If you are worried about inflation eating away at your savings, you aren’t alone. We all feel the pain of increased costs at the grocery store, insurance, or even home services. So what are the best investments during inflation or devaluation of the dollar?

This article covers the best investments when the prices for everything rise. We’ll explore why inflation happens, how it affects your purchasing power, and what you can do about it. You’ll learn about the historical performance of gold during inflationary periods and why it’s considered a reliable hedge. We’ll also look at other investment options that can help safeguard your wealth when the inflation rate increases.

Read on to learn how to make your money work for you, even when inflation is working against you.

Reasons inflation rises

Inflation continues to be a key issue in our global economy, with its ups and downs affecting everyone. In 2022, inflation in the U.S. shot up to 8%, leading the Federal Reserve to raise interest rates. Although it has now settled to a more typical 2%, there’s still some uncertainty, and investors are staying on their toes. Let’s dive into the factors to get a clearer picture of what might cause inflation to climb again.

Demand-pull inflation

When people start spending more, or when the economy picks up, and there’s anticipation that prices might go up in the future, demand for goods and services shoots past what’s available. This creates inflationary periods that reduce the purchasing power of today’s dollar.

Economic recovery: When consumers start spending more after a recession, and businesses ramp up their investments, demand can rise higher than what the current supply can meet, which then causes inflation.

Government stimulus: Government policies like tax cuts or increased public spending increase overall demand in the economy, increasing consumer prices.

Asset price bubbles: When the prices of assets like stocks or real estate shoot up quickly, it often results in more consumer spending, which can cause inflation increases.

Cost-push inflation

Another form of this dynamic is cost-push inflation, which happens when it’s more expensive to produce products. This could be because of higher wages, pricier raw materials, or increased energy costs. Companies then pass those costs onto consumers by increasing prices.

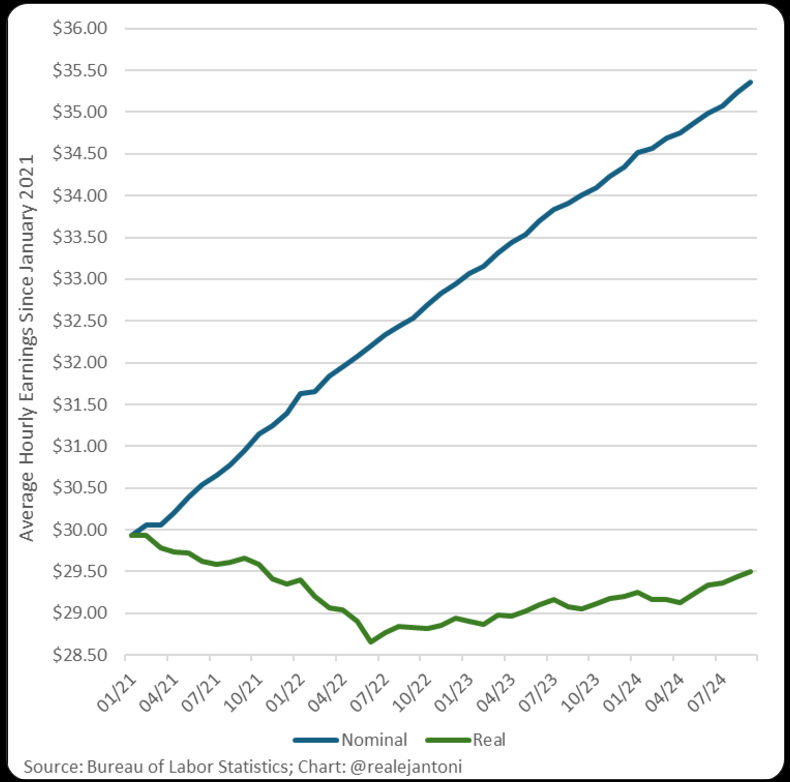

Take a look at the chart below from economist E.J. Antoni, Ph.D. Since 2021, we’ve had higher wages, and paychecks keep growing, but what people can buy with that paycheck is shrinking.

Supply chain issues or new government policies like tariffs or stricter regulations can worsen this kind of inflation.

Monetary policy

When central banks increase the money supply or maintain low interest rates, consumers have more to spend. This boosts demand, driving up prices for goods and services.

Exchange rate or external shocks

A weaker currency increases import costs, raising overall prices. Unexpected events like oil price spikes or geopolitical tensions can also suddenly accelerate inflation. Recent examples include:

Russia-Ukraine war: The war has disrupted energy supplies like natural gas, driving up global prices.

