If you have some extra cash to invest, should you put it in gold or Bitcoin? There’s a lot of buzz around both this year so it can be hard to know which is the better option. This article gives you the information you need to decide.

Gold is up over 70% as of December 2025 from the past year, and Bitcoin is lower than October prices but may change in the future. So, if you are looking to diversify and add non-traditional assets to your portfolio, which one is the better investment?

This article compares the two, but to give you a TLDR version: You buy gold for safety, and you buy Bitcoin for speculation. Keep reading to learn which is the better investment for your specific goals.

Gold vs Bitcoin overview

Gold is a physical asset class. You can buy physical gold and store it at home, in a safe deposit box, or in a third-party depository. You can also buy digital gold, which basically means paper-based gold assets like mutual funds or stocks in gold mining companies. Demand for gold comes from investors, central banks and industrial uses like electronics.

It’s also a limited resource. We only have so much gold on the earth and can’t just make more to meet demand. We discussed this more on one of our recent podcasts:

Bitcoin is not something you can physically own. It’s a digital asset using blockchain technology. This digital ledger records information and stores information in a secure way that’s not possible to change.

There isn’t an industrial use for Bitcoin, and the entire value relies on the perception of its value. It has a finite supply of 21 million coins, so there is some scarcity just like gold.

Here’s a quick look of the main differences between gold and Bitcoin as investment options:

| Feature | Gold | Bitcoin | Notes |

|---|---|---|---|

| Nature of asset | Physical commodity | Digital cryptocurrency | One is tangible, the other is blockchain-based |

| Primary role | Store of wealth, hedge | Speculative growth | Gold aimed at stability; Bitcoin aimed at high returns |

| Volatility | Lower, more stable | High, frequent swings | Bitcoin price can change rapidly |

| Liquidity & trading | Sold through dealers, markets | 24/7 crypto exchanges | Bitcoin trades any time but depends on tech/exchange issues |

Background and track record of gold vs Bitcoin

These investment options have very different backgrounds.

Gold

Gold has been around for thousands of years and is very established in the global financial system. It’s also a very strong long-term asset that many investors see as an “insurance policy” to preserve their wealth. A great example of this is how central banks buy gold to protect their country’s wealth from changes in fiat currencies or economic uncertainty.

