Gold’s been on a roll this year. As of this writing, it’s up over 50% per ounce compared to the same time last year. That means a lot of new investors are looking to invest in gold. One of the easiest ways to start is to go with bars, and here are our picks for the best gold bars to buy in 2026.

Introduction to Gold Investing

There are a lot of reasons to own gold. If you look at what’s happening right now with tariffs, global tensions, and higher inflation, it’s no surprise investors are turning to gold investments. It’s a way to preserve wealth, own a tangible asset, and diversify your investment portfolio.

Benefits of gold bars

When it comes to what form of physical gold is best, high-quality gold bars are usually the better deal. They have lower premiums than coins since you’re basically buying in bulk.

They’re also easier to store and stack in a safe, bank vault, or depository.

Top 5 gold bar brands to buy

The most popular investment-grade gold bars you can buy right now are:

1. PAMP Suisse gold bars

PAMP Suisse gold bars are among the most recognized choices for serious investors because of their quality and distinctive artwork.

They’re famous for their Lady Fortuna design, which depicts the Roman goddess of fortune. Released in 1979, it was the first gold bar to feature a decorative image rather than a plain surface.

Key facts about PAMP Suisse gold bars

- Reputation: Luxury/premium Swiss refinery.

- Purity: 99.99% and even 99.999% pure gold options.

- Design: Known for detailed designs and themed collections.

- Security: Proprietary Veriscan® technology.

- Premiums: Higher than most brands.

- Best for: Premium buyers who care about brand and design.

Example PAMP Suisse gold bar

Behind the brand

- Produces investor education like “The Precious Pod” podcast.

- Publishes annual forecast and trend reports.

2. Valcambi Suisse gold bars

Valcambi gold bars have a clean, minimalist design and low premiums. One of their standout innovations is the CombiBar. It’s a gold bar that can be broken into smaller 1-gram pieces.

Valcambi is one of the largest precious metals refiners in the world and even supplies gold bars to other brands.

Key facts about Valcambi gold bars

- Reputation: Trusted Swiss refinery known for efficiency and precision.

- Purity: 99.99% gold.

- Design: Simple logo and refinery stamp.

- Security: Sealed CertiCard packaging with serial numbers and holograms.

- Premiums: Lower than most premium gold bars.

- Best for: Investors focused on low premiums and practical utility.

Example Valcambi gold bar

Behind the brand

- Publishes sustainability, certification, and product catalogs on its website.

3. Perth Mint gold bars

Australia’s official government mint produces Perth Mint gold bars. Investors know them as high-quality bars with a government-backed guarantee.

Key facts about Perth Mint gold bars

- Reputation: Government-backed Australian mint.

- Purity: 99.99% gold.

- Design: Perth Mint swan logo on front and kangaroo pattern on the back for most bar sizes.

- Security: Tamper-evident assay card with serial number and official government seal.

- Premiums: Moderate, usually lower than PAMP Suisse but slightly higher than Valcambi.

- Best for: Investors who want a government-backed bar.

Example Perth Mint gold bar

Behind the brand

- The mint has an active YouTube channel showing the latest gold coins and bars.

- You can also find annual reports on sustainability and certifications on its website.

4. Royal Canadian Mint gold bars

The Royal Canadian Mint is Canada’s official government mint. It produces both coins and gold bars.

Key facts about Royal Canadian Mint gold bars

- Reputation: Government-owned refinery.

- Purity: 99.99% gold.

- Design: Maple leaf logo on the front, plain back with simple text.

- Security: Sealed assay card and unique serial number.

- Premiums: Moderate. Higher than Valcambi but lower than PAMP Suisse.

- Best for: Investors who want a government-backed gold bar.

Example Royal Canadian Mint gold bar

Behind the brand

The mint provides educational resources on its website and YouTube channel.

5. Credit Suisse gold bars

Credit Suisse is not a manufacturer of gold bars. It’s a brand name for bars made by Valcambi Suisse. These gold bars originally came about because of Credit Suisse’s banking and precious metals trading business.

