Are you exploring ways to secure your retirement savings and wondering if a Gold IRA vs traditional IRA is the better option? Both offer a path to building wealth for the future.

Learn about the differences between these two types of accounts to help you align your retirement plan with your financial goals and preferences. The good news is you can also go with both options if you want a way to diversify your savings with physical gold.

Understanding IRAs

An Individual Retirement Account (IRA) is an account that helps you save for retirement with tax advantages. There’s a few different types of IRAs which have different rules and ways to grow your retirement funds.

Traditional IRA

A traditional IRA allows you to save for retirement using pre-tax income, which may reduce your annual taxable income. Earnings in the account grow tax-deferred, meaning you’ll only pay taxes when you withdraw funds during retirement.

These accounts hold assets like stocks, bonds, and mutual funds. Annual contribution limits apply. For the tax year 2026, the contribution limit is $7,500 for individuals under age 50 and $8,600 for those aged 50 and above.

You can withdraw funds at the retirement age of 59½.

Gold IRA

Gold IRAs, also sometimes called precious metal IRAs or Silver IRAs, are self-directed retirement accounts. Because you’re in charge of where to allocate your savings, you can hold physical gold and other precious metals as part of your retirement savings.

This account gives you more control over investment choices beyond standard stocks and bonds.

You’ll see the same tax benefits as with a traditional IRA, and you can have these types of Gold IRAs:

Traditional Gold IRA: You fund this account before taxes, and it grows tax-deferred until you withdraw it in retirement. At that point, you’ll pay income taxes on your investments.

Roth Gold IRA: You put money into this account after taxes, and it grows tax-free. You can then withdraw your physical gold or other metals tax-free in retirement as long as you’ve held the account for five years.

SEP Gold IRA: If you’re self-employed or a small business owner, you can fund this account with pre-tax money for both yourself and your employees.

Comparative analysis

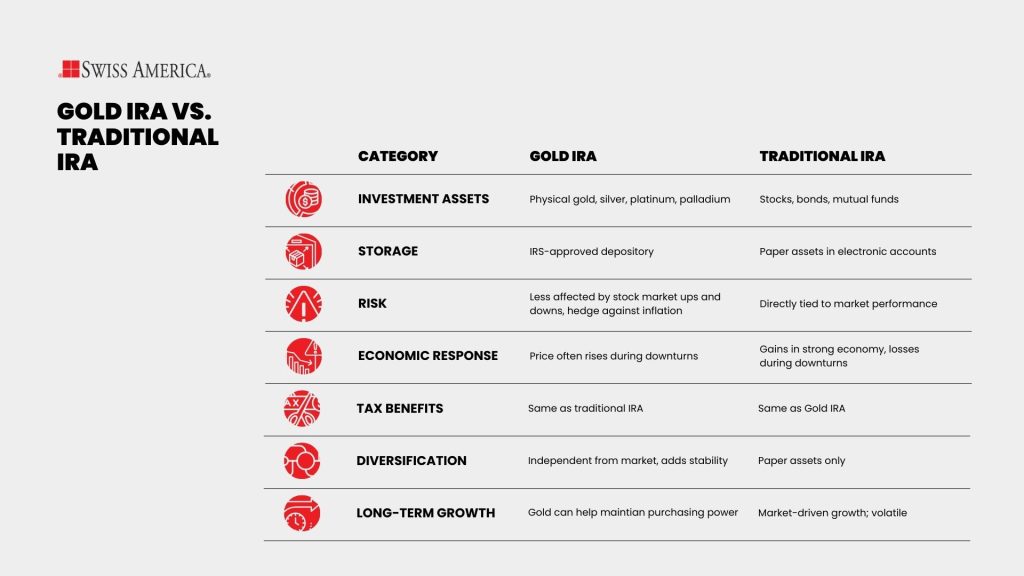

A Gold IRA and a traditional IRA are both retirement accounts that offer tax advantages. However, they are different in assets, risks, and how they respond to economic conditions.

Investment assets

Gold IRA

A Gold IRA lets you invest in physical gold coins and bars and other physical precious metals such as silver, platinum, and palladium.

