Curious about platinum as an investment? Discover the available options, how platinum investing works, and what to know about market demand.

You don’t hear people talk about investing in platinum as much as gold or even silver. It’s not as steady as gold, but its industrial uses play a big role in its overall performance. Think of platinum as a way to diversify your precious metals investments.

This article covers how platinum investing works, the available options, and the key factors that drive its price.

Platinum investments

Platinum is a rare and valuable metal that’s much scarcer than gold or silver. Platinum has uses in industries like automobiles, electronics, medical devices, and jewelry. There’s only so much platinum on the earth, and just eight countries mine it today:

South Africa

Russia

Zimbabwe

Canada

United States

Australia

Columbia

Peru

Why invest in platinum

People buy platinum as a way to diversify assets and protect their wealth. Many of the reasons that drive investment demand for this metal are similar to other precious metals. But, there’s also individual investor preference and speculation about the future. One investor, nrhymes writes in the Reddit r/Platinum forum that their reasons for buying platinum include:

“Platinum is currently 1/2 the price of gold, historically it is the opposite. First rule of all investing is to buy low and sell high.

One main reason why platinum is so low is because of the mainstream narrative of electric vehicles (don’t require platinum) overtaking combustion engines and hybrids (use platinum in catalytic converters). People think combustion engines are going to disappear fast, but when you see the problems EVs have had for manufacturers and high pricing, companies like BMW, Ford, and others have just recently openly stated they are drawing back on their production and ramping back up conventional and hybrid vehicles. Also, second and third world countries like China and India have populations with increasing purchasing power, they want vehicles just like you and I, and the number of cars being bought with combustion engines will likely dramatically increase.

Platinum is overwhelmingly mined in only 2 countries, South Africa and Russia. Those 2 countries are the definition of instability, and if anything major happens that could halt production (which sadly is very probable) the supply of platinum is going to be decimated sending the price much higher.”

Common reasons for investing in any precious metal include:

Inflation protection

Platinum acts as a hedge against inflation. When the value of paper currency declines due to inflationary pressures, the price of platinum can rise which helps to protect your wealth and purchasing power.

This happens because platinum gets priced in terms of currency, and when that currency weakens, it takes more of it to purchase the same amount of platinum. At the same time, industrial demand can further drive up its price during periods of inflation. This gives investors the dual benefit of both supply-demand dynamics and a currency hedge.

Portfolio diversification

Platinum allows you to diversify your portfolio since it reacts differently from traditional assets like stocks and bonds. You can hedge your bets against market risks with platinum products that might actually perform better in economic downturns or geopolitical events.

Tangible asset

Platinum is a physical asset that gives the security of owning something tangible. Other wealth vehicles like digital investments or paper assets may lose value or vanish during market upheavals. The price of your platinum bars or coins may vary but you’ll still own an actual physical asset.

No counterparty risk

Platinum is a direct ownership asset. You don’t have to depend on any third parties for its value. If a company doesn’t hit its quarterly numbers, a bank fails, or a contract falls through, none of these things affect your ownership of this physical metal.

Protection from digital risks

Your platinum coins or bars don’t have cyber risk. Most paper investments do face threats like hacking, data breaches, and system failures. Physical platinum is immune to these risks. So, you’ll get a level of security that paper investments cannot offer.

Ways to invest in platinum

You can invest in platinum in several different ways, including:

Physical platinum bullion

Platinum bullion is the most straightforward way to own actual platinum. You can purchase coins or bars:

Platinum coins

Governments mint these coins, and they serve as legal tender, so you can use them to pay for goods and services. But while that’s technically possible, you’d lose money if you actually used coins in this way. For instance, an American Platinum Eagle 1 oz coin has a face value of $100, but its platinum content is worth over $1,000 as of this writing.

Other coins you might see include:

Canadian Platinum Maple Leaf

Austrian Platinum Philharmonic

British Platinum Britannia

Australian Platinum Koala

Australian Platinum Kangaroo

Chinese Platinum Panda

Isle of Man Platinum Noble

Russian Platinum George the Victorious

South African Platinum Krugerrand

Platinum bars

Platinum bars give you a way to invest in platinum with lower premiums over the spot price than coins. They are available in various sizes, from small 1-gram bars to large bars weighing several kilograms. Compared to everyday objects, the smallest bar is about the size of a postage stamp and thinner than a credit card. The most common larger bar is 10 oz which is about the size of a smartphone.

Platinum IRAs

You can use a retirement account to invest in platinum. For example, you might roll over a 401(k), convert an existing IRA or set up a brand new precious metals IRA.

