Right now is a good time to look at a gold coins IRA for your retirement. There’s a lot we can’t predict, and 2025 was very rocky with several market fluctuations. Gold reached record highs, and 21% of our customers decided to protect their retirement savings with a Gold IRA.

If you want to buy gold bullion coins with your retirement funds, there are a few requirements from the Internal Revenue Service (IRS). This article covers the setup process and what physical gold qualifies, so you can start protecting your wealth today.

Introduction to Gold IRA accounts

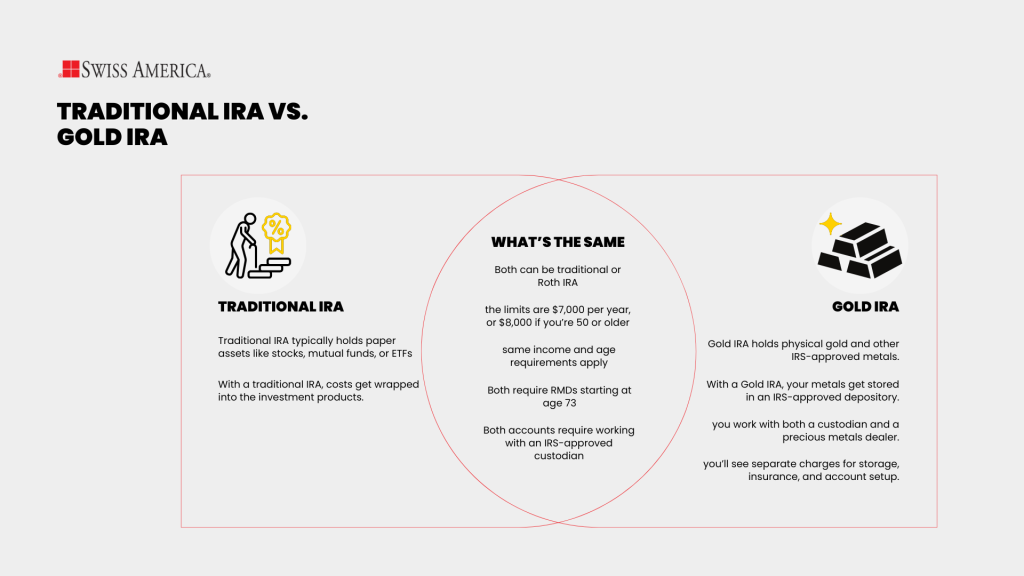

A Gold IRA is a self-directed Individual Retirement Account that allows you to hold physical precious metals, including gold, silver, platinum, and Palladium. Here’s how this type of account compares to a traditional IRA:

What’s the same:

- Tax treatment: Both can be traditional (tax-deferred) or Roth IRA (after-tax contributions with tax-free withdrawals).

- Contribution limits: In 2026, the limits are $7,500 per year, or $8,600 if you’re 50 or older.

- Eligibility rules: The same income and age requirements apply as with a regular IRA.

- Required Minimum Distributions (RMDs): Both require RMDs starting at age 73 if you’re using a traditional IRA.

- Custodian requirement: Both accounts require working with an IRS-approved custodian.

What’s different:

- Assets held: A traditional IRA typically holds paper assets like stocks, mutual funds, or ETFs. A Gold IRA holds physical gold and other IRS-approved metals.

- Storage: With a Gold IRA, your metals get stored in an IRS-approved depository. You can’t store them at home.

- Structure: Gold IRAs are self-directed, so you work with both a custodian and a precious metals dealer.

- Fees: Both types of IRAs have fees. With a traditional IRA, costs get wrapped into the investment products. With a Gold IRA, you’ll see separate charges for storage, insurance, and account setup.

What is IRA-approved gold?

The IRS allows retirement accounts to hold specific types of gold that meet purity and manufacturing standards. These requirements for gold bullion coins and bars include:

- Purity: Gold products must be at least 99.5% pure. This meets minimum fineness requirements and applies to both coins and bars.

- Source: The gold must come from an IRS-approved mint or refiner. This includes national government mints like the U.S. Mint and Royal Canadian Mint, and private refiners accredited by organizations such as the LBMA (London Bullion Market Association), NYMEX, or COMEX.

- Form: Only certain coins and bars meet the requirements. That includes coins like the American Gold Eagle, Canadian Gold Maple Leaf, Australian Gold Kangaroo, and gold bars that meet the required standards.

- Condition: The gold must be in uncirculated or in its original mint packaging. Damaged, heavily worn, or collectible coins (also called numismatic coins) do not qualify.

These rules follow the IRS’s requirement that gold be held in an IRA only when its value ties to its metal content. That’s why coins like proof sets, rare coins, or graded numismatics aren’t eligible.

Why invest in gold?

Gold is a completely separate way to hold wealth that’s not tied to a company’s performance or a government’s policies. It’s also a tangible asset that people across the world recognize as valuable, no matter what’s happening in the markets.

You don’t invest in gold to chase growth. Instead, you can use it as a way to protect your purchasing power. The dollar loses value over time because of inflation, but gold historically keeps its value. This is due to the limited supply of gold and the fact that the government can’t just create more at will.

