If you’re thinking about protecting your wealth with precious metals, you might be asking yourself, are silver coins a good investment?

The demand for silver comes from both investment and industrial uses. When demand rises, the value of silver holdings such as coins or bars usually increases. Silver is also used in expanding areas like renewable energy and artificial intelligence (AI) which is growing at 26% CAGR. All of this momentum adds to its investment appeal.

That growing demand pushes silver into the spotlight. But it’s not without its ups and downs. Silver can be volatile, so you’ll want to understand both the potential and the risks.

Understanding silver bullion

Until you start looking into investing in precious metals like silver, you might not even come across the word “bullion.” It basically just means investment-grade silver. It’s the purest form of the metal, sold as coins or bars.

If you’re buying silver bullion, you’ll want to go through a reputable precious metals dealer. That’s where you’ll find legitimate silver bars and coins meant for investment, not collectibles or jewelry.

Why invest in silver bullion coins?

People invest in silver bullion because it’s something tangible they can hold in their hands. It gives you a way to diversify your wealth and acts like a safety net. Investors consider silver bullion and other precious metals as a safe haven, especially when the economy takes a hit or there’s global trouble.

People trust silver to hold its value even when everything else feels uncertain. That’s why it doesn’t move with the stock market and tends to do well when there’s economic uncertainty.

Like all precious metals, its value depends on demand from investors, industrial uses, and even the silver jewelry market.

Industrial uses of silver

You might be surprised by how many ways silver is used that don’t usually make headlines. In fact, industrial demand for silver rose by 4% last year compared to the year before. That jump wasn’t random. It’s tied to some major trends shaping the global economy.

- Green energy: One big driver is green energy. Silver is a key component in solar panels and electric vehicles. As both sectors continue to grow, the need for silver rises right along with them.

- Artificial intelligence: The boom in AI means more demand for the tiny components that make it all work. Silver supports the interconnections, contacts, and circuit boards inside AI-powered semiconductor chips.

- Construction: As developers put up more homes, shopping centers, and medical buildings, the systems inside these structures rely on silver. Electrical wiring, heating elements, and insulation all use silver to function efficiently.

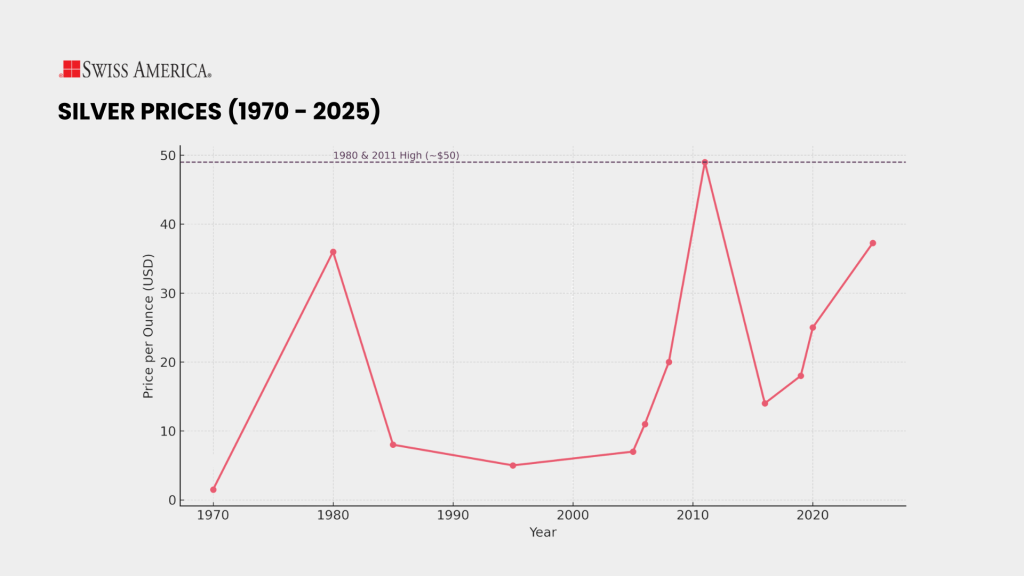

History of silver prices

Silver is usually more volatile than gold. Its price can swing more sharply, partly because much of its demand comes from industrial use. Gold, on the other hand, is usually more stable. Most of its demand comes from investors, and that demand is mainly about preserving wealth.

