Have you ever wondered how much platinum is in the world? It happens to be one of the rarest metals found in only a few places on Earth. But how much do we have, and is there enough demand for it to be a good investment?

Platinum is a lifesaving precious metal used in over 600,000 new heart pacemakers each year. It’s also an investment option available as bullion coins or bars. Despite its scarcity and critical uses, platinum remains considerably cheaper than gold.

In this article, we’ll explore how much platinum exists in the world and share details to consider if you’re thinking about investing in this precious metal.

How much platinum is in our world today?

Platinum is one of the rarest precious metals on the planet. It makes up only about 0.000005 parts per million (ppm) of the Earth’s crust. This means that if you were to take a random scoop of the Earth’s surface, you’d need to sift through a massive amount of material to find just a tiny speck of platinum.

In comparison, gold’s estimated concentration in the Earth’s crust is about 0.000004 ppm, while that of silver is 0.000075 ppm. So, silver is more abundant than platinum, and gold is slightly rarer.

To paint another picture, assume you’re walking down a long street to spot one specific house. In such a scenario, finding platinum would be like spotting that house after walking past 380 blocks. Gold would be like walking 450 blocks to find that one house, and silver would be a shorter walk of just 25 blocks.

Pure platinum mining

Total global platinum mining production was 180 metric tons in 2023. Countries that produce commercial quantities of natural platinum include:

South Africa: 74.3%

Russia: 10.6%

Zimbabwe: 8.0%

Canada: 3.2%

United States: 1.8%

Other countries: 2.2%

Platinum inventories

We don’t have an exact count of how much platinum companies have mined since its discovery in 1941. However, scientists estimate that all the platinum ever produced would only reach your ankles in an Olympic-sized swimming pool, totaling around 10,000 metric tons.

In comparison, all the gold ever mined would fill three Olympic-sized swimming pools.

As for the global annual platinum mining, the average is 190 metric tons. That’s quite low compared to gold’s over 3,000 metric tons each year.

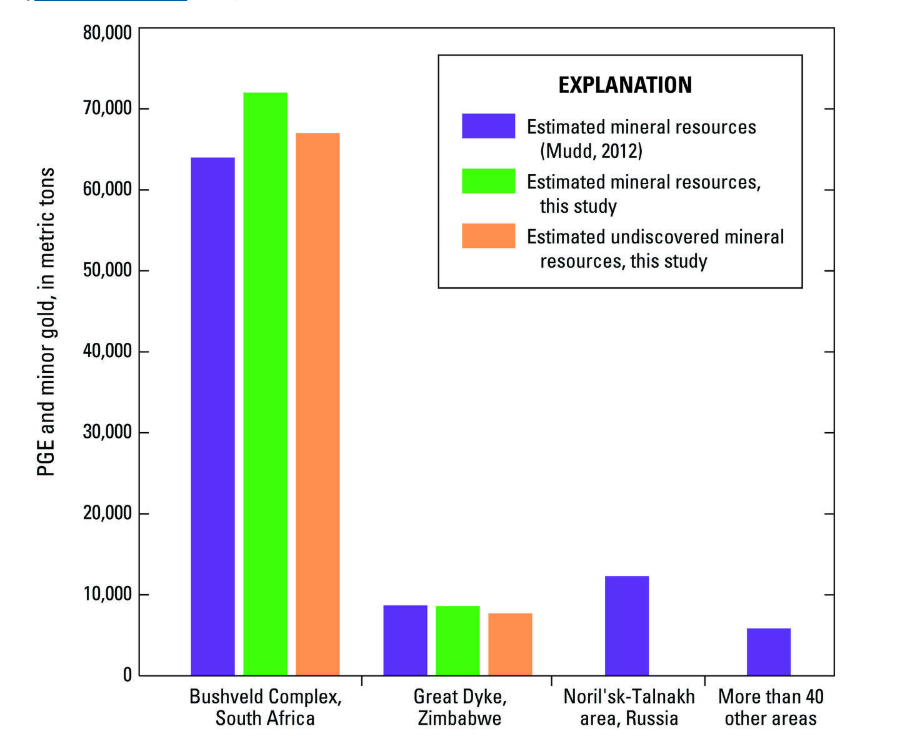

The below graph from The United States Geological Survey shows known and estimated undiscovered platinum group metals in the world:

Platinum demand

Since the early 2000s, annual worldwide demand for platinum has averaged around 7 million ounces per year.

The greatest source of demand is for platinum catalysts to produce catalytic converters, which need about 1-15 grams depending on the size of the vehicle.

Platinum fundamentals and history

We promise not to turn this section into a chemistry chapter, but it’s useful to understand the basics of platinum if you’re considering it as an investment. As Warren Buffett says, “Never invest in something you don’t understand.”

Platinum is a chemical element with the symbol Pt and atomic number 78. It’s a dense, malleable, and ductile metal with a silverish-white color. As a member of the platinum group metals and group 10 of the periodic table, platinum is the least reactive metal known in human history.

The overall platinum group metals consists of six noble metals:

Palladium (Pd)

Rhodium (Rh)

Iridium (Ir)

Ruthenium (Ru)

Osmium (Os)

These metals share similar physical and chemical properties, like high resistance to corrosion and excellent catalytic capabilities. That’s why people use platinum in jewelry, catalytic converters, and other industrial products.

Properties and applications of platinum

Because it’s resistant to corrosion and has an extremely high melting point, platinum is a valuable material for industrial uses like:

Electric vehicles: The auto industry uses platinum for green hydrogen production and fuel cell electric vehicles.