COVID-19: The pandemic caused widespread disruptions in global supply chains, leading to shortages of various goods. For example, the shortage of semiconductor chips led to higher prices for cars, computers, and other products.

Investing in gold to combat rising inflation

Gold has long been considered a reliable option during economic uncertainty and times of inflation. Regular currencies can lose value as inflation rises, but gold usually holds or even increases in worth during these periods. It’s a tangible asset with value, making it a reliable choice for inflation protection.

Historical performance

Central banks hold their gold reserves in response to inflation, driving up demand and prices. This consistent trend explains gold’s reputation as a solid defense against inflation and economic instability. Recent examples include:

Great recession: From early 2007 to late 2009, gold prices surged from around $650 to nearly $1,200 per ounce, driven by investors seeking safety amid the financial crisis and inflation concerns from government stimulus measures. The loss of confidence in the stock market and fears of currency devaluation fueled this rise in gold prices.

Early 2020’s: During the pandemic, gold prices surged as global uncertainty and economic instability drove investors to seek safety. Fears of inflation and the economic impact of lockdowns pushed demand higher, with gold surpassing $2,000 per ounce by mid-2020.

2024: The ongoing war in Russia and Ukraine, conflicts in the Middle East, and concerns over BRICS and the devaluation of the US dollar fuel the rising gold prices. Gold recently hit $2,500 per ounce as investors continue to seek safety. We recently shared our thoughts on the possibility of gold surpassing $3,000 per ounce on our podcast.

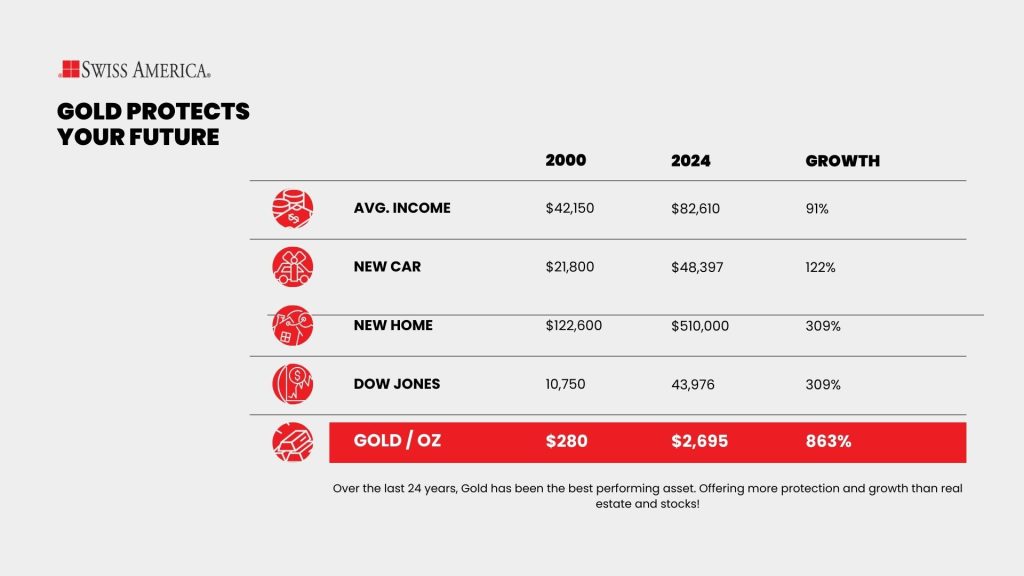

Also consider this historical performance chart for the last 24 years:

Why gold is an inflation hedge

Intrinsic value: Gold has inherent value, making it a dependable source of wealth during times of inflation when currency values may decline.

Limited supply: Because there’s only so much gold, its value stays steady or goes up when regular money loses value due to rising prices.

Diversified portfolio: Including gold in a retirement portfolio can reduce your overall risk since it can perform well when other assets lose value due to inflation.

Considerations when investing in gold

No passive income: Gold’s primary role is to preserve wealth rather than generate passive income like dividends or rental payments. It excels at maintaining purchasing power over long periods, but it doesn’t generate cash flows.

Storage costs: If you own physical gold, you’ll need a secure spot to store it, which might mean spending more on insurance or storage.

Limited liquidity: Gold is generally easy to buy and sell, but in some situations, it might take a little longer to find a buyer at the price you want. The good news for Swiss America customers is that we buy back your gold.

Other inflation hedges

What other investment options can you make to hedge against inflation and the rising cost of living?

