Are you watching your savings steadily lose value while prices continue to climb? Deloitte forecasts inflation above 3% through Q3 2025, so this might be a likely scenario.

Many investors turn to gold and silver to protect their wealth but don’t forget about platinum and its advantages as another option. This rare metal serves as a hedge against inflation, and its industrial applications in everything from catalytic convertors to medical devices make it valuable in times of economic uncertainty.

Learn how to buy platinum, including physical metal and paper asset alternatives. You’ll also discover how platinum protects against inflation and provides portfolio diversification to help protect your wealth.

Understanding platinum as an investment

Platinum is one of the rarest elements on Earth and about 80% of the world’s production happens in South Africa. It’s a dense, malleable, and highly unreactive industrial metal, which makes it useful in several industries.

People look at buying gold and might overlook platinum, but don’t pass up this metal as a possible way to diversify your portfolio.

Types of platinum products

What kind of platinum bullion can you buy?

Platinum bullion coins

Just like gold and silver coins, you can buy platinum bullion from various manufacturers. The sizes include 1/10oz, 1/4oz, 1/2 oz and 1 oz. Some of the most popular coins include:

- Platinum American Eagles

- Canadian Maple Leaf

- Australian Platinum Kangaroo

- British Platinum Britannia

- Austrian Philharmonic Platinum Coin

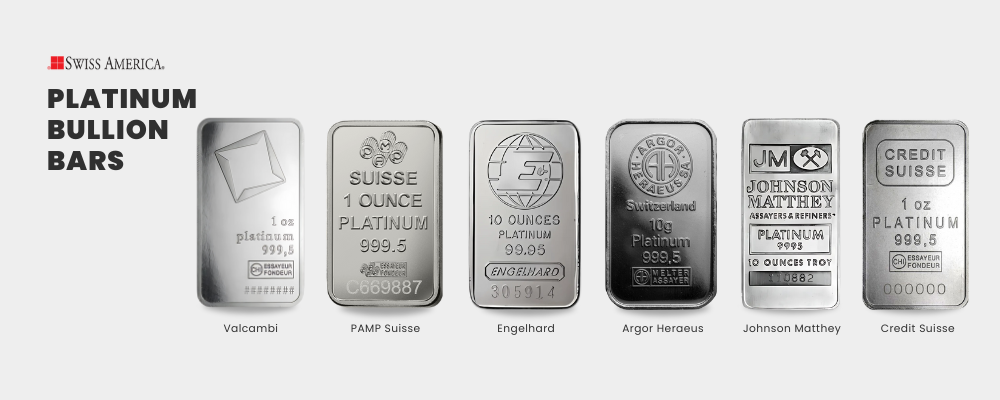

Platinum bullion bars

Platinum comes in all the same bar sizes as silver and gold. This includes 1 gram, 1 ounce, 10 ounces, and 1 kilogram. Most of the same manufacturers that produce other precious metals bars also make platinum, including:

- Valcambi

- PAMP Suisse

- Engelhard

- Argor Heraeus

- Johnson Matthey

- Credit Suisse

Factors influencing platinum prices

What drives platinum prices? Most of this depends on investment demand, spot price, and manufacturing costs:

- Spot price: This is the price you’ll see if you look up “current price of platinum” online. It changes all the time based on supply and demand.

- Manufacturing costs: The cost to produce platinum products affects what you pay. Bars are cheaper to make, which means they come with lower premiums.

- Demand from industries: Platinum supports the automotive and other industries. Depending on what is happening with the economy and trends, it can drive platinum pricing.

Where to buy platinum

You have several options to buy platinum bars or coins:

- Precious metal dealers: Reputable dealers like Swiss America can help you learn about buying platinum and offer useful resources along the way. It’s best to go with a well-established company with a solid track record, so you’re more likely to get fair pricing and high-quality metals.

- Online e-commerce: It can be easy to buy online, but you don’t get the one-on-one guidance that can be really helpful when investing in precious metals.

- Local coin shops: You can buy from a physical coin shop, but availability and pricing may vary. Some shops may not offer the same level of specialized knowledge or resources as larger dealers.

Non-physical platinum investments

You can also make a platinum investment with paper assets like:

Exchange-traded products (ETPs)

Exchange-traded products like platinum ETFs (Exchange-Traded Funds) are another way to gain exposure to platinum. These funds pool investors’ money to buy platinum assets, which they can trade on stock exchanges.

The drawback of this platinum investment is that it is a paper asset, which means it relies on third-party systems, has cyber risks and has increased management fees.

Platinum mutual funds

You can also buy mutual funds that focus on platinum investments. These funds might invest in companies involved in platinum mining stocks or other parts of the platinum industry, so they provide indirect exposure to platinum’s market value.

