Why is gold valuable? Why do investors buy it and what impacts its price? These are all good questions to ask- especially right now. It seems everyone’s talking about gold — especially now that the Federal Reserve just cut interest rates.

Goldman Sachs recently stated, “Our preferred near-term long is gold. It remains our preferred hedge against geopolitical and financial risks, with added support from imminent Fed rate cuts and ongoing EM central bank buying.”

If you’ve ever wondered why gold is valuable, this article covers its historical relevance, why people buy gold today, and what affects its price.

Why is gold valuable?

Gold has been part of human history since 4000 B.C., when people used it for decoration. The National Mining Association traces the use of gold as money all the way back to 1091 B.C. in China. So, with gold, we have a natural element used for decoration and money.

These factors form the whole reason gold has inherent value. As for why people like investing in gold, the reasons we usually see include:

Safe haven asset

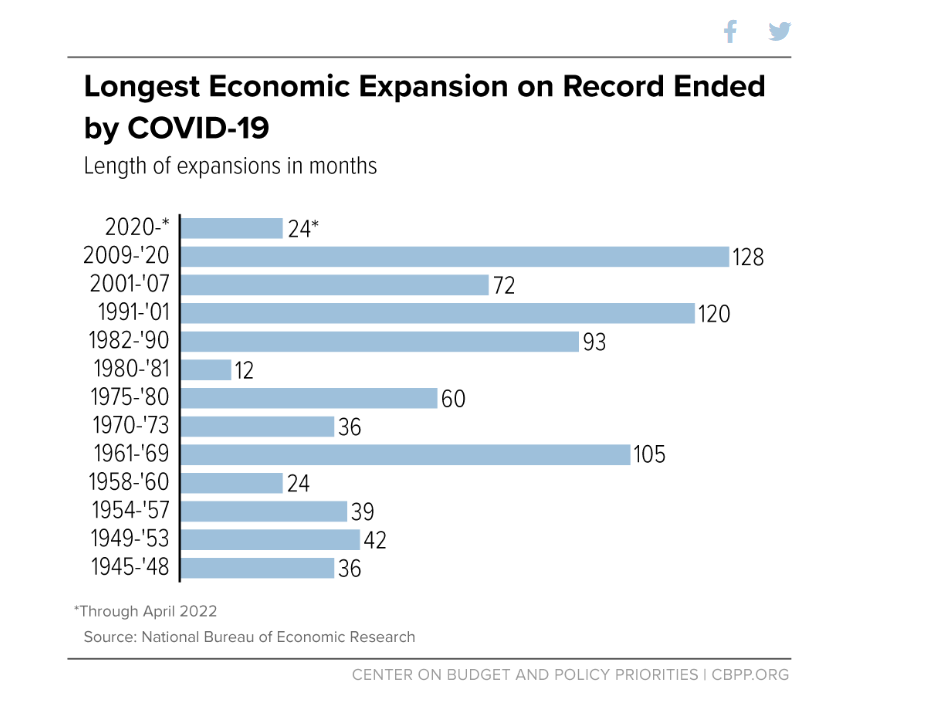

Gold holds its value even when the cost of living rises or when currencies lose strength. Ups and downs are part of every country’s economic cycle. In fact, economic data from the National Bureau of Economic Research shows that from 2009 to 2020, the U.S. experienced the longest expansion in history.