The way these accounts work is that you’ll choose a self-directed IRA custodian who actually manages the account for you. You’ll roll over your funds, and once you’ve funded the account, you will direct your custodian to buy IRS-approved metals on your behalf. From there, your precious metals dealer ships your platinum bullion to an IRA-approved depository under the direction of your custodian.

Once you reach retirement age, you can either have the metals shipped to you as an “in-kind” distribution or ask your custodian to sell them for you.

Platinum ETFs

Platinum Exchange-Traded Funds (ETFs) offer a way to invest in platinum but you won’t actually hold physical precious metal. These funds track the price of platinum and trade on stock exchanges.

They can be very liquid investments since you can sell quickly but they don’t have all the advantages of owning actual platinum bars or coins.

Platinum mining stocks

You can invest in platinum mining companies which gives you indirect exposure to the platinum market. The platinum price impacts the value of these stocks. Other factors include the company’s operational performance, mining efficiency, and broader market factors.

Platinum futures and options

Investors who want to take bigger risks when investing in platinum look at futures and options. This is a much more speculative strategy. The way it works is you agree on a purchase or sale of platinum at a predetermined price on a future date.

The risk is that you make a bad decision on this platinum price and end up having to cover your losses.

Platinum-backed tokens/cryptocurrencies

These are digital assets where each token represents ownership of a specific amount of physical platinum which is usually 1 gram. There’s some flexibility and liquidity in selling these assets, but they are also paper-based versus actually owning physical platinum.

Costs of owning platinum or other precious metals

Investing in platinum or other precious metals has some costs you’ll want to factor into your overall investment returns:

Storage and insurance: Since platinum is a physical asset, you’ll need a secure place to store it. You might use a home safe, a bank safety deposit box, or a third-party depository. Either way, you’ll have fees for this storage. You’ll also want to decide on insurance coverage for your platinum to protect against theft or damage.

Dealer premiums: When you go buy physical platinum, you’ll pay a premium over the market’s spot price. This premium covers manufacturing and distribution costs. The amount depends on the rarity or purchase size of the metal.

Selling costs: When it comes time to sell your platinum, you might have costs like dealer commissions or transaction fees.

Taxes: Like other investments, you’ll pay taxes on physical metal. This could include sales tax depending on where you live or where you ship your platinum to. And, if you sell your platinum bullion at a profit, you’ll have capital gains taxes.

3 Steps for buying physical platinum

If you’re new to buying platinum, here’s how you can get started:

Step 1: Find a reputable dealer

Look for dealers like Swiss America that have a strong reputation and a history of great customer service. To make sure that you are getting authentic platinum, check if the dealer provides certifications.

A good dealer also has accreditation from reputable organizations like the American Numismatic Association (ANA) or the Industry Council for Tangible Assets (ICTA).

Step 2: Buy platinum bullion

Open an account with the dealer and buy platinum bars or coins. As we mentioned above, if you are using a retirement account to fund your purchase, you’ll need to follow IRS guidelines for what’s eligible. The general rules for these retirement accounts are:

Purity: Physical platinum bullion must have a minimum fineness of 99.95%.

Production: A national government mint must produce the coins. Or, if you are buying bars, they must be from an accredited refiner/assayer recognized by COMEX, NYMEX, or the LBMA.

The IRS doesn’t allow you to purchase collectible or numismatic coins with IRA accounts.

Step 3: Store and monitor

If you are buying platinum bullion outside of a retirement account, you can store it wherever you want. For those buying in a precious metals IRA, your custodian arranges for secure IRA-approved storage.

Swiss America customers can easily see the value of their investment in real time through our customer portal. Besides checking the market status, you can also get investment recommendations and liquidation quotes if you decide to sell.

What drives platinum prices

The price of platinum is affected by various market dynamics like:

Currency strength

Since people trade platinum globally in U.S. dollars, the strength of the dollar impacts its price. A weaker dollar makes platinum cheaper for foreign investors, so they’ll buy more, driving up prices.

If the dollar is strong, platinum is more expensive for non-US investors, which may reduce demand.

Supply and demand

The availability of platinum versus how much industries need it plays a major role in its price. Platinum’s scarcity and concentrated mining in a few countries make its supply easily disputable. And, when the demand exceeds supply, prices rise.

Technological changes

Advances in technology can either increase or reduce platinum demand. For example, traditional vehicles use platinum in catalytic converters, but the growth of electric vehicles could reduce this need. Yet, new technology comes out all the time, so there may be future uses for platinum that could increase demand.

Global economic health

The economy has a greater impact on platinum than other precious metals like gold. When the economy is strong, industrial demand grows as people buy more cars or technology. During economic slowdowns, the opposite can happen.

