Like all investments, buying precious metals has pros and cons. Before making any decisions, it’s a good idea to know the advantages and disadvantages of investing in gold.

Lately, it feels like there’s uncertainty around every corner. What’s happening with tariffs? Are more layoffs coming? Will the Federal Reserve cut rates? We’re all asking these kinds of questions and looking for stability. That’s where gold comes in.

A recent survey from the World Gold Council found that 95% of central banks expect increased gold purchases next year. Governments are trying to protect their own wealth and prepare for economic uncertainty.

As of this writing, gold is at $3,400 an ounce, so it makes sense to ask whether now’s the time to buy. To make the right call, you need to weigh the whole picture. Let’s take a look at what works in gold’s favor and the tradeoffs you should consider.

Pros and cons of adding gold to your investment portfolio

Gold can make sense to protect against economic uncertainty, but like every investment, there are drawbacks to keep in mind as well.

| Pros | Cons |

| Independent from stocks | No income or yield |

| Hedge against inflation | Price can swing |

| Diversifies portfolio | Needs secure storage |

| Physical, self-owned asset | High tax on gains |

Pros of gold investing

Gold remains a chosen investment for central banks, conservative investors, and people who want a hedge against uncertainty. Here are some of the pros of gold:

Safe haven asset

Investors consider gold to be a defensive asset because it’s independent of the stock market and other growth assets. Gold doesn’t follow earnings reports, interest rate decisions, or corporate news, so it’s a way to offset what might be happening in the market.

Inflation hedge

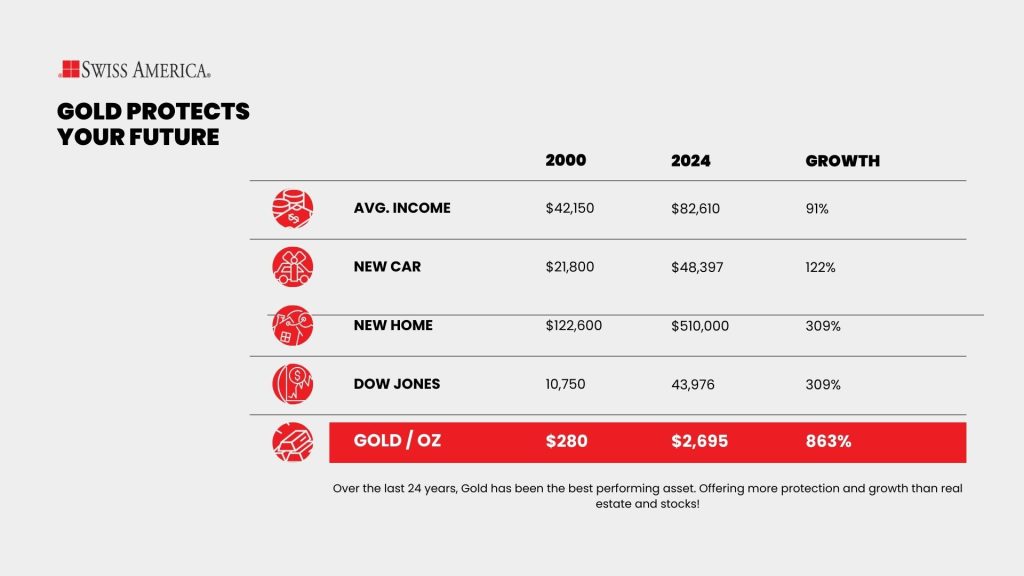

Gold can be a way to protect your purchasing power from the eroding effect of inflation. There’s only so much gold in the world, and the government cannot just print more. Investors know that it’s a scarce resource and that gold prices can rise during periods of inflation. Here’s a comparison showing this dynamic:

Portfolio diversification

Most experts recommend holding a portion of your portfolio in gold as a way to protect against financial crisis, unpredictability of traditional stocks and ownership of a completely separate asset. Historically, gold prices increase when confidence in the economy drops, there’s a recession or markets become unstable.

Tangible asset

Many people like owning a tangible asset that they fully control. Nearly all other assets involve some type of third party, whether it’s a bank, brokerage, or platform managing it for you. Gold is one of the few assets you can hold directly, and it’s portable enough to store or move without depending on anyone else.

Cons of gold investing

Drawbacks to consider if you are looking to buy gold coins or bars.

No income or yield

Gold doesn’t pay dividends or generate cash flow. Buying gold bullion is more like taking out an insurance policy to protect your wealth. If the price goes up, you make money investing in gold, but you might miss out on higher returns from other assets. It really comes down to what you’re trying to achieve with your portfolio.

Price volatility

Gold can be unpredictable because prices usually rise during times of economic uncertainty. When things start to look better, investors sell gold and move into assets that generate income. This cycle reflects how people react to inflation, market swings, and overall confidence in the economy.

Storage and security costs

Since gold bullion is a physical asset, it needs secure storage. You can keep it at home, in a bank safety deposit box, or in a gold vault service. No matter what you choose, there are costs to think consider. If you store it yourself or at a bank, check with your insurance provider to see what coverage you need. If you use a depository, make sure to factor in the annual storage fees when weighing your options.

