Gold prices have increased 30% so far in 2024. Does that mean it’s a good or bad time buy gold? Get the answers here.

With inflation rising, markets fluctuating, and economic concerns mounting, it’s no wonder people are asking, “Is it a good time to buy gold?”

The short answer? It’s always the right time. Why? No one can predict the next crisis and we don’t always know when we’re in a recession. The best time to buy gold is before you need it. Since you don’t when that is, the second best time to buy is now.

This article covers the current market trends, gold prices, and different ways you can invest.

Is now a good time to invest in gold?

Gold has a way of grabbing attention during economic uncertainty, and now it is no different. Inflation reduces purchasing power, central banks are buying gold like never before, and market volatility has everyone second-guessing their investments. In times like these, gold offers something rare: stability.

Gold has been a reliable hedge for centuries, and it’s no different in 2024. This year, gold prices have steadily climbed, reflecting growing investor interest. Geopolitical tensions, economic shifts, and unpredictable markets add to its appeal which is why gold is now over $2600/oz.

We even recently discussed how gold could reach $3000/oz on our podcast. It’s safe to say that now might be the right time to see if gold fits your investment goals.

Why is gold considered a safe haven asset

Since the beginning of time, people have considered gold a safe haven investment compared to other asset classes. But why?

Well, that’s essentially because of the safety net gold provides. When other investments start to feel a little too risky, gold is a safe option since it tends to preserve its value.

Factors driving the demand for gold

Some of the indicators of gold demand include:

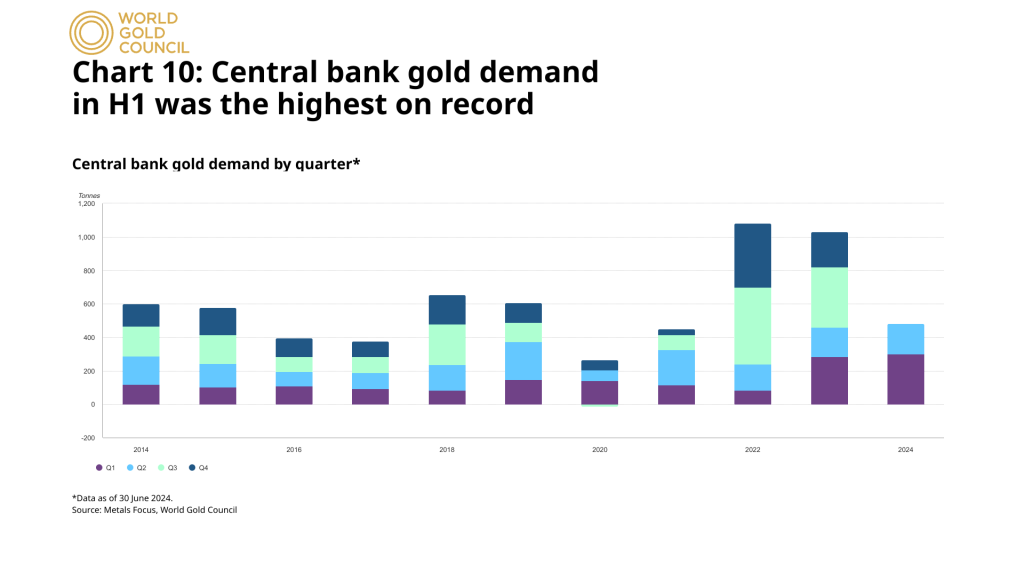

Central bank purchases

According to the World Gold Council, the central bank demand for gold in the first half of 2024 is the highest on record. If you’re wondering why that matters and whether this affects you, it does.

When central banks start buying gold, they signal their confidence in gold as a hedge against instability. The truth is, that central banks, such as the Federal Reserve and People’s Bank of China don’t make these decisions very lightly.

That’s one of the biggest reasons is because of gold’s store of value. It’s not like paper currency, which can be devalued by inflation or even by simply printing more money; there’s only so much gold, so it retains its value over the years.

