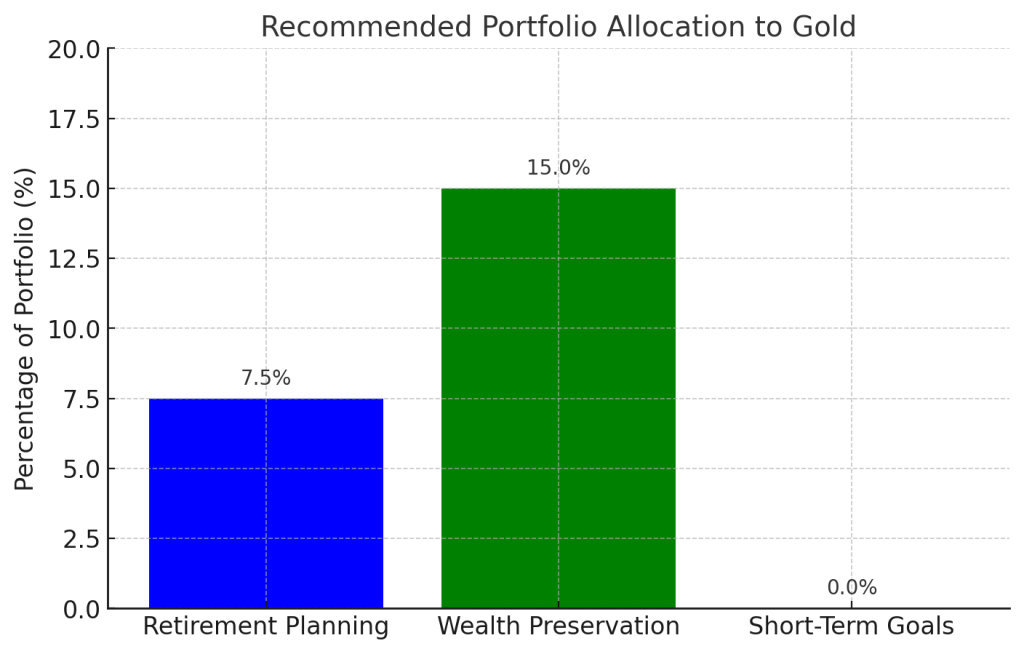

Experts recommend holding 5-15% of your portfolio in gold based on your financial goals and risk tolerance.

Gold prices are soaring due to geopolitical tensions, inflation fears, and unprecedented central bank buying. As of this writing, prices recently hit $3500/oz.

But rising prices and shifting market dynamics leave many investors wondering: How much gold should I own? Is it time to increase your gold holdings or focus on maintaining balance within your portfolio?

The role of gold in an investment portfolio

Here’s why investors look at moving into a Gold IRA or just adding gold to their non-retirement investments:

Gold as a type of asset

Gold is a steady and reliable asset that can help reduce your portfolio’s risk. It’s different than other asset classes because it performs well when there’s chaos in the world. It also has an independent value not tied to any institution. The problem with gold stocks or bonds is they can lose value if the issuing companies or governments fail to meet their obligations.

This is where physical gold stands out because it doesn’t have counterparty risks. For example, it doesn’t matter if:

- A bank fails

- The government changes policy

- There’s a cyber attack

Gold’s worth remains unaffected by any of these things, making it a secure store of wealth.

Gold as a hedge against inflation

Gold has long been a reliable store of value, especially during economic uncertainty. Currencies lose purchasing power because of inflation, but gold’s value increases because of its scarcity.

For example, during the 2008 financial crisis, governments printed more money, which decreased the value of the U.S. dollar. Meanwhile, gold surged from over $600 per ounce in 2007 to around $1,600 by 2012, demonstrating its ability to preserve wealth during inflation. So, gold can be a stable way to protect savings and pass wealth to future generations.

Gold during financial crises

Gold tends to perform well in times of financial or geopolitical crisis as investors seek stability. Its value usually rises during stock market declines or economic recessions. Investing in gold is a strong choice for balancing risk and reducing the impact of unpredictable market conditions.

As Reasonable-Wafer-248 from the r/Gold forum on Reddit puts it, “If you hold an ounce of gold, you are doing better than 50% of the population.“

Determining how much gold to own

Deciding how much gold to own depends on several personal factors. Personal finance experts always say that it depends on your specific needs:

Rule of thumb for gold allocation

Financial advisors often recommend holding 5-15% of your overall investment portfolio in gold. This gives you diversification and a hedge against risks in other asset classes. However, you don’t want to hold too much gold because it’s not an income-generating investment.

And if you buy gold beyond this allocation, you could miss out on gains from other assets. That’s why diversification across your entire portfolio makes a lot of sense.