Over decades, an ounce of gold has maintained its ability to buy the same amount of goods, while fiat currencies have steadily lost ground.

Gold also moves independently from stocks and bonds. That makes it one of the few ways to add diversification to your portfolio. When the market crashes or inflation spikes, gold has a history of moving in the opposite direction. It’s like having insurance but with an investment you hold.

It’s also liquid. You can buy, sell, or trade gold almost anywhere in the world. Coins and bars from recognized government mints are easy to verify and easy to move when needed.

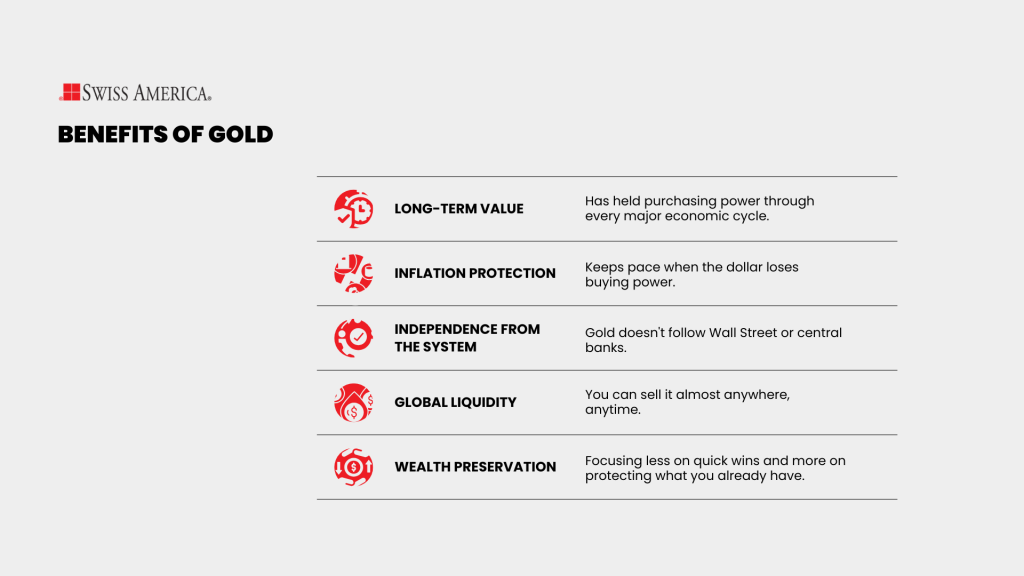

Here’s what gold gives you:

- Long-term value: Gold has held purchasing power through every major economic cycle.

- Inflation protection: Gold prices keep pace when the dollar loses buying power.

- Independence from the system: Gold doesn’t follow Wall Street or central banks.

- Global liquidity: You can sell it almost anywhere, anytime.

- Wealth preservation: Wealth preservation means focusing less on quick wins and more on protecting what you already have.

Other precious metals investments

You can also hold silver, platinum, and palladium in a self-directed IRA. These precious metals must meet the IRS purity levels of:

- Silver: 99.9%

- Platinum: 99.95%

- Palladium: 99.95%

Some common IRA-approved options include:

Silver

Silver coins can include American Silver Eagle and Canadian Silver Maple Leaf. Small bullion bars like Royal Canadian Mint and PAMP Suisse also qualify.

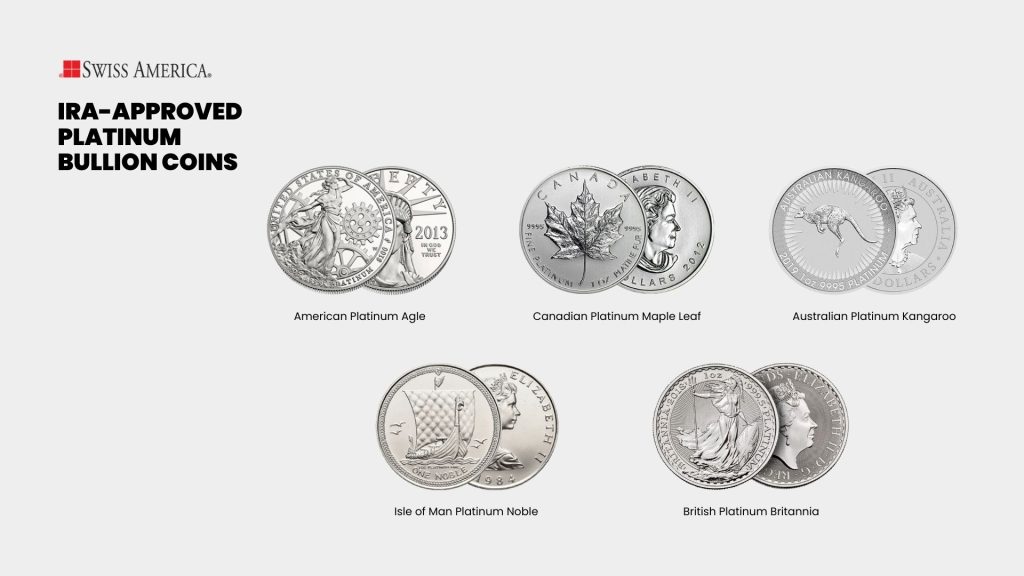

Platinum

You can buy platinum bullion coins like American Platinum Eagle or Canadian Platinum Maple Leaf. Bars from approved refiners can include Johnson Matthey and Credit Suisse.

