If you’re thinking about gold investing for retirement, how do you open a Gold IRA account tax- and penalty-free? This article breaks down what a Gold IRA is, the rules you need to know, and how to get started.

With today’s economic uncertainty, concerns about the US dollar, and central bank buying, more investors are turning to gold. JP Morgan Chase even predicts gold could reach over $4,000 per ounce by the second quarter of 2026. If you’re considering adding gold to your retirement accounts, here’s what you need to know.

What is a Gold IRA?

A Gold IRA is when you use a self-directed individual retirement account (IRA) to own physical gold and other IRS-approved precious metals. With a self-directed IRA, you aren’t limited to traditional paper assets like stocks or bonds. You can also hold alternative assets such as:

- Precious metals

- Real estate

- Crypto

- Forex

This type of account sees all the same tax benefits of a traditional IRA. You can set it up as a Roth Gold IRA, which grows tax-free, or a traditional Gold IRA, which grows tax-deferred.

Understanding Gold IRA rules and regulations

There are specific rules for IRA investments in gold or other precious metals:

Eligible precious metals

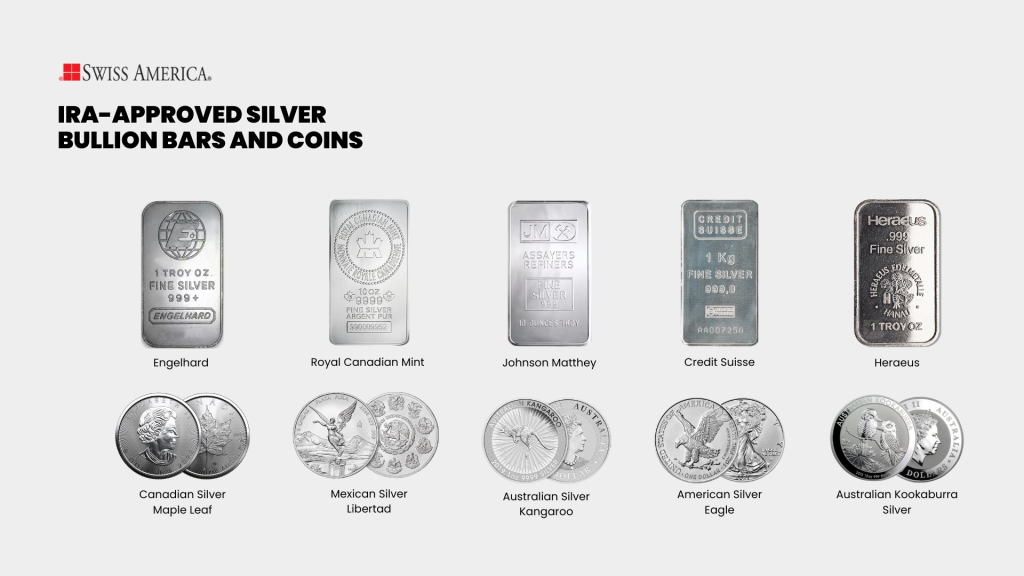

A Gold IRA isn’t limited to gold coins and bars. The IRS also allows certain silver, platinum, and palladium, but only if they meet specific requirements.

Gold: Must be 99.5% pure or higher. Common gold coins include American Gold Eagle, American Gold Buffalo, and Canadian Maple Leaf. IRS-approved gold bars must come from government mints or accredited manufacturers.

Silver: Approved silver needs to be 99.9% pure and includes coins like the Mexican Silver Libertad, American Silver Eagles, Canadian Silver Maple Leafs, and silver bars from manufacturers like PAMP Suisse or Royal Canadian Mint.

Platinum and palladium: Both of these precious metals must be 99.95% pure. Coins like the American Platinum Eagle or bars from IRS-approved refiners qualify.

Collectible coins and anything that gains value from rarity or design don’t qualify because they are not based purely on metal content. A good dealer will guide you to the right coins and bars so you know everything you buy for your Gold IRA rollover fits IRS rules and keeps your funds compliant.

Storage rules

When you buy gold or other precious metals inside a Gold IRA, you can’t keep them at home or in a personal safe. The IRS requires you to store them in an approved depository. These facilities secure your metals and insure them. Examples of IRS-approved depositories include Delaware Depository, Brinks, and Texas Precious Metals Depository.

Your custodian works with your precious metals dealer to ship your gold to the depository they use. From there, the depository stores and tracks your metals. You can choose commingled storage, where your metals go into a shared vault, or segregated storage, where they keep your exact coins and bars in a separate space.

| Category | Details |

| Gold | 99.5% pure |

| Silver | 99.9% pure |

| Platinum/Palladium | 99.95% pure |

| Manufacturers | Approved mints and refiners |

| Not Allowed | Collectible coins |

| Storage | IRS-approved depository |

Contribution rules for a Gold IRA

A Gold IRA follows the same contribution rules as any other IRA. For 2026, you can contribute up to $7,500 if you are under 50, or $8,600 if you are 50 or older. You also can’t add more than your earned income for the year.