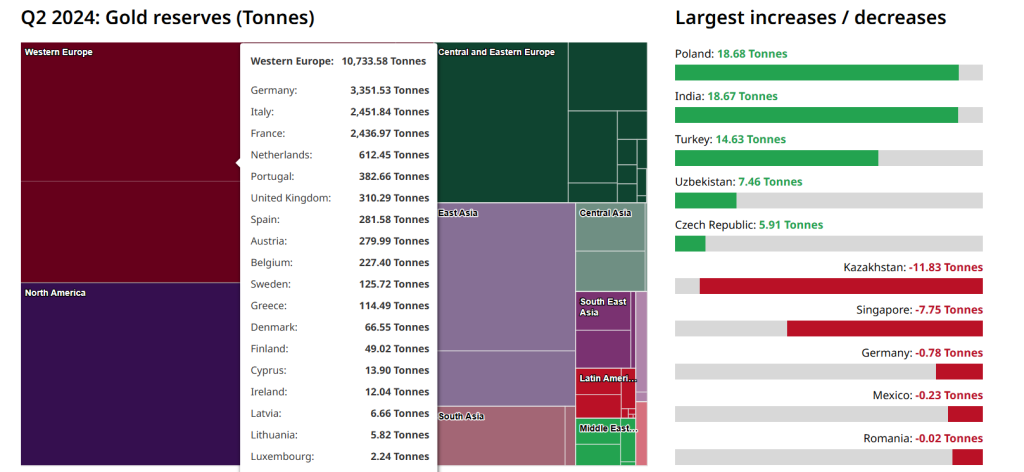

Investors and central banks buy gold if they think inflation might increase, we might have a recession, or when they worry about fiat currencies losing buying power. You can get a sense of where central banks stand via the World Gold Council website which shows which countries are buying more gold and which ones are selling. Here’s a current snapshot as of Q2 2024:

Physical asset

Many investors worry about paper assets like stocks and bonds losing value overnight. The fact that you can hold gold in your hand as a tangible asset gives people a sense of security, knowing their investment isn’t just a number on a screen.

Of course, there are other physical assets like real estate, but gold bullion is also portable. Consider that if gold trades in financial markets at $2500/oz, you can hold $25,000 worth of money in a gold bar the size of a cell phone.

Easily traded worldwide

As you can see from the Gold.gov graph showing all the government banks that add gold to their treasuries, it’s a valuable metal no matter where you go. This makes it easy to buy, sell, or trade it across the world.

Protected from digital risks

Gold cannot be hacked or compromised by online threats. It’s not a digital currency, it doesn’t rely on banking systems and it doesn’t need internet access. When you consider the growing number of cyber threats and incidents happening every day, gold gives investors a store of value that hackers can’t touch.

No dependency on other parties

If you own gold or other precious metals, they’re yours outright. You don’t need banks, governments, or companies to uphold their end of an agreement. You avoid the risk of someone else failing to meet their obligations. When you consider that government policy can easily change or banks can fail, many investors like not having to rely on anyone else.

Here’s a comparison of key value drivers to help you grasp the core reasons why gold holds value across markets and history:

| Value driver | What it means | How it helps investors | Example / Insight |

|---|---|---|---|

| Scarcity | Limited global supply | Supports long-term value | Only ~190,000 tonnes mined historically |

| Safe haven | Holds value in uncertainty | Protects wealth in downturns | Investors buy gold when inflation rises |

| Tangible asset | Physical, not digital | You own real, portable metal | A gold bar holds high value in a small size |

| Global liquidity | Traded worldwide | Easy to buy/sell in many markets | Central banks hold gold reserves |

There’s only so much gold

Gold is a rare and limited resource. The World Gold Council estimates that we’ve mined around 190,000 tonnes throughout history. While that may sound like a lot, it amounts to less than one ounce per person globally. Since it’s indestructible, nearly all of it is still circulated today in forms like jewelry, bullion, or technology.

Miners add about 2,500 to 3,000 tonnes of new gold each year, but demand often exceeds the supply. Of the new supply added, about 75% of this comes from new mining, and 25% is recycled, mostly from jewelry.

The US Geological Survey estimates suggest around 57,000 tonnes of gold remain underground, but accessing it depends on price and technology. Some people even speculate that future gold mining may come from the oceans, though this is an extremely high cost.

For now, gold remains a limited and rare metal resource.

