It’s no secret that with any investment, you’ll have fees and costs just to manage the investment (because nothing in life is truly free except maybe those samples at Costco). So, if you’re thinking of buying physical metals with your retirement savings, what are the Gold IRA rollover fees you can expect?

This article covers the most common fees so you can get an idea of how these costs might impact your investment strategy.

Gold IRA rollover fees

Every investment involves fees, whether it’s management fees for stocks and mutual funds or closing and financing costs for real estate. Gold and precious metals IRAs are no different. Knowing these costs upfront can help you make the best decisions possible.

The good news is that most Gold IRA companies provide up-front information about fees, so you can plan without surprises.

Types of fees in Gold IRA rollovers

Fee structure and types are very dependent on which IRA custodian you choose. For the fees below, we’ll give a range of Gold IRA costs for a few different custodians:

Setup fees

Precious metals IRA custodians almost always charge a fee to set up your account. This one-time fee can range from $50 to $300, and it covers the company’s administrative cost to get everything set up. It includes things like verifying your identity, setting up your online account access, and getting IRS documentation ready.

Example pricing from a few individual Gold IRA custodian companies includes:

- Gold Star Trust: $50

- IRA Financial: No set-up fee

- Strata Trust: $50

Maintenance fees

Once you have your physical gold retirement account set up, the custodian charges annual fees to manage your account. Some might have a flat fee structure that can range from $75 to $300 per year, while others charge a percentage of the value of your account.

These fees include services like:

- Providing account statements.

- Keeping records.

- IRS compliance.

- Buying/selling physical gold coins and bars on your behalf.

Current maintenance fee rates from the same three Gold IRA companies include:

- Gold Star Trust: $90

- IRA Financial: $460 for a self-directed IRA

- Strata Trust: $125

Storage fees

With retirement accounts, the IRS has rules about where you keep your physical gold and other precious metals. You can’t store them at home because the government considers this a withdrawal from your savings. This is why your Gold IRA custodian sets up secure storage with a third-party depository.

These IRS-approved depositories are facilities that only store precious metals. They have strong security like 24×7 monitoring, secure access, and technology systems to track investors’ metals. When you buy gold, your custodian directs your precious metals dealer to ship it directly to the depository.

The costs for this service are part of the annual Gold IRA storage fees, which range from $100 to $300 per year with flat fee structures. If the custodian charges percentage fees, these can be 0.5% to 1% of your account’s value.

You can choose a couple of different options for gold storage:

- Segregated storage: This type costs a bit more because your physical gold bullion coins or bars stay separate from other investors’ gold holdings. The depository labels your gold and silver and stores it in an individual space.

- Commingled storage: You can also choose to have your physical gold and other precious metals commingled with other investors’ holdings and share the same space. You have a claim on a portion of the total pooled inventory versus specific gold coins or bars. The depository uses sub-accounting to track each investor’s holdings.

Transaction fees

Some custodians might charge transaction fees when you buy or sell gold and other precious metals in your account. Costs can range from $10-$100 per transaction or percentage of the transaction amount.

Not all providers charge for this, which is why you’ll want to shop around and compare pricing before you decide on a Gold IRA custodian.

Wire transfer fees

Anytime you need to transfer funds into or out of your self-directed Gold IRA account, the custodian might charge wire transfer fees. This includes when you first roll over your retirement savings to set up your Gold IRA or when the custodian needs to send funds to your gold dealer to buy your metals.

Other fees

Custodians might charge other fees like paper statement fees, late fees, or account termination fees. These smaller costs can add up so be sure to ask Gold IRA providers about these potential expenses before you make a decision.

Some custodians might also charge a processing fee for transferring assets into your Gold IRA or fees for insurance costs.

Gold IRA Fee Summary

| Fee type | Description |

| Account setup | One-time fee to set your account. |

| Annual maintenance fee | Recurring annual fee for account administration. |

| Segregated storage | Annual fee for storing your metals separately from others. |

| Non-segregated storage | Annual fee for storing your metals with other investors. |

| Buy, sell, exchange | Fee for buying, selling, or exchanging metals within your account. |

| Cashier’s check or wire transfer | Fees for funding logistics. |

| Various other fees like late fees, paper statements, termination fee, etc. | Various fees. |

Minimizing Gold IRA rollover fees

How can you reduce your expenses for a Gold IRA? The biggest thing you can do is contact a few different Gold IRA companies and compare costs.

Fixed fee structure

No one likes bad surprises, so choose a company that charges flat fees instead of a variable fee structure so you know exactly what Gold IRA fees you can expect each year. Inflation and other costs might cause the annual maintenance fee or storage fee to go up slightly with price increases but you’ll know what that amount is and can plan for this in your retirement projections.

Commingled storage

Go with commingled storage to minimize fees. Working with an IRS-approved IRA custodian means you can be confident in the safety and security of your assets. Even though your metals are part of a larger pool, the depository tracks your IRA assets with a detailed record-keeping system.

Online statements

Ditch the paper and go for electronic statements. Your Gold IRA custodian will provide online account access so you can easily check the value of your holdings and any IRS reporting status information.

If you choose Swiss America as your gold dealer, our customer account portal provides additional features like real-time market values and tailored investment recommendations.