A Gold IRA rollover is different. Moving money from traditional and Roth IRAs doesn’t count toward your annual contribution limit. So, you can roll over larger amounts from these retirement accounts without hitting that IRS cap.

Choosing a Gold IRA custodian

Some of the things you should look for when choosing an IRS-approved custodian include:

Reputation and experience

Work with a custodian with a long history of handling self-directed IRAs and understanding how precious metals accounts work. Look for a company that’s been in business for years and has a solid reputation backed by consistent customer reviews.

Your custodian takes care of the paperwork, keeps your account in line with IRS rules, and coordinates directly with your gold dealer and the depository.

Fees and services

The fees associated with a custodian’s services include:

- Setup fee: A one-time cost to open your account, usually between $50 and $100.

- Annual maintenance fee: Covers IRS reporting and account management, about $90 to $300 per year.

- Storage fee: Paid to the depository for holding your metals, often $100 to $200 annually for commingled storage and more for segregated storage.

- Transaction fees: Some custodians charge for sending wires, processing rollovers, or making purchases, often $25 to $50 per transaction.

If you don’t already have a custodian in mind for your precious metals IRA, the Swiss America team often work with Gold Star Trust. Their specific fees include a $50 setup fee, $90 annual maintenance, $100 per year for commingled storage, and variable costs for segregated storage. They also don’t charge a fee when you buy, sell, or exchange precious metals.

| Fee Type | Description | Typical Cost |

| Setup Fee | One-time cost to open your account | $50 – $100 |

| Annual Maintenance Fee | Covers IRS reporting and account management | $75 – $300 per year |

| Storage Fee | Paid to depository for holding metals | $100 – $200 annually (commingled); more for segregated |

| Transaction Fees | Charges for wires, rollovers, or purchases | $25 – $50 per transaction |

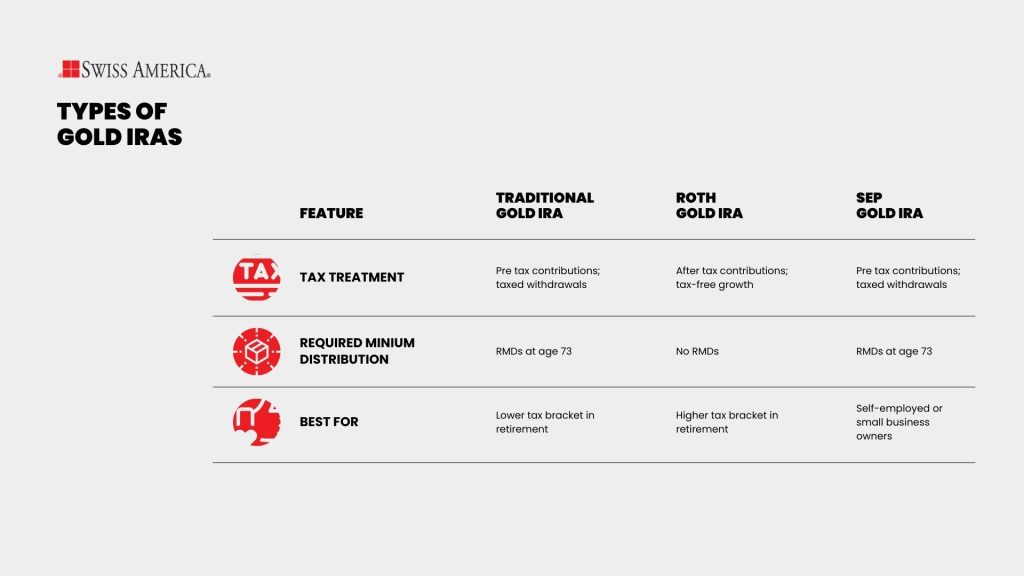

Types of Gold IRAs

You have a couple of different options for a Gold IRA:

Traditional Gold IRA vs. Roth Gold IRA

You can set up a precious metals IRA in a few different ways, similar to how a traditional IRA works.

One option is a traditional Gold IRA. With this account, you invest pre-tax money, which gives you tax-deferred growth. If you qualify, you can make annual contributions, and those contributions may be tax-deductible.

Another option is a Roth Gold IRA. Here, you invest after-tax money, and your account grows tax-free as long as you meet the rules. You need to have the account open for at least five years and reach retirement age before taking withdrawals on your gains. You can also make contributions to a Roth with after-tax dollars.

The right choice depends on your financial goals, your tax situation, and what fits best with your overall retirement plan.

Investing in a Gold IRA

You can invest in gold through tax-advantaged retirement accounts, but there’s a difference between the two main options:

Physical Gold IRA vs. “paper Gold” IRA

A Gold IRA means that you hold physical gold. This is not the same as investing in gold-related securities, like gold ETFs or mining stocks. Paper gold investments don’t give you a tangible asset, and they don’t give you the independence that physical gold does from the stock market.

