Gold is an asset people turn to for diversification, risk reduction, and wealth preservation. With prices currently 30% higher than in January 2024, you might be wondering if now is the right time to buy and what gold could be worth in 2025. Learn about our gold price prediction 2025.

Remember when a dollar felt like, well, a dollar? Those days seem long gone. With inflation continuing to rear its ugly head and global uncertainty fueled by events like the Russia-Ukraine war, many are searching for a financial safe haven. One word keeps popping up: gold. Adding fuel to this fire, major financial institutions like Goldman Sachs are bullish on gold, recommending it as a smart investment in these turbulent times.

This article covers Goldman Sachs’ and our gold price prediction for 2025. From the rise of alternative currencies to central banks making gold purchases, we’ll examine why gold might be the golden ticket to protecting your financial future.

The case for gold: Goldman Sachs weighs in

Goldman Sachs forecasts a surge in the price of gold to $2,700 per ounce by early next year. The Swiss America team has covered rising gold prices in many of our podcasts and how we believe it can hit $3000/oz. This bullish gold price forecast comes down to three key factors:

Central bank purchases

Central banks are aggressively increasing their gold reserves. This buying spree, which has seen central banks acquire roughly triple the amount of gold compared to pre-2022 levels, is fueled by concerns about geopolitical uncertainty and the stability of the US dollar.

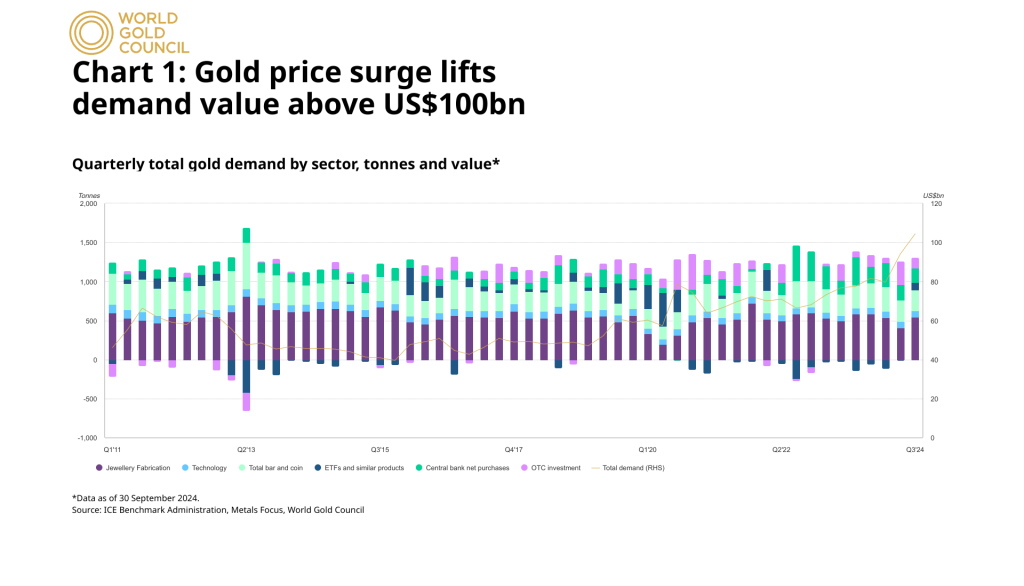

This chart from Gold.org shows the total demand for gold reached the highest levels ever so far in 2024, with central bank purchases leading the way.