Uses of gold

Here’s a look at some of its key uses:

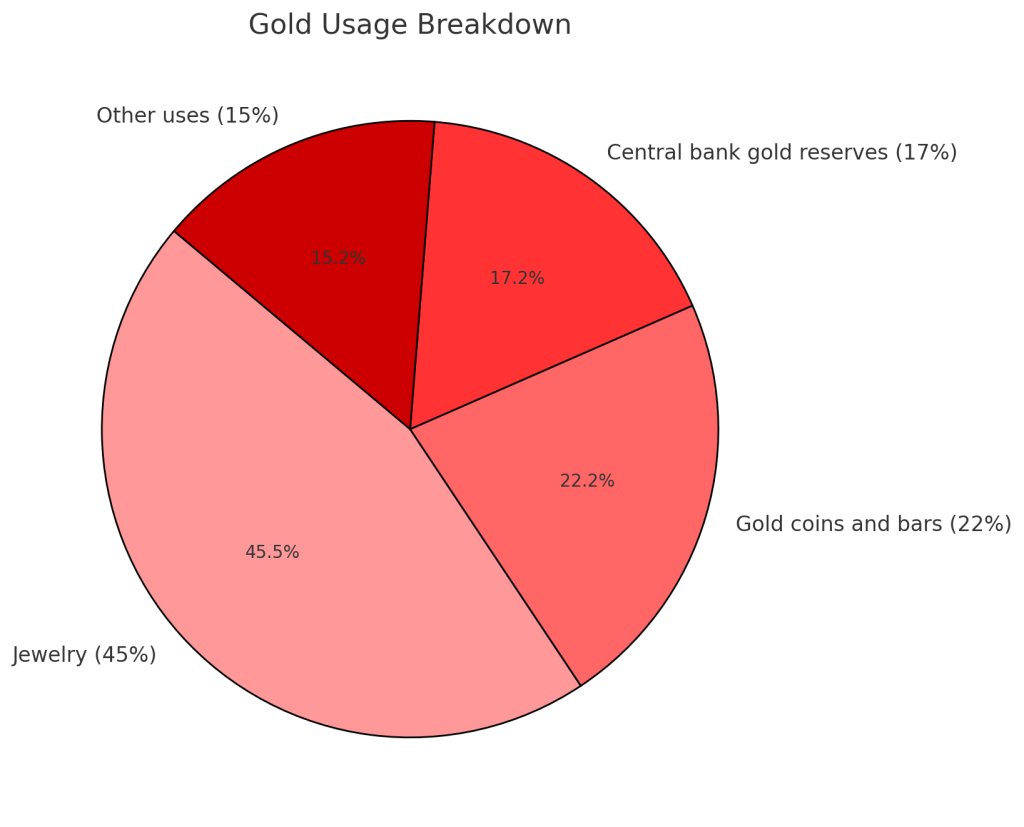

Investment: About 27% of the demand for gold comes from investors. As NextVoiceUHear from Reddit puts it, “Physical Gold = Good insurance & permanent wealth if you can keep it.”

Jewelry: Almost half of the world’s mined gold goes into jewelry, and it’s especially popular in countries like India and China, where gold jewelry is both a culturally fashionable statement and a form of wealth.

Technology: Although it represents less than 10% of gold’s total use, technology like smartphones, tablets, and computers would not exist without it.

Central banks: Government banks make up 12% of the demand since they hold gold as a key part of their financial reserves. Gold no longer backs currencies as it once was during the gold standard but it still provides stability.

Factors that affect the price of gold

Several elements can influence the price of gold and contribute to its value over time:

Currency fluctuations

The value of the U.S. dollar plays a big role in gold prices. When the dollar weakens, gold prices tend to rise because it becomes cheaper for people to purchase gold using other currencies. And then, the opposite is true because a strong dollar can put downward pressure on gold prices, making it more expensive in other currencies and lowering demand.

Economic uncertainty

We’ve covered above how people turn to gold during times of economic uncertainty. When economies face recessions or financial crises, investors turn to gold as a safe investment which then creates demand and drives up prices.

Inflation

During inflation periods, investors turn to tangible assets like gold, which can maintain or even increase in value.

