As of this writing, the market price of gold is $4,500/oz, 44% higher than last year. Why? Gold is where investors turn when there’s economic uncertainty, geopolitical crisis, or other concerns about the stability of money. If you’re looking at adding gold to protect your retirement, this Gold IRA guide covers all the details you need.

Understanding Gold IRAs

What exactly is a Gold IRA? It’s a self-directed retirement account where you hold physical gold instead of stocks and bonds. You may also hear people refer to these accounts as a Precious Metals IRA or Silver IRA. Whether you hold gold, silver, platinum, and palladium or all of these precious metals, there’s a few rules and steps to set up one of these retirement savings accounts.

Why invest in Gold IRA?

Buying physical gold with retirement savings gives you access to all the tax benefits of traditional IRAs, combined with the top reasons for owning gold:

Diversify your retirement accounts

There’s a reason why most experts recommend holding 5%-15% of your retirement portfolio in gold or other precious metals. President Nixon ended the gold standard over 50 years ago, and ever since then, gold is completely independent of the stock market and paper currency. This protects your savings by spreading risk so one event doesn’t impact all your retirement assets.

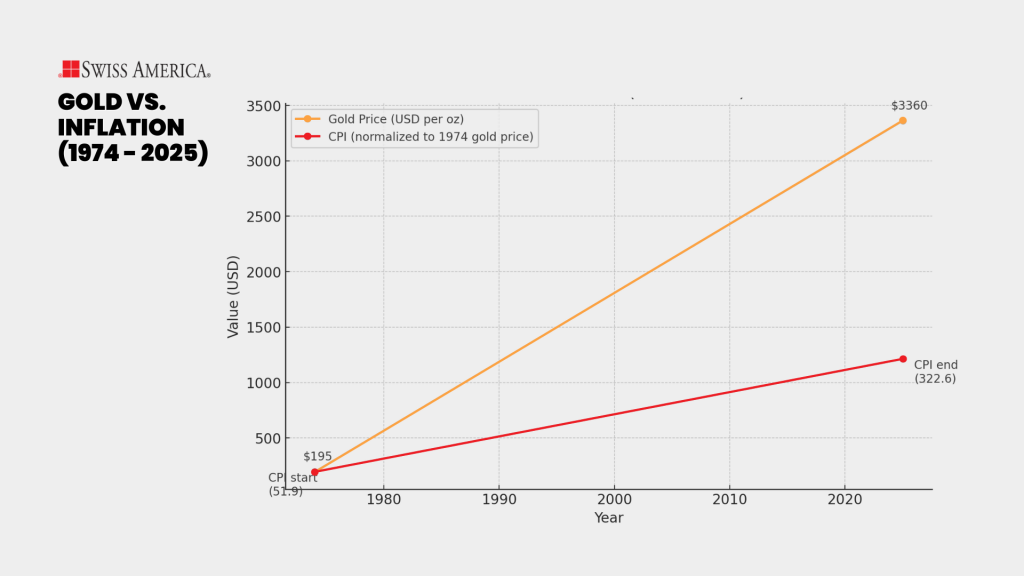

Hedge against inflation

Gold also helps protect your financial future from the effects of inflation. Because there’s only so much supply, gold has intrinsic value, and the government can’t just make more. As the cost of goods and services rises, gold often rises and gives you an added layer of protection.

The chart below shows how gold compares to inflation:

Own tangible assets

Gold and other precious metals are tangible assets that you own and can control. Many investors like the peace of mind and sense of security of holding something of real value that can’t be erased with a technical glitch or cyber attack.

Store of value

Physical precious metals can keep their worth over time. They don’t degrade and tend not to lose value just because they’re saved for later use. This allows you to store your wealth in an asset that can help protect your future purchasing power.

Protection against a falling dollar

The value of the dollar rises and falls based on factors like economic performance, trade balance, and interest rates. Right now, the United States has challenging results in a few of these areas, which is why the dollar’s value continues to decrease. When the value starts falling, individual investors and central banks turn to gold assets to protect their wealth.

Easy to sell

Gold investments are easy to sell. It’s not quite as fast as paper assets with the click of a button, but you can sell gold and other precious metals quickly since they’re recognized globally. This liquidity means you have flexibility if you want to move into other retirement assets.

Types of Gold IRAs

Now that you understand the benefits, let’s look at the types of retirement accounts you use for self-directed Gold IRAs.

Traditional Gold IRAs: You put pre-tax money into a traditional IRA, and it grows tax-deferred until you’re 59½. When you withdraw in retirement, you’ll pay regular income taxes. The advantage is that your money grows, and you may be in a lower tax bracket when you take it out.

