Is gold still a good way to protect your money when the economy is uncertain? As prices go up and markets change, you want to know if gold as an inflation hedge can keep your investments safe.

Inflation spiked to almost 7% a few years ago. Though it has since returned to more typical levels, that earlier increase created a new price baseline. So your groceries, insurance, and even services are way higher than they used to be. And while the pandemic-fueled inflation crisis is nearly over, future economic challenges are inevitable.

That’s why investors add gold to their portfolios to protect their assets’ value. But is gold still the go-to inflation hedge, or has its shine faded in today’s volatile market?

This article covers gold as inflation hedge and if it’s the right investment for your portfolio.

Gold’s relationship with inflation

People often see gold as a safe bet when inflation rises. But inflation rates alone don’t control gold prices. Take the 1970s, when high inflation saw gold prices soar. Then, in the 1980s, gold dropped even as inflation continued. The reason is that other factors like interest rates and market conditions also have a role in gold’s value.

Here’s a few reasons why gold prices and inflation rates don’t move exactly in sync.

Short-term vs long-term

In the short run, interest rate changes or stock market ups and downs can impact gold pricing. For example, in the early 1980s, high interest rates made bonds look better, which is why gold prices fell. But over the long term, gold usually holds its value. It often keeps up with inflation and proves to be a solid way to store wealth.

Investor behavior and market sentiment

Investor psychology also impacts gold’s performance as an inflation hedge. When the economy gets shaky, or global tensions rise, people often buy gold for its reputation as a haven, even if inflation isn’t through the roof.

We saw this during the 2008 financial crisis when gold prices soared, not because of inflation alone but because everyone was panicking. During the COVID-19 pandemic, the same thing happened: gold coins and bar sales hit record highs as people feared economic uncertainty and inflation from government stimulus.

Interest rates and gold prices

Central banks raise interest rates when inflation rises to help cool it down. This makes investments that pay interest, like bonds, more attractive than gold because gold doesn’t earn interest.

Take 2018 as an example. During that time, the Fed increased rates several times, and gold prices declined as investors moved to take advantage of higher bond yields.

Multiple factors impacting gold

Does inflation affect gold prices? Absolutely, but gold prices are not driven by inflation alone. Prices change due to a mix of factors, including supply and demand, interest rates, investor sentiment, geopolitical events, and broader economic conditions.

Gold’s track record over the years

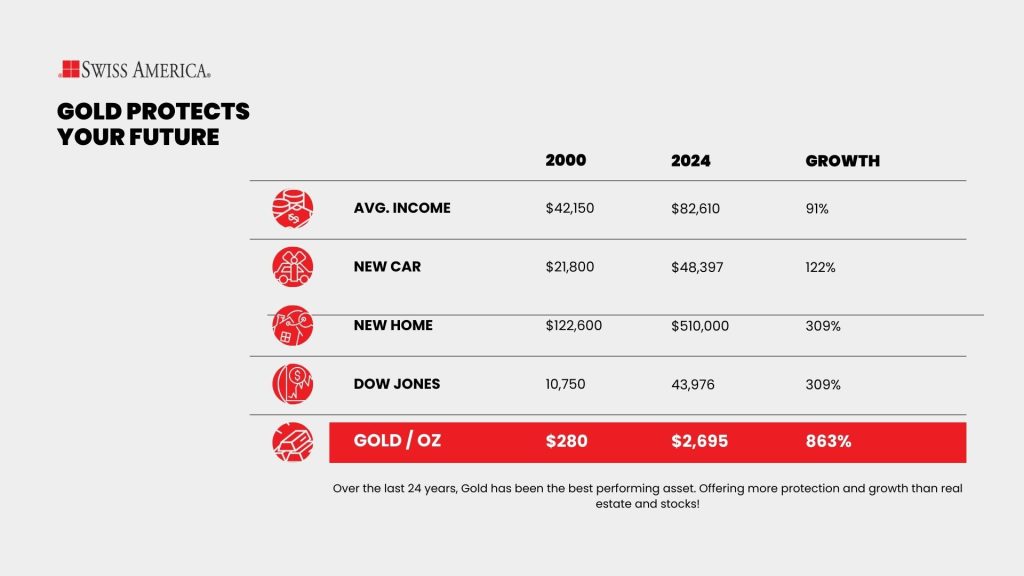

For decades, investors have used gold to balance and secure their portfolios from inflation. Here’s the historical data on gold and inflation to take a look at performance:

1970s: Strong inflation hedge

After Richard Nixon took the U.S. off the gold standard in 1971, America endured a high inflation period of 1973-1979, when annual U.S. inflation averaged 8.8%. But gold generated an impressive 35% annual return.

1980s-1990s: Mixed performance

From 1980 to 1984, the gold price fell by about 10% annually in real terms, even though inflation averaged 6.5%. Similarly, from 1988 to 1991, gold prices dropped by approximately 7.6% annually despite average annual inflation rates of 4.6%.

During this time, gold underperformed compared to other inflation hedges like real estate and commodities.

2000s: Strong rebound

From 2001 to 2012, gold prices surged by 375%, even after adjusting for inflation. This growth happened during a period of economic uncertainty. During that time, concerns about the U.S. dollar’s purchasing power and global financial stability created investment demand for yellow metal.

2010s-2020s: Mixed results

More recently, gold’s performance is mixed. Between 2021 and 2022, when U.S. inflation averaged around 6.8%, gold prices only gained about 1% annually.