In March 2023, Credit Suisse collapsed during the banking crisis and was taken over by UBS.

Key facts about Credit Suisse gold bars

- Reputation: Long-standing Swiss financial institution name.

- Purity: 99.99% gold.

- Design: Credit Suisse logo on the front, no artwork on the back.

- Security: Sealed assay card with matching serial number on the bar.

- Premiums: Moderate. Higher than Valcambi but lower than PAMP Suisse.

- Best For: Investors who want a well-known Swiss bar without paying for artwork or luxury branding.

Example Credit Suisse gold bar

Behind the brand

- Since Credit Suisse is a brand, it doesn’t produce educational materials. However, you can find gold and other precious metals investing resources on the UBS website.

Here is a summary of our recommendations on the best gold bars to buy:

| Brand | Design (front/back) | Premiums | Made by |

| PAMP Suisse | Lady Fortuna / plain | High | PAMP refinery |

| Valcambi | Valcambi logo / plain | Low | Valcambi refinery |

| Perth Mint | Swan logo / kangaroo pattern | Moderate | Government of Western Australia |

| Royal Canadian Mint | Maple leaf / plain | Moderate | Government of Canada |

| Credit Suisse | Credit Suisse logo / plain | Moderate | Brand (made by Valcambi) |

What to consider when buying gold

When you’re buying gold bars, it’s best to stick with well-known brands and mints like the ones mentioned earlier. That ensures you’re getting quality bars that are recognized around the world.

These investment-grade bars have to follow strict standards regarding shape, weight, and purity.

You’ll also want to factor in the additional costs that come with owning physical gold. These include:

- Premium: The spot price is what you see on the open market. The price you pay when buying gold bars or coins is higher because it includes a premium. That extra amount covers manufacturing, shipping, and dealer costs.

- Storage: You’ll need a safe place to store your gold. That could be a home safe, a bank vault, or a secure precious metals depository.

- Insurance: If you keep your gold at home or in a bank, look into insurance coverage in case of theft or damage.

- Taxes: Depending on where you live, your state may require sales tax on gold bullion. And if you don’t hold your gold in a precious metals IRA, you could owe capital gains tax when you sell for a profit.

- Shipping: An oz gold bar weighs 1 troy ounce which is around 31.103 grams. Shipping and insured delivery costs $20-$35 for these smaller gold bars.

Gold bars vs gold coins

If you’re trying to decide between gold bars and gold coins, it mostly comes down to what you like and how much you’re looking to invest. Both have their own benefits depending on your goals.

Here’s a simple breakdown to help you weigh the options:

- Premiums: Gold bars can have lower premiums per ounce than gold coins because they cost less per ounce to manufacture.

- Liquidity: Both are easy to sell as long as you stick with well-known brands and keep them in their original packaging.

- Storage: It can be easier to store gold bars if you buy the same size because you can stack them, and they take up less space per ounce.

- Flexibility: Some investors prefer gold coins because they come in smaller sizes and allow for a smaller initial investment.

- Authenticity: Gold coins come from government mints and can be easier to verify versus gold bars which require assay certificates.

- Designs: Gold coins can have historical and collectible value beyond the value of their gold, whereas gold bars have simple designs.

- Legal tender: Gold coins can be legal tender in some states and may be exempt from taxes because of this. Gold bars don’t have a face value.

