As we’re writing this, it’s early 2025, and you’re probably trying to figure out where to invest for the year. What is the better option—gold or real estate?

Which one will give you better returns? Is managing property tenants harder than keeping gold bars? (Spoiler: gold bars never complain about the thermostat.) And most importantly, which investment will help you sleep better at night?

We’ll dig into the returns, the risks, and the realities of owning each option so you can decide which option fits your investment strategy.

Characteristics of gold and real estate

Gold and real estate investments are actual tangible assets, which we think are the best investments to own. This is because when you own an actual physical thing, you have control.

You decide when to sell, how to manage it, and how to leverage its value while your virtual stock friends live at the mercy of their internet connection.

Physical gold investment

Gold has actual value that’s independent of the current market price. The age-old laws of supply and demand apply here. We only have so much gold in the world, and there’s constant demand for it. It’s the most stable precious metal that investors turn to when they want safety.

For example, consider how various countries’ central banks worldwide continue to stockpile gold. Gold ownership gives them a safety net against crises like currency devaluation or the potential weakening of the U.S. dollar due to our rising national debt.

Real estate investment

Many people like real estate investing as a way to grow their savings and generate income. The value of real estate depends heavily on location, condition, and demand. If you buy the right type of real estate in the right type of market, you can do well. But if you don’t… it doesn’t always turn out great.

Right now, there’s a high demand for housing because contractors slowed down building after the 2008 Great Recession. We now have a limited supply and a deficit of around 3.7 million units. This creates higher prices and increased competition for single-family homes and apartment complexes.

Meanwhile, the commercial office space has struggled since the global pandemic shifted many office workers to remote work.

Basically, the type of real estate investment matters and the location matters even more.

Gold vs real estate investment comparisons

A fair comparison between gold and real estate means picking a category of real estate. We’ve chosen single-family homes for the purposes of this article.

Here are the specific comparisons between these two investment options:

Investment returns

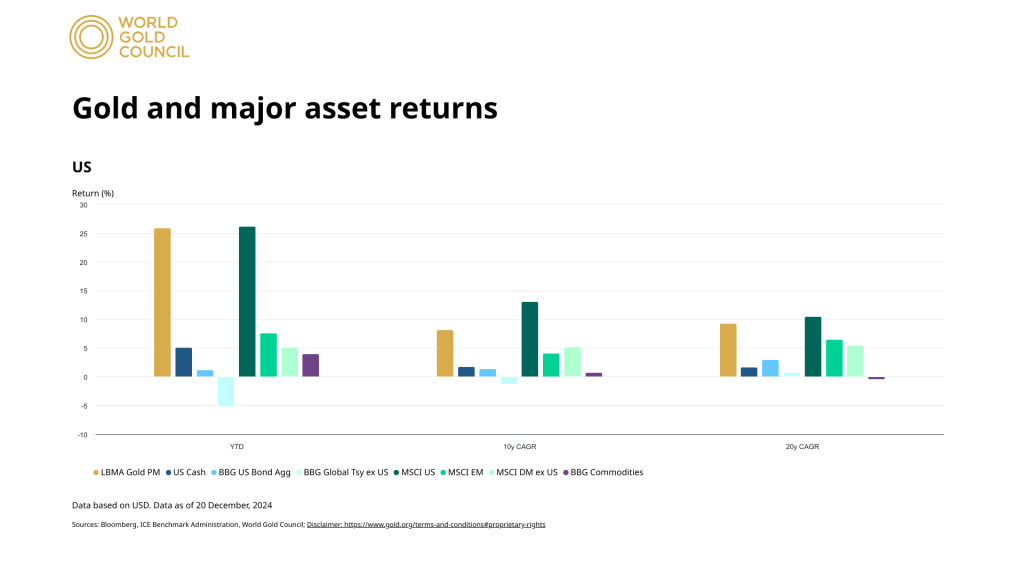

Which has better returns? Gold appreciates over time, and prices continue to grow. Data from the World Gold Council shows returns of over 25%. Meanwhile, the ten-year returns are around 8.15% and the twenty-year returns are 9.32%.