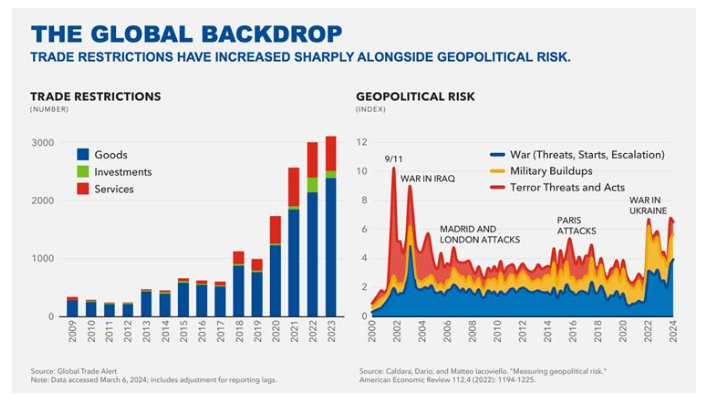

The conflicts in Russia and Ukraine, plus the growing tensions in the Middle East, drive central banks to seek safer assets. Rising concerns about U.S. financial sanctions and national debt also increase gold prices as they see gold as a reliable store of value.

Fed rate cuts

The Federal Reserve just cut interest rates. Gold doesn’t offer a yield, so it’s not as appealing to investors when interest rates are high. As rates fall, gold demand investment increases because it attracts investors who previously received higher returns in high-yield savings or money market accounts.

Potential geopolitical shocks

Gold has historically served as a safe haven asset during times of global instability. Goldman Sachs mentions that several geopolitical risks could further increase the price of gold. These risks include:

Increased financial sanctions

Escalating sanctions related to the ongoing conflict in Ukraine could drive investors towards gold. Goldman Sachs estimates that increases in sanctions comparable to what we’ve seen since 2021 could result in a 15% increase in gold prices.

The charts below the International Money Fund show the growing financial sanctions along with geopolitical tensions.

US debt concerns

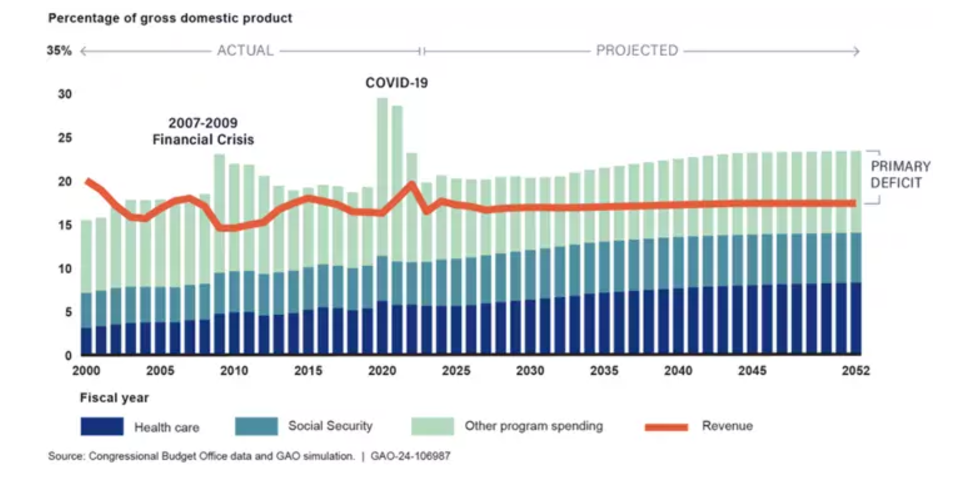

There’s increasing concern about the sustainability of US debt, which could also push investors to seek safety in gold. If something doesn’t change, the US debt will reach 106% of GDP by 2028. If credit-default swap spreads for U.S. government debt widen by one standard deviation (13 basis points), it would reflect heightened credit risk and increase gold demand.

The numbers beyond 2028 look dire for debt, which could mean a very long gold bull market.