Looking back, gold usually does well when inflation is high. For example, the World Gold Council found that gold returned about 15% per year on average when inflation was above 3%, compared to just 6% when inflation was lower. These numbers point towards gold performing better during times of rising inflation.

Even Warren Buffett, a long-time critic of gold as an investment, saw his company, Berkshire Hathaway, buy a stake in a gold mining company during the 2020 economic uncertainty.

A user on r/Gold summarized it this way: “It doesn’t perfectly match inflation at every point in smaller cyclical moves, but it does retain its purchasing power over long secular inflation moves.”

Gold vs other inflation hedges

Investors today have more options than just gold as an inflation hedge. But are they better?

Here’s a simple snapshot to show how gold compares with other inflation-hedging alternatives:

| Can outperform over the long term | Inflation Protection | Liquidity / Ease of Trading | Key Consideration |

|---|---|---|---|

| Gold | Historically strong, retains long-term value | Can outperform over the long term | No yield; portable & liquid |

| Stocks | Can outperform over long term | Very high | Offers income (dividends) but is more volatile |

| Treasury I Bonds | Tied to CPI → direct inflation protection | Moderate | Stable returns, lower risk than equities |

| Real estate | Often increases with inflation | Lower | Tangible asset, rental income possible |

Gold vs. the stock market

Stocks generally offer better returns and income over long periods, but gold can outperform as a hedge in shorter periods, especially during financial crises. For instance, during the COVID-19 market crash from February to March 2020, gold prices held steady or even went up, while stock markets saw steep declines.

Gold shines brightest when the stock market is down. However, even through April 2024, when inflation persisted and the stock market was up, gold still outperformed the S&P 500, rising 13% compared to the S&P 500’s 9.34% increase.

Gold vs. treasury bonds

U.S. Treasury I Bonds provide inflation protection with predictable returns tied to the Consumer Price Index (CPI). Most people consider them a stable, low-risk investment. But if you are looking for potential higher returns and a hedge against broader economic risks, you might want gold instead.

Gold vs. real estate

Real estate can also hedge against inflation since its values usually rise with increased prices. It gives you tangible value and potential rental income. The difference is that gold is more liquid and portable than real estate. Investing in buildings also requires a lot of upfront capital, has high maintenance costs, and can be riskier than gold.

Gold vs. Bitcoin

Some call Bitcoin “digital gold,” and see it as a modern alternative to gold for inflation protection. However, Bitcoin is much newer and more unpredictable, with price swings that make it much riskier than gold. Bitcoin doesn’t have a long history during high inflation, and it faces ongoing regulatory questions.

Bitcoin does have some benefits, like its fixed supply limit and ease of transfer. But its short track record and high volatility mean it’s less proven to protect against inflation.

How much gold do you need?

Experts generally recommend allocating 5-10% of your investment portfolio to gold as a diversification and inflation protection strategy. During times of high inflation, depreciation of the dollar, or economic concern, some might even recommend that you increase your allocation to 20%.

If you are trying to decide how much gold to invest in, you should consider all factors of your financial situation, including your retirement goals, time horizon, and risk tolerance. If you need help, consult a financial planner for advice.

Ways to own gold

Gold is both an inflation hedge and a valuable investment. It has practical applications in electronics, medicine, and even space technology. When governments print excess money to boost the economy, it can lead to inflation.

Physical gold

Owning physical gold bars or coins gives you a tangible asset that can’t be artificially produced.

If you’re buying gold outside a retirement account, remember to factor in storage, insurance, and security costs. Or, if you set up a Gold IRA, this allows you to hold physical gold in an account with tax benefits like deductions and deferrals.

Other ways to invest in gold

You can also invest in gold through paper assets like:

Gold ETFs

Gold mining stocks

Gold futures

Why investors choose Swiss America

We’ve helped customers get started with gold investing for over 40 years. You’ll find that customers love working with our team because we provide the following:

Educational resources: You can learn more about investing in gold from our in-depth research reports, regular podcasts, or daily market news.

Great support: Clients share their experience buying gold coins or bars and getting excellent support throughout the entire process. We can also help with advice on storage options, IRA rollovers, and insurance to protect your physical gold.

Visibility: You can easily see the value of your precious metal assets with our online portal. Besides real-time market data, you’ll also get investment recommendations and trade-in pricing if you need to liquidate your bullion bars or coins.

Is gold an inflation hedge? Absolutely.

Gold investors have used this precious metal to protect against inflation for decades. But does it still do this job in today’s economy? The answer is: mostly. Is gold a perfect inflation hedge that follows all the rules? No. Nothing’s perfect. But it has the longest and best track record of all the options.

If you want to add gold to your investment strategy, connect with the Swiss America team today!

Gold as inflation hedge: FAQs

Is gold a good hedge against inflation?

Buying gold has often helped protect money’s value when regular currency becomes worth less over time.

Does gold do well in high inflation?

According to the World Gold Council gold has average returns of 15% per year when inflation exceeds 3%.

Is a gold ETF a good hedge against inflation?

Gold exchange-traded funds, or ETFs, can add gold and other precious metals to your portfolio, but they are paper assets, so you won’t own a tangible asset.

Note: The information in this post is for informational purposes only and should not be considered tax or legal advice. Please consult with your own tax professionals before making any decisions or taking action based on this information.