That said, gold and silver can still be connected. They often move in the same direction, especially during major transitions in the market. Silver price history throughout the years includes:

- 1970s–1980: Prices jumped in the late 1970s and hit over $36 an ounce in 1980 during a speculative boom, then quickly dropped to under $10 an ounce by the late 1980s.

- 1990s–early 2000s: Silver prices were mainly below $10 per ounce during this time.

- 2006–2011: Prices rose above $10 in 2006 and doubled to around $20 in 2008 during the global financial crisis. They then spiked to nearly $50 an ounce in 2011 as economic uncertainty and quantitative easing took hold.

- 2012–2019: Prices declined again and went below $14 in 2016. It ranged from $16 to $20 per ounce through the late 2010s.

- 2020–2025: The COVID-19 pandemic and renewed industrial demand drove prices higher. In 2025, silver has already reached a high of $37.26/oz.

- All-time high: Nearly $50 per ounce in 1980 and again in 2011.

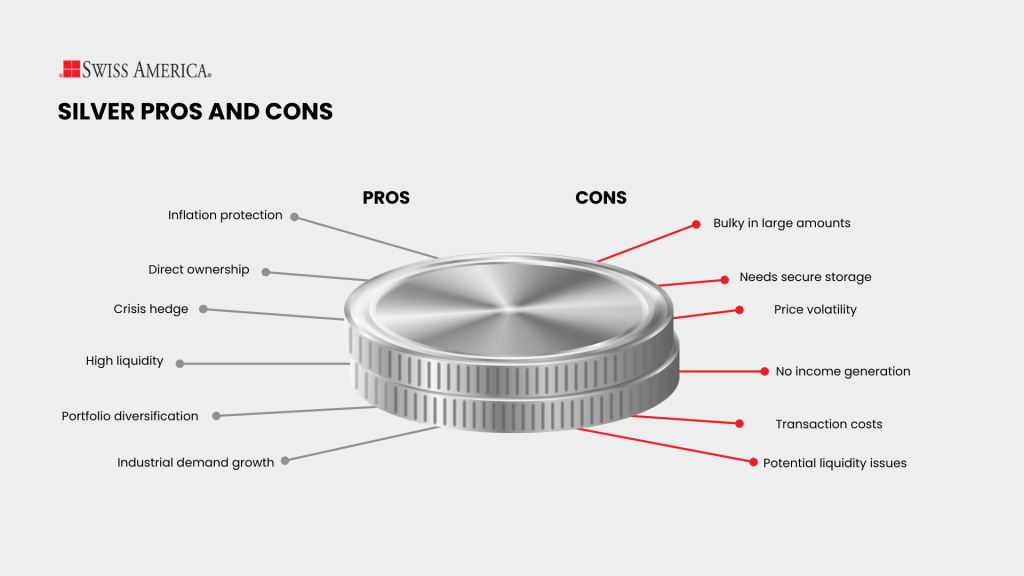

Pros and cons of physical silver investment

Just like any other physical precious metal for investment purposes, silver has pros and cons:

Pros

Here’s what makes silver worth considering:

- Inflation protection: It helps protect against inflation and a weakening currency. When the value of money drops, silver tends to hold its ground.

- Crisis hedge: It’s a safe haven during uncertain times. When things get shaky in the markets, people often turn to silver as a way to protect their assets.

- Direct ownership: You own the physical metal. There’s no counterparty risk and you’re not relying on a company or a financial institution to back it.

- Portfolio diversification: Silver doesn’t always move in sync with stocks or bonds, which helps balance things out.

- Liquidity: It’s simple to buy, easy to sell, and you can store it in small amounts without a lot of hassle.

- Demand: On top of that, silver has growing industrial demand. That gives it another layer of potential upside beyond just being a store of value.

Cons

Like all investments, there are drawbacks to be aware of:

- Bulky in large amounts: Silver takes up space. Holding a lot of it isn’t as simple as a few gold coins or digital assets.

- Needs secure storage: You’ll want a safe place to store it, and buy extra insurance to cover your investment. This all adds cost of holding physical assets like silver or other precious metals.

- Price swings: Silver can be volatile. Big moves up or down aren’t unusual.