To make these allocation guidelines easier to compare at a glance, here’s a side-by-side overview:

| Investor type / Strategy | Recommended % of portfolio in gold | Who it’s for | Primary goal |

|---|---|---|---|

| Conservative | 2–5% | New or risk-averse investors | Small safety hedge against volatility |

| Balanced / moderate | 5–10% | Most long-term investors | Standard diversification & inflation protection |

| Stronger hedge | 10–15% | Those wanting more protection | Bigger cushion during market stress |

| Aggressive / heavy allocation | 15–20%+ | Investors are very worried about economic risk | Maximum downside protection |

Assessing risk tolerance

Many people consider gold a stable asset, but its price can still go up and down.

- If you’re risk-averse: Start with a smaller allocation, like 5% of your portfolio.

- If you’re comfortable with market changes: Gradually increase your exposure up to 20% or more, depending on your overall portfolio diversity. You can use dollar cost averaging to add gold over time.

You should also consider how long you plan to hold your gold investment since this also impacts your risk horizon:

- Short-term (1-3 years): Hold smaller amounts of gold due to its slower price movements.

- Long-term (10+ years): Consider gold as a cornerstone of your portfolio for wealth preservation. It often outpaces inflation over time.

Diversifying with gold and other metals

As we mentioned above, gold provides a great way to diversify your investments. The same holds true for silver and platinum. You can add all of these to your metal portfolio, knowing that they have different demand and supply drivers.

Physical gold vs. digital gold

Physical gold means you actually own metal in the form of physical gold bullion coins or bars. Digital gold means paper-based investments.

Physical gold

Gold coins are a popular investment choice due to their purity, durability, and global recognition. Most modern coins are made from high-purity gold, ranging from 22 karat to 24 karat. These coins come in various sizes, with one troy ounce being the most common weight.

Gold bars are standardized units of refined gold that come in different sizes and forms. They come in various weights, with common sizes including 1 oz, 10 oz, 100 oz, 1 kg, and the 400 oz bar, which is the standard that central banks use.

Meanwhile, digital gold assets are ways that you invest in gold but don’t actually own the asset.

Digital gold

Digital gold assets are ways that you invest in gold but don’t actually own the asset. Examples include:

Gold ETFs and mutual funds

These funds track the price of gold or a basket of gold-related assets, offering a way to invest in gold without owning physical metal. However, they can be affected by management fees, market fluctuations, and liquidity issues.

Gold futures

Investors use gold futures contracts to buy or sell gold at a predecided price on a future date. They provide the potential for profits with minimal initial investment. However, futures are speculative and have significant risk due to leverage.

Gold mining stocks

Gold mining stocks allow you to invest in gold through shares of mining companies. These stocks can outperform gold when prices are rising, but they also carry the risk of company-specific issues like poor management, operational inefficiencies, or geopolitical instability.

Market factors influencing gold ownership

If you’re looking at gold versus other investments, is it a good choice? Here’s some key factors happening right now to consider:

Gold price trends

Analyze current and historical gold price trends and their impact on investment decisions.

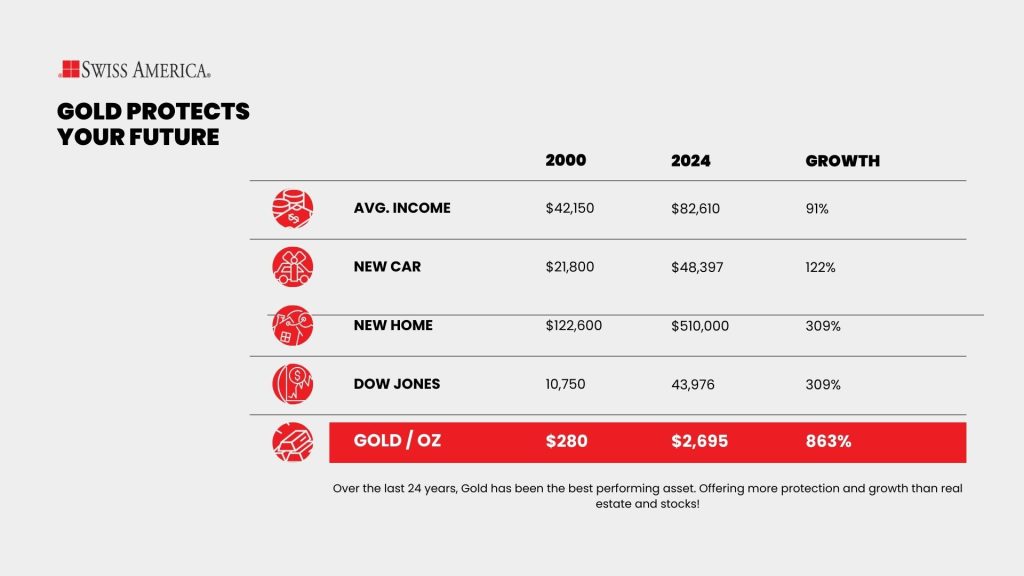

Gold is on a roll. As of this writing, it’s 30% higher than it was a year go. But what are the overall gold price trends? Remember, gold is scarce, it’s in demand, and it has intrinsic value separate from the stock market.

While no one can predict what the future brings, it’s like we’ll see scenarios where gold thrives like:

- Economic ups and downs.