Thermometers: You’ll find platinum in thermometers.

Catalysts: Manufacturers use platinum compounds to produce nitric acid, which helps create fertilizers and explosives.

Electronics: Electrical contacts and switches use platinum wire.

Glass industry: Platinum is a primary component for creating certain specialized glass like LCD screens and fiberglass.

Origin of platinum

Platinum’s history dates back thousands of years to Egyptian jewelry as far back as 700 B.C. In the 16th century, Spanish Conquistadors stumbled upon the metal while mining for gold in Columbia. They named it “unripe gold” or “little silver”, unaware of the treasure they had unearthed.

Platinum was officially recognized as a precious metal in the late 18th century. That’s when researchers started documenting platinum’s chemical properties and exploring its potential uses.

Platinum supply vs other precious metals

If you compare the rarest precious metals by annual mine production, platinum is much rarer than gold. We are talking about over 15 times greater scarcity in yearly yield. But, in terms of concentration on the earth’s crust, gold is slightly rarer than platinum.

What makes platinum stand out is how challenging it is to extract. Mining platinum is extremely labor-intensive. It requires about 10 tons of ore, which is naturally occurring rock that contains valuable minerals, to produce just one ounce of the metal.

To compare, gold requires about 2-3 tons of ore to produce one ounce and silver 5-10 tons per ounce.

Here’s a quick look at the platinum supply and rarity figures:

| Metric | Value | Comparison | Why it matters |

|---|---|---|---|

| Earth’s crust concentration | ~0.000005 ppm | More than silver, similar to gold | Shows how rare platinum is in nature |

| Annual global production (2023) | ~180 metric tons | Much less than gold (~3,000+ metric tons) | Indicates limited annual supply |

| Total ever mined | ~10,000 metric tons (estimated) | Gold fills 3 Olympic pools | Helps visualize total historical output |

| Ore needed per ounce | ~10 tons | More than gold & silver | Highlights the extraction difficulty |

The future of platinum

Most investors and experts expect the growing demand for green energy technologies to increase demand for platinum. From fuel cells to hydrogen fueling stations, platinum is part of the transition to sustainable energy.

The World Platinum Investment Council noted in the second quarter of 2024 that the platinum market faced a deficit of 464,000 ounces. Experts expect the total deficit for the year to reach 1,028,000 ounces, compared to 731,000 ounces in 2023.

Investing in platinum bullion products

Buying platinum bullion bars and coins for investment is a newer concept than buying other metals like gold or silver. People buy this metal to own a physical asset and perhaps take advantage of future increased demand.

If you look at the price history of precious metals, platinum sold at a premium higher than gold before the 1970s stagflation era. Gold prices were $35 an ounce, while platinum was going for $230 per ounce. But now, buying gold is about 2.67 times more than platinum per ounce.

Looking at their price history also reveals the differences in volatility, which impacts how to invest in platinum, gold, and silver. While all precious metals can be a store of value and hedge against inflation, platinum is more volatile. Most investors see it as a way to make potentially higher returns in a shorter time period versus other metals.

Also, consider that each precious metal is independent of the others and can serve different roles in a diversified portfolio.

How to invest in physical platinum

There’s different forms and account types you can use to invest in platinum.

Forms

You can buy platinum bullion coins or bars. Platinum coin sizes include 1 oz, 1/2 oz, 1/4 oz, 1/10 oz, and 1/20 oz. Common coins include:

Canadian Platinum Maple Leaf

Australian Platinum Kangaroo

British Platinum Britannia

Austrian Philharmonic Platinum Coin

Platinum bars come in sizes ranging from 1 gram to 10 ounces, with some manufacturers also producing 1 kilogram bars. Popular brands include:

Valcambi

PAMP Suisse

Credit Suisse

Johnson Matthey

Engelhard

Argor-Heraeus

Account types

You can buy pure platinum with regular funds or in a retirement account. If you decide to leverage your retirement account, you’ll transfer a portion of your 401(k) or existing IRA to a precious metals IRA.

The IRS has specific regulations for these accounts, including choosing a third-party custodian to manage your account. They hold your funds and buy platinum and other precious metals at your request. They’ll also take care of secure storage and regular reporting.

Why investors choose Swiss America for platinum

For over 40 years, Swiss America has helped thousands of customers buy platinum, gold, and silver. Our customers rave about their experience working with our knowledgeable team and staff. You’ll find helpful resources like our in-depth guides, regular podcasts, and daily industry news updates.

Our customers also benefit from our online portal which shows buying/selling history as well as real-time market value. You can also get liquidation quotes if you want to sell your metals back to us in the future.

Platinum metal final thoughts

Platinum is a rare and critical mineral commodity. It’s more volatile than gold because industrial applications drive most of its demand, but that also means you can make higher returns if you buy low and sell when demand is high.

If you want to know more about how to diversify your portfolio with platinum, contact the Swiss America team today!

How much platinum is in the world? FAQ

How much of the earth is platinum?

Approximately 0.000005 parts per million (ppm) of the earth is platinum.

Is platinum the rarest metal on Earth?

No. Platinum is not the rarest metal on Earth, but it is rarer than gold and silver.

What is better gold or platinum?

Both precious metallic elements can support a diversified portfolio. Gold is better for long-term stability, but platinum may offer higher returns during economic booms due to its industrial demand and price swings.

Note: The information in this post is for informational purposes only and should not be considered tax or legal advice. Please consult with your own tax professionals before making any decisions or taking action based on this information.