Did you know you can invest in precious metals through your IRA? There’s specific rules to set one up. And you’ll need to know about IRA-approved precious metals.

Investors usually turn to gold to reduce risk in their portfolios. Who can blame them when there’s so much uncertainty in the world right now? Every time companies report their quarterly earnings or a job market report comes out, the stock market reacts. It’s no wonder investors seek a safe haven to protect their assets.

One of the best ways to hold precious metals or gold is in an IRA. This path gives you the most tax benefits and also reduces your exposure to some of these market dynamics. You’ll just need to follow Internal Revenue Service (IRS) rules for these accounts, which also include the type of metals you can buy.

Learn about IRA-approved precious metals, how to open this type of account, and how to choose the best Gold IRA company to work with.

What does IRA-eligible mean?

If you decide to hold physical precious metals or gold inside your retirement account, you can’t just buy gold coins or other bullion without making sure they meet IRS requirements. The good news for Swiss America customers is that we can help you through the entire IRA process, including choosing the right approved gold, silver or other precious metals.

An introduction to precious metals IRAs

This individual retirement account can hold IRA-approved gold, silver, platinum, and palladium. This is the route to go if you want to protect your wealth and enjoy tax advantages at the same time.

Here’s how our team works with customers to set up their gold or precious metals IRA:

Open a Gold IRA account

You’ll open an account with a designated Gold IRA custodian. Already have a company you trust? Great! If not, don’t worry—we’ve got you covered with recommendations that make the whole process a breeze.

Your custodian takes care of everything, from buying and storing gold to managing your account, so you don’t have to stress about the details.

Fund your IRA

Once you’ve opened an account, the next step is to fund your IRA. You can do this by rolling over funds in existing accounts like 401(k), an existing IRA, or funding a new IRA account.

Purchase IRA-eligible gold

Our team helps you choose the right metals that match your goals. After you decide, you’ll ask your custodian to make the purchase on your behalf.

Manage your account

Gold is an easy investment, and you don’t have to watch it closely like paper assets in the stock market. But whenever you want to check how things are going, you can see your account balance and status through Swiss America’s online portal.

Approved precious metals for your Gold IRA

Now that we’ve covered how Gold IRAs work, here are the approved precious metals you can buy inside these accounts:

IRA eligible gold

Any gold you buy must be at least 99.5% pure. The IRS only allows 0.5% or less of other metals or impurities.

Common IRA-eligible gold coins can include:

Canadian Gold Maple Leaf

Austrian Gold Philharmonic

You can also buy gold bars produced by a national government mint or an accredited refiner certified or accredited by a precious metals authority like the New York Mercantile Exchange (NYMEX) or the London Bullion Market Association (LBMA).

Other metals for precious metals IRAs

You can also hold silver, platinum, and palladium in your account. IRS regulations for these metals include:

Silver

The silver you buy must be 99.9% pure and includes products like American Silver Eagle coins, Canadian Silver Maple Leaf coins, and silver bars from approved refiners.

You can buy one-ounce silver coins or bars ranging from one ounce to one kilo.

Platinum and Palladium

You can also add platinum or palladium to your IRA account. These physical precious metals must be at least 99.9% pure. Common bullion coins include:

Canadian Palladium Maple Leaf

You can also buy palladium or platinum bullion bars from approved refiners.

Qualifying platinum coins come in one-ounce sizes and bars ranging from one ounce to ten ounces.

Here’s a handy overview of the precious metals you can hold in an IRA and the requirements for each:

| Metal type | Minimum purity standard | Common IRA-approved examples | Form allowed |

|---|---|---|---|

| Gold | 99.5% purity | American Gold Eagle, Canadian Maple Leaf, gold bars | Coins & bars from approved refiners |

| Silver | 99.9% purity | American Silver Eagle, Canadian Silver Maple Leaf, silver bars | Coins & bars |

| Platinum | 99.9% purity | American Platinum Eagle | Coins & bars |

| Palladium | 99.9% purity | Canadian Palladium Maple Leaf | Coins & bars |

Benefits of precious metal IRAs

Is this type of account the right fit for your situation? The answer depends on your goals and situation. One of the main reasons for setting up a precious metals IRA is the tax advantages. Imagine watching your investment grow over the years without the IRS knocking until you’re ready to withdraw.

Tax-deferred growth

Your investments grow tax-deferred until you take distributions, meaning your assets compound over time without immediate tax obligations.

You only pay taxes on your precious metals IRA when you start taking distributions, which you can do starting at age 59½. When you do, the IRS taxes them as ordinary income.

Tax-free withdrawals

With a Roth precious metals IRA, you contribute after-tax money, which means you can withdraw your contributions at any time without taxes or penalties.

Suppose you invest $5,000, you can withdraw that $5,000 whenever you need it, tax-free. As your investment grows, say it reaches $7,000, you can still take out your original $5,000 tax-free, while the remaining $2,000 continues to grow tax-free until you’re ready to use it in retirement.

