Many investors want to incorporate portfolio diversification with precious metals into their retirement funds. But to add physical silver in 401k, you can’t just do it with your employer retirement account. Instead, you’ll set up a self-directed retirement account that lets you hold alternative assets.

Considering that silver prices are 40% higher than a year ago, and gold just hit $3,800/oz with J.P. Morgan Chase predicting $4,000/oz by spring of 2026, a silver IRA rollover might be just the hedge strategy you need.

This article covers the various terms for a Precious Metals IRA, how to do a rollover into a Self-Directed IRA, and the various IRS rules.

Silver IRA, Precious Metals IRA, Gold IRA: What’s the difference?

A Silver, Gold, or Precious Metals IRA is a self-directed retirement account that allows you to hold physical gold, silver, platinum, or palladium. You take existing retirement savings and roll over some or all of the funds into physical assets instead of paper ones like mutual funds, stocks, or bonds.

Your retirement savings could be from a previous employer, like a 401(k), 403 (b), or TSP. Or, you can do a Silver IRA rollover with an existing IRA.

Benefits of a Silver or Precious Metals IRA rollover

You’ve worked hard to save for retirement, so you don’t have to worry about money down the road. But if you rely completely on the stock market, you may lose value during times of economic uncertainty or rising inflation. Holding precious metals in your retirement portfolio can reduce these risks by:

Gold or silver can be a long-term store of value

Gold and other precious metals have held their worth for centuries. Ever since President Roosevelt broke the gold standard, the government can print paper currency at any time, which makes it lose purchasing power. By contrast, metals like gold and silver have a limited supply, which is why they continue to hold their value over time.

Gold or silver helps to diversify your portfolio

Adding physical metals to your Self-Directed IRA gives you independence from the stock market. When stocks and bonds struggle, the prices of precious metals usually rise, which helps smooth out the ups and downs in your overall portfolio.

Gold or silver can hedge against inflation and currency risk

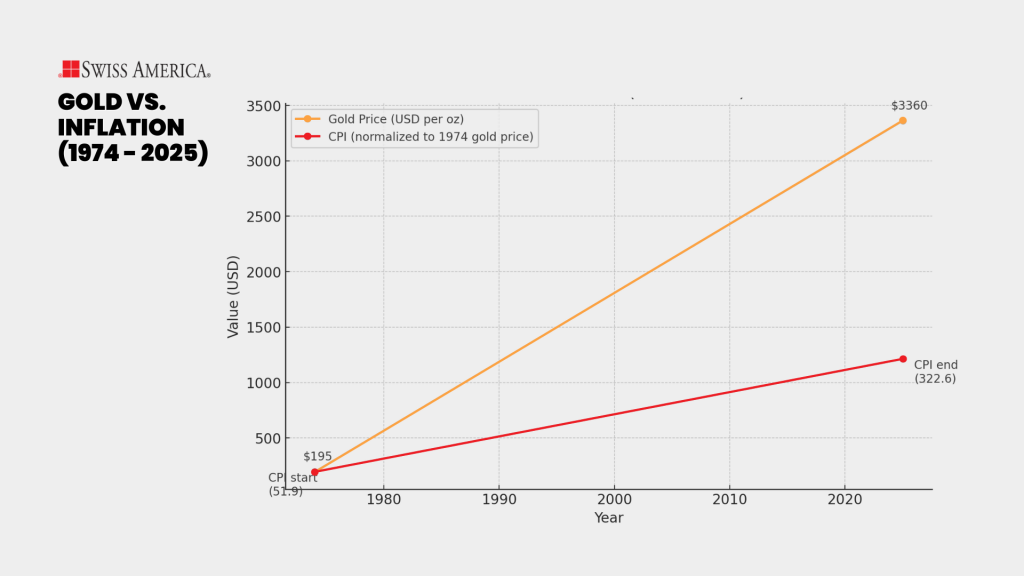

Gold and silver can provide a hedge against inflation. Looking at history, in 1974, gold was about $195 an ounce; as of this writing, it’s now $3600/oz. Meanwhile, the Consumer Price Index increased more than fivefold during that time. If you had physical gold during that time, your savings would have grown more than 18 times and outpaced inflation.

Gold or silver metals are safe haven assets

Physical precious metals historically perform well when investors worry about recessions or global events. Having them in your retirement account can act as a buffer when other assets seem uncertain.

Gold or silver metals are tangible

Coins and bars are physical assets that can’t be erased by a system glitch. They also don’t depend on a company’s performance. Many investors like owning something that’s completely independent of other asset classes.