Take the recent global pandemic, which increased inflation to over 7% in 2022. People bought gold, silver, and other precious metals as a way to preserve their wealth.

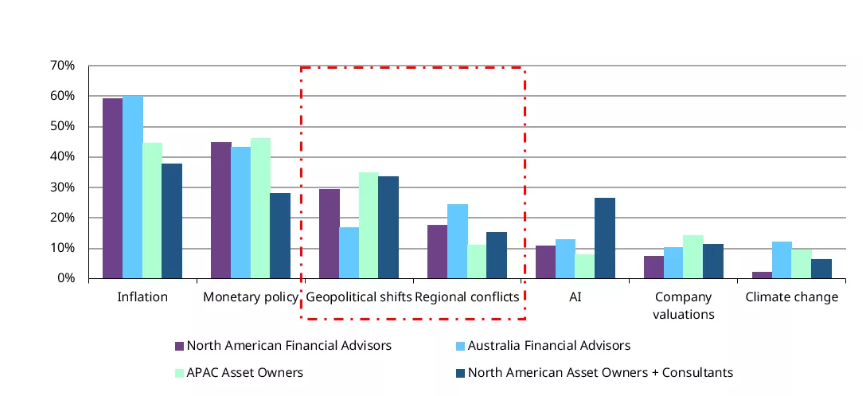

Geopolitical events

Wars, political instability, and trade tensions can also increase gold prices. When there’s uncertainty in global affairs, such as conflicts in the Middle East, investors seek the safety of gold. You can see this trend in the graph below from Gold.org:

Interest rates

Interest rates and gold prices have an inverse relationship. When interest rates are low, their returns on interest-bearing assets like bonds decrease, and people buy gold as a store of value.

And, when the Federal Reserve raises interest rates, investors turn to other assets like savings accounts versus gold bullion. Lower demand then reduces the price per ounce.

Steps to buy gold

If you want to get started investing in gold, here are the steps:

Step 1: Find a trusted dealer: Start by finding a reputable gold dealer like Swiss America. Do some research to make sure that they have positive reviews and a solid reputation. Look for transparency in their pricing and a history of reliable transactions.

Step 2: Choose your gold: Decide on the type of gold bullion you want to buy. This could be gold coins or bars, and the best option depends on your storage plans and how much money you have to invest. Also, if you buy gold or silver inside of a retirement account like a 401k rollover or Precious Metals IRA, the IRS has specific rules about which metals qualify.

Step 3: Receive and store your gold: Once you’ve made your purchase, the dealer ships your gold. If you are buying with retirement funds, your IRA custodian arranges for an IRS-approved depository to store it. But, if you’ll be owning gold outside of these tax-benefit accounts, you can store the gold wherever you’d like.

Step 4: Review your portfolio: Regularly monitor the value of your gold investment and stay updated on market trends. Swiss America customers can use our online portal to track portfolio status, see the value in real-time, and get investment ideas.

Choosing a dealer for your gold

Aside from understanding the gold market, a dealer like Swiss America can help you get access to educational resources to help you make the best decision for your situation.

We’ve been helping people secure their financial future for over 40 years, and our testimonials and reviews speak to our reputation and experience.

If you want to learn more, connect with our team today!

Why gold is valuable: FAQs

Why is gold precious and not iron?

People consider gold precious because it’s rare and has specific properties like corrosion resistance. Iron isn’t considered the same because it’s abundant and prone to rust, so it’s not as effective for long-term value.

When and why did gold become valuable?

Gold became valuable thousands of years ago when ancient civilizations started using it for trade, jewelry, and as a symbol of wealth and power. Its unique properties as a precious metal contributed to its enduring value.

Is gold the most valuable thing in the world?

Gold isn’t the most valuable thing in the world, but people prize it because of its historical and cultural significance. Depending on demand, certain rare elements or collectibles can be worth more.

Note: The information in this post is for informational purposes only and should not be considered tax or legal advice. Please consult with your own tax professionals before making any decisions or taking action based on this information.