With record highs at $4,500 an ounce, you may be wondering why gold price is increasing. There’s more to this answer than just increased demand and fixed supply. The reality is there’s a number of factors and stakeholders, including consumers, private investors, and central banks.

With persistent inflation and economic uncertainty, people just don’t fully trust paper money or stock markets to hold their value, so they’re buying gold. And every time confidence slips, the price responds.

This article covers what’s driving gold higher right now and what it might mean for the rest of the year.

What determines the price of gold?

Gold doesn’t have a fixed value. Its price moves because different forces pull in opposite directions. There’s only so much gold available, with only a small amount added each year from mining and recycling. Demand comes from many places, like central banks adding to reserves, investors looking for safety, and buyers in countries like India and China, where gold is part of daily life.

Ever since August 15, 1971, when President Richard Nixon ended the dollar’s convertibility into gold, the two have gone their separate ways. Gold no longer follows the dollar, and that independence is part of what makes it valuable.

At the same time, financial conditions impact how much people are willing to pay. A strong dollar, higher interest rates, or confidence in stocks can hold gold back. Weak currencies, inflation, or global economic uncertainty usually push it higher. In the end, gold’s price is really a reflection of how people feel about the future.

8 key drivers behind gold prices right now

What is driving large gold price fluctuations? Here are the top reasons we see:

1. Federal Reserve policy

The Federal Reserve has kept rates steady through 2026, but markets expect cuts before the year is over. That expectation has already helped push gold demand higher. Investors see gold as a stronger way to hold value with Treasury yields easing and inflation still running above target.

Fed officials have also suggested they may accept inflation closer to 3% instead of forcing it down to 2%. For investors, that points to looser policy ahead and more pressure on the dollar. Gold prices responded by moving to record levels this year.

2. Weakness in the US dollar

Gold trades worldwide in US dollars, but currency lost ground through much of 2025, falling against both the euro and the yen. That slide has made gold more affordable in other currencies and fueled stronger global demand. Central banks in Asia and the Middle East have been especially active buyers, taking advantage of the weaker dollar to add to gold purchases to their reserves.

This decline has been one of the key reasons gold is trading at record highs. As long as the dollar struggles, investors at home and abroad see more value in holding this precious metal.

We recently discussed how US policies actually cause the greatest threats to the US dollar on one of our podcasts:

3. Economic uncertainty

Gold represents trust outside of the financial system. When people see trouble ahead, they worry about how safe their money really is. The stock market can lose value overnight, banks can fail, and currencies can weaken, but gold remains a tangible store of wealth. That is why it often rises during recessions and financial crises.

The Great Recession in 2008, the market crash at the start of COVID in 2020, and the U.S. bank failures in 2023 all showed the same pattern. Confidence in financial institutions fell, and gold demand increased. Gold doesn’t depend on anyone’s balance sheet or policy decision, so it becomes a safe-haven asset when investors lose trust in the traditional financial system.

4. Central bank purchases

Central banks are some of the largest buyers of gold in the world, so their activity tends to dominate gold price movements. When central banks add gold to their reserves, it signals that they want protection from currency risk or a hedge against inflation. That extra demand can push prices higher, especially when multiple countries buy at the same time.

Recent years have seen record aggregate central bank holdings. The World Gold Council’s recent survey shows that 95% of central bankers believe central bank reserves will continue to increase through 2026.

Instead of holding only U.S. dollars or government bonds, this reserve diversification strategy reinforces gold’s role as a global store of value. Investors then follow this lead, viewing central bank demand as a reason to increase their gold holdings.

5. Inflation’s still hanging on

Even after years of higher interest rates, inflation is still above the Federal Reserve’s 2% target. In July 2025, consumer prices were up 2.7% from a year earlier, and core inflation was just over 3%.

We saw peak inflation during June 2022 at 9%. Prices have eased since then, but they never went back to where they were before the pandemic. Each year adds another layer of higher costs, which means households are still paying more for food and shelter.

The yellow metal has historically performed well in these kinds of cycles. It tends to hold its value when the dollar weakens and purchasing power erodes. From 2020 to 2025, gold rose more than 80%, giving investors a way to offset the steady pressure of higher prices.

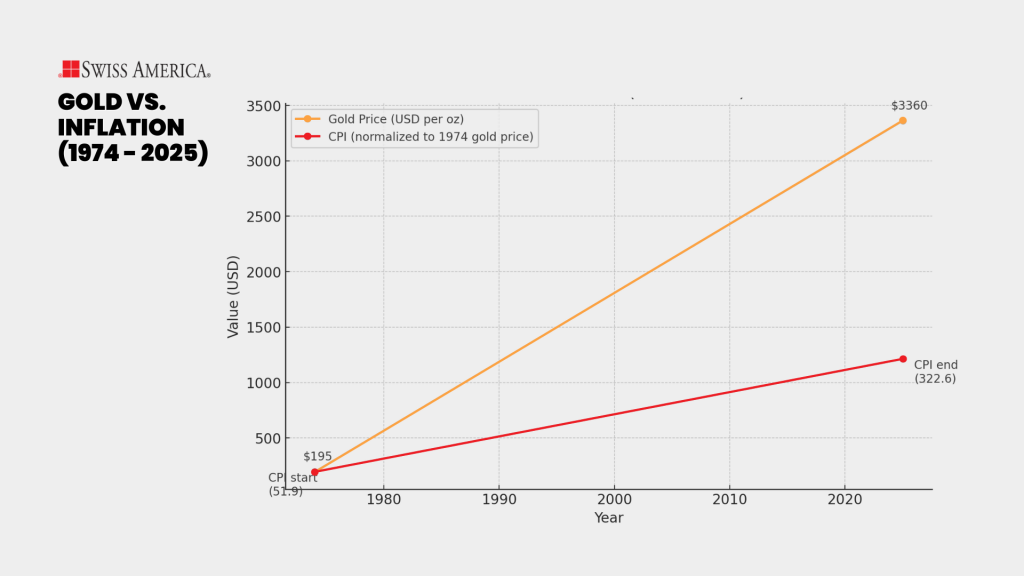

Going all the way back to when President Ford allowed citizens to own physical gold in 1974 to now, you can see how gold prices outpaced inflation:

6. Geopolitical risks

Global tensions have always influenced gold prices. When conflicts break out or trade disputes escalate, investors look for a safe place to put their money. Gold fits that role because it holds value regardless of what’s happening with governments or currencies.

In recent years, we’ve seen prices climb during the war in Ukraine, the flare-ups in the Middle East, and tariff battles between the United States and China. The more uncertainty on the world stage, the stronger the gold market.

7. Investor demand

Gold-backed ETFs that saw outflows in previous years are now reporting steady inflows as institutional investors add more to their balance sheets. At the same time, retail investors continue to leverage Gold IRAs to put their retirement savings into tangible assets.

The World Gold Council reported that global investment demand in the first half of 2025 was the strongest since 2020. This renewed buying has been one of the key drivers behind gold’s climb to record highs this year.

8. Consumer demand

Jewelry and technology buyers also impact demand and gold prices. So far, jewelry demand is mixed. Globally, volumes are down compared to last year because prices are high. In the U.S., a trend toward “investment jewelry” is catching on, with buyers looking at 22K and 24K items as both wearable luxury and a way to hold value.

On the industrial side, the demand for electronics has remained steady. Manufacturers use gold to produce smartphones, computers, and even medical devices. It’s a reliable source of consumption, especially as AI-related hardware growth keeps factories busy.

At a glance review of what impacts the price of gold last 2025:

| Driver | Impact on the price of gold |

| Federal Reserve Policy | Rate cut expectations push demand higher |

| Weak US Dollar | Makes gold cheaper abroad, boosts global demand |

| Economic uncertainty | Safe-haven buying increases in crises |

| Central bank purchases | Large buyers add to reserves, which increases demand |

| Inflation | Gold holds value as costs rise |

| Geopolitical risks | Conflicts/trade tensions drive safe-haven demand |

| Investor demand | ETFs and IRAs show renewed investor interest |

| Consumer demand | Jewelry/tech uses for gold generate demand |

Why does gold lose value?

Gold doesn’t actually lose value. Whenever you own gold bars or coins, you still have a physical asset that has worth. Instead, what happens is that the price of gold decreases when demand softens. Reasons why include:

- Economic confidence: Since many gold price movements are economic uncertainty related, when investors feel better about the economy, they’ll switch to riskier assets like real estate, bitcoin, or stocks.

- Stronger US dollar: A strong US dollar means gold costs more for holders of other major currencies to buy, which reduces demand.

- Higher interest rates: Since gold doesn’t pay interest, higher rates may prompt investors to move their money into bonds and other fixed-income assets.

- Central banks: If the major central banks start selling off their gold, this can also add supply to the market and reduce the price of gold.

These are common patterns, but you can’t always count on them as fixed rules. As of this writing, we still have higher interest rates. We don’t exactly have economic confidence, but we don’t exactly have substantial economic turmoil either. So, you have to balance the different variables to understand what happens from here into the future.

Is it the right time to buy gold?

With the current market, you may be wondering what will happen to gold’s future price. Should you buy now or wait until the price of gold drops? The reality is no one knows what will happen with current and future prices, but there are a few strategies you can use if you want to add this precious metal to your investment portfolio.

- Focus long-term: Every financial asset has ups and downs. You could buy gold today and watch the price fall tomorrow, but that does not make it a bad investment. It usually just reflects normal market volatility. The reason you hold gold is that it protects your wealth when the next crisis arrives, which is why it belongs in your portfolio for the long haul.

- Buying strategy: If you are worried about the price dropping after you buy, consider dollar cost averaging. This means purchasing gold in smaller amounts on a regular schedule. Over time, you end up buying at different prices, which helps balance out the cost of your holdings.

Final thoughts about why gold is rising

Yes, gold prices are higher than a year ago. Will it climb again next year? No one knows, and that’s exactly the point. You buy gold the same way you buy insurance. You hope you never need it, but you’re glad it’s there if something unexpected happens. Geopolitical tensions, a stock market selloff, or even a global crisis can strike without warning.

Gold helps you prepare for and offset unforeseen scenarios and situations that can chip away at your wealth. If you’d like to talk through how gold or other precious metals could fit into your portfolio, connect with the Swiss America team today.

Why gold price is increasing: FAQs

What will cause the price of gold to fall?

Gold prices fall when investors feel more confident about the economy. They shift money into riskier assets like stocks, which lowers demand for gold and pushes the price down. It’s less about gold losing value and more about where investors decide to put their money.

Is it better to keep gold or sell it?

Gold is worth keeping if you can. It pays off more as a long-term investment than if you try to trade it through the ups and downs.

The information in this post is for informational purposes only and should not be considered tax or legal advice. Please consult with your own tax professionals before making any decisions or taking action based on this information.