Gold IRA rollover process

Once you decide on a custodian, the process to rollover funds and set up your account includes:

Account set up

First, you’ll set up an account and fund it. There’s several ways you add money to your Gold IRA. Possible options include:

Previous employer plan: Rollover retirement account savings from a previous employer by asking the administrator to do a direct transfer of your 401(k), 403(b), or TSP savings to your Gold IRA account.

Existing IRA: Convert your existing traditional IRA or Roth IRA to a Gold IRA. This also involves a direct transfer of all or a portion of your funds so you can begin investing in gold.

New Roth Gold IRA: You might be able to use extra savings to open a Gold Roth IRA. The IRS has specific earned income rules, so check with your CPA or financial advisor to see if you qualify.

Choose metals

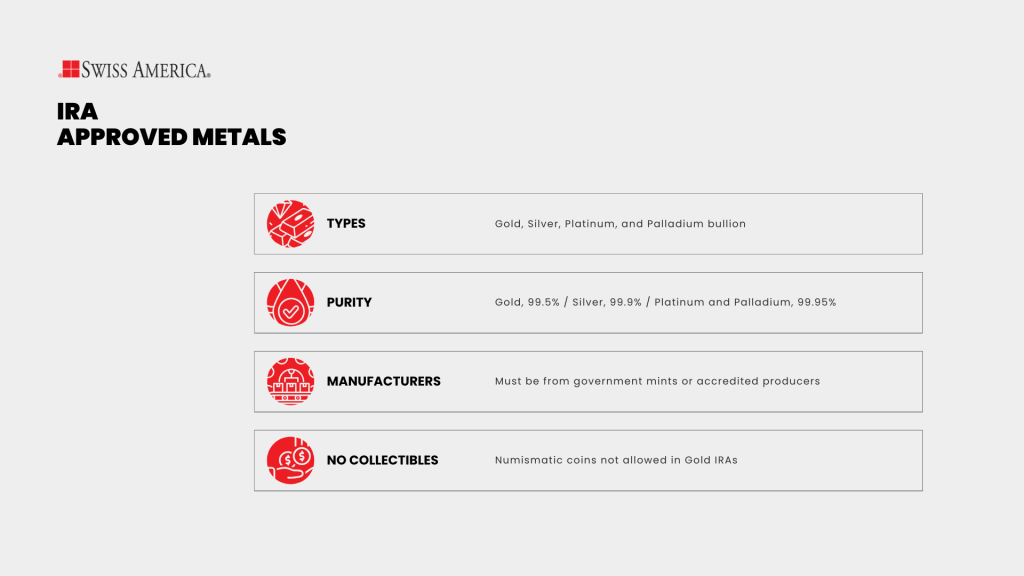

Next, work with your gold dealer to choose the metals you want to buy. The IRS has specific requirements about which precious metals qualify to help protect investors from scams or low-quality assets that can hurt your retirement account savings. These rules include:

Types of metals: You can buy gold, silver, platinum, and pallidum bullion for your Gold IRA.

Purity: The IRS rules specify purity levels for the bullion coins and bars in your account. Gold needs to be 99.5% pure, silver 99.9%, and platinum/palladium 99.95%. The only exception to these purity rules is the American Gold Eagle coin, which is only 91.67% pure.

Manufacturers: The gold coins or bars must come from a national government mint or accredited manufacturers.

Collectibles: Numismatic coins do not qualify because collectors value them for things like rarity or historical significance, not for their actual metal content.

Buy and store metals

Once you know what metals you want, direct your custodian to buy them on your behalf. They’ll work with the gold dealer, make the purchase, and then arrange for secure storage at a depository.

At this point, you don’t need to do anything else until you’re ready to make withdrawals in retirement.

What is the best Gold IRA company?

Besides choosing a custodian that has the best pricing and service options, you’ll need to decide on a gold dealer. Consider working with the Swiss America team for all your precious metals needs. You’ll find that we offer great service and helpful educational materials like:

You’ll also get guidance on which metals to buy and the pros and cons of each so you make the best decision for your investment strategy.

Gold IRA fees final thoughts

Just like traditional IRAs have annual account fees, your Gold IRA includes costs. However, if you go with a custodian that uses a flat fee structure, you’ll know exactly what to expect.

Flat fees are the best option for keeping costs low and understanding investment expenses because math surprises are only fun in grade school….

To learn more about using your retirement account savings to invest in physical metals, connect with the Swiss America team today!

Gold IRA rollover fees: FAQs

Can I roll my IRA into gold?

Yes, you can roll your IRA into gold. To do it, you’ll choose a self-directed IRA custodian, transfer funds, and tell them which physical gold bullion or other precious metals to buy with your savings. They’ll make the purchase and then take care of securely storing your metals until you reach retirement age.

Can I roll my 401k into gold without penalty?

Yes, you can roll your 401(k) into gold without penalty when you leave the company. The best way is to use a direct transfer to move your savings into a self-directed Gold IRA.

Do you pay tax on Gold IRA?

IRS tax rules for a Gold IRA are the same as with a traditional or Roth IRA. For a traditional Gold IRA, you pay taxes when you make withdrawals in retirement. For a Roth Gold IRA, you don’t pay taxes once you reach retirement age as long as you’ve held your gold assets in your account for at least five years.

The information in this post is for informational purposes only and should not be considered tax or legal advice. Please consult with your own tax professionals before making any decisions or taking action based on this information.