want to invest in gold coins or bars in the first place? Just like with any investment, it’s a good idea to learn about how it works before making your first purchase. The more information and data-backed reasons you have, the more comfortable you’ll feel about investing your money.

Potential capital appreciation

One of the benefits of investing in gold is capital appreciation. As of December 2025, gold trades around $4,500 per ounce, compared to just $280 per ounce back in 2000. That move represents more than a 1,000% increase over the past 25 years.

Even if you started investing more recently, you’d see strong returns. Throughout 2020, the spot price of gold averaged about $1,770 an ounce. Today, those same holdings are worth nearly double. It’s easy to see how much an investment in gold can grow depending on when you entered the market.

It’s best to think of any gold investment as a long-term strategy. Gold usually keeps its value but shows the most growth over decades. Investors who’ve stayed the course have seen gold steadily reward patience.

Crisis hedge

Another good reason to invest in gold is its historical track record of acting as a crisis hedge, especially during currency crises, economic uncertainty, and political instability.

Gold’s track record during financial crisis

If we look at the 2008 financial crisis, gold rose from about $850 an ounce to over $1,900 in 2011. This gain of more than 120% came as investors moved into gold to protect themselves from the banking system instability and the fallout in the stock market.

The same thing happened during the COVID-19 pandemic. Gold prices rose from $1,400 an ounce in the beginning of the year to $2,070 an ounce by August 2020. This roughly 40% increase in just a few months came during the time when there was so much uncertainty.

Gold’s track record during currency crises

Looking at current market updates, central banks bought more than 1,000 metric tons of gold in 2024, and the World Gold Council saw a similar pattern for 2025. Government treasuries kept adding to their gold holdings to protect against currency devaluation, a weaker US dollar, rising debt, and global tensions.

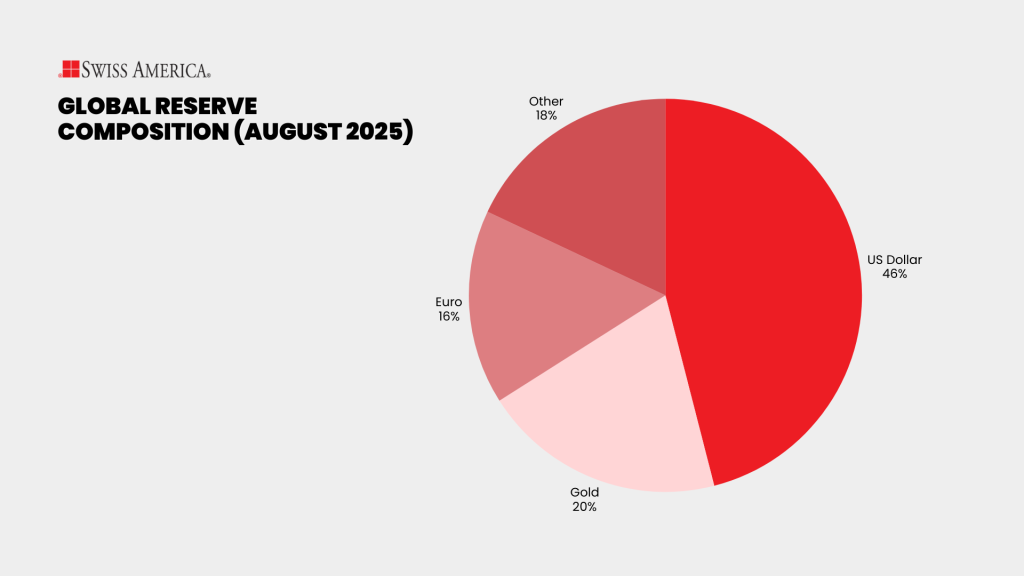

As of mid-2025, gold made up 20% of global reserves. This is more than the Euro’s 16% and about half of the US dollar reserves, which are around 46%.

Reliability

Owning tangible gold bars and coins also gives you a sense of security, unlike paper gold assets. Your wealth cannot go under because of a corporate bankruptcy or banking system failure, as we often see during crises.

There’s been questions around gold ETFs and whether they actually hold enough physical gold to back every share. During the 2020 pandemic, many gold mining companies saw their stocks tumble as operations shut down. For example, Barrick Gold dropped nearly 40% in just a few weeks even though the price of gold itself kept climbing.

It’s the same story with company-specific risks. In 2022, Newmont Gold Mining Company saw its shares fall more than 25% in a single quarter after reporting weaker production and higher costs, even though gold’s spot price stayed steady. The metal itself didn’t lose value, but the stock did.

When you own a physical gold coin or bar, it can’t declare bankruptcy, miss earnings, or get caught in a tax fight. It’s just gold, and it’s yours.

Portfolio diversification

If you’re buying gold or other precious metals for portfolio diversification, gold is a best value bet. It usually moves independently from, and sometimes opposite to, stocks and bonds. During the 2008 financial crisis, while the S&P 500 crashed 38.5%, gold rose more than 120% from around $850 an ounce in 2008 to over $1,900 by 2011.

The math backs this up. Gold’s correlation with the S&P 500 sits around 0.09, which shows how it has very little connection to stock market performance. Its relationship to bonds is slightly negative.

That’s why gold works so well to diversify your wealth. Stocks rely on earnings and economic growth, while gold responds to monetary policy, inflation, and safe-haven demand when confidence drops.

The risks of buying gold coins and bars

You should also know the potential risks of buying gold bars and coins, including price swings and extra costs.

Volatility

Gold prices can move around in the short term, but they’re generally more stable than other precious metals like silver, platinum, or palladium.

If you look at gold’s history, you’ll see sharp drops followed by strong recoveries, especially during periods of crisis. Those swings often set up new record highs.

Investors who bought at the 2011 peak, around $1,900 an ounce, had to wait nearly a decade before gold broke through that level again in 2020. If you try to time purchases or think only short-term, you’ll miss out on the long-term gains.

Additional costs

Beyond price risk, physical gold bars and coins come with extra costs that you should keep in mind. This includes storage and insurance for your gold or other precious metals. Account for these costs in your overall investment projections and strategy.

How to invest in physical gold or other precious metals

The first step in buying gold is to decide which form of gold or other metals you want to start with. Consider how much gold you want to own based on your overall investment strategy and risk tolerance.

Next, look for reputable dealers who guarantee authenticity and can guide you through the entire process. This step helps you avoid scams or counterfeit products.

Consider storage options as well to protect your metals and keep your investment safe.

Final thoughts on gold investment options

You can’t go wrong with gold bars or coins and the final decision comes down to your specific needs and situation. To learn more about getting started with gold investing, connect with the precious metals specialists at Swiss America today.

Gold coins or bars: FAQs

What are the disadvantages of gold coins?

Coins come with higher premiums than bars, but they’re easier to sell and buy in smaller amounts, which is useful if you’re stacking gold steadily.

What is the smartest way to buy gold?

The smart way to buy gold is through a trusted dealer, as part of a diversified portfolio, and with a long-term mindset.

Are gold coins or bars easier to sell?

Generally, coins are easier to sell because they’re widely recognized, produced by government mints, sometimes legal tender, and available in smaller amounts.

The information in this post is for informational purposes only and should not be considered tax or legal advice. Please consult with your own tax professionals before making any decisions or taking action based on this information.