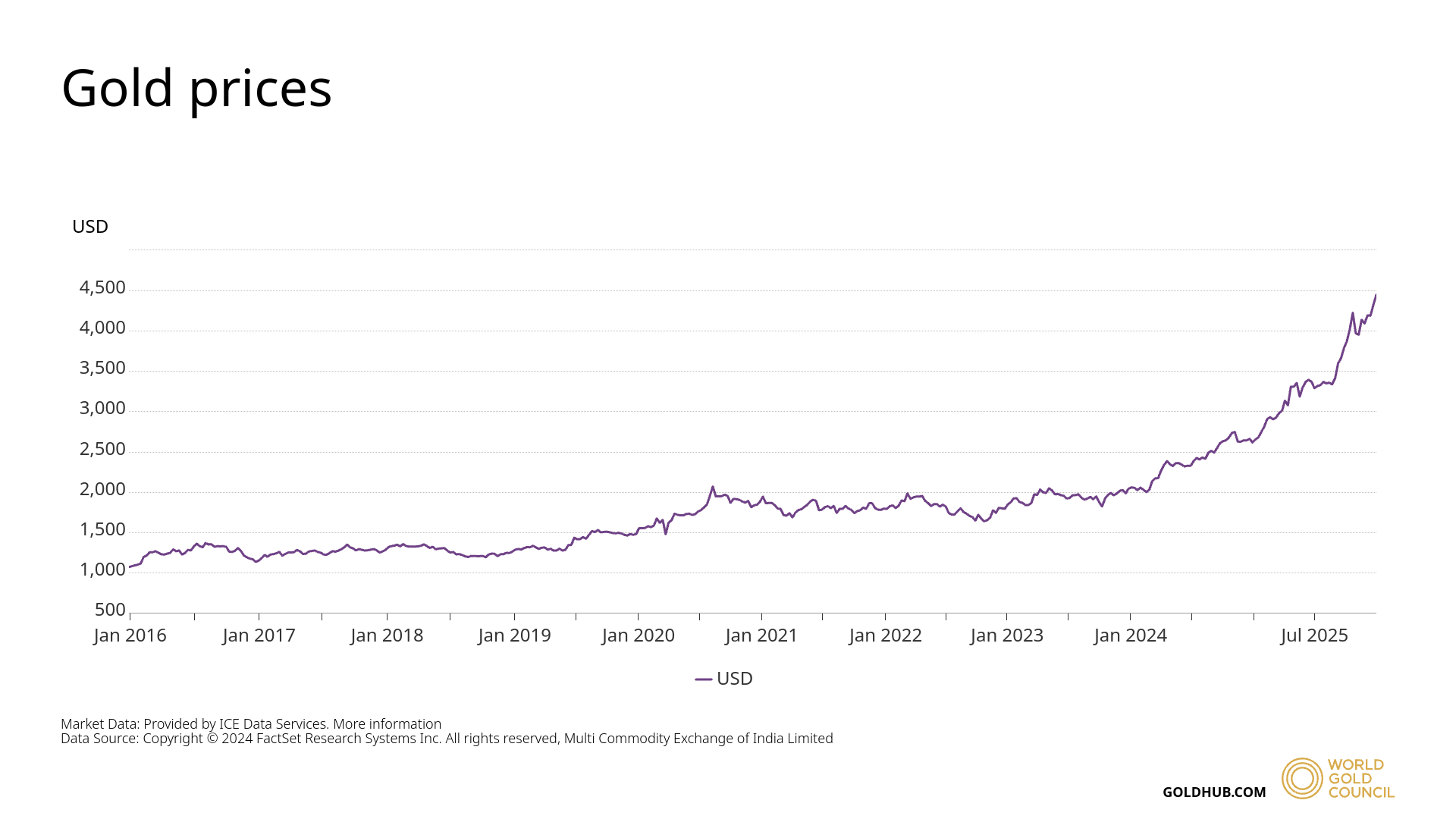

Here’s a chart from the World Gold Council showing the price of gold for the past ten years:

Bitcoin

Bitcoin is a very new asset. It’s only been around since 2009, and it’s more speculative. Most of what happens with pricing is when major investors or public companies buy bitcoin, which drives other investors to buy as well. This means that pricing is very volatile, and there’s no way to really make investment decisions on when to buy or sell.