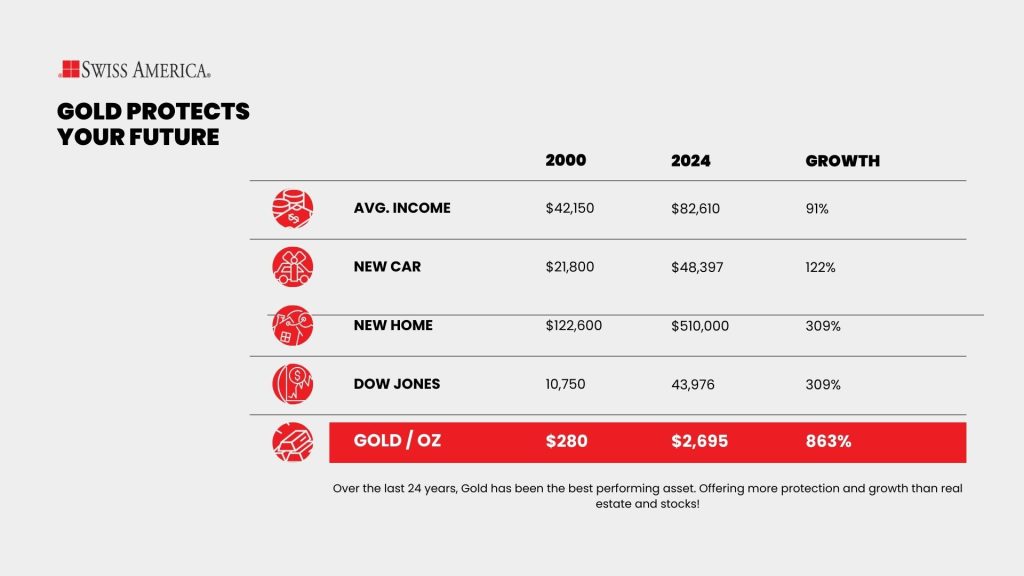

The chart below shows gold investment returns compared to paper currency and the stock market.

Real estate returns are harder to measure because, unlike gold, they depend on things like purchase price and rental income. REITs, which are like mutual funds for real estate, provide some data, but they involve counterparty risk since the management team directly drives the returns.

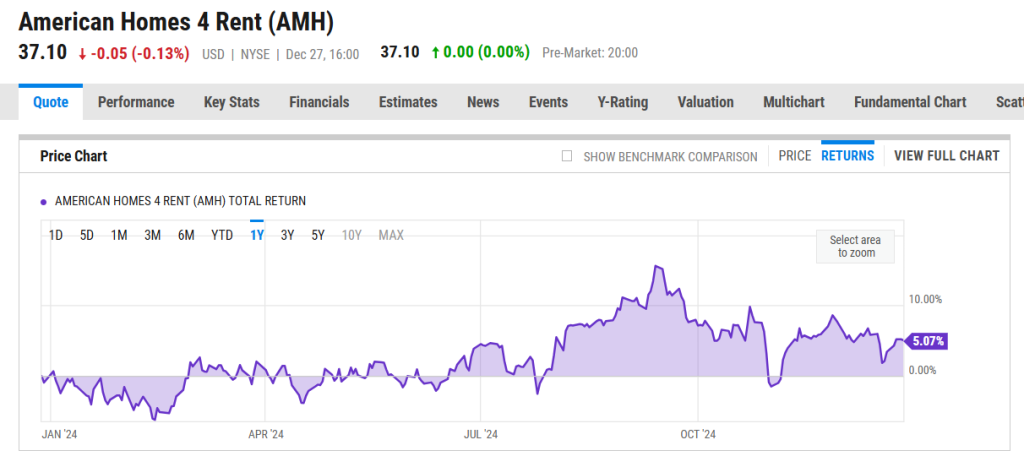

Still, let’s look at a single-family REIT called American Homes 4 Rent. Using the interactive charts from YCharts, you can see that their returns for last year are around 5.07%, but their returns for the last five years are 56.57%. The rental real estate industry has seen massive benefits from increases in rental rates and appreciation of property value.

We could also look at just the selling prices or value of single-family homes, which doesn’t take into account rental returns. Recent data from the National Association of Realtors shows that from 2012 to 2022, home prices increased by 7.9% per year.

Winning investment option: Gold is simple and steady, but single-family real estate has recently seen stronger growth and rental income potential.

