If you’re looking at buying physical gold and you’ve decided on bars, there are several gold bar sizes to choose from.

With gold around $3,800 an ounce as of this writing, you may not want to start with a full ounce. Or, you may want to go with a larger bar that combines multiple ounces so you can pay a lower premium over spot price by buying in “bulk”.

Here’s all the details on the various sizes of gold bars:

Quick overview of gold bars

You can buy physical gold in either coins or bars. Each has its pros and cons. Bars are easier to store and usually come with lower costs, while gold coins have intricate designs and the backing of government mints, which is why they have higher premiums.

Gold bars come from refineries or sovereign mints and manufacturers produce them in two different ways, depending on their size:

- Large bars: This is when the refiner pours molten gold into molds to create cast bars. Once the bars cool, refiner cleans, weighs, and stamps them.

- Smaller bars: For these smaller gram bars, the refiner mints rolled gold sheets into gold blanks and then punches, polishes, and stamps them with marks.

Gold bar various weights

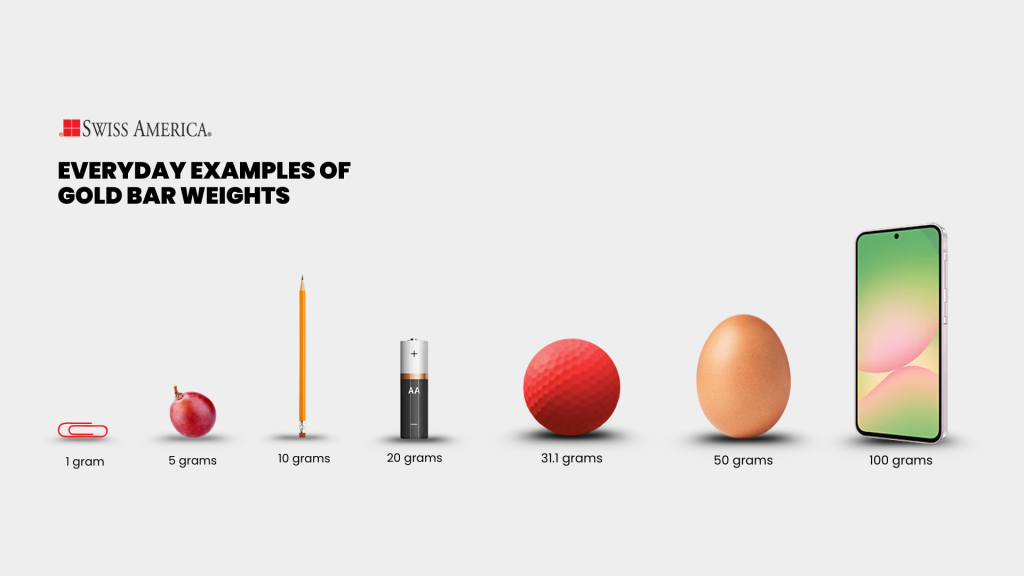

When you think of ounces in everyday life, like recipes or groceries, that’s the avoirdupois ounce, which comes out to 28.35 grams. Gold is different. The precious metals industry measures it in troy ounces, and one troy ounce is 31.1 grams.

So when we say gold is $3,500 an ounce, that’s $3,500 per 31.1 grams.

You can buy gold bars in 32 different sizes. We won’t list them all here, but the common ones most everyday investors look at are:

- 1 gram

- 5 grams

- 10 grams

- 20 grams

- 1 troy ounce

- 50 grams

- 100 grams

Here’s a simple graphic to help you visualize small to larger gold bars compared to every day objects:

You might also hear about the 400-ounce bar. Obviously, that’s massive. It’s mainly used by institutional investors in international markets.

Gold bullion bar standards

The London Bullion Market Association (LBMA) sets the standards for gold bars. This helps you know you’re buying authentic bars that meet quality rules. These standards are:

- Minimum purity: The gold content needs to be at least 99.5%.

- Identification: Bars have to be stamped with a serial number, refiner’s hallmark or logo, purity/fineness mark, and year of manufacture.

- Dimensions: Gold bars must meet very specific physical dimensions for length, width, and height, depending on size.

- Refinery: The bars must come from accredited refiners.

- Appearance: The bars need to be free from defects, cracks, or excessive irregularities.

- Verification: It’s not a requirement but a lot of bars do come with an assay certificate or a certificate of authority. This just verifies that the bar is authentic.