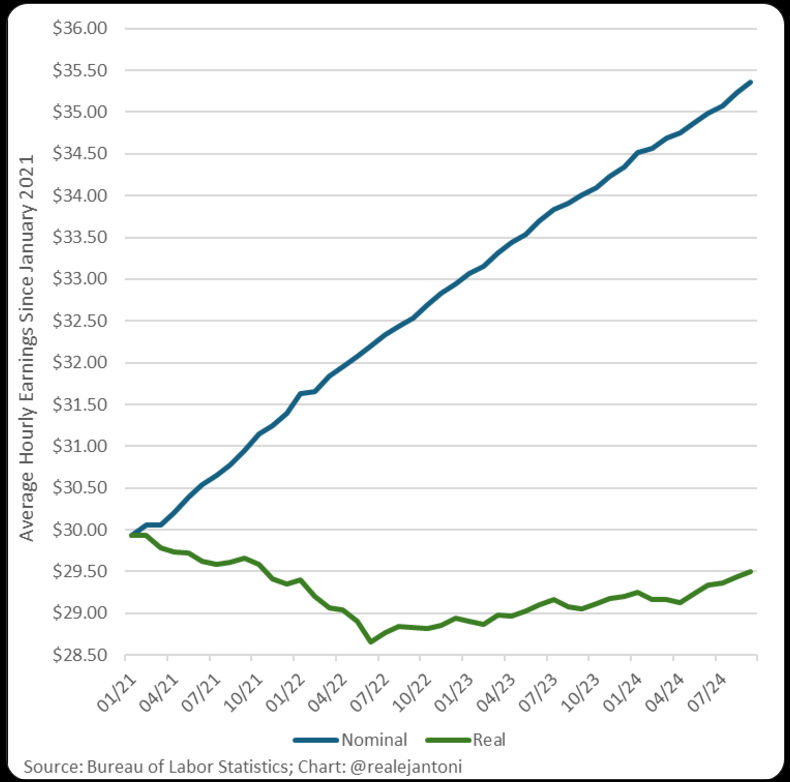

Inflation’s impact on gold prices

Inflation whittles away purchasing power over time. Consider a savings account paying a low interest rate, yet the goods and services you buy increase at a faster pace. What your money could buy two years ago is not what it can buy today. See the below graph via economist E.J. Antoni, Ph.D., showing that paychecks keep growing, but what you can buy with that paycheck is shrinking.

Gold bullion assets give investors a way to preserve their purchasing power over the long term.

The role of treasury yields

Treasury yields can also affect gold prices. When yields go up, people usually buy bonds instead of gold because they pay interest.

Even though yields have continued upward, the fear of inflation and uncertainty remains so strong that it’s compelled more investors to purchase gold. The balancing act between returns on treasury yields and the risk of currency depreciation decides the flow of money into gold.

In countries where the local currency depreciates fast, like Argentina or Turkey, investors and governments store value via gold. This adds to global demand, contributing to the recent price increases and predictions.

And finally, it’s the way gold bullion reacts to rising inflation that makes it a store of wealth. People are looking for alternative ways to keep purchasing power. This is why many financial experts describe gold as “real money” – because in a world where everything else becomes uncertain, it’s the value of gold that lasts.

Investing in physical gold

If you have ever thought about investing in gold, you may find the choices to be confusing. Do you go for physical gold, where you can hold and store it, or do you go for gold stocks or gold ETFs?

One of the best ways to invest in gold is by buying physical gold bullion assets in the form of bars or gold coins. When you buy physical gold, you truly own it. There’s no middleman or electronic certificate involved; it’s yours to keep, sell, or pass on. This sort of direct ownership gives peace of mind to lots of people.

Physical gold has intrinsic worth. It is a finite resource, and its value isn’t dependent on the currency of financial markets. If you’ve stashed away gold bars in a safe or coins in a secure place, having a tangible asset seems like a sure thing in an uncertain economy.

Physical gold is best for long-term investors. It’s not an investment to generate quick returns but rather to preserve wealth for decades.

Other ways to invest in gold

You can also invest in gold through paper assets.

Gold mining stocks

If you invest in gold mining companies, your’e buying stocks of a company that extracts gold. The major players there are Barrick Gold and Newmont Corporation. Their stock value tends to mirror the price of gold.

If the company is performing well, the potential price rise of the stock might be more than the standard movement of gold prices.

The downside is that gold mining stocks depend on the gold price as well as the company’s overall performance. Even if the price of gold increases, the stock may go down because of operational issues, regulatory hurdles, or poor management in the mining company. Stocks don’t give you the same independent and tangible assets as gold bullion.

Gold Exchange-Traded Funds (ETFs)

Each gold ETF is an actual investment that tracks the price of gold. You buy them just like any other type of stock. They give you exposure to the value of gold, but you’re never actually an owner of any precious metal. Instead, you hold a paper investment that represents an entitlement to gold.

Gold mutual funds

Gold mutual funds hold assets like mining stocks and precious metals. They have higher fees than ETFs, but they are also paper assets. If you want the security of a physical asset class that doesn’t rely on a third-party for performance or control, physical gold is a better bet.

