If you’re looking to move some of your retirement savings into alternative investments like precious metals, you’ll need to work with a Self-Directed IRA provider. Their role is to keep your account compliant with IRS rules. This article gives you a Self-Directed IRA custodian list so you can compare options and choose the best fit to support your overall retirement planning.

What is a Self-Directed IRA?

If you want to use some of your retirement money and invest beyond paper assets like the stock market, mutual funds, and exchange-traded funds, that’s where a Self-Directed IRA (SDIRA) comes in. Instead of a standard brokerage account, a self-directed IRA lets you branch out into other assets like:

- Precious metals

- Real estate

- Bitcoin

- Private investments like private equity or private debt

You can also have more than one IRA. For example, you might have a Traditional or Roth individual retirement account along with another IRA for alternative assets. That could be a Gold IRA, a crypto IRA, a real estate IRA, or something similar.

Why look at a Self-Directed IRA?

A Self-Directed IRA gives you more choices with your retirement savings, and just like a traditional IRA, you still get tax advantages. The exact benefits depend on the type of account you open, but they may include:

- Tax-deferred growth

- Tax-free distributions

- Deductions for contributions

What is a Self-Directed IRA company?

A Self-Directed IRA company is a non-bank firm approved by the IRS to manage your IRA funds. It opens your account, processes transactions, and handles IRS reporting and compliance.

Note that the custodian doesn’t give investment advice or tell you what to buy, and they also don’t sell you metals or other retirement assets. You decide on what you want to buy, and the custodian handles the paperwork and recordkeeping so your IRA stays in good standing.

What to look for in a Self-Directed IRA custodian

A good place to start looking for a Self-Directed IRA company is by asking your precious metals dealer for recommendations. Here are some things to look for:

- Experience: Choose a custodian that’s been in business for years.

- Customer reviews: Check out what other investors say about their experience on sites like TrustPilot or Google reviews.

- Support: Look for great customer support through multiple options including phone, email, and online support.

- Investment options: Make sure the custodian handles the types of alternative assets you’re looking to buy now and in the future.

- Fees and costs: Custodians charge setup fees, annual maintenance, and other fees, such as storage costs for precious metals. Compare options and pricing to reduce the impact of fees on your retirement account.

- Compliance: The custodian ensures that your account complies with IRS rules and regulations. Verify their regulatory status and licensing.

- Technology: You’ll need an easy way to monitor the status of your alternative investments, so look for a custodian that offers an online platform for viewing your account value and statements.

How we chose our list of Self-Directed IRA custodians

To create our list of precious metals Self-Directed IRA companies, we started with companies that specialize in precious metals Self-Directed IRAs, and from there, we looked at:

- Customer reviews: We prioritized companies with a large number of positive reviews. A higher volume of feedback provides a better picture of what investors experience day-to-day.

- Transparency in fees: We only included companies that publicly list their fees since transparent pricing helps you avoid unexpected costs.

Top 9 Self-Directed IRA custodians

Here’s our complete list of the nine best nonbank custodians to manage gold, silver or other precious metals alternative assets:

| Company | Setup fee | Annual maintenance | Commingled storage | Fee schedule | Reviews |

| Strata Trust | $50 | $150 | $0.10 per ounce per month | Fees | Trustpilot: 4.9 |

| Horizon Trust | $2995 | $395 | $100 | Fees | Trustpilot: 4.9 Google: 4.9 |

| IRA Financial Trust Company | – | $495 | $100 | Fees | Trustpilot: 4.8 |

| Gold Star Trust | $50 | $90 | $100 | Fees | Trustpilot: 4.4 Google: 3.4 |

| Madison Trust | $50 | $440 | $100 | Fees | Google: 4.8 |

| uDirect IRA Services | $50 | $275 | $96 | Fees | Google: 4.5 |

| Vantage IRA | $50 | $350 | $125 | Fees | Google: 4.4 |

| Equity Trust | $50 | $225 | $100 | Fees | Trustpilot: 2.3 |

| Forge Trust | $50 | $200 | $100 | Fees | Trustpilot: 2.6 Google: 3.7 |

Self-Directed IRA rules for precious metals

Every type of alternative investment comes with its own IRS rules on top of the standard IRA rules, like tax treatment and contribution limits. For precious metals IRAs, these two rules are:

Qualified metals

The IRS sets rules on which metals qualify. The ones that do are gold, silver, platinum, and palladium bullion, which are investment-grade metals. Note that you can’t buy collectible coins in your retirement account. Each of these qualified metals has to meet a minimum purity level and come from either a government mint or an accredited refinery.

Storage

The second rule is that you can’t store your metals at home. A lot of people are surprised by this, but if you take possession of the metals, the IRS treats it as a distribution. Instead, your IRA custodian arranges storage in an IRS-approved depository until you’re ready to withdraw at retirement age at 59½ or later.

