Are you worried that inflation and market ups and downs put your retirement savings at risk? A Gold IRA can help protect your wealth and offer the tax benefits of a traditional IRA. With many investors turning to gold for diversification and financial security, a Gold IRA might be the solution you’re looking for.

According to the World Gold Council, gold returns for 2024 are 27.94%. And while this is a standout year compared to 10-year returns of 8.13%, holding gold is a solid way to preserve your wealth.

Want to learn how to get started? This guide will show you the steps on how to open a Gold IRA account and explain everything you need to know to take control of your financial future.

Understanding Gold IRA accounts

A Gold IRA is a retirement account that lets you invest in physical gold and other precious metals like silver, platinum, and palladium. It works like a traditional IRA but has specific rules for holding precious metals.

You may also hear these accounts referred to as a precious metals IRA or a Silver IRA.

There are three types of Gold IRAs, each with different tax advantages:

Traditional Gold IRA

Traditional IRAs let you invest pre-tax money, so your savings grow tax-deferred until you retire. It’s a good choice if you think you’ll be in a lower tax bracket when you start making withdrawals at age 59.5.

With this account type, you’ll also need to take required minimum distributions starting at age 73.

Roth Gold IRA

Roth Gold IRAs use after-tax money. You pay taxes now, and your retirement grows tax-free. You can withdraw your contributions anytime. Then, when you reach retirement, you can take out the proceeds tax-free as long as you’ve held the account for at least five years.

With these types of Gold IRAs, you do not have to take minimum distributions, and you can also pass on your gold and other precious metals to your heirs.

SEP Gold IRA

If you’re self-employed or a small business owner, you can use a SEP IRA to hold physical gold. You’ll make pre-tax contributions for yourself and your employees. This type of account allows your money to grow tax-deferred, and you’ll pay taxes once you reach retirement age.

Types of Gold IRAs

| Feature | Traditional Gold IRA | Roth Gold IRA | SEP Gold IRA |

| Tax treatment | Pre tax contributions; taxed withdrawals | After tax contributions; tax-free growth | Pre tax contributions; taxed withdrawals |

| Required minimum distribution | RMDs at age 73 | No RMDs | RMDs at age 73 |

| Best for | Lower tax bracket in retirement | Higher tax bracket in retirement | Self-employed or small business owners |

Step-by-step guide to opening a Gold IRA account

Here are the steps to open an account for your Gold IRA investing:

Step 1: Choose a custodian

To open a Gold IRA account, start by choosing a custodian who specializes in these accounts. The role of this company is to manage your funds and handle secure storage of your metals. They buy and sell metals on your behalf and take care of IRS regulations and administration for retirement accounts.

Look for a company that has great reviews and transparent information about their management and other fees.

Step 2: Fund your Gold IRA

There are different ways to fund your Gold IRA. You can make a cash contribution directly. Or, you can transfer funds from an existing IRA or roll over money from a retirement plan like a 401(k), 403(b), or TSP without triggering tax penalties.

The best way to handle the rollover is to use a direct transfer where the administrator for your current funds directly sends the funds to your Gold IRA custodian.

Step 3: Buy and store precious metals

Once you fund your account, direct your custodian to purchase gold through a trusted and experienced precious metals dealer.

The dealer then ships the metals to an IRS-approved depository of your custodian’s choosing. This is because if you take physical possession of your metals before retirement, the IRS considers this a distribution.

Considerations and compliance

Considers for precious metals IRAs include:

Eligible precious metals

The IRS has rules around which metals can go into your Gold IRA. Only gold, silver, platinum, and palladium bars or coins that meet the IRS’s purity standards qualify.

Qualifications for gold are that it must be at least 99.5% pure and produced by refiners or mints accredited by organizations such as LBMA, COMEX, or NYMEX.

Common qualified coins include:

