What are the differences between a Gold IRA vs 401(k)?

As the U.S. economy recovers from the pandemic, inflation climbs to the highest levels in over 40 years. Prices hit a peak in June 2022, and although inflation slowed down, everyday items still cost a lot more than they did before the pandemic.

Are your retirement savings ready to handle these changes?

In this article, we’ll take a look at how Gold IRAs can be a great way to protect your wealth during times of rising costs and economic changes. We’ll compare Gold IRAs and 401(k)s to help you understand how each can support your long-term goals.

Understanding Gold IRA

A Gold IRA is a type of retirement account where you can hold physical gold and other precious metals. It’s a way to hold gold coins or bars as part of your savings. These accounts are self-directed, which means you have more control over where you invest.

There are different types of Gold IRAs:

Traditional Gold IRAs: You fund these with pre-tax dollars, and your investments grow tax-deferred. You may also be able to make tax-deductible contributions every year.

Roth Gold IRAs: These accounts get funded with after-tax dollars so your savings grow tax-free. Since you have already paid taxes, you can withdraw your contributions at any time. And, you can withdraw your proceeds tax-free once you hit retirement age.

SEP Gold IRAs: This Gold IRA account is for anyone who’s self-employed or a small business owner. You can fund these with pre-tax dollars.

SIMPLE Gold IRAs: This is a plan small businesses use for both employer and employee pre-tax contributions.

Understanding 401k plans

A 401(k) is a retirement plan offered by your employer. Under this plan, you can save a portion of your paycheck before taxes to invest. Many employers match a percentage of the contributions, which helps your retirement savings grow faster. It’s one of the most popular ways to save for retirement in the U.S.

There are two main types of 401(k) plans:

Traditional 401(k): You contribute from your paycheck before taxes. This lowers your taxable income for the year. Then, you pay taxes when you withdraw the money in retirement.

Roth 401(k): Money goes into this account after taxes, so you don’t get a tax break upfront. But you get tax-free qualified withdrawals in retirement.

Difference between Gold IRA and 401k

Choosing between a Gold IRA and a 401(k)? Knowing what makes them different can help you figure out which one’s the best fit for your retirement goals. Here’s how they stack up:

Investment options

Gold IRA

With Gold IRA investing, you can buy physical bullion metals like gold, silver, platinum, and palladium. These metals must meet specific purity levels set by the IRS. Your custodian stores your metals in an IRS-approved depository until you reach retirement age.

The IRS also sets rules around which metals you can buy in this retirement account. Gold must be at least 99.5% pure, silver at least 99.9%, and platinum and palladium at least 99.95%.

401(k)

You can invest your 401(k) in traditional investments like mutual funds, stocks, bonds, and index funds. Your employer or plan administrator usually picks the options, so you don’t have as much control.

Contribution limits

Gold IRA

Gold IRAs have the same contribution limit tax rules as traditional and Roth IRAs. For 2026, if you’re under 50, you can contribute up to $7,500. If you’re 50 or older, you can contribute up to $8,600.

401(k)

401(k) plans have higher contribution limits. In 2025, if you’re under 50, you can contribute up to $23,500. If you’re over 50, the IRS allows you to contribute up to $30,500.

Tax benefits

Gold IRA

A Gold IRA lets your investments grow tax-deferred until you retire which helps you build more wealth over time. Depending on your income and other retirement plans, your contributions might be tax-deductible.

You can also move funds from traditional IRAs or 401(k)s without paying taxes right away, so you keep those tax benefits.

401(k)

A traditional 401(k) lets your money grow tax-deferred until you retire, so you won’t pay taxes on it until you start making withdrawals. Contributions come out of your pre-tax income, which lowers your taxable income for the year. For example, if you earn $75,000 and contribute $4,000, you’ll only pay taxes on $71,000.

Employer contributions also boost your savings and aren’t taxed upfront, but you’ll pay taxes on them when you withdraw in retirement.

If you have a lower income, you might also get the Saver’s Credit, which can reduce your tax bill even more.

Risk and volatility

Gold IRA

A Gold IRA can be stable, but its value can change with global events, currency shifts, and political issues. Storage and insurance costs might affect your profits, and selling could come with fees. Future tax or regulation changes might also impact its benefits.

