According to the World Gold Council, 2024 saw a four-year high in gold investment demand. A big part of that came from central bank buying, and we’re still seeing gold climb in 2025. If you’re thinking about investing in gold bars or coins, this article gives background, guidance, and comparisons to other types of gold investments.

Understanding gold as an investment asset

Investors turn to gold because it helps protect wealth, adds diversity to a portfolio, and acts as a hedge against inflation and economic uncertainty. It’s a tangible asset you wholly own, with no need to rely on anyone else to deliver on promises. That independence is part of why people move toward gold when things feel unstable. People see it as a safer choice when other assets feel risky.

Historical significance of gold bars

Gold is the oldest currency. Egyptians traded it as far back as 3600 BC, and standardized gold coins started appearing around 600 BC. With gold, you’re looking at a form of money that’s been supporting economies for over 5,600 years.

In the 20th century, countries started moving away from tying their currencies directly to gold. In 1971, the United States ended the dollar’s direct convertibility to gold. That shift made gold completely independent from any single country’s currency, even though it still holds value.

Throughout history, gold has served as a hedge against economic downturns. We saw this during the Great Recession, when COVID-19 hit, and we’re seeing it now as investors react to shifting policies and economic uncertainty.

Gold as a protective asset

Gold is a defensive asset because it tends to move in the opposite direction to the stock market during economic downturns. This helps you diversify and preserve your wealth during economic shocks.

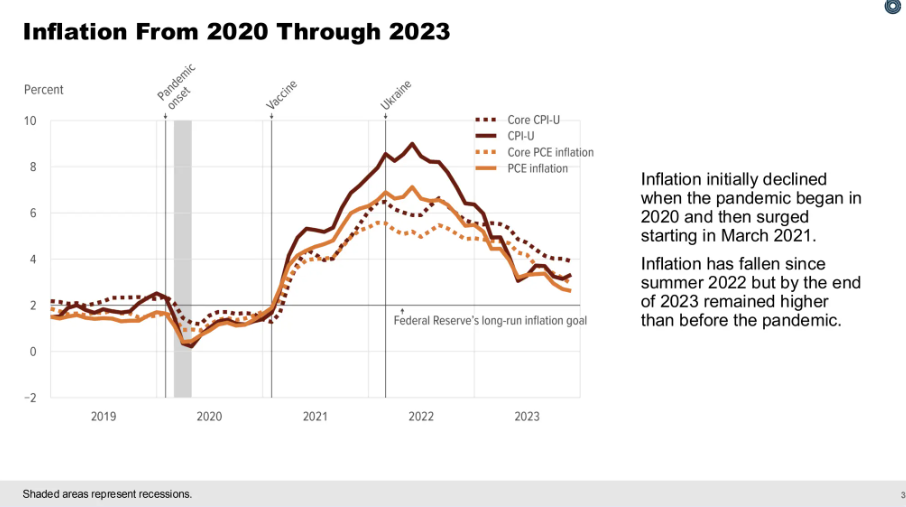

Gold is also a hedge against inflation because it’s limited in supply. The government can’t print more of it, so it tends to hold its value. When inflation causes cash to lose buying power, gold prices usually go up. Since it’s a scarce asset, the rise in value helps protect your money.

Fundamentals of gold bar investments

Physical gold with a purity of at least 99.5% is called gold bullion. You can buy it as bars or coins, which investors choose one or the other for different reasons. Gold bars offer a simple, no-frills option and come in a range of weights. Bullion coins have decorative designs, but they’re different from collectible coins. Investment-grade coins and bars get their value from their gold content and the current market price, and this value doesn’t depend on collectibility or personal opinion.

When you invest in gold bars or coins, you own the physical asset. This is different than gold stocks, mutual funds, exchange-traded funds, or gold futures. All of the latter are paper assets where you don’t actually have a tangible item.

If you Google “spot price of gold,” you’ll get the current market price for one troy ounce of gold. However, when buying gold bars or coins, there’s a premium on top of the spot price. This premium covers manufacturing, distribution, and dealer costs and is about 1% to 5% of the underlying gold value.

Gold dealers also buy gold from individual sellers. The difference between the price they’ll pay you and the selling price is called the bid-ask spread.

Market dynamics affecting gold value

The value of gold depends on several market factors, including supply and demand. On the supply side, there’s only so much gold in the world, and gold mining companies have a certain amount of output per year. Demand can change rapidly in response to:

- Central bank purchases: Each country’s treasury decides how much gold to keep in reserve. During times of concern about currency values or economic changes, many central banks will buy physical gold as a hedge.

- Economic uncertainty: When investors worry about recessions, they’ll look at owning phyiscal gold as a way to protect their wealth against market ups and downs.