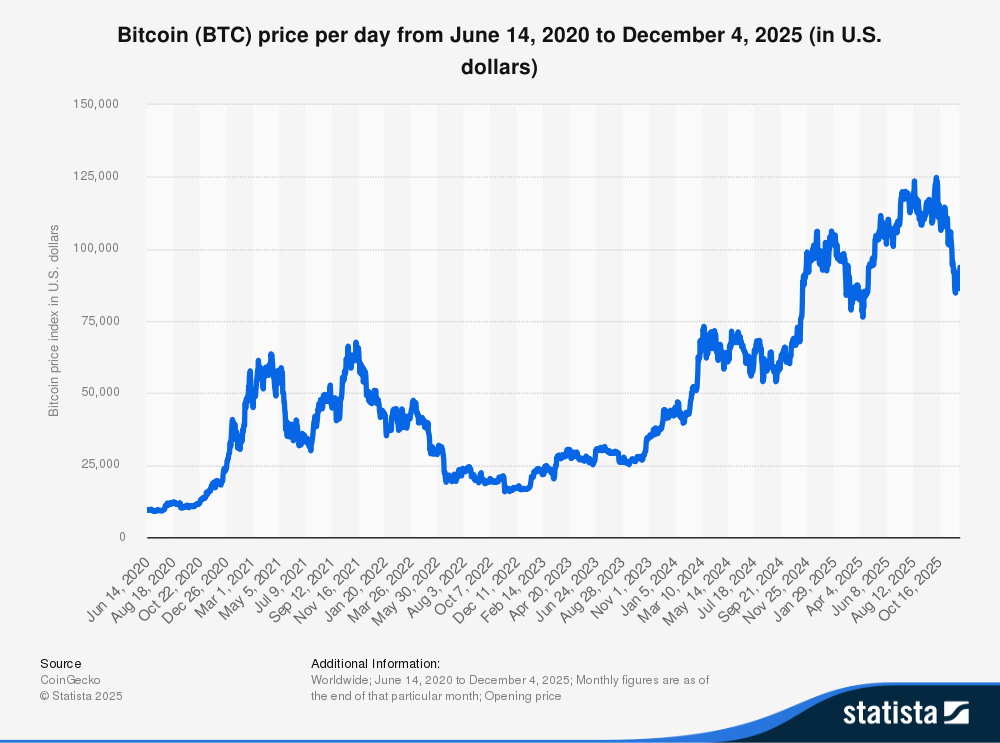

The below chart from Statista shows the price change for Bitcoin from June 2020 to December 2025.

Comparing gold and Bitcoin for your investment goals

There’s many reasons why investors decide to buy alternative assets like gold and Bitcoin. Here’s an overview of common reasons and a comparison of each:

Store of wealth

Many investors look at investing in alternative assets as a way to protect their wealth. Gold has a reputation as an inflation hedge even though this isn’t always the case. Whether or not it beats inflation, it does make sense as a way to preserve your wealth.

Bitcoin doesn’t give you these benefits. As you can see from the price chart, investing in Bitcoin means your coins might be worth very little one day and then skyrocket the next.

Portfolio diversification

It’s always a good idea to diversify your portfolio beyond traditional stocks and bonds. That’s where these alternative assets might make sense.

Most advisors recommend placing 5%-10% of your overall investments into metals like gold, silver, and platinum. This makes sense because these commodities do not follow the same trend as the market. So if there’s a sell-off and the market crashes, your metals can provide stability.

Bitcoin also doesn’t follow the market, but it does have larger swings in prices. Depending on your risk tolerance, you might consider Bitcoin a way to diversify as well since it also doesn’t follow traditional market patterns.

Global acceptance

Gold has been around for thousands of years, and it’s recognized and valued in almost every country. Central banks hold this metal as part of their reserves to protect their country financially if something happens to their currency or if they don’t want to rely solely on the US dollar. If something does happen to their fiat currency, holding gold helps a country to still receive loans or other investments.

There’s growing adoption of Bitcoin in recent years but it’s not a universally accepted asset class. Some countries have larger investor rates than others, and each country’s government makes individual decisions on how to regulate this cryptocurrency.

There are also more and more financial institutions offering Bitcoin-related products like stocks in Bitcoin mining companies. In 2024, the Securities and Exchange Commission approved the first spot Bitcoin ETFs.

Potential for high returns

Gold’s place in a personal finance strategy is to hold and protect the money you’ve worked so hard for. It’s an “insurance policy” of sorts that protects your cash from uncertainty and stock market volatility. You don’t keep gold with the goal of getting high returns. You keep it to protect your future.

An investment in Bitcoin is very different. Because of the huge price swings and the fact that people buy it because of perceived value, it’s very volatile. If you have a higher risk tolerance, Bitcoin can generate high returns. It’s a good idea to consult with a financial advisor and do research before you decide to invest in such a risky investment.

Decentralization

Gold is naturally decentralized since no single government or institution controls it. And the value of the metal doesn’t rely on any single country or bank policy. So you can trade gold outside of the traditional banking system, and it won’t matter if the system fails; you’ll still have gold. Many investors like this independence.

From the very beginning, Bitcoin was created specifically to be decentralized. It operates on a system that no country issues or controls. It’s also a peer-to-peer platform, so there’s no need for intermediaries for buying, selling, or trading.

Risks of gold vs Bitcoin

Besides the fact that prices can go up and down following the market, what are the risk profiles with either investment?

Gold risks

There are two main risks with physical gold.

No income: Because gold is not an income-generating asset, you might have an opportunity cost where you lose gains you might have received with other investment types.

Theft: The second risk is that someone might steal your metal. You’ll need to reduce this risk by storing it in a secure location and buying the right insurance coverage levels.

Bitcoin risks

There are four main risks of Bitcoin:

Regulatory uncertainty: Since Bitcoin is still new, regulations might change and also be different across countries. These changes could impact its use and future value.