Liquidity

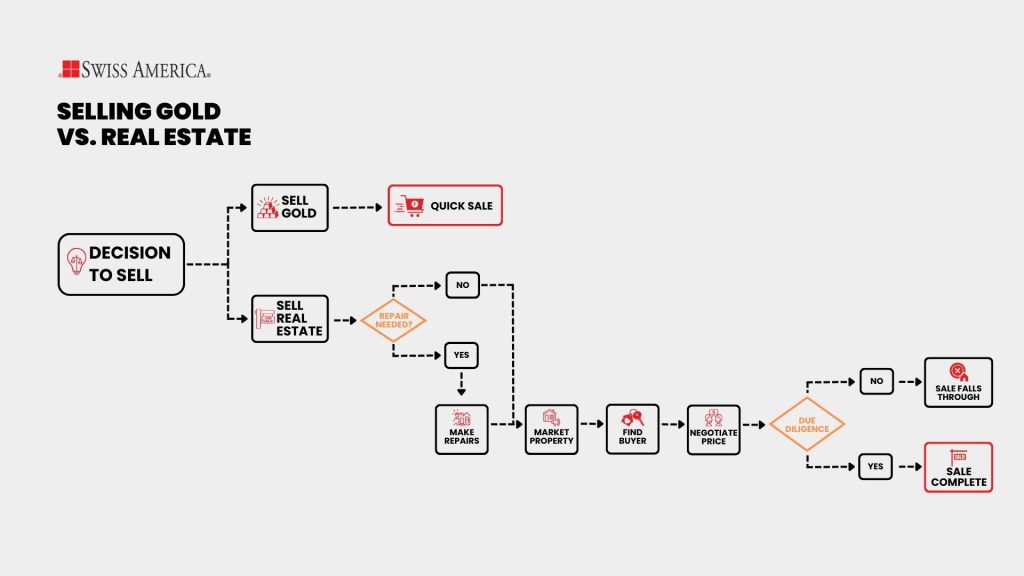

This is an area where gold investment stands out. Unlike real estate, if you want to sell gold, you have many quick options. If you work with Swiss America to buy gold, you can sell it back to us. You can also take it to a local coin shop or use online marketplaces. It’s as quick and easy as selling stocks or bonds.

Selling real estate is a whole different ballgame. You’ll need to:

Potentially make repairs

Put your property on the market

Find a buyer

Negotiate a price

Go through due diligence where the buyer might back out

Complete closing paperwork

This whole process can take months, and your success may depend on economic conditions, interest rates, and the location of your property.

Winning investment option: If you need cash quickly, gold is the better option.

Cash flow

Physical gold investments don’t generate cash flow. Most investors are OK with this because the whole point of owning gold is to protect the value of their hard-earned money. It’s more like an insurance policy versus a revenue-generating asset.

Real estate investments give you cash flow through rent.

Winning investment option: If your goal is income, real estate investment is the better choice.

Volatility

Both real estate and gold can go up and down in price. That’s why investors consider both to be long-term investments that require patience. The risks for each asset class include:

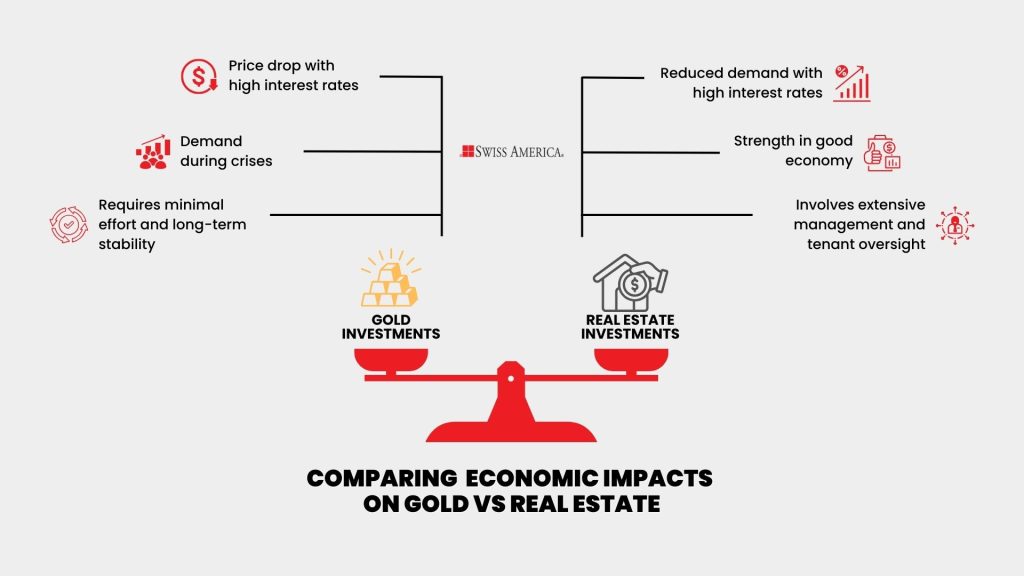

Gold investments: The biggest factor in gold prices today is investor demand. If there’s a crisis, poor stock market conditions, or a recession, investors turn to gold, which increases the cost. But, when things are great, or interest rates are high, gold prices can drop.