- Currency strength: When the US dollar weakens, it costs less for buyers using other currencies to buy gold. As they buy more, it increases demand and raises prices.

- Geopolitical tensions: Gold prices also rise when investors seek the safety of gold in response to wars and crises in various parts of the world.

Types of gold bars

The largest bars you’ll find are called good delivery bars. They usually weigh 400 troy ounces and are standard bars used by central banks and institutional investors in international markets.

Next are kilobars, which weigh one kilogram. They’re also used by institutional investors, especially in the Asian gold market.

Retail investors buy in smaller denominations, including:

- 1 gram

- 2 & 2.5 gram

- 5, 10, 20, 50 gram

- 100, 250, 500 gram

- 1, 5, 10 ounce

- 1 kilogram

Manufacturers make the bars in either minted or cast versions. Minted bars come from rolled gold and have a uniform appearance with precise edges and stamped designs. Cast bars are made by pouring molten gold into molds, which gives them a more rugged and unique look.

Purity levels and hallmarks

The market measures gold’s purity using fineness and karats. Fineness refers to purity in parts per thousand. For example, gold with a fineness of 995 means it is 99.5% pure. Karats measure purity on a scale of 24, with 24 karats meaning pure gold. Anything less than 24 karats contains some other precious metal.

Common gold purity levels include:

- 999.9 or 24 karat: As close to pure gold as you can get.

- 999 or about 23.9 karat: 99.9% pure, and is a common standard for many gold coins and bars.

- 995 or about 23.88 karat: 99.5% pure, and is the minimum purity required for large gold bars traded on international markets.

Reputable dealers provide an assay certificate. The refiner issues this document, which confirms the bar’s weight and purity. The bar also includes a hallmark, a stamped mark on the gold itself that certifies its origin and fineness. Together, these serve as proof that you’re buying authentic, verified gold.

Buying bars

You have several options when buying gold bars, but the best choice is to work with a reputable precious metals dealer. Authorized dealers like Swiss America meet federal and state requirements for buying and selling gold. They hold the official licenses, follow record-keeping rules, and comply with customer protection regulations. This is the safest way to buy gold and get reliable guidance.

Work with the dealer who’s been in business for several decades and has a track record of great reviews. Take time to connect with their team and see what education and resources they provide to help you make investment decisions.

Other options include banks and online marketplaces. If you decide to use an online marketplace, be cautious and verify the seller’s reputation to avoid counterfeit or misrepresented products.

Popular gold bars

You can buy gold directly or through a self-directed IRA, often called a precious metals IRA. If you use retirement funds, there are specific rules about which types of physical gold qualify. Below is a list of some of the most popular IRA-eligible gold bars and what they look like.

- PAMP Suisse: Lady Fortuna design.

- Valcambi: Swiss-made minimalist design.

- Royal Canadian Mint: Maple leaf design.

- Credit Suisse: Simple design.

- Perth Mint: Australian government-backed with the swan logo.

Managing physical gold investments

If you’re buying gold outside of a retirement account, you can store it wherever you choose. But if you’re using a gold IRA, the IRS requires you to use a third-party depository. The main storage options are:

- Home: You can store gold at home in a secure safe. It’s best to place the safe in a discreet location and keep your ownership private. The main risks here are theft or damage to your gold bars or coins.Bank Vault: Some banks offer safe deposit boxes, which provide higher physical security than home storage. Just be aware that FDIC insurance does not cover gold stored in a bank.Depository: The IRS requires you to use precious metals depositories if you’re using retirement funds to invest in gold. But you can also use them outside of retirement accounts if you want that level of protection. Depositories have strong physical security, record keeping, and insurance coverage. The downside is that you won’t have direct access, so you’ll need to follow their visiting policies to view your gold.Insurance: Factor insurance into your overall plan. Depositories usually include insurance as part of their service, but always verify coverage levels and details. If you store gold at home, talk with your insurance provider about adding extra coverage so you’re protected.

Portfolio integration strategies

If you’re adding gold to your portfolio, most experts recommend allocating 10% to 15% to physical gold. This is about owning the metal itself, not gold-related investments. These allocation percentages don’t include gold funds, gold jewelry, or gold mining stocks.

Keep an eye on your allocations over time. Some precious metals dealers offer tools to help you track and make changes. For example, Swiss America customers can view their holdings and current market value through their account. If you need to sell gold to rebalance, they offer a buy-back program.

Liquidity management and exit strategies

When you’re ready to sell, contact your dealer to get a current buyback quote. Dealers base their offer on the spot price minus a small spread. You’ll need to confirm the bar’s weight, purity, and serial number. Some dealers may ask you to ship the gold for inspection before finalizing the payment. This is to ensure the gold’s authenticity and condition before completing the transaction.