This decision ultimately comes down to what fits best in your retirement portfolio. If you’re looking for an inflation hedge, an asset that moves independently of the market, and something that doesn’t depend on anyone else, that’s when it makes sense to hold physical gold.

Avoiding tax penalties with a Gold IRA

The way to avoid tax penalties with your gold IRA is to follow all of the regulations that you would with a traditional IRA. This includes:

- Contribution limits: The current limit is $7,500 per year, or $8,600 if you’re age 50 or older.

- Excess contributions: If you make excess contributions, you’ll need to remove the extra amount and any earnings before April 15 for that tax year.

- Required minimum distributions: If you have a traditional gold IRA, you must begin taking RMDs at age 73.

- Withdrawals: You can start withdrawing funds or have your physical gold shipped to you once you reach age 59½.

- Rollovers: When rolling over from a previous employer-sponsored plan, like a 401(k) or another IRA, it’s best to use a direct rollover so the funds move directly from your current administrator to your new gold IRA custodian.

Common questions about Gold IRAs

Some of the main questions investors have about using an IRA for gold investing include:

Can I store my Gold IRA metals at home?

No. You cannot store your metals at home because the IRS treats it as a distribution. If you take direct control of your retirement savings without an administrator, the IRS counts it as a withdrawal.

When you reach retirement age and take a distribution, you can sell your metals for cash or have them shipped to you.

What happens if I don’t meet RMD requirements?

If you don’t take your RMDs, the IRS imposes penalties. You could owe a 25% excise tax on the amount you should have withdrawn. On top of that, you still have to pay ordinary income tax on that same amount, so those costs can add up fast.

Your Gold IRA custodian will remind you when it’s time to take your RMDs and can help with the process. They won’t give investment or tax advice, so it’s still on you to keep track of the deadlines.

What are the IRS rules for rollovers and transfers into a Gold IRA?

The most important thing when doing a gold IRA rollover is to meet the deadlines. A direct rollover makes this simple. Your current plan administrator sends the funds straight to your gold IRA custodian, so you never handle the money and avoid any penalties.

An indirect rollover is more complicated. In this case, the check comes to you, and you have 60 days to deposit it into your new gold IRA. There are several moving parts with this approach, which is why most people stick with a direct rollover. Also, keep in mind you can only do one indirect rollover in a 12-month period.

What happens if I buy non-approved metals?

This gets tricky. If you buy non-approved metals with your IRA funds, the IRS treats it as a prohibited investment. That means they consider it an early distribution. You’ll owe ordinary income tax on the amount you invested, and if you’re under 59½, you may also face a 10% early withdrawal penalty. Additional penalties could apply as well.

Swiss America for Gold IRAs

Swiss America has been in business for over 40 years and has helped thousands of investors open gold IRA accounts without taxes or penalties. The company focuses on providing education, resources, and guidance so you can understand the IRS regulations and make the most of these tax-advantaged accounts for your retirement savings.

Opening a Gold IRA account

Here are the steps to open your Gold IRA account:

Step 1: Choose a Gold IRA custodian

The first step is to choose the gold IRA custodian with whom you’ll work. Once you’ve made that choice, open the account. This usually involves an application and personal identification.

Step 2: Fund the account

Next, you’ll fund the account. This could be through a rollover or with new funds you have available. Either way, you’re putting money into the account so the custodian can manage it according to your instructions.

Step 3: Buy and store metals

Once you’ve added your retirement savings to the account, you’ll work with your gold dealer to choose which precious metals to buy. After you decide, you’ll give your instructions to the gold IRA custodian, and they’ll make the purchase for you. The gold dealer will then ship the metals directly to the depository that your custodian uses.

Final thoughts on a Gold IRA

Is a Gold IRA right for you? This decision comes down to your goals. A Gold IRA can be a strong option if you want to hold physical gold to protect your wealth from inflation or diversify beyond the stock market.

To learn more about how Gold IRAs work, the rules involved, and which metals qualify, connect with the Swiss America team today!

Open Gold IRA account tax and penalty free: FAQs

Is a Gold IRA tax-free?

No, a Gold IRA isn’t tax-free. If you have a traditional Gold IRA, your money grows tax-deferred, but you’ll pay taxes in the future when you take distributions in retirement. With a Roth Gold IRA, you use after-tax dollars, so your withdrawals in retirement are tax-free as long as you meet the requirements.

What is the downside of a Gold IRA?

The main drawback of a Gold IRA is that it doesn’t pay dividends or generate cash flow. You can profit if gold prices rise and you sell, but it’s primarily a defensive asset designed to protect your wealth rather than produce income.

How much does it cost to open a gold IRA?

The costs can be $150 to $300 a year, depending on the custodian you choose. This covers account setup, storage fees for your metals, and administrative costs charged by the custodian.

The information in this post is for informational purposes only and should not be considered tax or legal advice. Please consult with your own tax professionals before making any decisions or taking action based on this information.