In 2025, 48.5% of Swiss America customers chose silver to protect their wealth. We’ve seen increased investor activity due to the relative affordability of silver compared to gold. If you want to add this metal to your portfolio, what is the best silver IRA to go with?

This article covers how to do a rollover, IRS rules, and some of the reasons why investors take this option for their retirement accounts.

What is a Silver IRA?

A silver individual retirement account allows you to hold physical silver and other precious metals as part of your portfolio. It functions the same as a regular IRA with the same tax and contribution rules but instead of paper assets like stocks, bonds or mutual funds, you can hold physical silver or other precious metal bullion.

The types of Silver IRAs you can have include:

Traditional IRA: You fund this account with pre-tax dollars and your investment grows tax-deferred. You might roll over these funds from a 401(k) or set up a new IRA. When you are ready to retire, you’ll pay income tax on the withdrawal amounts.

Roth IRA: This account type grows tax-free because you’re investing after-tax dollars. When you reach retirement age of 59.5, you won’t pay taxes when you withdraw.

IRA and 401k Silver IRA rollover accounts

Depending on the account you have, you can do a Silver IRA rollover by converting your existing IRA or 401k into silver. Here’s how it works:

Step 1: Choose a precious metals dealer

Consider working with a reputable dealer like Swiss America. We’ve been in business for over 40 years and helped thousands of customers with Self-Directed IRAs.

Step 2: Open an account with an IRA custodian

The independent IRA custodian manages your retirement funds on your behalf and verifies IRS compliance.

If you don’t already have one in mind, we recommend Gold Star Trust. You’ll open accounts with both the custodian and Swiss America.

Step 3: Fund your account

Contact your current plan administrator to let them know you want to roll over your funds into a Self-Directed IRA.

You have a couple of options for the rollover, but the best route is to choose a direct rollover. In this scenario, your current administrator sends the funds directly to your IRA custodian. This makes sure your funds easily stay compliant with IRS rules for retirement accounts.

Adding more funds

If you want to contribute more each year, these IRAs have the same contribution limits as traditional IRAs. For 2026, the amounts are $7,500 or $8,600 if you are 50 and older.

There are other rules for Roth IRAs depending on your income, so check the IRS site for more details.

Step 4: Buy your metals

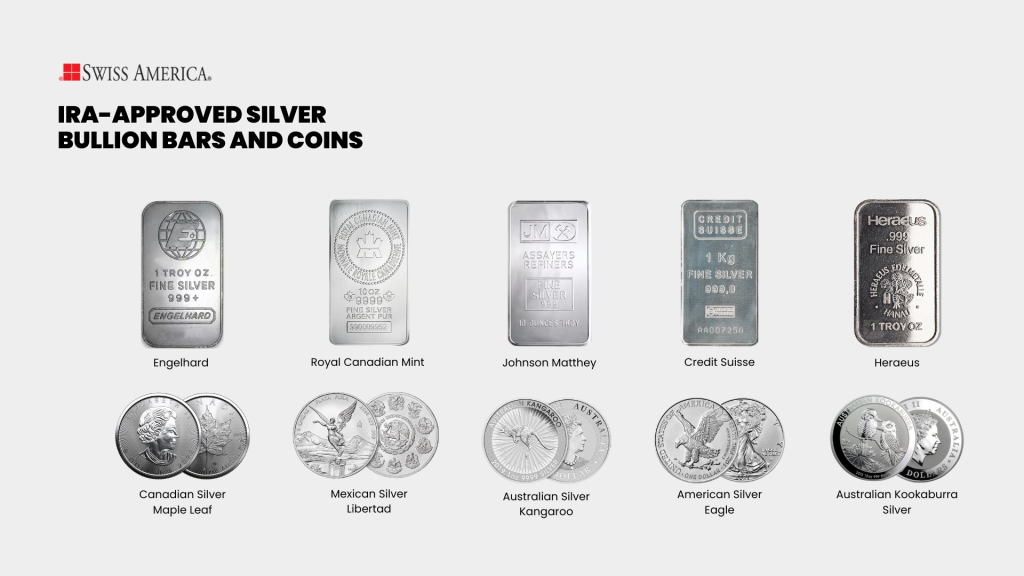

The IRS has rules about which silver coins or bars you can hold in your Self-Directed IRA, and our team can provide details on your options. For example, IRA-eligible coins include:

Canadian Silver Maple Leaf

Austrian Silver Philharmonic

Once you’ve decided on what silver or other precious metals you want to buy, you’ll instruct your custodian to make the purchase on your behalf.

