Silver and other precious metals are popular with investors right now. Over the past year, gold has climbed more than 34% and silver is up about 30%. With ongoing market volatility, trade tensions, and questions around interest rates, a Silver IRA rollover could be a smart way to protect your retirement savings.

This article covers what Silver IRA is, the benefits of this type of investment, and how you can get started with silver assets today for your retirement.

Understanding a Silver IRA

A Silver IRA is a retirement account that lets you hold physical silver instead of traditional paper assets. It’s a self-directed individual retirement account designed to help you invest in silver bullion coins or bars as part of your long-term savings.

People look at investing in a Silver IRA as a way to diversify their retirement portfolio, and benefit from tax advantages that you get with traditional IRAs.

Benefits of investing in a Silver IRA

A self-directed Silver IRA gives you more than just another place to park money. It adds a tangible asset to your retirement savings that doesn’t depend on Wall Street or government policy to hold value. When stock markets fall or the dollar weakens, silver often moves in the opposite direction, giving your portfolio balance when needed.

Silver also protects you against inflation. Cash loses buying power as prices rise, but silver and other precious metals have a long track record of keeping pace with the cost of living. Keeping silver in your IRA gives you a safety net so that your savings continue to hold real-world value.

Silver prices are much lower than gold, so you can build meaningful holdings without a large initial investment. That accessibility makes it easier for you to add gradually and adjust your exposure over time.

Finally, silver has demand beyond investment. It’s in technology, medical equipment, and solar energy. This industrial demand supports long-term value and means your retirement account contains a strong financial and practical tangible asset.

How Silver IRAs work

This self-directed retirement account means you choose the metals you want rather than being limited to a preset list of options.

You can fund it by rolling over money from an existing IRA or 401(k) or making new contributions from your taxable income. The annual contribution limits are the same as those of a traditional IRA.

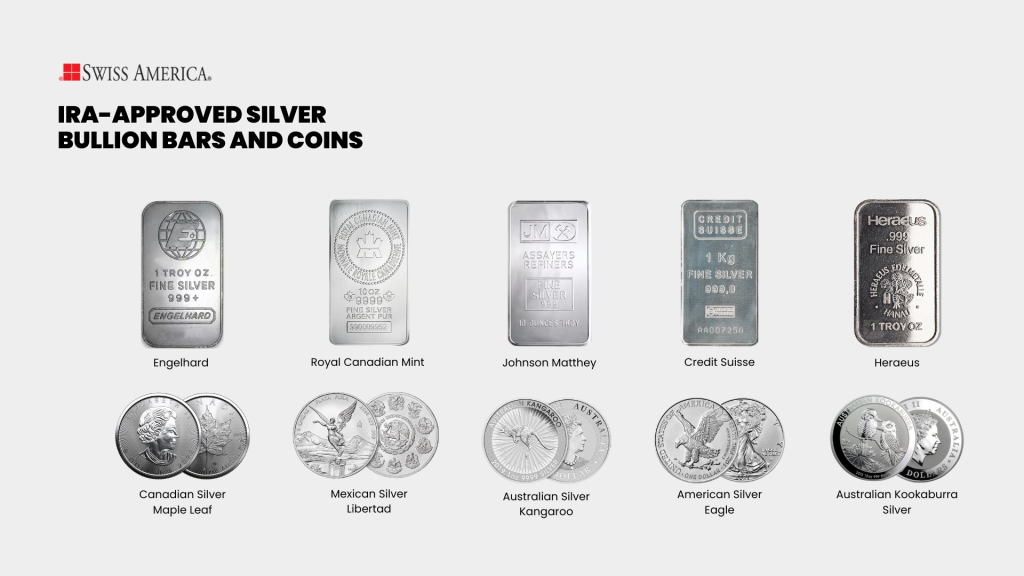

The IRS allows only investment‑grade silver that is 99.9% pure and comes from IRS-approved government mints or refiners. Popular silver bullion options include:

• American Silver Eagle coins

• Canadian Silver Maple Leaf coins

• Bars from accredited refiners such as Royal Canadian Mint or PAMP Suisse

Types of Silver IRAs

You can set up a Silver IRA account the same way you would any other retirement account. The two main options are:

Traditional Silver IRA: You make contributions with pre-tax dollars. Your silver grows tax-deferred, and you pay taxes when you take distributions in retirement.

Roth Silver IRA: You contribute after-tax dollars. The account grows tax-free, and you do not pay taxes on qualified withdrawals in retirement.

Simplified Employee Pension (SEP) Silver IRA: Designed for self-employed individuals or small business owners, this option allows higher contribution limits. A SEP Silver IRA can be a way to put more retirement savings into physical silver if you qualify.

All of these accounts let you hold physical silver coins or bars inside your retirement plan. The decision between them usually depends on whether you prefer to pay taxes upfront or when you withdraw.