The IRS requires that your metals meet certain purity and manufacturing standards. Common IRA-approved gold coins include the American Gold Eagle or Canadian Maple Leafs. You can also buy gold bars from accredited refiners like Pamp Suisse and Royal Canadian Mint.

Once you purchase gold, your Gold IRA custodian stores your metals in an IRS-approved depository. If you tried to store your gold at home, the IRS would consider this a distribution.

Traditional IRA

A Traditional IRA invests in paper assets like stocks, bonds, and mutual funds. Each of these depends on market performance, which means they’ll do well during strong economic times but may lose value during downturns.

They also rely on someone else’s ability to perform or keep your account secure. For example, gold stocks might do poorly if the company doesn’t meet its operational goals. Or, you might get locked out of your online account if there’s a cyber attack.

Economic considerations

Gold IRA

People see gold as a hedge against economic volatility. This is because when there are market downturns or periods of high inflation, investors buy tangible assets like gold.

The more investors buy gold, the higher the price rises. Take the 2008 financial crisis, when prices jumped nearly 25% because investors wanted to protect their money from falling prices with many other investments.

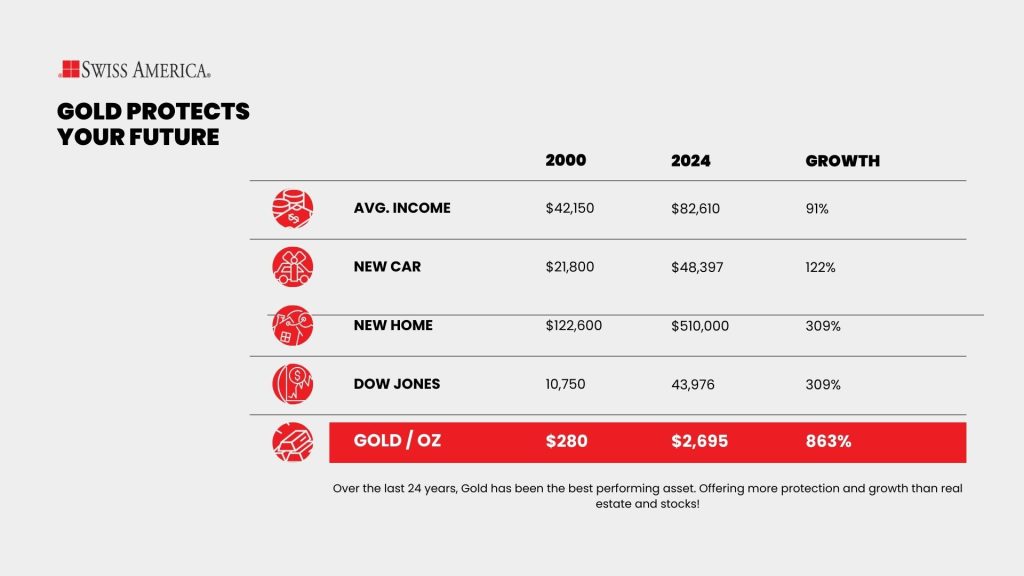

Consider gold’s performance compare to inflation since 2000:

Traditional IRA

A Traditional IRA depends on stock market performance. In a strong economy, stocks and mutual funds can increase in value but then lose value during slowdowns or crashes. These IRAs mirror the economy’s ups and downs, with big gains in good times and higher risks in bad times.

Tax implications

There’s really no difference here. A Gold IRA gives you all the same tax benefits as IRAs with traditional investments. You have options for both traditional Gold IRAs or Roth Gold IRAs, with the IRS tax rules for each.

Below is a comparison of these two retirement account:

| Feature | Gold IRA | Traditional IRA | Key takeaway |

|---|---|---|---|

| Assets held | Physical precious metals (gold, silver, etc.) | Paper assets (stocks, bonds, mutual funds) | Different asset types affect volatility and diversification |

| Market exposure | Hedge against market downturns | Tied to stock & bond market performance | Gold can act independently of markets |

| Storage requirements | Must be held in IRS-approved depositories | No special storage requirement | Storage adds cost and custodian rules |

| Tax treatment | Same tax benefits as traditional IRAs | Tax deferred (or tax-free for Roth) | Structurally similar tax rules |

Retirement planning

If you’re looking at both options, be sure to consider criteria around investment growth, risk management, and income during retirement.