Lower tax rates at retirement

When you take money out of your IRA at retirement, the IRS taxes it as regular income. Many investors believe they’ll be in a lower tax bracket then. If that’s the case, it means you’ll pay less in taxes on your withdrawals than you would have during your working years.

Diversification with tax benefits

A precious metals IRA lets you diversify your portfolio while enjoying the same tax benefits as other retirement accounts.

Economic uncertainty, inflation, or geopolitical events drive gold prices up as investors pull out of the stock market. Unfortunately, the world is full of unpredictable events and economic swings. Holding physical gold in your portfolio can help you manage these risks.

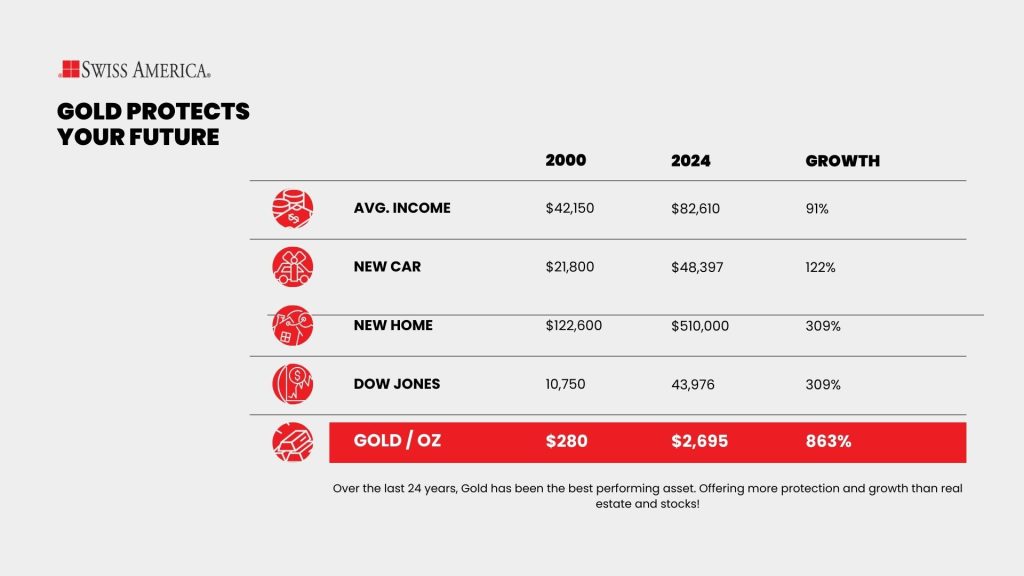

Consider the chart below showing gold’s performance over the last 24 years compared to inflation:

This perspective is shared by many, such as Reddit user Avionics_Engineer06, who shared in the r/Bogelheads forum:

“In an inflationary environment the assets that are likely to do best include. Short term debt like treasuries, TIPS, Floating Rate Assets, Commodities like Gold, Silver, Energy such as oil, food etc…” – Reddit user Avionics_Engineer06

Gold IRA companies

How do you choose which company to work with when purchasing precious metals? Working with an established dealer like Swiss America gives you the following:

Reliability: Since the early 1980s, we’ve successfully worked with investors through economic cycles and markets. Our decades of experience make us an experienced and trustworthy partner for gold and other precious metals.

Customer satisfaction: Our thousands of satisfied clients enjoy quick delivery of high-quality metals, responsive and knowledgeable customer service, and consistent support that meets or exceeds expectations.

Expert advice: We offer experienced guidance on secure storage, precious metals IRAs, gold-to-silver ratios, portfolio integration, and market trends. Our team goes the extra mile to provide the knowledge you need to make smart investment decisions.

IRA approved gold

Precious metal IRAs can be a great strategy to help protect your wealth against risks, inflation, and other global events. If you seek a safe haven, consider this path, which also gives you all the tax benefits of a traditional IRA.

Ready to get started with a Gold IRA? Contact the Swiss America team today to discuss your options. Our experts will guide you through the process, help you choose IRA-approved metals, and ensure your precious metals investment aligns with your retirement goals.

Don’t wait for the next market shift – take control of your financial future now.

IRA-approved precious metals: FAQs

How is gold taxed in an IRA?

Good news—you won’t owe a dime in taxes on your gains until you’re ready to cash out. And when you do, the IRS will treat it just like your regular income.

Can I convert my IRA to gold?

You can convert your IRA to gold by transferring funds to a self-directed IRA that allows precious metals investments.

How do you cash in a gold IRA?

To cash in a gold IRA, you can sell the gold through your custodian and take the proceeds as a distribution.

Note: The information in this post is for informational purposes only and should not be considered tax or legal advice. Please consult with your own tax professionals before making any decisions or taking action based on this information.