Roth Gold IRAs: With a Roth IRA, you contribute funds after you’ve already paid taxes. The account then grows tax-free, and qualified withdrawals in retirement are also tax-free. You can also take out your initial contributions at any time.

SEP Gold IRAs: These retirement accounts work like traditional IRAs in that you fund them with pre-tax dollars. The difference is that these accounts are for individuals who are self-employed or own a small business.

| Type of Gold IRA | How you fund it | Tax treatment | Best for |

| Traditional | Pre-tax dollars | Grows tax-deferred, taxed on withdrawal | People who expect to be in a lower tax bracket at retirement |

| Roth | After-tax dollars | Grows tax-free, withdrawals tax-free | People who want to pay taxes now and have tax-free retirement income |

| SEP | Pre-tax dollars (employer contributions for self-employed) | Grows tax-deferred, taxed on withdrawal | Small business owners or self-employed individuals looking for higher contribution limits |

Funding a Gold IRA

You can fund your Gold IRA in a couple of different ways, depending on where you currently have your existing retirement accounts:

Gold IRA rollover

If you have retirement accounts at a previous employer, you can move those funds into a self-directed IRA. This includes retirement accounts like a 401(k), 403(b), or TSP.

You can also rollover all or a portion of your traditional IRA to a Gold IRA.

A direct rollover is the best method since it’s completely tax and penalty-free. The way it works is that your current plan administrator sends your funds straight to your new Gold IRA custodian.

New contributions

If you don’t want to move money from another retirement plan, you can fund your Gold IRA with new contributions from your income. This works the same way as a traditional IRA. For 2026, you can contribute up to $7,500 if you’re under age 50, or $8,600 if you’re 50 or older. And, you can’t contribute more than your earned income for the year.

Note that contributions are separate from any rollovers or transfers. You can roll over as much money as you want and still make a new annual contribution on top of that.

IRS rules and regulations for Gold IRAs

Precious metals IRAs have a few rules that are different from those of traditional IRAs. These include:

Approved precious metals

You’ll need to buy IRS-approved precious metals with your retirement savings. These include:

- Type of metals: Gold, silver, platinum, and palladium.

- Form: Bars or coins.

- Purity: Gold must be at least 99.5% pure, silver must be at least 99.9% pure, and platinum and palladium must be at least 99.95% pure.

- Manufacturer: Coins must come from approved government mints and bars from accredited manufacturers.

Popular gold bullion coins include American Gold Eagles and Canadian Gold Maple Leafs. Gold bars include PAMP Suisse and Perth Mint.

See our graphic below for these popular bullion coins and bars:

Gold IRA custodian

Gold IRAs require you to work with a self-directed IRA custodian. The custodian’s role is to manage your account, buy and sell metals on your behalf, and take care of storing your precious metals. Note that they don’t provide investment advice, and they also don’t sell gold or other precious metals.

Physical gold IRA depository

When you buy gold or other precious metals with your retirement funds, your custodian takes care of another IRS requirement, which is that you store precious metals in an IRS-approved depository. You can’t keep your gold at home because the IRS considers this a distribution, which leads to penalties and taxes.

Prohibited transactions

You can’t buy gold on your own and then add it to your IRA. Everything you buy with retirement savings must flow through the IRA custodian. The IRS also doesn’t let the IRA owner use the gold for personal use, loan collateral, or sell it to/from family members or yourself.

Gold IRA fees

Along with IRS requirements, you should also factor in the costs of maintaining a Gold IRA. Custodian account fees include:

- Account set up: This one-time fee ranges from $50-$150.

- Annual maintenance: Annual fees can be anywhere from $75-$300.

- Storage fees: Costs to store your precious metals range from $100 – $250 per year.

- Other fees: Might include other fees for wire transfers or appraisals.

Tax benefits of a Gold IRA

A Gold IRA offers the same tax-advantaged benefits that you see with a traditional or Roth IRA. These include:

Traditional Gold IRAs

If you decide to set up a traditional Gold IRA, you’ll get the benefit of tax-deferred growth. This includes reducing your taxable income right now and maximizing your potential growth during prime saving years.

You may also be able to deduct contributions you make to your traditional IRA. There are some income requirements that you can’t exceed to be eligible, so you should check with your financial advisor or tax professional to confirm.

Roth Gold IRAs

For a Roth IRA, you get the benefit of tax-free growth as long as you’ve held the account for at least five years before taking withdrawals. You can also take out your initial contributions at any time since you already paid taxes on them. This gives you flexibility if you find that you need cash.