Diversification

Diversification helps spread risk by investing in different asset types. You can do this with traditional retirement accounts that hold a mix of stocks, bonds, and mutual funds.

Gold IRAs give you even more diversification because metals act differently than the stock market. Gold is an independent asset that doesn’t rely on the market or a company’s performance to have value.

This makes them a solid hedge against inflation and market crashes, which is why advisors recommend both. Combining a traditional IRA with a Gold IRA creates a portfolio that grows over time and can create stability for your savings.

To maximize diversification, consider allocating 5% to 15% of your portfolio to gold, depending on your risk tolerance and goals.

Long-term growth

Traditional IRAs can give you growth through stocks and bonds. However, market ups and downs can affect these investments. A downturn can reduce the value of these traditional investments, so adding gold can help you manage this risk.

Gold is best as a long-term asset. Over several years, it can hold its purchasing power and provide solid returns. In fact, gold’s average annual increase from 1971 to 2019 is over 10%. Some years are higher than others, like what we see right now in 2024, where gold is up over 28%.

As you approach retirement, consider shifting some stock investments to gold to reduce risk while still leaving room for growth.

Choosing the right IRA

Choosing the right IRA depends on your retirement goals and risk tolerance. Here’s what you’ll want to evaluate:

Factors to consider

Deciding between a precious metal IRA and a traditional IRA depends on your financial goals, risk tolerance, and time horizon. If you want stability and protection against economic volatility, a Gold IRA is a good choice. Gold performs well during times of high inflation or market downturns, so it can potentially protect your savings against inflation and economic instability.

It can also be a good idea to have both options. Traditional IRAs give you access to the stock market and then Gold IRAs help you diversify your investments and reduce your risks.

Finding the right IRA company

Choosing the right IRA provider is an important step. Look for a company with a strong reputation, transparent fees, and excellent customer service. For Gold IRAs, your precious metals dealer can refer you to a custodian with experience handling physical metals and offering secure storage options.

Evaluate custodians based on factors like:

Storage options: What are the custodian account fees for IRS-approved depositories? Can you choose between segregated and commingled storage?

Fees: What are the account setup and transaction fees? Do they provide a clear fee breakdown upfront?

For Traditional IRAs, focus on companies that provide:

Variety: A wide selection of investment choices, such as stocks, bonds, and mutual funds.

Support: User-friendly tools for managing your account online and reliable customer support.

Swiss America for your Gold IRA

If you want to learn more about Gold or precious metal IRAs, consider working with Swiss America’s expert team. With over four decades of experience, we’ve assisted thousands of satisfied clients in buying gold and other precious metals for their IRAs.

Take advantage of our extensive resources, including detailed guides, regular podcasts, and up-to-date news, to better understand Gold IRA investing options and requirements. Our expert advice and transparent pricing make sure that you’ll always know exactly what you’re paying for.

Gold IRA final thoughts

Understanding the differences between a Gold IRA and a standard IRA can help you decide on the best way to grow and protect your retirement savings. There’s no need to choose one over the other—you can incorporate both into your retirement strategy to balance growth and stability.

If you’re ready to explore how a Gold IRA can enhance your investment strategy, get a free Gold IRA kit here and learn more about this retirement account option.

Gold IRA vs traditional IRA: FAQs

Is it better to buy physical gold or a gold IRA?

It depends on your goals. Both allow you to own physical gold. The difference is a Gold IRA uses retirement funds to hold your gold or other precious metals.

Are Gold IRAs a good idea?

Gold IRAs are a good choice for diversifying your retirement portfolio, especially if you’re concerned about inflation or market volatility. Just like all investments, they have fees for storage and management costs to consider.

What is the minimum deposit for a gold IRA?

The minimum deposit for a Gold IRA with Swiss America is $5,000.

Note: The information in this post is for informational purposes only and should not be considered tax or legal advice. Please consult with your own tax professionals before making any decisions or taking action based on this information.