Capital gains tax

The IRS applies a minimum capital gains tax rate of 28% on long-term physical gold investments. One way that you can offset this is by using your retirement account to invest through a Gold IRA.

Ways to invest in gold

Some of the ways you can add gold to for portfolio diversification include:

Gold coins and bars

For physical gold investments, you’ll buy coins produced by government mints or bars from certified refineries. And if you’re setting up a Gold IRA, the IRS has specific rules to make sure you’re holding investment-grade metals that qualify for retirement accounts.

Common gold bars include Credit Suisse, Valcambi, PAMP Suisse, and Perth Mint. Gold coins can include American Gold Eagle, Canadian Maple Leaf, or Austrian Gold Philharmonic. Below are examples of IRA-approved physical gold:

Gold ETFs

Gold exchange-traded funds are paper assets that give you exposure to gold, but you don’t hold the physical asset. Instead, you own a share of investment-grade bars. This approach to gold investing can have commission costs and other fees that reduce your overall return.

Gold mutual funds

Gold mutual funds hold several gold-related assets like shares in gold mining companies, gold ETFs, and other gold-linked securities. This can be a way to diversify your gold investing, but these actively managed investments rely on someone else’s performance and can have high fees.

Gold mining stocks

You can also buy gold stocks in individual gold mining companies. This gives you a way to benefit when gold prices increase, but you’re also relying on the company’s performance for your return. If the company has operational issues or poor management, this impacts your investment.

Steps to buying gold

Buying physical gold is a pretty simple process.

Step 1: Start by researching gold dealers selling precious metals. Look for a company like Swiss America that’s been around for decades, has great reviews, and belongs to precious metals industry groups. A little research can help you avoid overpriced offers or scams.

Step 2: Decide which gold coins or bars to buy. Stick with well-known options like American Eagle, or Canadian Maple Leaf coins, or gold bars from approved refiners. These are easier to sell down the line and meet IRA requirements if that’s your path.

Step 3: Decide how you’re going to store your physical gold. It could be in a home safe, a bank safe deposit box, or a depository. Each option has pros and cons, but make sure to insure your gold and keep it secure.

Step 4: Keep track of your gold as part of your overall portfolio. You don’t need to check prices daily, but make sure you’re still within your target allocation. If the value of your gold reaches more than the amount you planned for, you might want to sell some. If it’s down, maybe you’re buying more.

Step 5: When it’s time to sell, go back to your dealer. Most of them offer buyback programs. You’ll get a quote, ship your metals, and once they verify everything, you’ll get paid. It’s not instant like selling a stock, but it’s not a complicated process either.

Gold investing tips

You can increase success with gold investing by following these tips:

Go with proven physical gold options

Sometimes people buy the wrong type of gold, like gold jewelry or collectible coins, thinking these will help their investment strategy. But those are speculative. It’s better to go with investment-grade gold bars and coins where value relies entirely on their gold content, not on opinions or collector demand.

Work with a reputable dealer

A good dealer provides education and resources so you can make investment decisions. They should also be upfront about any fees or costs that come with investing in gold. These can include:

- Premium: When dealers sell gold, the difference between the retail price and the spot market price is called the spread.

- Bid-ask spread: When you sell physical gold, there’s usually a difference between the market price and what the dealer offers for buyback.

Use a Gold IRA to save on taxes

One of the best ways to invest in gold bullion bars and coins is through a self-directed precious metals or Gold IRA. Holding gold in this kind of account lets you avoid the higher capital gains tax the IRS charges on physical gold and other precious metals.

From a tax standpoint, it works just like a traditional IRA. Your gold can grow in value without being taxed each year. You’ll only owe taxes when you take distributions in retirement. And if you go with a Roth version, you handle the tax part upfront, and your withdrawals later on come out tax-free.

Talk with a financial advisor

Work with a financial advisor to discuss your risk tolerance and decide how much gold to add to your portfolio.

Final thoughts about gold investing

There are times when gold makes a lot of sense. And there are other times when other investments have more expected growth potential. But since no one can predict the future, holding a portion of your wealth in gold is a way to prepare for whatever the next crisis or downturn might be.

To learn more about your options for investing in gold, connect with the Swiss America team today!

Disadvantages of investing in gold: FAQs

What does Warren Buffett say about gold?

Warren Buffett hasn’t been the biggest fan of gold because it doesn’t produce income, but even he bought into gold mining stocks when the timing made sense. Like any investment, it depends on your goals.

Is there any risk in investing in gold?

Yes, gold prices can go up and down just like any other asset. But people invest in it to offset risk, not add to it.

Is it really worth it to invest in gold?

If you’re looking to protect your money, hedge against inflation, or add a real asset to your portfolio, gold can be worth it.

The information in this post is for informational purposes only and should not be considered tax or legal advice. Please consult with your own tax professionals before making any decisions or taking action based on this information.