Just like with the stock market, it’s hard to know the exact right time to sell. For example, gold hit $3,000/oz in fall 2024. Then, trade tensions and new economic policies in 2025 shifted more investors towards owning physical gold. If you sold at $3,000, you missed out on this upward trend. You can watch the market and get a general idea of what’s going on, but it’s unlikely you’ll catch the perfect price. The better approach is to make a plan based on your overall financial goals.

When you go to sell, you’ll need to provide identification, and the dealer may be required to report the sale for tax purposes. For example, these scenarios require the dealer to complete IRS documentation:

- If you sell 1 kilogram or more of gold bars to the same dealer in a single transaction, the dealer must file IRS Form 1099-B.

- If you receive more than $10,000 in cash from a transaction, the IRS requires the dealer to file Form 8300.

If your sale does not meet these thresholds, the dealer doesn’t need to report the transaction to the IRS. However, you are still responsible for reporting profits on your tax return.

Tax and legal considerations when investing in gold

The IRS classifies physical gold as a collectible, which comes with specific capital gains tax rules. If you hold gold for more than one year, it falls under long-term capital gains. The tax rate for collectibles is 28%, which is higher than the rate for stocks and bonds.

If you hold the gold for one year or less, any gains get taxed as ordinary income. That’s the same as with most assets, and the rate depends on your tax bracket.

Your cost basis for the gains includes the price you paid plus any related costs, like dealer premiums and storage fees.

Estate planning for physical gold assets

You can include physical gold in your estate and pass it on to heirs. The tax treatment depends on how you bought the gold. If you purchased it through a Roth IRA, your heirs can inherit it tax-free. If you bought it outside of a retirement account, your heirs will owe taxes when they sell the gold later.

Traveling with gold coins or bars

Many people like owning gold as a tangible asset because they can take it with them and, if needed, use it as currency in another country. Just be aware of customs rules and reporting requirements. Most countries require you to declare gold if you’re carrying more than a certain amount when entering or leaving. Some may even restrict or ban the import or export of gold, so always check local laws before traveling with it.

Risks of physical gold investments

All investments have risk, and owning physical gold is no different. Areas to consider include:

Market Risk: Changes in the market can lead to a drop in gold prices if investors start selling. This usually happens when positive economic news increases investor confidence, making them more willing to take on riskier assets.

No Income: The goal of gold investing is not to be an income-producing investment but rather a protective one. Gold doesn’t generate dividends or cash flow.

Costs: This isn’t a risk unique to gold, but it’s something to consider with any investment. Understand the associated costs. Stocks and bonds have fees, real estate has maintenance and insurance costs, and gold is no different. Just be aware of storage fees and dealer premiums.

Comparing physical gold with other gold investments

Here’s a quick comparison of physical gold to other types of gold investments:

Gold bars vs. gold ETFs

Bars give you physical ownership with no counterparty risk and are independent of the financial system. However, they do require storage and insurance and are less liquid than paper assets.

ETFs are paper assets, which means they are easy to buy and sell. The drawback is that you don’t own tangible property, and you also might have management fee costs.

Gold bars vs. gold mining stocks

Bars give you direct exposure to the price of gold and can have lower volatility than mining stocks. The cons include a lack of income from your physical gold, plus storage and insurance costs.

Owning stock in gold mining companies may be easier to buy and sell, and pay you dividends. However, you face exposure to the company’s operational performance.

Gold bars vs. gold futures

Gold bullion bars are simple and easy to own. You don’t have to watch what’s happening with them or worry about timing. This is also a drawback because physical bullion isn’t suited for short-term trading.

If you trade gold futures, you can use leverage and short-term trading strategies to generate a return. However, these strategies carry an increased risk of loss, and when contracts expire, they require active management.

Gold bars vs. numismatic coins

The price of gold bullion is directly related to its gold content. This is positive, but it can be a drawback if you are hoping to speculate on rare coins that might exceed gold price movements.

Collectible coins, also called numismatic coins, gain value from rarity and collector demand. You can lose money on these coins because they require specialized knowledge to understand what you’re buying.

Final thoughts on investment gold

Owning physical gold is a smart move to protect your investment portfolio. Work with a reputable dealer like Swiss America who can provide education resources and guidance. To learn more about adding gold to your investment strategy connect with the Swiss America team today!

Investing in gold bars: FAQs

How do beginners buy gold?

Buying gold can be simple. Research options, connect with a reputable dealer, decide which gold coins or bars you want to own, buy them, and store them.

Is gold a good investment right now?

It’s always a good time to buy gold. Even if the price is higher than it was before, you still get the core benefits. It’s an inflation hedge, a tangible asset, and a way to protect your money.

The information in this post is for informational purposes only and should not be considered tax or legal advice. Please consult with your own tax professionals before making any decisions or taking action based on this information.