Curious how to invest in precious metals? You may see the headlines of how gold keeps reaching new highs, with banks like J.P. Morgan Chase predicting that it’ll hit $4,000/oz in the spring of 2026. Or, you might just want to diversify your portfolio so you aren’t entirely dependent on the stock market.

This article covers the different ways you can invest, the pros and cons of each, and how you can get started today.

Understanding precious metals

What exactly do we mean by precious metals? It basically means rare metals that have high value. The most common precious metals are gold, silver, and platinum. Each of these is easy to buy and sell. They also all qualify as metals you can hold in your IRA if using retirement funds is part of your investment objective.

Why invest in precious metals?

The biggest benefit of precious metals investments is that they diversify your portfolio and can help reduce risk. Gold, silver, and platinum have low correlation to the stock market. So, when there’s a crisis or concerns about the global economy, the stock market might be down, but gold can be up.

As of this writing, the spot price of gold is around $3,700/oz. That’s a 44% increase from September 2024! Why? Worries about the economy, the value of the U.S. dollar, and speculation on interest rates. Investors keep adding metals right now to gain exposure to tangible assets that don’t always follow what happens with stock prices.

The upside and downside of investing in precious metals

Before you decide how to invest, it’s good to look at what precious metals like gold can do for your portfolio in general. These are the key benefits and drawbacks to keep in mind, no matter which type of investment you choose.

Upside

Key benefits precious metals can bring to your portfolio include:

Protects against inflation

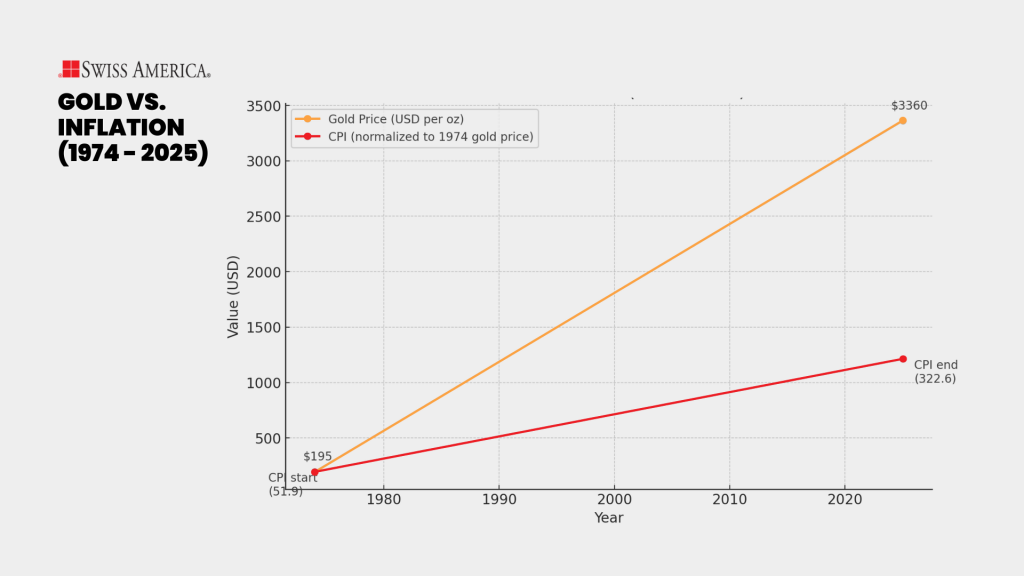

Physical gold and other precious metals can be a hedge against inflation. Since there’s a limited supply, they can hold or gain value as the dollar loses buying power. Say you buy precious metals at today’s price. The value rises, and if it grows at a higher rate than inflation, you protect your money.

Take a look at gold’s performance against inflation over the last 50+ years:

Wealth insurance

Investors look at the precious metals sector as a defensive strategy. Gold and silver are an independent asset class. And, if you own the physical metals, their value doesn’t depend on company earnings or government policies.

Easy to sell

It’s easy to sell precious metals. If you own the physical metals, gold dealers like Swiss America have a buy-back program, which makes it easy to sell when you’re ready. Or, if you have paper investments, you can sell them via your broker.

Downside

The disadvantages of gold and other precious metals include:

No income

Precious metals don’t generate income. They’re a protective asset, so you give up cash flow and dividends if you go this route versus investing in stock or bond markets. The exception is that if you own gold mutual funds, you may receive dividends from mining companies or other gold-related companies.

Price volatility

Sometimes prices can be extremely volatile. If the economy’s strong, investors sell gold and silver to move into other investments with higher returns. That change drops demand and can happen without much warning.

Opportunity cost

Investing in precious metals also means your money isn’t available for other investments that might generate more income.

5 Types of precious metals investments

There’s a few different investment products for precious metals. You can buy physical metals or own paper investments like gold ETFs, mutual funds, and mining stocks.

1. Direct ownership

Physical precious metals investments that you directly own in physical form. It includes silver and gold bullion bars and coins. You’ll take physical delivery and decide where to store it.

Pros of physical gold:

- Tangible asset: Physical asset you own. You don’t need an internet connection, a secure password, or to wait until business hours to access your gold and silver.

- Complete control: You really don’t need anyone to do anything for you to control your physical precious metal. This means that a bank going out of business or a cyber attack has zero impact on you owning precious metals.

Cons of physical gold:

- Storage and insurance costs: You’ll need to factor in storage and insurance costs for your gold and other precious metals. You might buy a home safe, use a bank vault, or use a depository.