Gold or silver metals are easy to sell

Gold and silver are easy to buy and sell almost anywhere in the world. There’s always a market for investment precious metals, and you can easily convert them back into cash.

Potential drawbacks of a Precious Metals or Silver IRA rollover

Just like any investment, there are drawbacks to consider as you look at making a decision on adding physical gold or silver to your retirement account. These include:

No income

Gold is a defensive asset, not a growth asset. Unlike stocks or bonds, it doesn’t pay dividends or interest. When you hold gold, silver, or platinum in a self-directed IRA, the trade-off is security and diversification in exchange for no income generation. Be sure to factor that into your overall retirement strategy.

Higher costs

A Gold IRA overall account structure costs more to maintain because of storage and special fees. However, individual investment fees on the paper assets in a traditional IRA might be higher than gold costs, like dealer premiums over spot, shipping, and storage costs.

How to set up a Gold or Silver IRA?

Opening a Gold or Silver IRA isn’t complicated, and a precious metals dealer like Swiss America can help you with these steps:

Step 1: Pick a Self-Directed IRA custodian

You can’t open a Precious Metals or Silver IRA through a regular brokerage. Instead, the IRS requires you to work with a Self-Directed IRA custodian. They take care of paperwork, keep the account compliant, and arrange storage for your metals in an approved depository.

To find a good IRS-approved custodian, look for:

- Companies that have experience with Precious Metals IRAs.

- Transparent fees, which include the initial setup, annual maintenance, and storage fees.

- Positive customer reviews.

Once you pick a precious metals custodian, you’ll fill out an application to open your account.

Step 2: Fund your Precious Metals or Silver IRA account

The next step is moving your retirement funds into your Self-Directed IRA. For existing retirement accounts, the best option here is to use a direct transfer where your current administrator sends the money directly to your custodian.

You can also make a brand new contribution. As of 2026, the IRS allows you to contribute up to $7,500 if under 50 or $8,600 if you are 50 and over.

Step 3: Pick IRA-approved metals

There are rules about which metals you can add to your silver IRA. IRS-approved precious metals include:

- Eligible IRA-owned metals: Gold, silver, platinum, and palladium.

- Forms: Coins or bars from government mints or accredited manufacturers.

- Purity: Gold must be 99.5%, silver 99.9% and platinum/palladium 99.95%.

Gold

Eligible gold coins include the American Gold Eagle and Canadian Maple Leaf, and bars include Valcambi and PAMP Suisse.

Silver

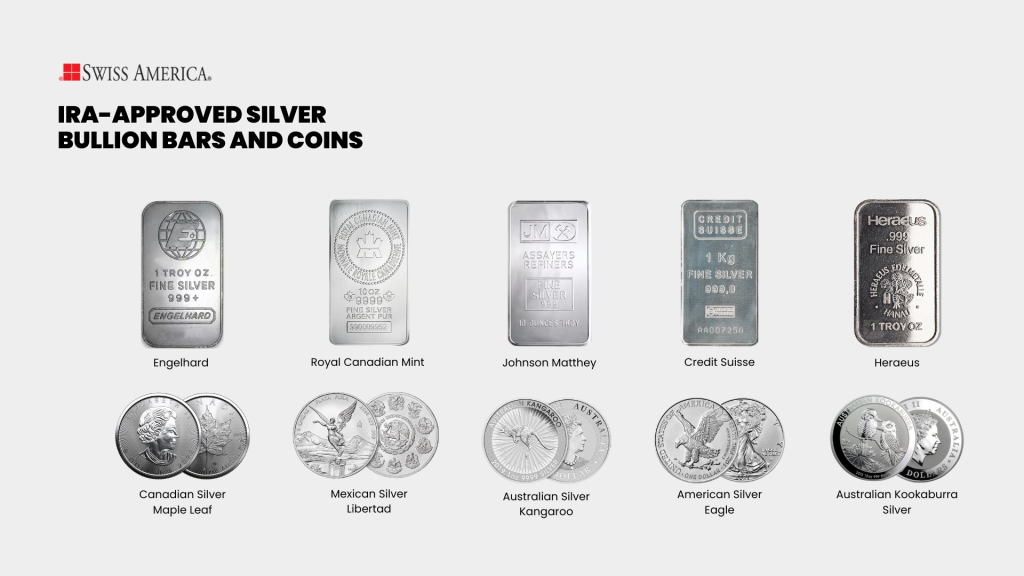

Silver coins and bars that you can add to your retirement account include the American Silver Eagle and the Mexican Libertad. Silver bars include Englehard I and Royal Canadian.

