What happens to gold prices during recession? In short, they usually go up. Why? The reasons vary, but in general, gold’s independence from currency, third parties, and the U.S. dollar means it’s a safe haven investment.

This article covers gold performance during past recessions and why to consider investing in gold before there’s a recession.

Gold prices in recessions

During a recession, the price of gold acts differently from other assets. If there’s a real estate downturn or a stock market crash, gold often remains steady.

When there’s a crisis or turmoil, investors turn to gold, which drives up the price and increases its value. And, it’s not just investors that feel this way. Central banks also buy gold as a way to protect their individual country’s assets.

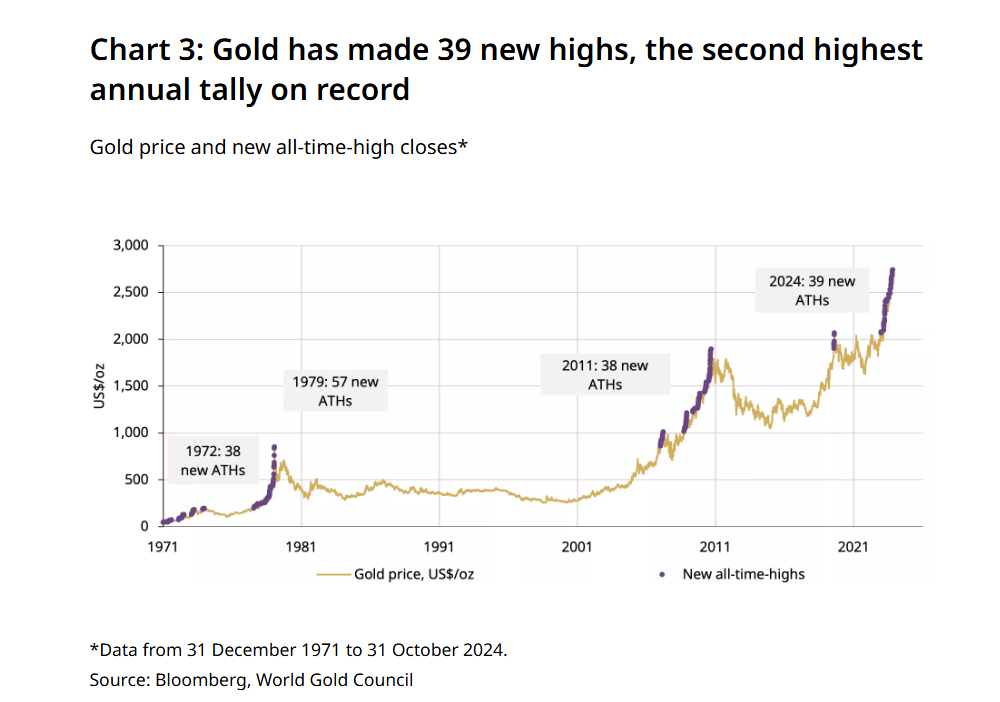

As of this writing, people have concerns about our economy and speculate that we are already in a recession or that we might experience deflation. This uncertainty is why gold is over $3800/oz, and gold demand continues to reach record highs, as you can see from the Gold.org chart below:

If you look back at history, you can see some interesting patterns in how gold prices responded during past recessions.

Despite initially falling by about 5% from $677.97 to $643.46/oz, gold regained much of its value by the end of the year as the economy stabilized.

The takeaway? Gold can recover as stability returns even when prices dip.

Gulf War recession (1990-1991)

Gold prices remained relatively stable during this recession, rising slightly from $362.85 to $363.23/oz. But, once the recession hit, there was a nearly 9% surge.

The takeaway? Gold can react quickly to sudden uncertainty.

Dot.com recession (2001)

During this period, gold prices climbed by nearly 5% from $263.03 to $276.16/oz. The tech bubble burst led investors to seek safer investments like gold.

The takeaway? Gold’s performance overcame economic damage in the tech sector.

The Great Recession (2007-2009)

This was a standout moment for gold. Its price more than doubled between 2008 and 2012, driven by fears of economic instability and the Federal Reserve monetary easing policies.

The takeaway? Investors at that time worried about the economy and the real estate market. Gold gained momentum as a safety net.

COVID-19 recession (2020)

When the pandemic hit, gold prices jumped by 5.56% in just two months, from $1,626.34 to $1,716.75 per ounce. The rapid rise reflected the global market volatility and uncertainty.

The takeaway? When investors worry about the unknown, they buy gold.

So, are we currently in or about to go into a recession? No one knows for sure, but we’ve discussed some of the recent economic data on our podcast:

Here’s a quick look at how gold responded during past recessions:

| Recession period | Gold price change | Market context | Key insight |

|---|---|---|---|

| Volcker recession (1980) | Slight dip early, then recovery | High inflation and tight monetary policy | Gold regained value as markets stabilized |

| Gulf war recession (1990-1991) | Slight rise + ~9% surge | Geopolitical upheaval | Gold reacted quickly to uncertainty |

| Dot-com recession (2001) | ~5% increase | Tech bubble burst | Investors moved to safe assets |

| Great recession (2007-2009) | More than doubled over time | Financial crisis + Fed easing | Strong safe-haven demand |

| COVID-19 recession (2020) | +5.56% jump in short term | Pandemic volatility | Rapid rise with market turmoil |

Investing in physical gold ahead of a recession

There’s no way to fully predict a recession, even when investors study trends like economic growth, interest rates, and the stock markets to predict status. That’s why it’s a good idea to proactively invest in gold before an economic downturn.