Choosing a Silver IRA company

Not all precious metals companies are the same. When you open a Silver IRA, you want to work with a firm that knows the rules, offers transparency, and puts your best interests first. Here are the qualities to look for:

Experience and fees

A Silver IRA has specific IRS requirements, from eligible metals to approved storage. Work with a company that’s been in the industry for decades and knows how to guide you through the process without mistakes that could trigger penalties.

Some companies bury their charges in fine print. Look for straightforward pricing on account setup, annual maintenance, storage, and buyback policies. You should know exactly what you’re paying before you ever commit.

Reputation and support

A good company has a long track record like Swiss America and strong customer feedback. Check ratings with the Better Business Bureau and see what other investors have said about their experiences.

A reputable silver dealer does more than sell you silver. They explain your options, answer your questions, and help you make decisions that fit your retirement goals.

Silver IRA fees and costs

Like any retirement account, a Silver IRA has some costs. Knowing them upfront helps you avoid surprises and ensure the account is still a good fit for your goals. Most of the fees come through your IRA custodian, whose role is to follow IRS rules to keep your account in compliance.

Setup fee: Most custodians charge a one-time fee to open your account. This is usually between $50 and $100. We often recommend Gold Star Trust, and their setup fee is $50.

Annual maintenance fee: Your IRA custodian handles IRS reporting and keeps your account in good standing. Expect an annual charge that typically ranges from $90 to $300.

Storage fee: Since the IRS doesn’t allow you to keep IRA silver at home, your custodian arranges to keep it in an approved depository. Storage fees usually run $100 to $200 a year for commingled storage, with higher costs if you choose segregated storage.

Transaction fees: Some custodians charge for each purchase, sale, or transfer inside the account. These can be $25 to $50 per transaction.

Dealer premiums: When you buy silver coins or bars, the price is higher than the market “spot price.” The difference is called the premium, and it covers minting, distribution, and the dealer’s costs.

| Fee type | Description | Typical range |

| Setup fee | One-time fee to open your account. | $50 – $100 |

| Annual maintenance fee | Covers IRS reporting and account maintenance. | $90 – $300 |

| Storage fee | Cost for storing IRA silver in an approved depository. | $100 – $200+ |

| Transaction fees | Charged per purchase, sale, or transfer. | $25 – $50 |

| Dealer premiums | The premium above the silver spot price covers minting, distribution, and dealer costs. | Varies (above spot price) |

Rollover and transfer options

If you already have a retirement account, you can use it to fund a Silver IRA without paying taxes or penalties as long as you follow IRS rules. There are two main ways to do it:

Rollover

With a rollover, your current retirement plan sends the money to you first. You then have 60 days to deposit it into your new Silver IRA. If you miss that deadline, the IRS treats it as a withdrawal, which means income taxes and possibly a 10% penalty if you’re under 59½. You can only do one rollover in a 12-month period.

Transfer

A transfer, also called a direct transfer, is when the money moves straight from your old custodian to your new one. You never touch the funds, which makes this the simpler and safer option. Transfers aren’t limited to once a year, and there’s no 60-day clock to worry about.

New contributions

You can also fund a Silver IRA with earned income, just like a traditional IRA. For 2026, the contribution limit is $7,500 if you’re under 50, or $8,600 if you’re 50 or older. These contributions can be tax-deductible in a traditional IRA or grow tax-free in a Roth IRA, depending on which account type you choose.

Getting started with a Silver IRA

Once you’ve decided a Silver IRA makes sense for your retirement, here’s how to put the plan into action:

Step 1: Open your account

Work with a self-directed IRA custodian to set up the account. This step is mostly paperwork and identification, similar to opening any other IRA.

Step 2: Fund it

Move money into the account through a transfer, a rollover, or new contributions from earned income.

Step 3: Select your silver

Choose the coins or bars that fit your strategy, making sure they meet IRS standards.

Step 4: Store it securely

Your custodian coordinates delivery to an IRS-approved depository, who insures and tracks the metals.

Final thoughts about silver in your IRA

A Silver IRA can be a practical way to bring stability and diversification into your retirement plan. It won’t replace traditional investments, but it can help protect what you’ve worked hard to build from inflation, uncertainty, and market swings.

If you’re curious how silver might fit into your retirement strategy, the next step is having a conversation to learn more. The team at Swiss America has guided investors through this process for decades and can walk you through the options so you can make the best decision for your situation.

Silver IRA Rollover: FAQs

What does “IRA-eligible silver” mean?

IRA eligible silver means silver that the IRS allows in a retirement account. The rules say it has to be at least 99.9% pure and produced by an approved mint.

Is silver a good investment for retirement?

Silver can be a good retirement investment because it helps protect against inflation and adds diversification, though it works best as part of a broader portfolio rather than your only asset.

What is the most profitable way to invest in silver?

The most profitable approach is usually to treat silver as a long-term investment, using it to preserve wealth and then selling when prices peak.

The information in this post is for informational purposes only and should not be considered tax or legal advice. Please consult with your own tax professionals before making any decisions or taking action based on this information.