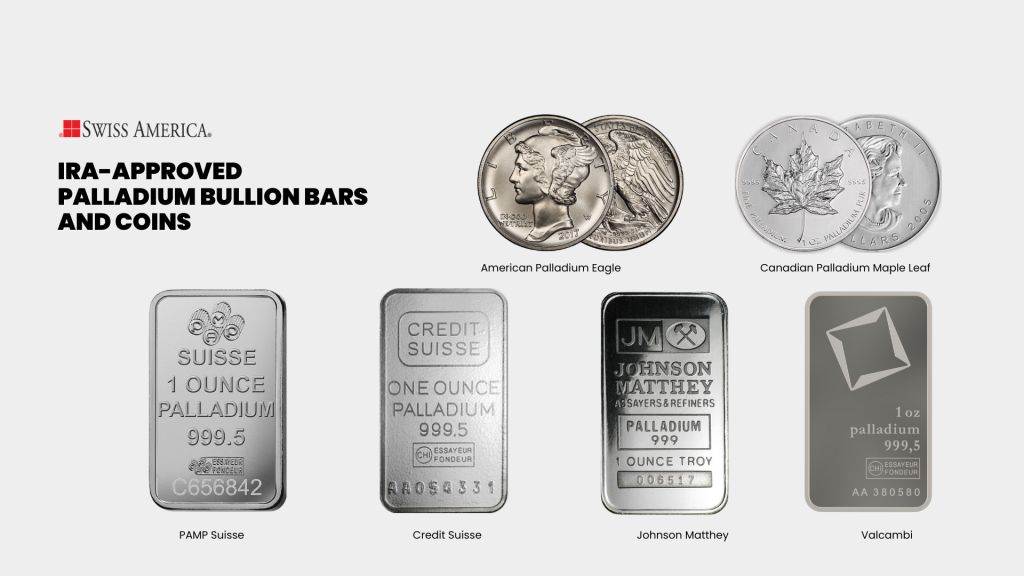

Palladium

Coins can include Canadian Palladium Maple Leaf and qualifying palladium bars come from approved manufacturers like Valcambi.

Setting up a Gold IRA account

Here’s how to set up your Gold IRA account:

Step 1: Pick a Gold IRA custodian

You’ll need a self-directed IRA custodian to manage your physical precious metals. They buy and sell bullion coins on your behalf and make sure everything follows IRS rules.

Step 2: Open your account

Complete an application and provide identification to open your self-directed IRA.

Step 3: Fund the account

You can roll over an existing retirement account like a 401(k), traditional IRA, or other qualified plan. You can also do a transfer from another IRA.

Step 4: Buy your gold

Work with a reputable precious metals dealer to choose IRS-approved coins or bars for your account. Your custodian coordinates the purchase and handles documentation.

Step 5: Store the metals

The custodian arranges secure storage at an IRS-approved depository. You can’t store gold at home if it’s part of an IRA because the IRS considers it a distribution.

Here’s a quick breakdown of how the Gold IRA setup process works:

| Step | What you do | What happens |

|---|---|---|

| Choose a custodian | Pick a self-directed Gold IRA custodian | They manage the account and follow IRS rules |

| Open the account | Fill out an application and verify your identity | Your Gold IRA is officially opened |

| Add funds | Roll over or transfer money from another retirement account | Funds move without taxes or penalties |

| Buy gold | Select IRS-approved coins or bars | The custodian completes the purchase |

| Store the gold | Gold is sent to an approved depository | Keeps your IRA compliant |

Final thoughts on IRA-approved gold coins

Adding gold to your retirement portfolio is a smart way to diversify and guard against future risks. No one can predict what’s ahead, but if you look at the volatility in stocks and other paper assets over the past few years, it’s easy to see why investors turn to gold for stability.

To learn more about setting up a Gold IRA and what physical gold you can buy, sign up for our free Gold IRA kit or connect with the Swiss America team today.

Gold coins IRA: FAQs

Are Gold IRAs a good idea?

Yes they can be. It’s a way to add physical gold bullion to your retirement savings and help protect against stock market volatility.

Can you physically hold gold in an IRA?

You can hold physical gold bars and coins in the account. You can also hold platinum coins and bars, silver coins or bars, and palladium.

Is gold taxable in an IRA?

Gold in an IRA gets taxed the same way as any other IRA asset. If you have a traditional IRA, you’ll pay taxes when you take distributions. In a Roth IRA, qualified withdrawals are tax-free as long as you’re at least 59½ and the account has been open for five years.

What is the difference between a Gold IRA and a regular IRA?

A Gold IRA holds physical precious metals like gold or silver, while a regular IRA holds paper assets like stocks or mutual funds. Both follow the same tax rules and contribution limits.

The information in this post is for informational purposes only and should not be considered tax or legal advice. Please consult with your own tax professionals before making any decisions or taking action based on this information.