If you have, or are thinking about owning, gold or other precious metals in your retirement account, you may wonder what happens when it’s time to liquidate. This article covers how to sell Gold IRA and the steps involved.

We’ll also look at why people invest in a Gold IRA in the first place, along with the rules you need to know to get started.

Understanding precious metals IRAs

You can use your retirement funds to invest in alternative assets. A precious metals IRA is one way to do that. It’s a self-directed IRA account where you can hold physical gold, silver, platinum, and palladium bars or coins using your retirement savings. People also call it a physical Gold IRA or a Silver IRA.

It works just like a traditional IRA when it comes to tax rules, benefits, and structure.

Benefits of investing in a Gold IRA

There are several benefits to owning physical precious metals. A big reason people open a Gold IRA is to offset what might happen in the stock market. It’s also a way to hedge against inflation, since physical gold has historically outpaced it.

And for some people, it’s about owning a tangible asset that doesn’t follow the same patterns as everything else.

Why sell a Gold IRA?

At some point, you might need to access your retirement savings. Maybe some unexpected expenses come up. Maybe you want to rebalance your portfolio and invest in something else. Or, you might have to take a distribution based on IRS rules if you’re using a traditional IRA structure.

The common reasons why people liquidate their Gold IRA account include:

Need cash

There may be a time when you need to tap into your retirement savings for a financial emergency. It’s not ideal because if you take early distributions before the age of 59.5, you’ll face ordinary income tax and 10% IRS penalty.

The exception is if you have a Roth IRA. In that case, you can take out your initial contributions without paying taxes, but you’ll miss out on potential growth.

Rebalance investment portfolio

If you’re trying to keep a certain percentage of your retirement account funds in gold versus the stock market, and the gold rises in value, you might need to rebalance your portfolio. This could be a scenario where you need to sell the gold in your IRA.

Required minimum distributions (RMDs)

If you have a traditional IRA, once you reach age 73 the IRS requires you to take minimum distributions and pay taxes at that time. Your precious metals IRA custodian will send you reminders, but this is another situation where people end up selling some of their Gold IRA.

When is a good time to sell gold?

No one can predict the future, so it’s hard to know the perfect time to sell. Gold and other precious metals usually do well when people are worried about the economy or when there’s high inflation. It can help offset both of these situations because people often turn to physical gold as a safety net.

If you aren’t sure, you can check with a financial advisor to see if it’s a good time to sell your Gold IRA.

Steps to sell your Gold IRA

The process to sell gold coins or bars in your retirement account can take anywhere from a few days to a couple of weeks, depending on your custodian and the depository. Here’s how it works:

Step 1: Contact your Gold IRA custodian: Reach out to your custodian and let them know you want to start the selling process. Tell them exactly what you want to sell, whether it’s specific items or just a portion of your holdings.

Step 2: Request a buyback quote: Ask your gold dealer for a buyback quote. They’ll look at the metals you want to sell and give you a price. This won’t be the same as the spot price. The difference between their quote and the spot price is called the spread.

Step 3: Review and accept the quote: Look over the quote and decide if you want to accept it. You can also check with other dealers to compare offers before you commit.

Step 4: Complete paperwork: Fill out and submit an investment direction form with the transaction details. This goes to your custodian and tells them what you want to sell.

Step 5: Depository moves your metals: Your custodian submits documentation for the transaction to the IRS-approved depository, which then ships your metals to the dealer.

Step 6: The dealer buys your metals: Your dealer receives the metals, checks their condition to confirm they’re still in their original packaging and uncirculated, and then makes the purchase.

Step 7: Custodian wires the proceeds: Your custodian sends the proceeds to your IRA account. From there, you’ll submit a distribution request form if you want to withdraw cash or transfer funds after you sell. If you have a traditional precious metals IRA, you’ll pay taxes at that time. If you have a Roth Gold IRA and your account qualifies, you can withdraw the proceeds tax-free.

Liquidation options

When it’s time to liquidate precious metals, you have two options:

Cash distributions

A cash distribution is when you sell your gold or other precious metals and receive the proceeds in cash. At that point, you’ll pay taxes on the distribution. You might also have the option to take the money as a lump sum or through a series of withdrawals from your retirement portfolio.

In-kind distributions

You can also take possession of your physical metals through an in-kind distribution. This means you can store your gold at home or anywhere you choose. There are still tax implications, since you’ll pay taxes on the current value at the time of the distribution. That value then becomes your new cost basis for any future sale.

| Distribution type | Definition | Tax implication | Other notes |

| Cash Distribution | Sell metals, get cash | Taxes on cash received | Can be lump sum or installments |

| In-Kind Distribution | Receive physical metals | Taxes on value at distribution | Value becomes new cost basis |