Here’s a quick comparison to help readers connect drivers with their market impact:

| Key driver | What it means | Expected effect on gold | Example from article |

|---|---|---|---|

| Central bank purchases | Higher safe-haven demand increases the price | Lower interest rates reduce the appeal of yield-bearing assets | Central banks tripled purchases vs pre-2022 levels |

| Fed rate cuts | Lower interest rates reduce the appeal of yield-bearing assets | Boosts gold attractiveness | Fed cuts enhance gold demand |

| Geopolitical risks | Conflicts or sanctions increase uncertainty | Safe-haven flows push prices up | Sanctions + global tensions drive gold |

| Dollar weakness | Dollar depreciation makes gold cheaper for foreign buyers | Can lift global gold buying | National banks are buying gold rather than holding currency |

A fading greenback: Why the US dollar is under pressure

In our recent podcast episode, we also discuss several concerning factors contributing to the potential decline of the US dollar and driving up the price of gold:

Alternative currencies

We see a growing influence of alternative currencies like the Chinese Yuan. With intensifying trade relationships between nations like Russia and China, these countries seek ways to decrease reliance on the US dollar for international transactions. This shift gained momentum following sanctions on Russia, pushing countries to explore alternatives outside the US financial system.

Gold as a safe haven

The weakening dollar directly contributes to the increasing allure of gold. As the greenback falters, investors seek refuge in tangible assets that retain value during economic turbulence.

Gold has been a historical safe haven, and now investors drive demand in the face of a declining dollar and geopolitical uncertainty.

Ways of buying gold

There are a few different ways you can invest in gold, but choosing physical gold can be a wiser strategy than investing in other gold-related products like ETFs, mining shares, or mutual funds.

ETFs

Investing in a gold ETF might seem like owning gold indirectly, but this approach comes with risks. Essentially, you’re buying shares of a fund that holds gold, relying on the ETF provider and the custodian of that gold to fulfill their obligations.

This reliance on third parties creates vulnerabilities in volatile market situations. Your investment now relies on the financial health and operational integrity of these entities.

Mining stocks

You can buy mining shares as a way to gain exposure to gold. But, instead of directly owning gold, you’re investing in a company engaged in the business of mining gold. The success of your investment becomes linked to the mining company’s performance, which can change based on various unpredictable factors like:

Gold prices

Production costs

Geopolitical events

Environmental regulations

Labor relations

Gold mutual funds

Gold mutual funds pool money from multiple investors to purchase a basket of gold-related assets. This basket can include a mix of mining company stocks and other gold-backed securities.

This approach offers some level of diversification within the gold sector, but it still doesn’t provide the same level of control or security as owning physical gold. You’re still relying on fund managers and their investment decisions, which might not always align with your individual risk tolerance or investment goals.

Physical gold

Deciding to own physical gold comes down to a desire for tangible control, enhanced security, and peace of mind. When you hold physical gold, you possess a valuable asset with inherent worth, independent of the complexities and potential vulnerabilities of financial markets.

This ownership provides a level of reassurance that’s difficult to achieve with paper assets. You control where and how to store your gold versus having to navigate the uncertainties of financial systems.

Gold price predictions final thoughts

Goldman Sachs analysts believe that gold is a wise investment choice in today’s economic climate. We agree and note in our podcast that gold’s impressive 22% year-to-date growth positions it as the second best-performing asset class after cryptocurrency.

Physical gold gives you security and peace of mind, especially during turbulent economic times. There are only a few other tangible assets that give you direct control with no counterparty risk.

Diversifying your portfolio with physical gold can hedge against risk and provide a sense of security during volatile times. To explore this further, consider consulting a reputable gold dealer, like Swiss America, to learn more about incorporating physical gold into your investment strategy.

Gold price prediction 2025: FAQs

What will gold be worth in 5 years from now?

Goldman Sachs predicts gold will rise to $2700 per ounce in the near term due to central bank purchases and economic uncertainty. Though long-term forecasts vary, these factors suggest continued growth over the next five years.

Will gold go up in 5 years?

Experts expect gold prices to rise, supported by central bank demand and potential geopolitical risks. Analysts like Goldman Sachs point to these trends as reasons for ongoing upward movement.

What is the target price of gold in 2025?

Goldman Sachs has set a short-term target of $2700 per ounce, with the potential for further increases if economic conditions favor gold as a safe-haven asset.

Note: The information in this post is for informational purposes only and should not be considered tax or legal advice. Please consult with your own tax professionals before making any decisions or taking action based on this information.