Just like ETPs, mutual funds are paper assets. The value of your investment depends on someone else’s performance, such as the profitability of the platinum mining companies or the investment manager’s decisions.

Platinum futures

Platinum futures contracts or options allow you to buy or sell platinum at a predetermined price on a specific future date. When you enter a futures contract, you’re committing to either purchase or sell a specified amount of platinum at the contract’s expiration.

Investing in futures can offer opportunities for profit but it also carries significant risks due to market fluctuations and leverage.

Below is the comparison of your options to invest in platinum, physical and non-physical:

| Investment type | What it is | Pros | Cons |

|---|---|---|---|

| Platinum bullion (coins/bars) | Physical metal you own and store | Tangible asset; diversification; industrial demand support | Storage & insurance costs; no income generation |

| Platinum ETFs / ETPs | Exchange-traded funds tracking platinum | Liquid; easy to buy/sell | No physical ownership; management fees |

| Platinum mutual funds / stocks | Investments in mining companies or related funds | Potential dividends; indirect exposure | Market risk beyond the platinum price |

| Platinum futures/options | Contracts to buy/sell at a set future price | Leverage & profit potential | High risk; complicated |

Considerations for investing in platinum bullion

What should you consider before you buy platinum? Just like any other investment strategy, you’ll want to take a look at your goals.

Investment timeframe

Are you looking for short-term gains? The price of platinum changes constantly, and it’s a more speculative investment than gold. If you on top of watching the market and demand, platinum can be a good option for short-term investments.

For long-term investing, platinum might have a large potential for growth. It’s a key component in the growing green technologies industry for products like fuel cells and clean energy systems.

Storage and security

You’ll want to decide how you want to store your physical platinum bullion. Most investors choose a home safe, bank safety deposit box, or third-party depository. Each option has pros and cons, so keep the various costs in mind.

Market research

Anyone looking at short-term platinum investing should always keep updated on the latest market trends and spot prices. Some good resources include the World Platinum Investment Council and the National Minerals Information Center.

Pros and cons of investing in platinum

Before you go buy this physical metal, it’s good to make sure you know the pros and cons. What’s interesting is that sometimes you’ll find a pro to also be a con. Here’s what we mean:

Pros of investing in platinum bullion

- Diversification: Platinum is a tangible asset that operates differently than the stock market, so it’s a way to diversify your savings.

- Demand drivers: The automotive industry and other sectors use platinum for production, which drives demand.

- Return potential: Platinum’s price swings mean you can also make more money than with other assets like gold.

Cons of investing in platinum bullion

- Economic downturns: The same demand drivers in industries like green energy or automotive can go away if there’s an economic downturn. This hurts the price of platinum.

- Price shifts: The price swings that might give you great short-term returns can also give you losses.

- No income: Just like all precious metals, platinum doesn’t generate income, so you might lose out on some returns depending on your investment needs.

Selling platinum

What if you want to sell your physical platinum bullion? First, take a look at what is happening in the platinum market to see current demand and prices above what you paid. If it’s a good time, find a reputable buyer.

The good news for Swiss America customers is you can sell your platinum bars or coins back to us. It’s easy to get a quote through our online portal to see if it’s worth selling at the current platinum price.

Working with Swiss America to buy platinum

For over 40 years, we’ve assisted thousands of satisfied customers in selecting the best precious metal investments tailored to their needs. Through our team, you’ll get access to educational resources like detailed guides, regular podcasts, and daily news updates.

You can be confident buying platinum coins or bars knowing we provide transparent pricing on premiums above spot. We also provide information on physical platinum investing costs such as sales tax, insurance, and storage.

How to invest in platinum

For anyone looking to protect their portfolio from the impact of inflation or other economic uncertainty, investing in platinum bars or coins is a great way to diversify your risk.

To learn more about how to buy platinum, connect with the Swiss America team today!

How to buy platinum: FAQs

Is platinum a good investment?

Platinum is a good investment, especially if you want to diversify your portfolio with precious metals. Its rarity and industrial demand drive its value, but it is also more volatile than gold, so it’s better for investors who are comfortable with market fluctuations.

How much is 1g of platinum worth?

As of this writing, platinum is currently $32.15 per gram. Note that market conditions change daily.

What is the best way to buy platinum?

The best way to buy platinum is through a reputable dealer, where you can purchase platinum bars or coins. Look for dealers with positive reviews and experience in precious metals to have a smooth transaction.

Note: The information in this post is for informational purposes only and should not be considered tax or legal advice. Please consult with your own tax professionals before making any decisions or taking action based on this information.