American Gold Buffalo

Austrian Philharmonic

British Gold Britannia

Canadian Gold Maple Leaf

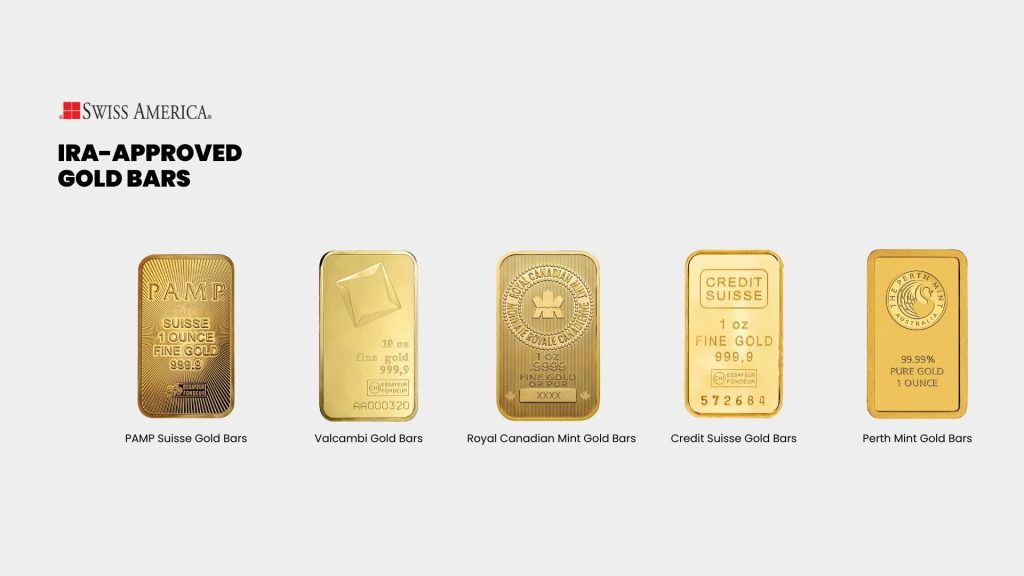

Qualified bars include:

PAMP Suisse Gold Bars

Valcambi Gold Bars

Royal Canadian Mint Gold Bars

Credit Suisse Gold Bars

Perth Mint Gold Bars

Reporting

To comply with IRS rules, you must report your Gold IRA contributions and the fair market value (FMV) yearly by filing these forms:

Form 5498: This form shows your IRA contributions, rollovers, conversions, and the value of your IRA at the end of the year. Your custodian prepares it and sends it to you and the IRS by May 31. You don’t file it with your taxes, but it confirms your contributions and helps you comply with IRS rules.

Form 1099-R: The 1099-R reports the distributions from your retirement account if you take out $10 or more. It shows the amount you withdrew, the taxable part, taxes withheld, and any rollovers. You’ll get it by January 31, and you need this to report your income and calculate your taxes.

Contribution limits

For 2026, the maximum amount you can contribute for the year is $7,500 if you’re under 50 and $8,600 if you’re 50 or older.

For a Roth IRA, your modified adjusted gross income (MAGI) impacts your ability to contribute:

Single filer

If you’re a single filer with MAGI under $146,000, you can make the full contribution. You can make partial contributions if your MAGI is between $146,000 and $161,000.

Married filing jointly

For married couples filing jointly, you can contribute the full amount if your MAGI is under $230,000 or partial contributions if your MAGI is between $230,000 and $240,000.

Withdrawals and penalties

Withdrawing your money before age 59.5 can trigger a 10% penalty plus any income taxes. However, there are specific circumstances that are exempt from the penalty, including:

First-time home purchase

Higher education expenses

Certain unreimbursed medical expenses

Check with a financial or tax advisor before making any early withdrawals.

Why choose Swiss America for your Gold IRA

When you’re looking at precious metals dealers to support your IRA account, consider Swiss America because of our:

Experience

Swiss America has been in business for over 40 years. We’ve seen many market ups and downs and can advise you on physical gold investing no matter which market we’re in. Our longevity also means you can count on us to give you the best recommendations possible and that you’re buying from a reputable dealer.

Customer reviews

Thousands of happy customers rave about their experience working with our team. Check out our customer testimonials and reviews on the Better Business Bureau.

Education

Our expert team can give you information and resources to help support your decision about setting up a gold and silver IRA. You’ll find in-depth resource guides, free resources like our Gold IRA kit, regular podcasts, and daily industry news updates.

Credentials

We’re a member of several reputable organizations that support the precious metals industry, such as the American Numismatic Association, the Industry Council for Tangible Assets, and the Numismatic Guaranty Corporation.

What is a Gold IRA final thoughts

Opening a Gold IRA account can help protect your retirement savings from economic uncertainty while benefiting from gold’s stability. Owning physical metals can help strengthen your future financial security by diversifying your retirement portfolio with these tangible assets.

If you’re ready to take the next step and learn more about opening a Gold IRA account, contact the Swiss America team today!

How to open a Gold IRA account: FAQs

How does a gold IRA work?

Precious Metal IRAs lets you hold real gold and other physical precious metals in your retirement account. You work with a custodian to buy, store, and manage your metals in a secure, IRS-approved facility, keeping everything in line with tax rules.

What is the best precious metal in IRA?

Gold coins and bars are the best choice for a Precious Metal IRA because they are stable and have a track record as a reliable store of value. But silver, platinum, and palladium can also provide growth and help diversify your investments.

Is a gold IRA a good investment?

A Gold IRA can be a good way to protect your savings from inflation, economic crashes, and market ups and downs. It doesn’t give you income like with traditional investments but it helps reduce your risks through diversification.

Note: The information in this post is for informational purposes only and should not be considered tax or legal advice. Please consult with your own tax professionals before making any decisions or taking action based on this information.