Step 5: Storage and management

Using retirement funds means you can’t take possession of your precious metals or store them at home. The reason is that if the dealer shipped the metals to you, the IRS considers this a distribution and imposes tax penalties.

Instead, the custodian sets up shipping to an IRS-approved depository for secure storage until you are ready to sell or you want to take distributions at retirement age.

You can manage your account through Swiss America’s online portal, which gives you real-time access to portfolio value, market updates, and investment recommendations.

Benefits of silver in your IRA

Some of the reasons to consider adding silver as part of your retirement plans include:

Limited supply and industrial demand

Just like gold and other precious metals, there’s only so much silver on the earth. Because of its limited supply, whenever demand increases, it can drive up the price and increase the value of your investment.

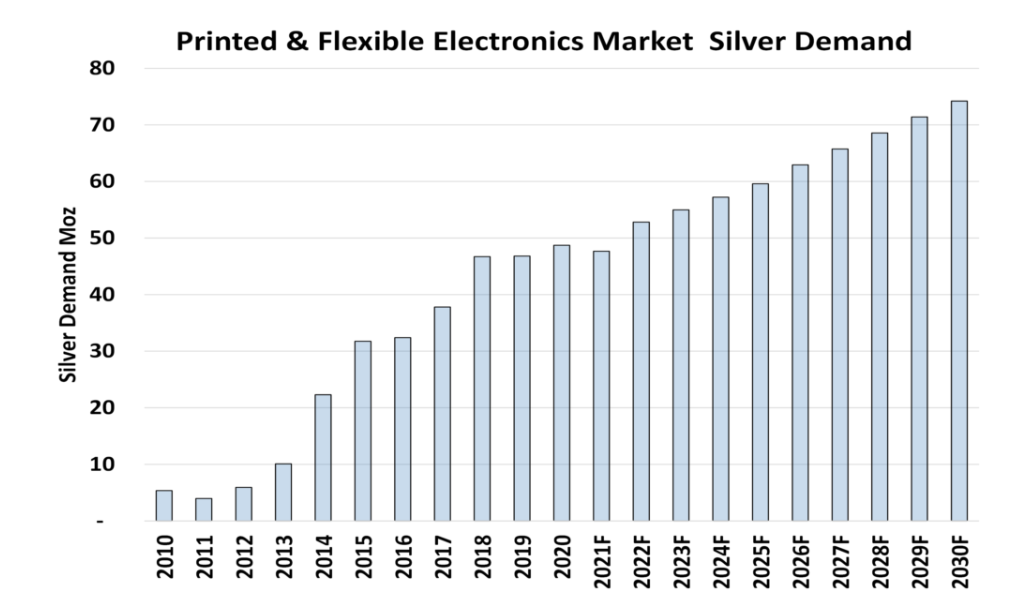

The Silver Supply Institute expects the supply and demand gap to increase by 17% in 2024 due to demand from several industries, like:

Solar panels

Batteries

Semiconductors

Medical instruments

Electronics

The graph below shows anticipated industrial demand through 2026:

Hedge against inflation

High inflation, which devalues the US dollar, can decrease the value of your retirement portfolio. People wanting to protect their wealth turn to silver and gold as a hedge against inflation. The reasons why are:

Their value can rise during inflation to protect your purchasing power.

They have built-in value independent of any single currency.

They’re priced in US dollars, which can offset dollar devaluation.

Tangible asset

Tangible asset ownership means you can control your silver and don’t have to rely on a third party, digital access, or anything else to manage it. Many investors like the security of knowing that a cyber event or stock market crash can’t wipe out the value of their investments.

Affordability and accessibility

Investors can buy more silver for the same amount of money compared to gold. As of this writing, the gold-to-silver ratio is 71.8, which means you can buy 71.8 ounces of silver for every 1 ounce of gold. So owning silver is an affordable way to diversify your savings into metal assets.

If you want to learn more about silver assets, check out our podcast and our thoughts on how high silver might go in the near future:

Silver IRAs final thoughts

Adding silver to your portfolio can be a way to diversify and reduce risks. To learn more about setting up an account and the various options, contact Swiss America today.

Best Silver IRA: FAQs

Is a Silver IRA a good investment?

It can be. Many investors like having silver in their IRA accounts as a way to diversify their portfolios and hedge and against various risks like economic uncertainty and inflation.

Is investing in silver tax-deductible?

No, investing in silver itself isn’t tax-deductible, but you might be able to deduct your annual contributions to a Silver IRA. Be sure to check IRS rules and limits.

Note: The information in this post is for informational purposes only and should not be considered tax or legal advice. Please consult with your own tax professionals before making any decisions or taking action based on this information.