As you look at your investment strategy and how to best handle market fluctuations, you may wonder if investing in gold vs stocks is a better option in 2026. It’s no secret that gold prices have been on a roll ever since the pandemic. With all the market volatility over the past year, gold is up 29% since the start of 2025. Meanwhile, the S&P 500 is up around 5.7%.

People are still worried about tariffs, interest rates, unemployment, and the economy, and that’s pushing more demand for gold. J.P. Morgan Chase thinks gold could hit over $4,000 an ounce by the second quarter of 2026. So, with all the momentum around gold, should you add it to your portfolio instead of stocks?

This article covers the different benefits of both asset classes so you can decide which is the better investment for your specific needs.

Basics of gold investing

Investors have turned to gold for years to diversify their investment portfolios. Gold isn’t tied to the stock market, so it often holds up when other assets drop. It also helps keep your purchasing power intact when inflation is high.

Common gold investments include:

- Gold bullion: These are physical gold bars and coins that you buy from a precious metals dealer.

- Digital gold: This category includes digital assets like exchange-traded funds (ETFs) that pool investor funds to buy physical gold and issue shares representing ownership.

- Gold mining stocks: Shares in mining companies, or mutual funds that track a mix of gold-related assets.

Basics of stock investing

These investments give you ownership in companies that trade on the stock market. How much return you make depends on how those companies perform. You could see gains or you could see losses. Here are the main ways people invest:

- Individual stocks: This is direct ownership in a particular company.

- ETFs and mutual funds: These pool money from many investors to buy a mix of assets, and each share gives you a slice of that pool.

Pros and cons of gold investment

Like all investments, there are advantages and drawbacks to investing in gold. These include:

Pros

Gold offers a hedge against inflation and economic instability. It tends to hold its value in both situations. It also has a low correlation with stocks and bonds, so when the market is down, gold may be performing well. Gold has no counterparty risk because it doesn’t rely on any company’s performance to generate value.

Cons

Physical gold doesn’t pay dividends or bring in cash flow. It’s mainly a defensive investment. You also need to consider costs for storage and insurance. One last drawback is that the IRS taxes gold at a higher capital gains rate, but you can lower that by investing through a Gold IRA.

Pros and cons of stock investment

Considerations for stock investing include:

Pros

You can see higher returns depending on how the company performs. Stocks also give you plenty of ways to diversify your portfolio and manage volatility. They offer capital appreciation and are highly liquid, so you can easily buy and sell them when needed.

Cons

The market can feel like a roller coaster with all the ups and downs. You can lose some or even all of your money if a company does poorly or goes under. That’s why you’ll have to research company-specific risks and other options or work with an investment adviser who can help you make informed decisions.

Historical returns of gold vs stocks

Both gold and stocks offer potential for price appreciation. Over time, stocks have a higher return, but gold is a great defensive asset against inflation. Here’s how they compare.

Returns

It became legal for individual investors to own physical gold again on December 31, 1974, during the Ford administration. Since then, tracking gold against stocks through different economic cycles shows gold returned 17.2 times an original investment, while stocks delivered higher returns at 93 times.

| Asset | Start value (Dec 1974) | End value (Aug 2025) | Return multiple | Approx annualized growth (CAGR) |

| Gold | $195 | $3,360.30 | 17.2x | 5.8% per year |

| S&P 500 | 67.07 | 6250.66 | 93.2x | 9.4% per year |

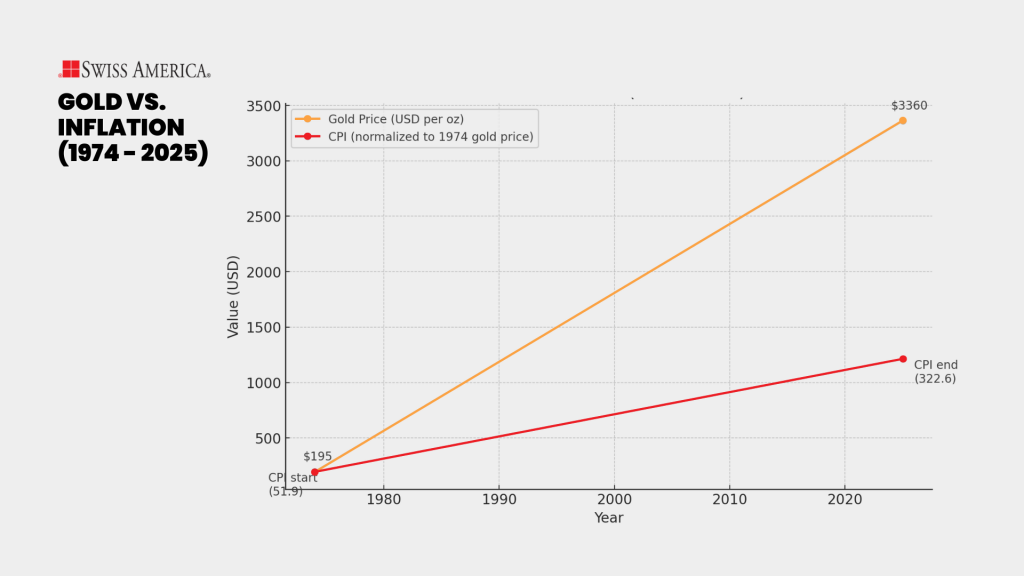

Inflation protection

When you look at gold as an asset to protect your money from increasing prices, it has outpaced inflation over that same period by nearly three times:

Which is the better investment?

Most experts recommend owning both assets to support your financial goals. Sometimes, physical gold has higher positive returns, but in general, stocks perform better over extended periods. Many investors see gold as a way to protect against market downturns, hedge against inflation, and diversify their portfolios.

An example of holding both could be owning 90% stocks and 10% gold. From there, keep an eye on both gold and stocks to see if you need to revisit the ratio as they increase or decrease in value.

To learn more about gold and adding this precious metal to your portfolio, connect with the Swiss America team today!

Investing in gold vs stocks: FAQs

Is it better to buy stocks or gold?

The answer depends on your goals and your current portfolio. Most experts recommend holding 5% to 10% of your money in gold to help offset stock market volatility.

Is it still a good idea to invest in gold?

Yes. Gold offers a safe haven for part of your portfolio. When there’s high inflation or bad economic news, the market often struggles, but gold can provide stability.

Does gold outperform the stock market?

Historically, gold does not outperform the stock market. As of now, gold is up 29% year to date, while the S&P 500 is up about 5.7%. Most investors buy gold not for high returns but to protect their wealth, using it almost like insurance.

The information in this post is for informational purposes only and should not be considered tax or legal advice. Please consult with your own tax professionals before making any decisions or taking action based on this information.