- Tax implications: Depending on where you live, you might have sales tax when you buy physical metals. You’ll also need to consider capital gains tax. The IRS considers precious metals collectibles and applies a higher capital gains rate than other investments. One way to avoid this is to use a Self-Directed Individual Retirement Account to buy metals.

2. Exchange-traded funds (ETFs)

These paper investments give you a share in a trust that holds physical gold in a vault. You buy these through a broker, and they’re traded on the stock exchange.

Pros of ETFs:

- No storage costs: You don’t own the physical asset, so with exchange-traded funds, you don’t need to pay for storage of metals.

- Easy to sell: You can easily sell your shares since they trade on the stock market.

Cons of ETFs:

- Counterparty risk: You don’t own the underlying metals, so you’re relying on someone else to store, manage, and report on them.

- Fees: You’ll pay management fees and commissions when you buy and sell your shares.

3. Mutual funds and stocks

You can own shares in companies involved in precious metals production, like Barrick Gold or Newmont Corporation.

Pros of mutual funds:

- Active management: Mutual funds have more active management than other paper precious metals investments. This can potentially mean better performance than exchange-traded funds.

- Broader investment: You’ll get exposure to a broader set of precious metals-related investments, like mining stocks, futures, and other asset classes. This gives you diversified holdings.

Cons of mutual funds:

- Tax implications: Mutual funds trade more frequently than other paper precious metals investments, so they may not be as tax-efficient as ETFs or physical gold in an IRA.

- Higher minimums: There can be higher initial minimums to get started with mutual fund investing.

4. Precious metals CDs

Some banks offer precious metals certificates that pay a return tied to the performance of precious metals.

Pros of CDs:

- Fixed returns: These investments can give you fixed or guaranteed returns, which reduces your exposure to price volatility.

- Convenience: CDs are easy to own and don’t require you to watch them for performance.

Cons of CDs:

- Early withdrawal penalties: CDs require you to commit your investment to a specific timeframe, and if you need to sell earlier than this, you’ll face withdrawal penalties.

- Opportunity costs: Because your money is locked up, you give up the opportunity to invest in other commodities or assets if the market changes.

5. Futures and options

This risky form of investing involves speculating on future results with contracts to buy precious metals at a predetermined price at a future date.

Pros of futures:

- Leverage: You can borrow funds to invest in gold or silver futures, which can increase your overall returns.

- Lower costs: With this type of investing, you don’t pay management fees and you don’t have storage costs like you do with a direct investment of gold.

Cons of futures:

- Complexity: You’ll need to understand contract details, margin requirements, expiration dates, and rollovers, which is more involved than any of the other ways of investing in precious metals we’ve covered.

- Active management: These are not passive investments. They require active management to see what’s happening in the market with each precious metal’s price.

Here’s a quick summary of the pros/cons of each option:

| Investment type | Pros | Cons |

| Direct ownership | Tangible asset you control Independent asset | Storage and insurance costs Tax implications |

| ETFs | No storage costs Easy to buy and sell on the stock exchange | Counterparty risk Management fees |

| Mutual Funds & Stocks | Active management Broader exposure to metals-related assets | Less tax-efficient Higher minimum investment |

| Precious Metals CDs | Fixed returns Simple to own and manage | Early withdrawal penalties Opportunity cost |

| Futures & Options | Leverage potential No storage or management fees | High risk and complexity Requires active monitoring |

What impacts the price of precious metals?

Adding gold, silver, and platinum bar or coin investments gives you a diversified portfolio, but what affects each metal’s price? Factors for each:

Gold: Investors buy this yellow metal when they are worried about inflation, the strength of the dollar, or a potential recession. For the past few years, central banks have become the biggest buyers of physical gold. That trend doesn’t look like it’s slowing down. The World Gold Council’s 2025 survey shows 95% of banks plan to keep adding gold through mid-2026. Demand like this is why we see larger gold price movements.

Silver: Demand for silver comes from both investors and industrial use. It’s in electronics and industrial products like EV vehicles, medical devices, and even groundwater treatment. Since you’ll find it in the computer industry or cars, silver prices can see a drop in demand when people stop buying these products.

Platinum: This is another industrial metal like silver. One of the biggest is catalytic converters. So, if people stop buying as many cars, it hurts demand and reduces prices.

Deciding on what metals to buy

If your main goal is protection from market swings or worries about the financial system, owning the physical metal itself is the most direct path. When you hold coins or bars, you’re not relying on anyone else for your investment.

Most investors start with gold since it has the largest market. Silver and platinum can add variety, but they are more volatile and may not generate steady returns. Most advisors recommend allocating about 5% % to 15% of an investor’s portfolio to precious metals as part of a balanced strategy.

Final thoughts on investing in precious metals

The first step is to figure out your goals and how much of your portfolio you want to allocate to precious metals. From there, you can explore the options and decide which approach fits your needs.

If you’d like to learn more about owning physical precious metals, our free resources and podcast can give you details on how it works. You can also contact the Swiss America team to get answers to your questions and get started.

How to invest in precious metals: FAQs

What if I invested $1000 in gold 10 years ago?

In September 2015, gold was about $1,183 an ounce. Today, it’s over $3,700 an ounce. A $1,000 investment back then would have grown by more than 200%.

Is precious metals a good investment?

It can be a good investment because it gives you a way to diversify your portfolio against economic uncertainty, geopolitical developments, and other crises that may occur.

What is the best precious metal to invest in now?

As of this writing, most precious metals are doing well, but if you can afford gold, it has the highest investor demand when there’s fear and worry in the market.

The information in this post is for informational purposes only and should not be considered tax or legal advice. Please consult with your own tax professionals before making any decisions or taking action based on this information.