Tax implications of Gold IRAs

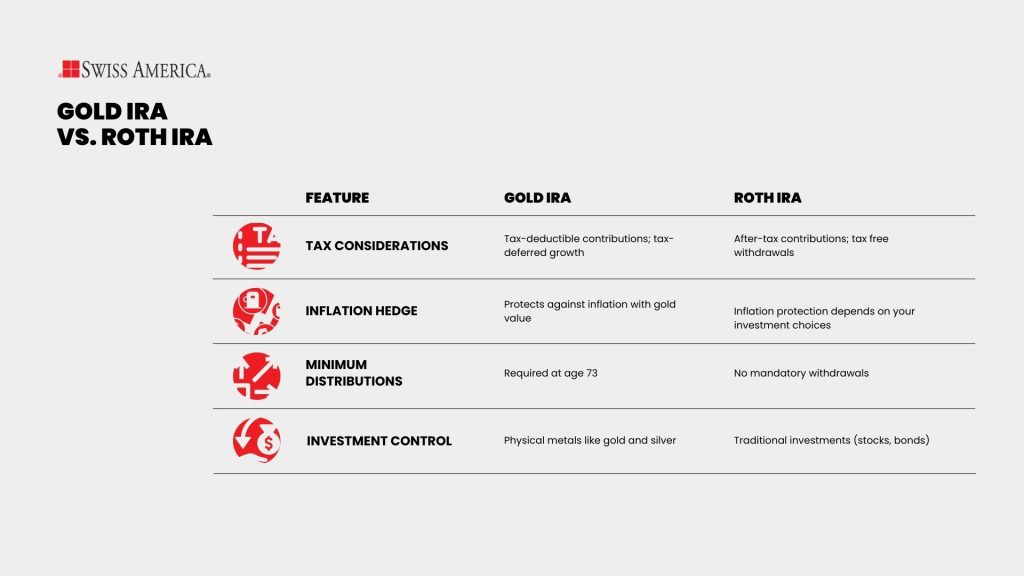

The tax regulations around Gold IRAs depend on the type of account that you have, which can be a traditional or Roth IRA.

Traditional Gold IRA

If you’re using a traditional IRA, you contribute to the account with pretax dollars. Those funds grow tax-deferred. When you’re ready to take distributions or liquidate in retirement, as long as you’ve reached age 59½, you’ll pay taxes on the withdrawals based on your income tax rate at that time. The advantage is that you get years of tax-deferred growth, and you may be in a lower tax bracket when you retire.

With this type of account, you also have to start taking required minimum distributions at age 73. These are taxed as ordinary income. You can delay liquidation for several years, but eventually the IRS requires it so they can collect taxes. If you miss the RMD deadline, there’s a 50% penalty on the amount you should have withdrawn.

Roth Gold IRA

A Roth Gold IRA works differently. You contribute after-tax dollars, so you’ve already paid taxes on that money. The value of your physical gold or other precious metals grows tax-free. As long as you’ve had the account for at least five years and you’re at least 59½, you can withdraw all of the proceeds without paying taxes. You can also take out your original contributions at any time since you already paid taxes on them.

This type of account has no required minimum distributions.

Gold IRA regulations and requirements

Some of the details and rules for this type of retirement account include:

Custodian

You can’t use a traditional brokerage firm to buy gold. You’ll need a custodian to set up your account and handle the purchase of metals. This administrator is often called the IRA trustee or an IRS-approved custodian. They buy and sell gold on your behalf, following your instructions.

Approved metals

The IRS has specific rules for which metals qualify for your retirement account. This includes the type of precious metal, required purity levels, and approved manufacturers.

Precious metals: Gold at 99.5% purity, silver at 99.9%, and platinum or palladium at 99.95%.

Forms: Approved coins or bars.

Manufacturers: Government mints or accredited refiners like PAMP Suisse, Valcambi, and Credit Suisse.

The precious metals dealer you work with can guide you on which gold products qualify. Below is a sampling of popular coins and bars that are IRA-approved.

Storage

You can’t store your IRA gold at home. Some companies may promote this idea, but it’s a complicated approach that can lead to tax penalties and legal issues. The better option is to rely on your custodian, who will arrange for your precious metals to be stored at an IRS-approved depository.

Gold IRA vs traditional investments

Traditional retirement portfolios usually include stocks, bonds, and mutual funds. A Gold IRA adds another layer of diversification to your retirement portfolio. It can help offset economic uncertainty, global events, and other unknowns that make people uneasy.

Many investors believe that gold will keep its value when paper money and other investments may lose value. That’s why we continue to see central banks purchase gold to protect their reserves. In fact, 95% of central bankers surveyed expect even more gold purchases in the next 12 months.

Many people also like precious metals because they’re tangible assets. When you physically own something like this, it doesn’t depend on anyone else’s performance. Gold is also not tied to the stock market, which makes it a solid way to balance out your investments.

Final thoughts on how to sell Gold IRA

A gold IRA is a great option if you want to hold precious metals as part of your retirement portfolio. Connect with the Swiss America team today to learn more about how to get started.

Can I cash out a Gold IRA?

Yes, you can cash out a gold IRA, but it’s usually not a good idea if you haven’t reached the retirement age of 59½. The exception is if you plan to cash out and move the funds into another type of IRA account.

What is the downside of a Gold IRA?

A downside of gold or any other precious metal is that it doesn’t pay dividends or generate income. It’s a defensive asset class meant to protect your wealth. This is why experts usually recommend holding only a portion of your retirement portfolio in gold, not all of it.

Do you pay tax on Gold IRA?

It depends on the type of account you have. With a traditional Gold IRA, you pay taxes when you make withdrawals after reaching retirement age at 59½. With a Roth Gold IRA, you don’t pay taxes on withdrawals as long as you’ve had the account for at least five years and you’ve reached the IRS retirement age.

The information in this post is for informational purposes only and should not be considered tax or legal advice. Please consult with your own tax professionals before making any decisions or taking action based on this information.