- No income: Silver doesn’t pay interest or dividends like stocks or bonds. You’re holding it for value, not cash flow.

- Buying and selling costs: Premiums and dealer fees can eat into returns, so you’ll need to be aware of those costs to include in your analysis.

- Less liquid: In some markets or situations, it might take longer to find a buyer at the price you want.

Investment options

We’ve been focusing on physical silver, but there are other ways to invest in it, too. The catch with these alternatives is that they’re all paper assets, so you don’t actually own or hold the silver yourself. These options include:

- Silver ETFs: Exchange-traded funds that follow the price of silver. Some are backed by physical silver, others by financial contracts. You can trade them on the stock market just like shares.

- Silver stocks: When you buy these, you’re getting a stake in silver mining companies that mine or produce silver. Their value moves with the price of silver but also depends on how well the business performs.

- Silver futures: These are contracts that lock in a price for silver on a future date. They’re used for both betting on price moves and protecting against them. Not beginner-friendly, and the risk can be high.

Here’s a quick glance at your silver investment choices:

| Option | What you own | Primary advantage | Main drawback |

|---|---|---|---|

| Physical silver coins | Tangible bullion | Direct ownership, hedge against inflation | Storage & insurance costs; bulky in size |

| Silver ETFs | Shares that track the silver price | High liquidity; easy to buy/sell | Management fees; you don’t hold metal |

| Silver mining stocks | Shares of mining companies | Potential for company growth | Market risk & business performance factors |

| Silver futures | Contract to buy/sell at a future price | Leverage potential | Complex & high risk for many investors |

Storage and security

Storing silver coins starts out simple. A few rolls can easily fit in a drawer, a small lockbox, or a home safe. That’s one of the perks of physical silver in coin form. It’s compact, stackable, and doesn’t take up much room at first. But once you start building a larger position, space becomes an issue, and so does security.

A quality home safe with solid fire and theft protection is a good step up. Some people also use a bank safe deposit box for off-site storage, while others go with a third-party depository that offers insured, professional storage.

Cost and fees

When you’re investing in silver, be aware that the cost goes beyond just the spot price. Especially with physical silver, there are a few fees to understand, and for many investors, the tradeoffs are worth it.

When you buy silver coins, you’ll pay a bit above the spot price. That increase, also called a premium, covers the cost of minting, distribution, and dealer margin. The exact amount depends on what you’re buying.

Government-minted coins like the American Silver Eagle carry higher premiums than generic rounds or bars, but they also come with added trust and recognition.

Silver ETFs and other paper-based options have their own cost structure. You’ll pay an annual management fee, which adds up over time and also impacts your returns.

Investment strategies

There’s more than one way to approach silver, and the strategy you choose depends on what you’re trying to get out of it.

Some investors adopt a buy-and-hold mindset. They don’t look to time the market, and they hold silver as a long-term store of value. The goal is to protect purchasing power and have something tangible to fall back on.

Others take a more active approach and look to trade based on price swings or broader market trends. That can work if you have the time and discipline, but it also means dealing with more volatility and risk.

The key is knowing your goals. Are you trying to preserve wealth, protect against inflation, or take advantage of short-term moves? Your answer should guide how you invest and how much silver you hold.

Building a well-rounded portfolio can include other physical precious metals. For example, gold bullion or platinum can help round out your broader strategy. And then, when you balance metals with other assets, it can help reduce risk.

Final thoughts about investing in silver

Silver doesn’t get the same spotlight as gold, but it shares many of the same qualities. It can be a safe haven asset during times of uncertainty and offers protection against inflation and currency weakness.

If you want to learn more, Swiss America is here to help. We offer education, resources, and support to help you understand your options and decide if silver makes sense for your investment strategy.

Are silver coins a good investment? FAQs

Will silver be worth more in ten years?

No one can predict exact prices, but with growing industrial demand and long-term economic pressures, silver has a solid case for higher value over time.

Do silver coins hold value?

Yes, silver bullion coins hold tangible value based on their metal content, and many also carry added trust and recognition from being government-minted.

Should I hold on to my silver coins?

If you’re thinking long-term and want protection against inflation or uncertainty, holding on to your silver coins can make a lot of sense.

The information in this post is for informational purposes only and should not be considered tax or legal advice. Please consult with your own tax professionals before making any decisions or taking action based on this information.