401(k)

A 401(k) depends on the stock market, so its value can change dramatically, especially during downturns. Having limited investment options or too much company stock can be risky.

Some employers let you borrow from your 401(k), but this can hurt your savings, and you have to repay the loan if you leave your job. Without investment knowledge, you might also make choices that don’t pay off.

Gold IRA vs. 401(k)

| Feature | Gold IRA | 401(k) |

| Investment options | Physical golds, silver, platinum and palladium that meet IRS purity standards. | Stocks, bonds, mutual funds, and index funds picked by your employer or plan administrator. |

| Contribution limits (2026) | $7,500/year if you’re under 50, or $8,600/year if you’re 50 or older. | $23,500/year if you’re under 50, or $31,000/year if you’re 50 or older. |

| Tax benefits | Your gold grows tax-deffered, and you might get tax deductions or roll over funds tax-free. | Contributions lower your taxable income, and your money grows tax-deffered until you withdraw. |

| Risk and growth | Gold prices can go up or down depending on things like global events or economic changes. | Your balance depends on the stock market, which can go up and down but has long-term potential growth. |

Advantages of Gold IRA

Gold IRAs come with some great perks for anyone wanting to protect their retirement savings. Here’s why they’re such a popular choice for building long-term financial security:

Hedge against inflation

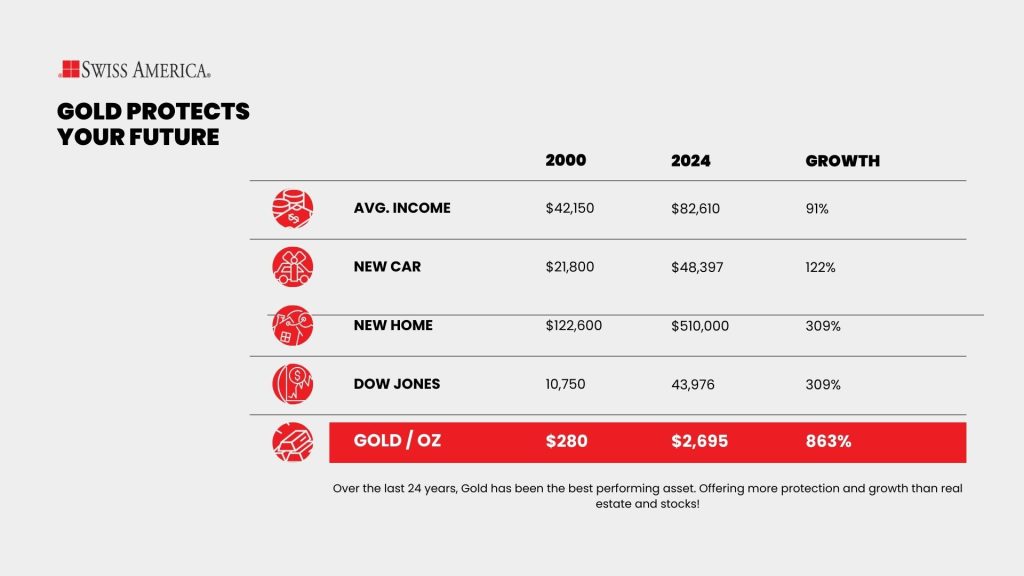

Gold has a strong reputation for protecting against inflation. Its value often increases as prices rise, helping to preserve your purchasing power. For investors concerned about inflation reducing their savings, gold offers a sense of security.

Historically, gold maintains its value or even grows when paper currencies lose strength, so it’s a great option for retirement savings during uncertain times.

For example, our growing national debt due to wars, economic problems, or stimulus spending can increase inflation. To cover the debt, the government might print more money, which lowers the value of paper currency. That’s when gold can really shine, as it often holds its value or even increases when inflation kicks in.