Here’s a quick snapshot of your investment options:

| Investment type | Ownership | Liquidity / risk level | Who it’s best for |

|---|---|---|---|

| Physical gold | You own actual bullion or coins | Lower liquidity; storage/insurance needed | Long-term wealth preservation |

| Gold mining stocks | Shares in gold companies | Higher liquidity; company risks | Investors seeking growth exposure |

| Gold ETFs | Paper asset tracking gold price | High liquidity; no physical ownership | Easy market exposure & diversification |

| Gold mutual funds | Pooled portfolio of gold assets | Medium liquidity; higher fees | Investors preferring managed portfolios |

Role of gold in an investment portfolio

Gold can help stabilize your investment portfolio. Here’s how:

Gold as a diversification asset

One of the major reasons investors buy gold is it’s a way to reduce risks. Allocating your investments across asset classes protects you from losing all your money in one asset class.

Gold tends to act opposite to stocks, bonds, or real estate and shows little correlation with these assets. This characteristic helps stabilize a portfolio from underperforming investments.

Risk tolerance and asset allocation

You should decide if gold fits your risk tolerance. Many experts recommend allocating 5-10% of your portfolio to gold. That amount reduces economic unpredictability without putting too much of your investment capital into a non-yielding asset.

Long-term wealth preservation

Gold also preserves wealth. Currencies can lose value because of inflation and central bank policies but gold’s scaracty makes it hold value over time.

Gold in chaos

When there are crises in the market or global geopolitical threats, gold thrives. Investors rush to buy gold, which then drives up the prices.

Things to consider before investing in gold

Here’s a few considerations before you invest in gold.

1. Current market movements and price volatility

Gold prices can change without notice and often follow market trends or global political events. You can watch what’s happening in the gold market but there’s no way to know before a crisis hits could send prices higher. That’s why you should buy gold when you can versus trying to time the market.

2. Market conditions

Market conditions like higher inflation periods or Federal Reserve interest rate reductions increase the demand for gold.

3. Investment goals

It’s always a good idea to evaluate your investment goals before investing. Are you looking to preserve your wealth, diversify your portfolio, or protect your money during an economic recession? Gold serves all these purposes.

4. Best times to invest in gold

Since it’s almost impossible to predict gold prices or world chaos, a great strategy for buying gold is to use dollar cost averaging. This approach means you buy gold on a regular basis versus making a large purchase all at once. You’ll end up buying gold at a variety of price points over time.

In the Reddit r/Gold forum, a user asks when is it a good time to buy gold. User NCCI70I shares:

“It’s always the right time to buy gold.

It’s called FDCA (Fiat Dollar Cost Averaging).

And then put it away and don’t think about it because the daily volatility will kill your sense of peace and sanity otherwise.

One day years from now pull it back out again and be amazed at how much you’ve accumulated.”

And user azrolexguy says:

“Don’t wait to buy Gold, buy Gold and wait”

Choosing a gold dealer

If you’re looking at holding physical gold, you’ll need to choose a reputable dealer to work with. For over 40 years, investors have chosen Swiss Amercia because of:

Customer service: Thousands of happy customers rave about working with our team. We’re here to support you and provide guidance on purchasing gold as well as setting up retirement accounts such as a Gold IRA.

Educational resources: Learn more about gold and other precious metals from our in-depth research reports, podcasts, or daily industry news. We’ll also help you understand storage and insurance options for your gold purchase.

On-going support: Swiss America customers can view their transactions and real-time market value through our online portal. You’ll also get investment strategy recommendations and quotes to sell back your gold if needed.

When to buy gold final thoughts

For thousands of years, investors have considered gold a safe bet. Gold has lasted through all wars, economic collapses, financial crises, and global conflicts.

It’s still a safe bet for the future.

To learn more about investing in gold, connect with the Swiss America team today!

Is it good time to buy gold: FAQ?

When should gold be sold?

You should hold on to gold as long as you can. Most people only sell it when they need cash or if their gold is part of a retirement account, which they have to sell per IRS rules at retirement age.

Should you buy gold now or wait?

No one can predict what’s going to happen with gold or any other investment. If you want to protect your wealth with gold, it’s always a good time to buy and hold for the long term.

Is gold a good investment before a recession?

Gold usually does well during a recession. The challenge is knowing when we are in one. That’s why you should buy gold now versus waiting to see what happens with the economy.

Note: The information in this post is for informational purposes only and should not be considered tax or legal advice. Please consult with your own tax professionals before making any decisions or taking action based on this information.