A Roth IRA also gives you the ultimate flexibility with your Gold IRA funds. You never have to take withdrawals during your lifetime if you don’t want to. You can pass on your physical gold to your heirs, who’ll then pay taxes when they make withdrawals.

Gold IRA withdrawals

When you’re eligible to take withdrawals from your Gold IRA, you’ll ask your custodian to either sell your physical assets for cash or ship them to you as an in-kind transfer. With traditional IRAs, you’ll pay ordinary income taxes on the funds you receive or the fair market value of the physical gold at the time the custodian ships it to you.

Withdrawal rules for traditional and Roth IRAs include:

Traditional IRAs

Traditional retirement accounts allow you to make withdrawals after age 59.5 without tax penalties. If you try to do this before that age, you’ll pay a 10% penalty plus regular income tax at the time of withdrawal.

Other IRS regulations include required minimum distributions (RMDs) that you’ll need to take at age 73. If you fail to take these, you could see 25% excise tax penalties.

Roth IRAs

As we mentioned above, you can withdraw your initial contributions at any time without penalty since you already paid taxes on them. Then, once you reach 59.5 and you’ve held the account for at least 5 years, you can withdraw your precious metals tax-free.

Pros and cons of physical Gold IRAs

Before you can decide if a Gold IRA is right for your financial future, consider the pros and cons.

Gold IRA pros

Besides all the benefits of owning physical gold that we talked about earlier, the specific pros of setting up a Gold IRA include:

- Tax-advantaged accounts: A Gold IRA allows you to own the oldest form of currency that’s completely separate from other assets while also getting all the same tax benefits of traditional and Roth IRAs.

- Avoid capital gains tax: Using an individual retirement account is one of the most tax-efficient ways to invest in gold because you can eliminate capital gains taxes. Normally, IRS guidelines treat gold as a collectible, which means higher tax rates when you sell. But when you hold physical gold inside an IRA, you can avoid those extra costs.

- Control over tangible assets: The self-directed IRA structure gives you tangible retirement assets you can control. If you decide to use in-kind distributions, you can keep owning your physical gold once you retire.

Gold IRA cons

There are some drawbacks to Gold IRAs versus other retirement accounts.

- No income: Gold doesn’t generate passive income, unlike stocks, bonds, or even other alternative assets like real estate. So you’ll need to weigh the opportunity cost of purchasing gold versus other asset types.

- Higher fees: The Gold IRA account itself has higher fees than traditional IRAs. This includes costs for management and storing your metals in the IRS-approved facility.

- Complexity and scams: If you don’t work with an experienced Gold IRA custodian and a reputable gold dealer, you risk not meeting IRS regulations or even potentially falling victim to scams.

How much to invest in physical gold

Now that you know the pros and cons, how much of your retirement funds should hold physical gold?Your financial advisor or other experts likely recommend 5-15% of your overall retirement portfolio. Besides a fixed percentage allocation, some of the other models people use include:

- Dollar cost averaging: This involves adding physical gold in regular increments to your overall portfolio. You can do this each year as long as you stay within the IRS’ annual contribution limits.

- Central bank model: You might follow how central banks invest as a guide for your own gold investments. This strategy is more active because banks change their allocation depending on things like economic uncertainty or geopolitical risks.

- Target date model: Similar to target date mutual funds, this strategy allocates your portfolio based on your planned retirement date. When you’re younger, you keep a smaller allocation to gold in favor of income-generating assets. As you approach retirement, you gradually increase your gold holdings.

- All-weather portfolio model: This particular model comes from Ray Dalio and recommends holding 7.5% of your retirement portfolio in gold to balance risks from stock market volatility.

- Investor risk model: Depending on your risk tolerance, you might allocate funds to physical gold based on whether you’re conservative, balanced, or aggressive in your investment goals.

Physical gold vs paper gold

A Gold IRA holds physical precious metals or gold. Paper assets like Gold ETFs, mutual funds, or stocks in gold mining companies are not the same. Here’s how they compare to owning physical assets:

Gold ETFs

Gold exchange-traded funds combine investor money into shares tied to gold assets. Each share represents fractional paper ownership of the gold, and you trade shares on the stock market. The pros of these investments are that you won’t have storage costs, and you can easily sell with the click of a button.

Cons are that you don’t actually own tangible assets, so you’re relying on a financial institution, and you’ll also pay management fees.

Gold mutual funds

Mutual funds give you exposure to the broader gold market since they invest in a variety of gold-related assets. Since you don’t own any physical precious metals, you don’t need to pay for storage, and you can trade in and out of the fund quickly.

The downside is that the investments may not always align with gold prices, and the management fees can be high.