Portfolio diversification

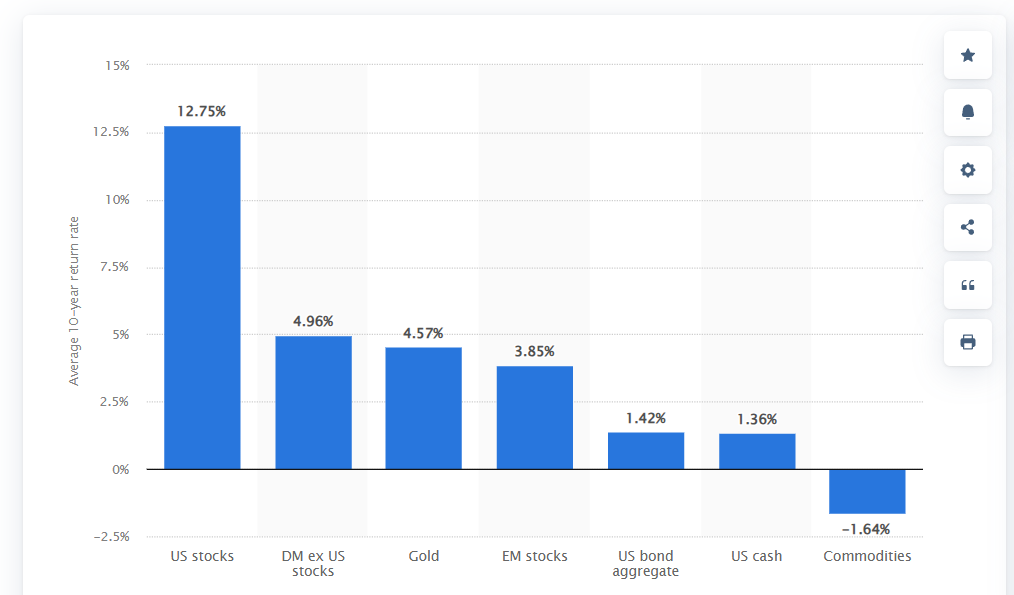

A Gold IRA helps diversify your retirement savings by adding physical gold and other precious metals to your portfolio. According to Statista, its 10-year return outperformed emerging markets, cash, and bonds.

Wealth preservation

Gold has always been viewed as a reliable way to protect your wealth. Its value and limited supply make it a steady investment over the long term. When the economy hits a rough patch, or people fear uncertainty, gold usually holds strong or even goes up.

This gives investors a safe place to shield their money from market ups and downs. As one Reddit user, collectivethink, shared in the r/Gold forum:

“For many of the reasons mentioned above; inflation hedge, store of value, diversification, but mainly cause I sleep well knowing a portion of my wealth won’t go to zero. Ever.”

Liquidity

A Gold IRA gives you a good mix of flexibility and access, making it easy to turn your gold into cash when you need it. Gold is recognized all over the world, so there are plenty of buyers and sellers out there. You can work with a dealer like Swiss America to sell your gold or use an online marketplace or a local coin shop.

Since gold’s value usually stays steady, it can be simpler to cash out compared to other investments that might be harder to sell quickly.

Advantages of 401k plans

401(k) plans also have advantages, which is why so many people rely on them for retirement planning. Here’s what makes them such a helpful way to save:

Employer contributions

A great feature of 401(k) plans is that many employers will match contributions so that your retirement savings can grow faster. For example, an employer might match dollar-for-dollar on the first 3% of your salary and then 50% on anything between 3% and 5%.

This is like “free money” for employees, encouraging them to contribute enough to get the full match.

Ease of management

401(k) plans are easy to manage, making it simple for employees to save for retirement. Contributions get taken directly from paychecks, so you don’t have to worry about making deposits.

Plans give you different investment options, like mutual funds and target-date funds, so you can choose ones that match your risk level and retirement goals.

Wide range of investment options

These plans also offer many traditional investment options. This allows you to pick investments that fit your financial goals and risk tolerance. Many also offer professionally managed options to help guide investment choices.

Considerations

If you are trying to decide between a Gold IRA and a 401(k), there are a few things that could impact your investment strategy and retirement savings. Here’s what to consider:

Rollover options

A Gold IRA rollover lets you move your retirement savings from a 401(k) into an account that holds physical gold and other metals. There are two main ways to do this:

Direct rollover

A direct rollover moves funds straight from your 401(k) to your Gold IRA provider. It’s tax-free and avoids penalties since the funds don’t pass through your hands. This method is the best option because it’s easier and follows IRS rules.