Gold bar sizes

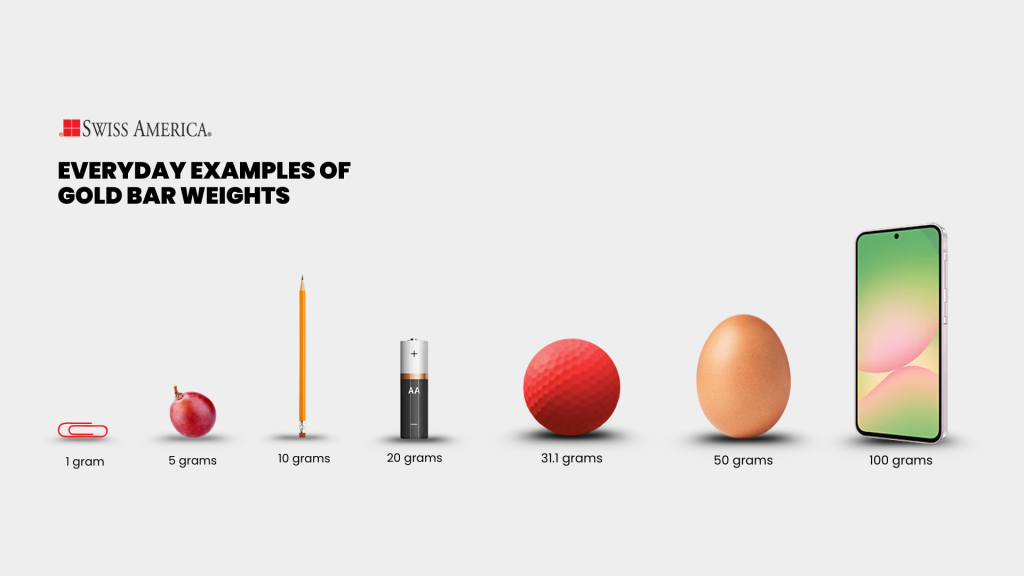

Gold bars come in various sizes but the smaller bar sizes we list below are best for everyday gold investors. Note that very large gold bars might require specialized markets for resale, which can add cost and complexity.

| Bar’s weight | Comparable object |

| 1 gram | Paperclip |

| 5 grams | Grape |

| 10 grams | Pencil |

| 20 grams | AA battery |

| 1 troy ounce (31 grams) | Golf ball |

| 50 grams | Egg |

| 100 grams | Smart phone |

Authenticity of gold bars

Gold bars offer built-in verification of authenticity when you buy them from a reputable dealer. They come in assay cards, which are secure display cases that are tamper-evident. Each card lists the serial number, the bar’s weight, and the purity certification.

Keeping your gold in its original packaging makes it easier to sell on the secondary market if you ever decide to liquidate. Be sure to always buy from reputable mints or refiners, as this will make it easier to sell when the time comes.

Gold bar investment strategies

You should consider gold a long-term investment. We’ve seen the price of gold increase by more than 50% in just one year, but this isn’t always the case. Gold prices can be volatile, so experts recommend holding anywhere from 5% to 15% of pure gold bullion as a way to diversify your investment portfolio.

Gold bullion bars are usually considered the best option for long-term investments because:

- Inflation hedge: Gold helps protect your wealth from inflation. If you buy a 1 oz gold bar today and prices rise over time, the value of your gold usually rises too.

- Tangible asset: Owning physical gold bullion is a real asset that you can completely control because you don’t rely on anyone else. You don’t need contracts or anyone to act on your behalf for it to keep its value.

- Protect against currency deflation: Gold isn’t tied to any country’s currency, so holding gold bars or coins gives you a way to protect your wealth even if paper money loses its strength.

Where can you find the best gold bars to buy?

To find the best gold bars, work with a reputable dealer. Look for a company that’s been around for decades and has strong customer reviews. Ask about their pricing, shipping process, and buyback policy so you know what to expect when it’s time to sell.

The best dealers take time to educate you and provide resources so you can make the right choice for your situation. If you want to learn more about the best gold bars for your needs, connect with the Swiss America team today.

Best gold bars to buy: FAQs

How much is 1 oz of gold worth now?

As of this writing, the spot price of 1 oz gold is $4,500.

Does the brand of gold bar matter?

Yes, the brand matters. Choose gold bars from reputable mints or refiners at competitive prices to maximize your investment.

What is the best gold to buy for investment?

The best gold to buy is physical bullion from government mints or refiners. This gives you complete independence from the stock market or other asset classes and diversifies your portfolio.

The information in this post is for informational purposes only and should not be considered tax or legal advice. Please consult with your own tax professionals before making any decisions or taking action based on this information.