Market manipulation: The overall Bitcoin market has a small concentration of ownership. This means a few investors can manipulate the market by making large trades.

Technology: Since this investment is 100% virtual and online, it is vulnerable to glitches or cyber-attacks.

Theft: Hackers or scammers can steal your crypto by accessing your accounts.

Selling gold vs Bitcoin

How easy is it to sell one investment type over the other?

Gold liquidity

Gold is very liquid and you can sell it during normal business hours. If you own physical bullion gold bars or coins, you can sell them back to your precious metals dealer or your depository if you decide to go that route for storage.

Bitcoin liquidity

You can sell Bitcoin 24/7, but your ability to sell depends on the exchange, congestion during times of high volatility, and any technology issues.

Taxes on gold vs Bitcoin

How do these investment options compare from a tax perspective?

Capital gains: The IRS considers gold a collectible, and if you hold your investment for more than one-year, your capital gains tax is at a minimum of 28%. The IRS treats Bitcoin like property, and your maximum taxes after one year are 20%.

Use as currency: If you decide to use your Bitcoin as a currency, it’s a taxable event. People don’t usually use gold in this way because the face value of coins isn’t anywhere near the actual investment value.

Reporting: Cryptocurrency transactions often have more complex reporting requirements compared to gold because of more frequent transactions and determining the cost basis.

Who should invest in gold vs Bitcoin?

Here’s three questions you can ask yourself to see what is the better investment for you:

What’s my risk tolerance?

Gold is an investment for security and stability. Bitcoin is an asset that might have greater swings in value but also in losses.

What’s my investment time horizon?

Gold is an excellent long-term asset to protect your money. Bitcoin is more of a short term speculative investment that you use to try and make gains.

Am I comfortable with storage and security risks?

Investing in physical bullion means you need a way to securely store it. Bitcoin holds cyber and other technology risks.

In the Reddit forum r/Gold, user Much-Marsupial6874 summarizes a list of reasons why they choose gold over Bitcoin, but one of the most compelling tangible asset reasons is that:

“Gold is much harder to accidentally delete or lose. If you lose your password to your gold you call a locksmith. With Bitcoin you cry yourself to sleep for potentially decades.”

Getting started with physical gold

If your research leads you to invest in physical gold, it’s a very easy asset to buy and hold. First, you’ll choose a reputable precious metals dealer like Swiss America. Our team can help you understand the various gold, silver, and platinum investments that best meet your goals.

Once you buy your metals, we ship them to you or to a third-party depository if you’d like. From there, you’ll store your metals and monitor overall market progress via our online portal. If you want to sell your metals, you can get a quote from us, or you can also sell with other brokers in the market.

Why investors choose Swiss America for gold investing

We’ve worked with thousands of happy gold investors over the past 40 years. Our clients choose us because of our:

Commitment to education: You’ll find in-depth research guides, regular podcasts, and daily market updates from our helpful expert team.

Credentials: You can be confident in the quality of our metals because we participate in industry governing bodies and trade organizations.

Transparency: Our teams will help you understand exactly what you can expect from costs and give you expert information on storage, sales taxes, and retirement account rules.

Gold or Bitcoin final thoughts

Should you invest in gold or Bitcoin? The reality is these are two different investment types that serve mostly different purposes. If you want to protect your wealth, gold is the best choice. If you are after quick returns and have a high-risk tolerance, Bitcoin is a better option.

Most investors we work with want a safe and secure way to protect their portfolios. If that sounds like you, connect with the Swiss America team today to learn more about metals investing.

Gold vs Bitcoin: FAQs

Can Bitcoin overtake gold?

Maybe, but there’s currently a big gap. Gold has a market cap of about $14 trillion. Bitcoin’s market cap is $1.4 trillion so it would need to increase by over 90% to surpass gold.

Is trading gold better than crypto?

The whole process of trading gold is very well-known, and you shouldn’t expect any surprises in the logistics. Crypto is still very new, with changing regulations, rules, and cyber risk.

Note: The information in this post is for informational purposes only and should not be considered tax or legal advice. Please consult with your own tax professionals before making any decisions or taking action based on this information.