Real estate

Property values tend to go up during inflation, especially in growing areas. As land, materials, and construction costs rise, so do property prices. For rental properties, landlords raise rents to keep up with inflation, helping them maintain the real value of their income.

Homeowners with fixed-rate mortgages also benefit because inflation gradually lowers the real cost of their loan payments. Since real estate is a physical asset with inherent value, it’s a popular choice for investors aiming to outpace inflation.

Cons of real estate as an inflation hedge

High initial costs: The upfront costs of purchasing real estate, like down payments, closing costs, and renovation expenses, are high and can be a barrier to entry for many investors. Some investors turn to real estate investment trusts as a way to hold real estate, but these are paper assets.

Property management: If you own physical real estate assets, managing properties can be time-consuming and challenging, especially if you have multiple properties or tenants. Income-producing real estate is not passive and can involve dealing with tenant issues, late payments, and vacancies, all of which can impact your rental income.

Interest rate risk: If you don’t use fixed-rate mortgages for your real estate investments, rising interest rates can increase your costs and reduce profitability. Higher interest rates can also dampen property values, making it harder to sell or refinance.

Treasury inflation-protected securities

Treasury inflation-protected securities (TIPS) are bonds issued by the government designed to protect against inflation. The principal value of TIPS goes up with inflation and down with deflation, based on the Consumer Price Index. When these bonds mature, investors receive either the adjusted principal or the original amount, whichever is higher, ensuring that the investment’s purchasing power is preserved, even during high inflation.

TIPS pay interest twice a year at a fixed rate, calculated on the adjusted principal, so the income stream increases along with higher inflation. These qualities make TIPS a popular option for cautious investors looking to maintain the real value of their money.

Cons of TIPS as an inflation hedge

Lower returns: TIPS usually don’t offer as high of a yield as regular Treasury bonds, especially when inflation is low. This could mean you’re seeing smaller returns overall, which isn’t what most investors hope for.

Tax headaches: One downside of TIPS is that the inflation adjustments get taxed as ordinary income, even though you won’t actually pocket that adjusted amount until the bonds mature. This can lead to a bigger tax bill each year even though you don’t have the actual cash from the gain.

Interest rate worries: Investing involves risk if interest rates go up. The value of TIPS might drop, and if you have to sell before they mature, you could end up taking a loss.

Here’s a quick summary:

| Investment option | Inflation protection | Pros | Cons |

|---|---|---|---|

| Real estate | Moderate–High | Property values and rents may rise | High upfront costs; management issues |

| TIPS (Inflation-Protected Bonds) | High (principal adjusts with inflation) | Preserves purchasing power; safe | Lower yields; tax implications |

Why gold investors choose Swiss America

When you are ready to add gold to your investment portfolio, here are the reasons why thousands of investors choose Swiss America:

40+ years in business: Since the early 1980s, we’ve successfully guided investors through numerous economic cycles and market shifts. Our decades of experience make us a seasoned, trustworthy partner in the precious metals landscape.

Happy customers: Our large base of satisfied clients enjoy timely delivery of high-quality metals, responsive and knowledgeable customer service, and consistent performance that meets or exceeds expectations.

Expert advice: We offer expert guidance on secure storage, precious metals IRAs, gold-to-silver ratios, portfolio integration, and market trends. Our team provides the knowledge you need to make smart investment decisions in precious metals.

Fair and transparent pricing: We offer competitive rates and clear pricing, so you always know exactly what you’re paying for your precious metals investment.

Gold trade program: Our gold trade program lets you sell your gold back to us when needed, providing liquidity for emergencies or portfolio rebalancing. We’re committed to your long-term success, not just one-time sales.

Best investment inflation final thoughts

Understanding inflation and its effects on your wealth is the first step in protecting your financial future. As we’ve covered, gold has consistently proven its worth as a hedge against inflation throughout history. Its unique properties of scarcity, durability, and universal value make it a reliable store of wealth when currencies falter.

Take the next step in safeguarding your wealth. Contact Swiss America today to discuss how gold can contribute to your inflation-resistant investment strategy.

Best investments during inflation: FAQs

What not to invest in during inflation?

Avoid cash and long-term bonds during inflation, as their value can decrease over time.

How to make money in inflation?

Invest in gold as it often rises in value during inflation, helping to preserve your wealth.

What is the best asset class during inflation?

The best asset class during inflation is often commodities like gold since they tend to increase in value and preserve purchasing power.

Note: The information in this post is for informational purposes only and should not be considered tax or legal advice. Please consult with your own tax professionals before making any decisions or taking action based on this information.