Gold mining companies

You can own shares in gold mining companies, which gives you exposure to the gold market. You don’t need to store metals, and you can sell your shares quickly on the stock market.

The challenge with these stocks is that you’re relying on the company’s operations strategy to impact your investment, and results may not always align with gold’s performance.

A quick comparison of these options includes:

| Investment type | Pros | Cons |

| Physical Gold IRA | Tangible, tax-advantaged | No income |

| Gold ETFs | High liquidity | No ownership |

| Gold Mutual Funds | Broad exposure | High fees |

| Gold Mining Stocks | Growth potential | Company risk |

Mistakes to avoid with your Gold IRA

A Gold IRA involves nuances around IRS regulations that you should be aware of and follow. To avoid extra fees and penalties, be sure to:

- Understand fees: Check with potential Self-Directed IRA custodians and compare costs so you can factor into your overall investment strategy.

- Diversify beyond your Gold IRA: You don’t have to roll over your entire existing retirement accounts into a Gold IRA. Move the amount you’ve decided on or start a new account to add physical precious metals over time.

- Buy only eligible precious metals: Lean on your gold dealer and custodian to follow IRS regulations for approved precious metals.

- Use an approved depository: You can’t store your gold assets at home until you reach retirement age.

- Avoid scams: Don’t fall for high-pressure sales tactics and only work with reputable Gold IRA companies that have been in business for decades.

Steps to set up a Gold IRA

It’s easy to set up a Gold IRA in just a few steps:

Step 1: Choose a precious metals IRA custodian

Most people start by asking their Gold IRA company for recommendations on a self-directed IRA custodian. It’s worth checking reviews and asking about fees before you decide who to go with.

Once you’ve decided on a company, open an account by filling out an application. You’ll need to provide identification and details about your individual retirement account.

Step 2: Fund your account

The next step is to contact your current plan administrator and let them know you want to do an IRA transfer. They’ll ask for the custodian’s contact information for your new self-directed IRA account and will transfer the amount of retirement savings you specify to them.

Step 3: Choose IRS-approved precious metals

With funds in your account, it’s now time to decide which approved gold, silver, platinum, and palladium you want to buy. Your Gold IRA company will give you guidance here as to which metals qualify.

Once you know which metals you want to buy, the custodian buys them on your behalf.

Step 4: Store and monitor

Your Gold IRA company then ships the metals to the IRS-approved facility per the custodian’s instructions. You’ll receive tracking information and access to online portals to check the status of your gold investments.

From here, it’s a good idea to monitor what’s happening with gold prices and periodically rebalance if needed to stay in line with your investment goals.

Choosing a Gold IRA company

How do you make sure you work with the best Gold IRA company? Here are our best tips on what to look for:

- Longevity: Look for a Gold IRA company like Swiss America that’s been in business for decades. Why? Because this shows they’ve been through different market cycles, they operate with integrity, and they’ll be there when you need support or to sell.

- Reviews: Check reviews on Google, Better Business Bureau, and the company website to see what other investors are saying.

- Education: There’s a lot of benefits to a Gold IRA, but as we’ve covered, there are IRS regulations you’ll need to follow. The best Gold IRA company provides education and resources so you can be confident in the decisions you make with your retirement funds.

- Credentials: Ask about the company’s credentials and participation in industry groups. This shows they’re committed to quality metals and not counterfeits or scams.

- Buyback program: At some point, you’ll likely want to sell your gold. You can easily do this anywhere, but it’s nice to work with a Gold IRA company that will buy back your precious metals when you’re ready to sell.

Final thoughts on a Gold IRA

If you believe in the benefits of gold investing, a Gold IRA offers one of the most tax-efficient ways to own it. There are some nuances to setting up and funding your self-directed Gold IRA, but once you get those in place, owning gold is very simple. The peace of mind that comes from diversifying and protecting your wealth is worth the setup.

To learn more about using an IRA investment to buy gold, connect with the Swiss America team today!

Gold IRA FAQs

Are Gold IRAs a good idea?

Yes. A Gold IRA helps to reduce risk in your retirement portfolio and protect your wealth. Holding physical gold in your individual retirement account gives you the most tax benefits, with all the benefits of owning gold.

What is the best Gold IRA account?

You can have a traditional or Roth Gold IRA. Both have tax benefits, but the better fit depends on when you’d rather pay taxes now with a Roth or later with a traditional IRA.

How much money do you need to invest in a gold IRA?

Swiss America has a $5,000 minimum to get started with a Gold IRA.

The information in this post is for informational purposes only and should not be considered tax or legal advice. Please consult with your own tax professionals before making any decisions or taking action based on this information.