Platinum

Example platinum coins include the American Platinum Eagle and the Isle of Man Platinum Noble. Eligible bars include Perth Mint and PAMP Suisse.

Step 4: Buy and store your precious metals

Once you know which physical gold, silver, or other precious metals you want to add to your retirement savings, you’ll direct your custodian to buy on your behalf. They’ll place the order with your gold dealer.

The gold doesn’t ship directly to you because the rules require IRA precious metals be held in an IRS-approved depository. That means no, you can’t stash them in your safe at home.

Withdraws from a Precious Metals or Silver IRA

Over time, you can rebalance, sell, or add more metals to your retirement account. Then, when you reach retirement age of 59.5, you can sell the metals for cash distributions, or take an in-kind distribution where the metals get shipped directly to you.

If your Precious Metals or Silver IRA is a traditional account, IRS rules state that you must take required minimum distributions (RMDs) at age 73. Be sure to consult with a tax professional on the best approach to meeting these rules.

Tax rules for a Silver, Precious Metals or Gold IRA

The tax implications for a Precious Metals, Silver, or Gold IRA are the same as those of traditional IRAs. You can have both a traditional IRA and a Roth, and the tax advantages of either option include:

Traditional Precious Metals IRA

You add to your retirement account with pre-tax dollars. The value grows tax-deferred, and then you’ll pay income tax when you withdraw at the age of 59.5.

Roth Precious Metals IRA

You fund your account with after-tax dollars, so the value of your gold, silver, and other precious metals grows tax-free. Then, you can make qualified withdrawals in retirement tax-free.

Adding precious metals doesn’t change the IRS rules around early withdrawal penalties. If you want to rebalance to keep your diversification on track, you can sell some of your metals and roll the funds back into a traditional IRA that holds paper investments.

Contribution limits

The Internal Revenue Code sets contribution limits for either account type every year. Note that if you have a Roth Precious Metals IRA, you’ll need to meet certain income requirements to add more funds. You can find this information directly on the IRS website.

Here’s a quick summary of the rules for the different account types

Precious Metals IRA vs. Traditional IRA (Paper Assets)

| Detail | Precious metals IRA | Traditional IRA (paper assets) |

| Assets allowed | Physical gold, silver, platinum, palladium | Stocks, bonds, mutual funds |

| Contributions | Pre-tax or after-tax, depending on account type | Pre-tax or after-tax, depending on account type |

| Growth | Tax-deferred or tax-free (if Roth) | Tax-deferred or tax-free (if Roth) |

| Taxes on withdrawal | Yes (Traditional) or No (Roth) | Yes (Traditional) or No (Roth) |

| Required minimum distributions (RMDs) | Yes, at age 73 (if Traditional) | Yes, at age 73 (if Traditional) |

| Storage requirement | Must be held in an IRS-approved depository | Not applicable since there’s no physical asset |

Choosing a Gold IRA company

What should you look for in a Precious Metals IRA company? Start with experience. Look for a company like Swiss America that’s been around for decades and has plenty of positive customer reviews.

The best companies also provide education and resources to help you understand the process of investing in physical metals. They should be part of industry organizations that verify standards for the purity of gold, silver, and other approved metals. This protects you from scams.

You’ll also want to ask about the dealer’s buyback policy so that when it comes time to sell, you have an easy option to liquidate your Gold or Silver IRA.

Final thoughts on a Precious Metals IRA

Unlike paper investments, precious metals are tangible assets that don’t depend on anyone else for their value. They’re independent of fiat currencies, which is why they can hold up well during market volatility or times of fear.

Using your retirement funds to buy metals is a great way to protect your financial future while still getting the same tax advantages as a traditional IRA.

Start protecting your wealth with a Precious Metals IRA today.

Silver in 401(K): FAQs

Can I put my 401(k) in silver?

You can use money from your 401(k) to buy silver, but not inside the 401(k) itself. The way to do it is by rolling over part of your funds into a self-directed IRA. From there, you can purchase precious metals like gold or silver.

What will 1 oz of silver be worth in 10 years?

There’s no way to know for sure, but you can get a sense by looking at past trends and current demand. Silver has a limited supply, and it’s part of the manufacturing process in many industries, so it could continue to see ongoing demand.

Should you have silver in your portfolio?

Most experts recommend keeping 5%-15% of your portfolio in gold or silver to diversify and reduce the risk of holding just stocks. Check with your financial advisor for specific investment advice.

The information in this post is for informational purposes only and should not be considered tax or legal advice. Please consult with your own tax professionals before making any decisions or taking action based on this information.