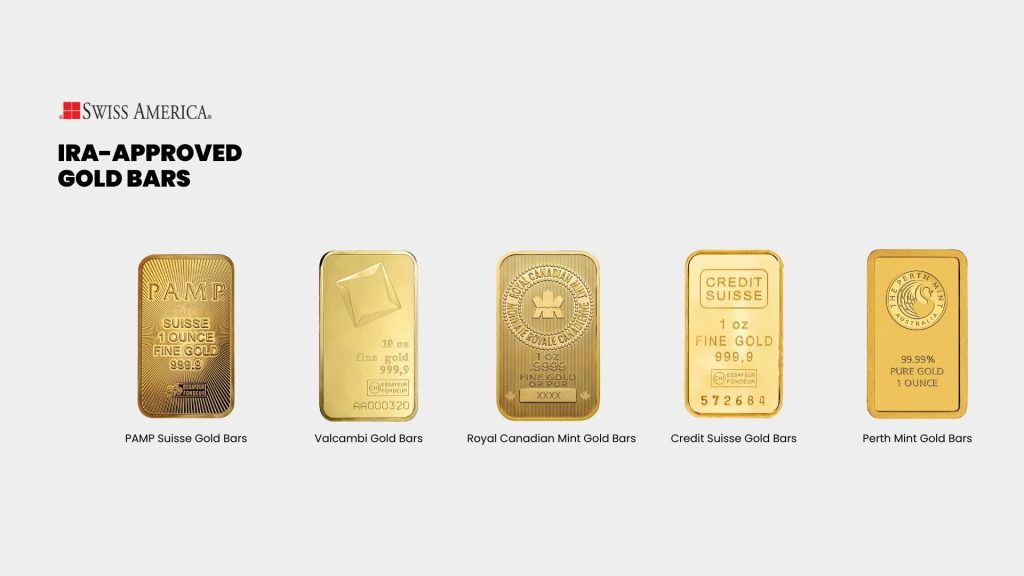

Some examples common bars for everyday investment needs come from manufacturers like Valcambi, PAMP Suisse, or Royal Canadian Mint.

Purchasing gold bars

If you want to buy gold bars, it’s best for individual investors to go through a reputable dealer. The difference between that and just buying online is that you get guidance and support. You can talk through your goals, ask questions, and get advice on things like storage or even other metals you might want to consider.

Dealers like Swiss America also offer buyback programs, which can give you peace of mind if you ever want to sell your gold.

Once you buy your bars, the next step is storage. Some people keep them in a safe at home, others use a bank’s safe deposit box, and some choose a third-party depository. The choice here depends on your specific scenario, how much gold you’re buying and where you feel is the safest place to protect your wealth.

Benefits of gold and other precious metals

One of the main reasons people buy gold is because it works like an insurance policy. They want a way to protect part of their wealth from the unknown. What that “unknown” looks like changes over time. In 2022, it was inflation at the highest level in decades. Right now it might be uncertainty around tariffs and where the economy’s headed. At other times it’s global crises like wars or geopolitical conflicts.

Gold, silver, and platinum have scarcity. We only have so much, and no one can just create more. That makes them different from stocks, real estate, or even Bitcoin. They stand on their own, which is why investors use them to diversify their portfolio.

Gold is easy to sell almost anywhere in the world, so you always have liquidity if you need it. And unlike a stock or a bond, you don’t have to rely on a company or government to make good on a promise. It’s just the metal itself. That’s why people also see it as a long-term store of value because it’s managed to hold purchasing power across centuries.

A quick summary of the reasons why people invest in gold or other precious metals:

| Benefit | What it means for you |

|---|---|

| Protection | Acts like insurance against inflation, crises, and uncertainty |

| Scarcity | Limited supply, no one can just create more |

| Diversification | Moves independently from stocks, real estate, and crypto |

| Liquidity | Easy to buy or sell almost anywhere in the world |

| No counterparty risk | Value doesn’t rely on a company or government promise |

| Store of value | Preserves purchasing power over the long term |

Where to get gold bars in various sizes

Looking for gold bars? Swiss America has a complete range of sizes and can help you figure out what works best for you. Call us today to learn more.

Gold bar sizes: FAQs

What is a standard size gold bar?

A standard gold bar, is also called “Good Delivery” bar. It weighs between 350 to 430 troy ounces. Smaller bars for everyday investors can vary depending on the gold content and commonly range from 1 gram up to 1 kilogram.

How big is a 27 lb gold bar?

A 27 lb gold bar is the “Good Delivery” bar. Its typical dimensions are about 7 inches long, 3.6 inches wide, and 1.75 inches thick.

Can you buy a 400 oz gold bar?

Yes, you can but a 400 ounce gold bar. As of this writing, it would cost about $1.4 million USD spot price which doesn’t include the dealer premium.

The information in this post is for informational purposes only and should not be considered tax or legal advice. Please consult with your own tax professionals before making any decisions or taking action based on this information.