Think of buying gold as a reliable asset that acts almost like insurance. Here’s why:

Wealth protection

Gold is a reliable way to protect your wealth before a recession. It tends to hold steady versus other asset classes like stocks or real estate, which can (and have) lost value during economic downturns. So you get the benefit of an asset that’s performing differently than what’s going on around you. This is why gold is known as a safe-haven investment.

Tangible asset

Gold is a tangible asset that doesn’t depend on a company’s earnings, a contract, or a bank. It’s completely independent, and you own it no matter what other parties do. In volatile markets, investors like the security of an asset they can physically hold.

Global liquidity

Gold’s high liquidity means you can quickly buy or sell it. Plus, since every country recognizes gold, you can sell it no matter where you are in the world. This makes gold a reliable option during recessions when investors need cash.

Inflation hedge

Gold is also an effective hedge against inflation, which often rises during or after recessions. Gold tends to increase in price when the value of currency decreases to help you keep your buying power. Investing in gold gives you a way to protect your wealth from the devaluing effects of inflation.

As one Reddit user, missannthrope1, explained in the r/NoStupidQuestions forum:

“I bought a small amount of gold and silver 10 years ago. It’s doubled in value. Find me anything that’s double in value, except bitcoin. Gold always outpaces inflation. Gold always increases in value over time. As soon as the economy gets bad, or world events heat up, the prices jump. Gold is at an all-time high.”

4 easy steps to invest in gold

Here’s a simple guide to help you through the steps of investing in gold:

Step 1: Find a reputable gold dealer

The first step in investing in gold is finding a trustworthy gold dealer. Look for a dealer with a solid reputation, great customer reviews, and strong ratings from industry organizations.

Step 2: Choose and buy your gold

Once you’ve chosen a dealer, decide on the type of gold you want to buy. Investment gold is called bullion and comes in coins and bars. You can think of bars like “buying in bulk,” and they may have a slight difference in premiums over the gold spot prices.

Step 3: Receive and safely store your gold

Once you receive your gold, decide where to store it. You can keep it at home in a safe or use a safety deposit box at your bank. For larger investments or added security, consider a precious metal depository. Also, be sure to buy insurance for your gold.

Step 4: Monitor the value of your gold investment

You can track the gold market using financial news websites or apps. And, Swiss America customers can use our online portal to see the status of their investments in real-time. You can also get investment strategy recommendations and quotes on liquidating your gold or other precious metals.

Choosing the right dealer

If you’re looking to add gold bullion to your portfolio, here are some tips to find a reputable dealer:

Experience

Look for a company like Swiss America, which has been in business for decades. For over forty years, we’ve helped investors safely buy gold to protect their wealth.

Customer feedback

Check the dealer’s reputation by reading customer reviews and ratings. Google reviews and the Better Business Bureau give you insight into the experiences of other buyers. Honest feedback from real customers helps you evaluate whether a dealer is reputable and dependable.

Educational resources

The best gold dealers provide resources to help you make decisions. Swiss America provides free educational materials, like guides, market trends, podcasts, and articles, to help you compare gold to other investments.

Buy-back programs

If you ever need to sell your gold, Swiss America offers a convenient buy-back program. This makes it an easy option for liquidating when the time comes.

Industry credentials

Look for dealers who are active members of organizations like the American Numismatic Association, the Industry Council for Tangible Assets, and the Numismatic Guaranty Corporation. These affiliations demonstrate commitment to high industry standards and ethical practices.

Final thoughts on gold price during recession

You’ve heard the saying “hindsight is 20/20”. For investors who want to reduce their risks as a way to prepare for economic uncertainty or situations like currency devaluation, gold brings peace of mind.

If you want to learn more about how to invest in gold or other precious metals, connect with the Swiss America team today!

Gold prices during recession: FAQs

Does gold go up or down during a recession?

Gold often rises during a recession because investors view it as a safe place to store value when they’re worried about the economy. The price of gold then increases as people want protection from market volatility.

What is the best asset to hold during a recession?

Investors consider gold one of the best precious metals to hold during a recession. This is because it retains or increases its value when other investments, like stocks or real estate, may decline. It’s a way to diversify your portfolio and reduce risks.

Is it good time to buy gold now?

If there are signs of economic uncertainty or a potential recession, it could be a good time to buy gold. Many investors turn to gold in times of instability, but it’s important to know your financial goals before making a decision.

Note: The information in this post is for informational purposes only and should not be considered tax or legal advice. Please consult with your own tax professionals before making any decisions or taking action based on this information.