Self-Directed IRA fees

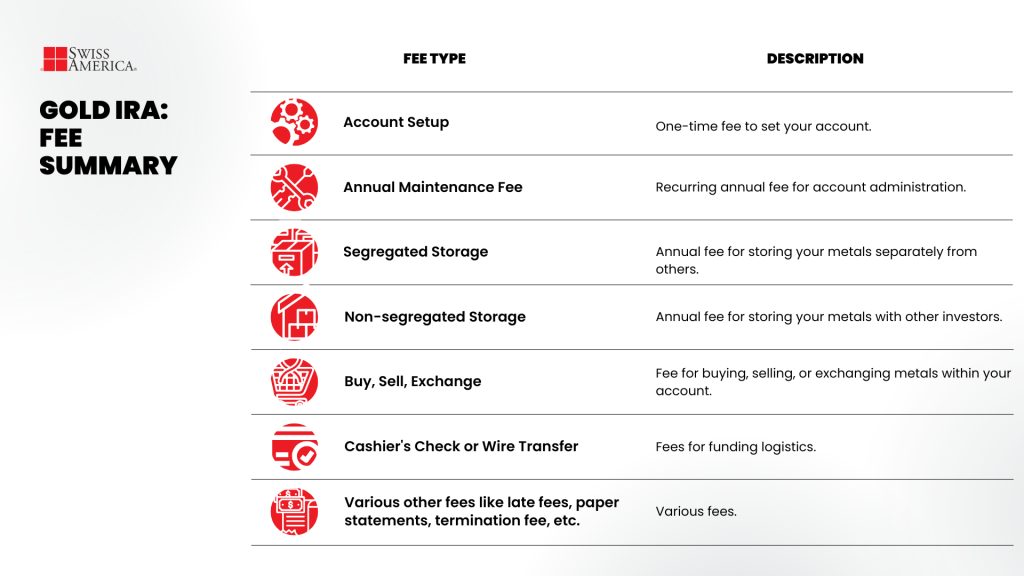

The custodian charges fees to manage your account. In general, you can expect these to include:

- One-time setup fee

- Annual fee

- Storage fees

Some might also charge additional fees, like transaction fees or fees based on wire transfers, special requests, or extra services.

Fees reduce your retirement funds and overall returns, so comparing several custodians is worth it. For example, if you invest $50,000 and pay $300 a year for maintenance and storage, that’s $3,000 over 10 years.

Self-Directed IRA account types

Just like with traditional investments, you can have both traditional and Roth IRAs. The differences include:

- Traditional IRA: You contribute pre-tax money, your funds grow tax-deferred, and you’ll pay taxes later when you take withdrawals in retirement.

- Roth IRA: You contribute after-tax money, and your account grows tax-free. Qualified withdrawals in retirement aren’t taxed.

You can also hold multiple IRAs at once, from standard accounts to alternatives like gold or silver.

Self-Directed IRA rollover options

You can roll funds into a self-directed IRA from retirement accounts, like:

- 401(k)

- 403(b)

- 457(b)

- TSP

- SEP IRA

- SIMPLE IRA

- Existing Traditional or Roth IRA

Your custodian will guide you through the rollover process. The main steps are:

- Open your new account.

- Have your current retirement account administrator send the funds to your custodian.

- Once the funds arrive, direct your custodian on which alternative investments to buy.

Self-Directed IRA distribution rules

Self-Directed IRAs follow the same distribution rules as any other IRA. You can start taking withdrawals from a Gold IRA at age 59½ without penalty. If you take money out earlier, the IRS counts it as an early distribution, and you’ll owe taxes plus a 10% penalty unless you meet an exception.

If you have a traditional Self-Directed IRA, you’ll also need to start required minimum distributions at age 73. With a Roth Self-Directed Gold IRA, there are no required minimum distributions. To take earnings out tax-free at retirement age, your account has to be at least five years old.

With both account types, you can sell the alternative assets for cash or take them as an in-kind distribution.

Self-Directed IRA inheritance rules

IRS rules for passing on alternative investments in a Self-Directed IRA include:

- Spouse beneficiaries: If your spouse inherits a Self-Directed IRA, they can treat it as their own IRA, roll it over into an existing account, or keep it as an inherited IRA.

- Non-spouse beneficiaries: Heirs over 18 have to withdraw all the funds within 10 years of the original account owner’s passing.

- Traditional vs. Roth: With a traditional Self-Directed IRA, inherited withdrawals get taxed as regular income. With a Roth, qualified withdrawals are tax-free as long as the original account met the five-year rule before the owner’s death.

- Distributions in-kind: Heirs may be able to take an “in-kind” distribution and receive assets directly.

Self-Directed IRA tax rules

A Self-Directed IRA follows the same tax rules as any other IRA:

- Contributions: For 2026, the max you can contribute is $7,500 if you’re under 50 or $8,600 if you’re 50 or older. You also can’t contribute more than your earned income for the year.

- Withdrawals: If you take money out before age 59½, you’ll pay income tax plus a 10% penalty.

- Required minimum distributions (RMDs): Traditional self-directed IRAs require withdrawals starting at age 73. Roth IRAs don’t have RMDs during your lifetime.

- Prohibited transactions: The IRS doesn’t allow you to personally benefit from alternative assets in your IRA until you reach retirement. For example, if your self-directed IRA owns real estate, you can’t live in it or rent it to family. If it owns precious metals, you can’t store them at home.

Final thoughts on choosing an IRA custodian

There’s more options than we can list here but this list of nine is a great place to start. You can also ask the company you’re buying alternative assets through for a recommendation, then check reviews and compare fees. Doing that legwork now helps you avoid issues later.

To learn more about precious metals investing and how to set up a Gold IRA, connect with the Swiss America team today.

Self-Directed IRA custodian list: FAQs

Who can be the custodian of a Self-Directed IRA?

An IRS-approved custodian manages a Self-Directed IRA. Their job is to manage reporting, buy and sell alternative investments on your behalf, and make sure everything follows IRS rules.

How to find an IRA custodian?

Look for an IRS-approved custodian with experience in alternative assets, great reviews, strong customer service, and transparent pricing.

How much does a Self-Directed IRA custodian cost?

For a precious metals IRA, you’ll usually pay $50–$100 upfront to open the account, plus $250–$600 annually for reporting and secure storage of gold and silver.

The information in this post is for informational purposes only and should not be considered tax or legal advice. Please consult with your own tax professionals before making any decisions or taking action based on this information.