The precious metals industry doesn’t follow the normal metric system you’re used to with everyday items. The ounces are different. So how many grams in an ounce of gold when the measurement isn’t the same you’re used to?

The answer is that there are 31.10 grams in an ounce of gold. This article gives you details on how to calculate measurements for the different sizes of gold coins or bars you can buy.

Gold measured in troy ounces explained

The gold industry standard for measurement is the troy ounce, which is slightly heavier than a regular metric system ounce (avoirdupois ounce). This system started in medieval Europe, and even though other measurements have changed over time, the troy ounce remains how we weigh gold today.

- Troy ounce: 31.10 grams

- Avoirdupois ounce: 28.35 grams

Calculating grams in a troy ounce

Since the gold market measurement doesn’t use the standard ounce, how do you calculate the amount of grams in any gold piece you’re looking at? Here’s how:

- If you see ounces: Divide the troy ounce amount by 31.10 to get how many grams in the ounce.

- If you see grams: Multiply the grams by .03215 to get the troy ounces.

Our sales data shows that 39.5% of investors buy gold in the .5 to 1 oz range, so these conversions come up a lot when comparing weights. Here are a few examples:

- 0.5 troy oz: 0.5 × 31.1035 = 15.55175 grams

- 10 grams: 10 ÷ 31.1035 = 0.3215 troy oz

- 1/10 oz: 0.1 × 31.1035 = 3.11035 grams

Here’s a table to easily see the difference:

| Weight shown | Conversion formula | Result |

|---|---|---|

| 1 gram | 1 ÷ 31.1035 | 0.03215 troy oz |

| 2.5 grams | 2.5 ÷ 31.1035 | 0.08037 troy oz |

| 5 grams | 5 ÷ 31.1035 | 0.16075 troy oz |

| 10 grams | 10 ÷ 31.1035 | 0.3215 troy oz |

| 20 grams | 20 ÷ 31.1035 | 0.643 troy oz |

| 50 grams | 50 ÷ 31.1035 | 1.6075 troy oz |

| 1/4 troy oz | 0.25 × 31.1035 | 7.7759 grams |

| 1/2 troy oz | 0.5 × 31.1035 | 15.55175 grams |

| 1 troy oz | 1 × 31.1035 | 31.1035 grams |

Gold weights for coins and bars

You don’t always have to buy one troy ounce of gold. You can buy gold coins or bars in smaller sizes, too. The size you choose affects price and premiums. Common gold bar weights you’ll see include:

• 1 gram

• 5 grams

• 10 grams

• 20 grams

• 1 troy ounce

• 50 grams

• 100 grams

• 250 grams

• 500 grams

• 1 kilogram

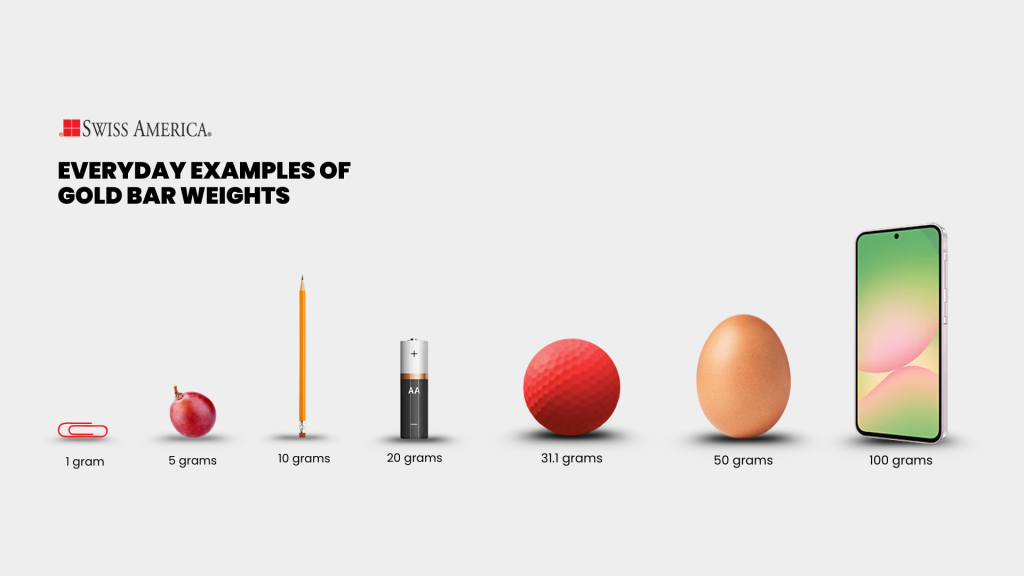

Here’s a quick comparison of some of these bar sizes to normal everyday items:

And you can buy gold coins in these fractional sizes:

• 1 ounce

• 1/2 ounce

• 1/4 ounce

• 1/10 ounce

Gold purity measurements

Besides how much they weigh, gold and other precious metals are also measured by their purity levels:

- 99.99%: This is considered four nines fine. You’ll see it in products like the Canadian Gold Maple Leaf, Australian Kangaroo, and many PAMP Suisse and Valcambi bars.

- 99.9%: Also known as three nines fine. Some international bullion bars and coins have this purity level, including certain products from the Royal Mint and the Austrian Mint.

- 99.5%: This is the minimum purity required for IRA-approved gold bars. You’ll see it in bars from refiners accredited by LBMA, like Metalor or Argor Heraeus.

- 91.67%: Purity of the American Gold Eagle. It’s a 22-karat coin, but it still contains one full troy ounce of pure gold, with small amounts of silver and copper added for durability.

The gold standard and market

The United States once followed the gold standard, which meant that the U.S. dollar was backed by gold. President Roosevelt ended it domestically in 1933 with Executive Order 6102 and the Gold Reserve Act that impacted private gold ownership. Then, President Nixon ended it for the rest of the world in 1971.

Ever since these monetary changes, the value of gold has been driven entirely by supply and demand. Because it’s an independent asset, investors use it to diversify their portfolios. Here are some of the other benefits of owning gold:

- Inflation protection: When prices rise and the dollar weakens, gold tends to hold its buying power. That’s why investors buy more during inflationary periods.

- Portfolio diversification: Gold doesn’t follow the stock market, which gives you a separate asset to help balance out volatility in your other holdings.

- Store of value: Gold has carried its value through every major economic cycle, which makes it a reliable way to preserve wealth over time.

- No counterparty risk: Gold is an independent tangible asset. It doesn’t depend on a company staying profitable or a financial system staying stable.

Other precious metals

Besides gold, other metals that also use the troy system are:

- Silver: Lower cost per ounce, strong industrial demand, easier entry point for new investors. The cons of silver are that it has more price volatility than gold and is bulkier to store in larger amounts.

- Platinum: Rarer than gold, used in automotive and industrial applications, with potential upside when supply tightens. Also, it is more volatile than gold since prices can change with variations in industrial demand.

- Palladium: High demand in catalytic converters, limited global supply, strong performance in certain cycles. Of all the precious metals, palladium is the most volatile due to its tight supply and heavy reliance on specific industries.

Final thoughts on gold measurement

Investing in gold is a smart choice to protect your financial future. Knowing how an ounce of gold is typically measured then helps you make informed decisions about how much you can buy.

If you want to learn more about gold investing and the various weight options available, connect with the Swiss America team today!

How many grams in an ounce of gold: FAQs

Is an ounce 28 or 32 grams of gold?

An ounce of gold isn’t 28 or 32 grams. Gold uses the troy ounce, which is 31.1035 grams. That’s the standard the entire precious metals market relies on.

How many grams are in an ounce of gold 14K?

A 14K gold ounce weighs 31.1035 grams. The weight doesn’t change. What changes is the purity. Fourteen karat gold is 58.3% pure gold, with the rest made up of other metals.

Is it legal to own a 400 oz gold bar?

Yes, it is legal to own a 400 oz gold bar. A bar that size weighs about 27.4 pounds, and at current prices it runs well into six figures. That is why most investors choose smaller bars or coins that are easier to store, insure, and sell.

The information in this post is for informational purposes only and should not be considered tax or legal advice. Please consult with your own tax professionals before making any decisions or taking action based on this information.