Substitution and recycling

In some industries, other metals like palladium can replace platinum and reduce demand. An example is catalytic converters. The automotive industry can substitute these two materials on almost a 1:1 basis. When manufacturers seek cheaper options, demand for this alternative metal drops.

Recycled platinum from used products can also add to the supply and lower platinum prices.

How much platinum should you buy

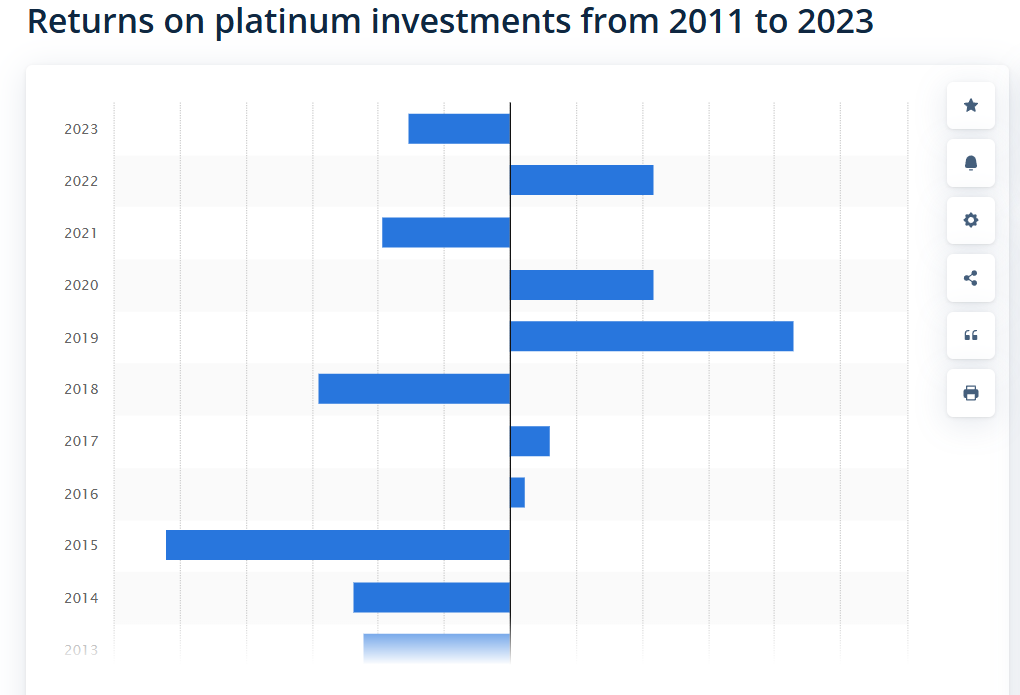

Like with any investment, you should always consider your goals, risk tolerance, and overall financial situation. As the chart below from Statista shows, platinum can be volatile, so if you’re looking to play it safer, you might want to keep it at 5% or less of your portfolio. Most experts suggest putting 5-15% of your total accounts into precious metals, so you can always apply the rest to gold which has less market ups and downs.

Why Swiss America for platinum bullion

Platinum investors choose Swiss America for our expertise and commitment to customer satisfaction. With over 40 years of experience, we have helped thousands of investors safely buy precious metals during many different market cycles.

You’ll get high-quality platinum, responsive service and expert advice on secure storage, IRAs, and market trends. We offer transparent pricing and competitive rates so that you know exactly what you’re paying.

Finally, when you’re ready to sell, our platinum trade program provides flexibility. This makes it easy to sell back your platinum if you need to use the cash for other purposes.

Investing in platinum

For investors willing to take on a riskier precious metal investment, platinum offers the potential for significant returns, along with possible losses. But, if you hold on through market swings and sell when prices are high, you could see greater returns than with gold.

To learn more about investing in platinum, gold, or silver, contact the Swiss America team today!

Platinum investing: FAQs

Is platinum a good investment?

It can be a good investment if you want to diversify your portfolio and capitalize on its industrial demand. It’s more volatile than gold, so be sure to consider your risk tolerance.

Is platinum a better investment than silver?

Platinum is rarer than silver and has more industrial uses, which increases its value during higher periods of economic growth. However, silver is more affordable and has a longer history as a monetary metal.

What is the platinum investment strategy?

A good platinum investment strategy is holding it as part of a diversified portfolio, considering both long-term potential and short-term volatility. Investors should watch for market trends in industries that use platinum, like automotive, and decide whether to invest in physical platinum or through ETFs and stocks.

Note: The information in this post is for informational purposes only and should not be considered tax or legal advice. Please consult with your own tax professionals before making any decisions or taking action based on this information.