Indirect rollover

An indirect rollover means you withdraw funds from your 401(k) and deposit them into a Gold IRA within 60 days. This is a complicated approach.

First, your employer holds 20% of the funds, but you have to deposit 100%, so you have to come up with the 20% somewhere else. Then, if you miss the deadline, the IRS treats it as a taxable payout, which could mean taxes and penalties.

Finally, you get the 20% back as a tax credit when you submit your tax returns that show you completed the full rollover.

Costs and fees

Investing in a Gold IRA might have higher costs than traditional 401(k) plans because they involve managing physical precious metals. Here are the common fees associated with Gold IRAs:

Setup fees: Your custodian charges a one-time fee of $50 to $100 to cover the cost of opening the account.

Annual maintenance fees: These fees cover the ongoing management of your Gold IRA and can cost between $75 and $250 per year, depending on the provider and the size of your gold investments.

Storage fees: Your custodian handles secure storage with a third-party depository. You can pick shared storage or separate storage with higher costs for the separate option. Storage costs can range from $100 to $300 per year.

Transaction fees: Some custodians charge transaction fees when you buy or sell gold in your IRA anywhere from 1% to 2% of the transaction amount.

Regulatory considerations

IRS regulations

Gold IRAs must follow IRS rules. As we mentioned above, your gold has to meet purity standards and be kept in an approved depository. These rules make sure investors don’t get scammed with fake gold or lower-quality metals than they paid for.

401(k)s also follow IRS rules for contributions, withdrawals, and tax benefits. Employer plans fall under the Employee Retirement Income Security Act of 1974 (ERISA) regulation to protect participants.

Custodian compliance

Both Gold IRAs and 401(k)s rely on custodians to keep everything running smoothly and within the rules. Your Gold IRA custodian handles more than just buying and storing your gold. They also take care of annual reporting and any paperwork if you want to sell or roll over funds.

With a 401(k), the custodian focuses on managing the plan itself. They track your contributions, handle distributions, and make sure the plan follows IRS and ERISA rules. Many also offer tools, like online dashboards, so you can keep an eye on your investments and make changes when needed.

How to choose a Gold IRA company

If you are looking into Gold IRA providers, here are a few things to think about to make the best choice:

Track record

How long has the company been in business? You want to work with a company that is solid and not likely to disappear after taking your money. Swiss America, for example, has been around for over 40 years and has shown it can handle the ups and downs of the market.

Client testimonials

Check reviews from other investors. Look for positive ratings on the company’s website, Google, and third-party platforms like Better Business Bureau.

Educational resources

The best Gold IRA companies offer valuable resources to help investors understand their options. Swiss America keeps you in the loop with regular news updates, podcast episodes, and free guides. Our goal is to help you make smart decisions about your retirement.

Pricing transparency

Make sure that the company you choose tells you about all the costs involved. This includes premiums above spot and any other charges like sales taxes and shipping fees.

Industry credentials

Go with a dealer that is part of well-known industry organizations, as they help enforce standards and make sure everything is above board.

Swiss America is a member of several organizations, including the American Numismatic Association, the Industry Council for Tangible Assets, and the Numismatic Guaranty Corporation.

Gold IRA

Understanding the differences between a Gold IRA and a 401(k) can help you figure out how to use each one to support your retirement goals and manage your risk. You don’t have to choose one over the other, and you can always do both if you want to.

To explore how a Gold IRA can fit into your investment strategy, check out our free Gold IRA kit today!

Gold IRA vs 401k: FAQs

What is the minimum deposit for a gold IRA?

The minimum deposit for a gold IRA depends on the provider. Swiss America’s minimum is $5,000.

How much does a gold IRA cost?

The first year of a Gold IRA is about $250. This includes IRA custodian account fees, annual maintenance and storage fees.

What is the golden rule for 401k?

Start early, contribute consistently, and try to save at least 15% of your income, including employer matches. This will help you build a strong retirement fund over time.

Note: The information in this post is for informational purposes only and should not be considered tax or legal advice. Please consult with your own tax professionals before making any decisions or taking action based on this information.