Experts like Goldman Sachs predict continued growth for gold in 2025 due to various factors like our national debt and potential trade sanctions.

Real estate investments: Real estate prices also depend on economic conditions, interest rates, and local market conditions. If the economy is great, real estate investments can be strong. But if interest rates are high, this reduces demand.

Winning investment option: Both real estate and gold have price volatility risks and can balance each other.

Tax benefits

If you hold physical gold investments in your IRA, you can see different types of tax benefits depending on the account type. If you use a traditional Gold IRA, your investments grow tax-deferred until you reach retirement age of 59.5. Or, you might have a Gold Roth IRA, which gives you tax-free growth. Plus, with either option, you might be able to deduct your annual contributions.

The same tax incentives apply to real estate investments inside your self-directed IRA. But, real estate investments have other tax advantages. These include the ability to deduct expenses like property taxes, mortgage interest, and other costs against your investment income.

Winning investment option: Both investment options have tax advantages, while real estate has specific tax incentives.

Management requirements

If you’re looking for a passive investment option, gold beats real estate hands-down. With gold, all you need to do is buy it, insure it, and store it securely. It’s that easy. And, if you keep it as a long-term investment, you don’t even need to watch what’s happening with the market conditions.

Real estate investments are way more involved. You’ll have to:

Get the property ready to rent.

Find and screen tenants.

Create legal lease agreements.

Manage tenants and collect rent.

Provide maintenance and repairs.

Keep accounting records.

Even if you hire a property management company to do most of this work, you’ll still need to oversee the property, review financial data, and make decisions about your investment.

Winning investment option: Gold investments are easier and simpler to own than real estate investments.

Inflation hedge

Which is a good investment to protect you from the eroding effects of inflation or depreciation of the dollar? Since you should look at both investments for a long period of time, both provide protection and a hedge. Specific to gold, check out our analysis of gold investment compared to inflation for the last 24 years:

Winning investment option: Since no one can predict what will happen with inflation, both real estate and gold are great options.

Which option is best?

The best option depends on your specific goals and needs. Gold investments are easy to own, easy to sell, and can protect your hard-earned money from inflation. Meanwhile, real estate investments give you income and tax incentives.

We made a quick review you can use to compare both options:

Gold vs. Real estate

| Category | Gold | Real estate |

| Long term return | ✓ | ✓ |

| Easy to sell | ✓ | ✕ |

| Cash flow | ✕ | ✓ |

| Easy to manage | ✓ | ✕ |

| Inflation hedge | ✓ | ✓ |

| Tax benefits (IRAs) | ✓ | ✓ |

If you can, why not have both? Holding gold investments is a great way to diversify your portfolio with simple investments that can give you a secure future. Since it doesn’t rely on the same market dynamics as real estate, it’s a way to split your savings and reduce your overall risk.

Real estate vs gold final thoughts

The reality is that only you can answer the question of which option is best. We’ve provided information on the difference between each but you’ll need to decide which works for your situation. Or, if you have the ability to do so, it’s always a good idea to hold gold investments as a defensive strategy for whatever the next crisis might be.

If you want to learn more about gold and precious metal investing, connect with the Swiss America team today! Our expert team is ready to answer any questions, and our educational materials, like our free Gold IRA kit or regular podcast episodes, can help you make the best decisions for your needs.

Gold vs real estate: FAQs

What is the downside of buying gold?

The biggest downside of buying physical gold is that it doesn’t generate income. The whole purpose of owning gold is as a defense strategy to help protect your wealth. It’s not an investment that gives you cash flow.

Can I buy real estate with gold?

You can sell your gold investments and then take the cash to buy a property but you can’t use gold directly to buy real estate.

What’s more valuable, gold or land?

There’s not a quick answer to this. Both are limited resources that we can’t just make more of. But, the value of land depends on what’s happening with the local market and the value of gold depends on investor sentiment.

Note: The information in this post is for informational purposes only and should not be considered tax or legal advice. Please consult with your own tax professionals before making any decisions or taking action based on this information.