- Geopolitical tension.

- Times of crisis, like natural disasters.

Central bank policies

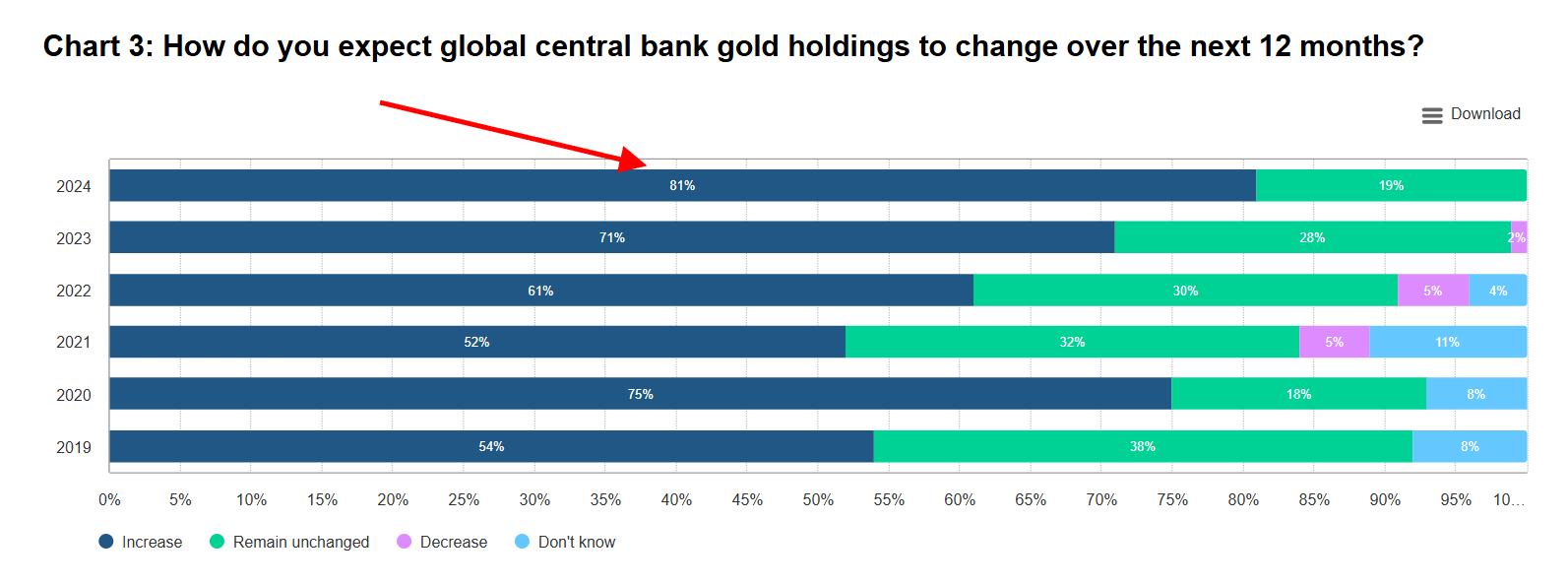

Each country’s central bank assess their individual gold need in order to protect their treasury and hedge against currency challenges.

Since 2022, central banks have been increasing their gold reserves. The past couple of years have been some of the highest buying years on record. This is because they’re concerned about geopolitical risks plus the stability of the US dollar.

A recent survey from the World Gold Forum shows that 81% of central banks expect continued increases in gold purchases through July 2025. As these banks buy more gold, the price of gold rises for all investors.

Why choose Swiss America for gold bullion

If you do want to add gold or other precious metal safe haven assets, consider Swiss America for your gold deal. We’ve worked with thousands of happy customers for over 40 years. Our team provides guidance on how to get started with precious metal investing, storage options, precious metal or Gold IRAs, and overall market trends.

Customers appreciate our timely delivery, responsive service, transparent pricing, and great experiences. Our gold trade program also provides liquidity that lets investors sell gold back when needed, making Swiss America a reliable dealer for adding gold to your portfolio.

How much gold should I buy?

Finding the right amount of gold for your portfolio is easier when you understand your financial goals and follow a clear strategy. Our team can help you decide how much is right for you so you can start building long-term financial security.

If you want to learn more about increasing your portfolio diversification with gold, contact the Swiss America team today!

How much gold should I own: FAQs

Is it worth owning physical gold?

Yes, owning gold is worth it, especially if you want a tangible and long-term asset to protect against economic instability.

Is it good to have gold in your portfolio?

Yes, including gold in your portfolio is a good way to diversify and hedge against market volatility because it performs well when traditional assets like stocks and bonds are underperforming.

What is a good amount of gold to invest in?

Experts recommend to allocate around 5-15% of your portfolio to gold. This balance lets you benefit from gold’s stability while still having exposure to other growth opportunities.

Note: The information in this post is for informational purposes only and should not be considered tax or legal advice. Please consult with your own tax professionals before making any decisions or taking action based on this information.