There’s more than 200 different types of gold coins you can buy in the precious metals market today. With so many options, how do you decide? This guide covers our recommendations on the best gold coins to buy for investment. Discover details on which ones qualify for Gold IRAs, what sizes you can buy, and a brief history of each.

You’ll also learn what to look for when you go to buy coins, and they compare to other metals like silver and platinum.

Top gold coins for your investment portfolio

We work with many investors who buy gold coins as a way to preserve their wealth. UBS recently shared their thoughts on gold’s value, stating:

“Gold remains a useful hedge against geopolitical tensions and fiscal concerns, in our view.”

Some of our clients use retirement funds to buy coins through a gold or precious metals IRA. If you’re considering this, the coins you buy must meet IRS eligibility requirements. That’s why our list clearly shows which coins qualify.

Our list also includes the most pure gold coins you can buy with the exception of American Gold Eagle coins but these have special historical significance and value.

Now, let’s take a closer look at the most popular gold bullion coins to buy:

American Gold Eagle

First minting: 1986

Purity: 91.67% gold

Sizes: 1 oz, 1/2 oz, 1/4 oz, and 1/10 oz

IRA eligible: Yes

The original Gold American Eagle coin dates back to 1792. This earlier version was available in several denominations, ranging from $5 to $20. These gold coins were standard currency until 1933 when President Franklin D. Roosevelt’s Executive Order 6102 made private gold ownership illegal during the Great Depression.

The government prohibited citizens from holding gold, forcing them to sell their gold to the Federal Reserve at a set price. This removed gold coins from circulation.

Private gold ownership became legal again on December 31, 1974, when Congress passed legislation allowing Americans to own gold coins, bullion, and certificates. This was a major shift in monetary policy and individual financial freedoms.

In 1985, the Gold Bullion Coin Act authorized the U.S. Mint to produce a new series of gold bullion coins. The United States Mint produced the first modern American Gold Eagle coins in 1986 which feature Lady Liberty on the front and a bald eagle on the back.

It became the official gold bullion coin of the United States and gives buyers a reliable, government-backed gold investment option.

American Gold Buffalo

First minting: 2006

Purity: 99.99% pure gold

Sizes: 1 oz

IRA eligible: Yes

The United States Mint produces the American Gold Buffalo coin. It was introduced under the Presidential $1 Coin Act of 2005 and became the first 24-karat gold coin produced by the Mint for public sale. This is the only gold bullion coin from the U.S. that competes with some of the purest gold coins, like the Canadian Gold Maple Leaf and the Austrian Gold Philharmonic.

By law, the Gold American Buffalo’s gold comes from newly mined deposits in America. The coin features a profile of a Native American chief on the obverse and an American bison on the reverse. It measures 32.7 mm in diameter and 2.95 mm in thickness and has one troy ounce of 99.99% pure gold with a legal tender face value of $50.

Canadian Maple Leaf

First minting: 1979

Purity: 99.99%

Sizes: 1 oz, 1/2 oz, 1/4 oz, 1/10 oz, and 1/20 oz

IRA eligible: Yes

The Royal Canadian Mint introduced the Canadian Maple Leaf in 1979. Initially minted with 99.9% purity, it became the world’s first bullion gold coin to achieve 99.99% purity in 1982.

The coin quickly gained popularity, and sales reached 3 million ounces in its first three years. The Mint expanded its offerings to include smaller sizes like 1/2 oz, 1/4 oz, and 1/10 oz.

They also added a micro-engraved maple leaf feature in 2012 to enhance security. This coin’s design has always had the iconic Canadian maple leaf on the front and various portraits of Queen Elizabeth II on the back.

It’s one of the most popular gold coins, with sales of over 30 million ounces.

South African Krugerrand

First minting: 1967

Purity: 91.67%

Sizes: 1 oz, 1/2 oz, 1/4 oz, 1/10 oz

IRA eligible: No

The South African Mint first minted the Krugerrand in 1967 to promote South African gold. At a time when countries like the United States restricted gold ownership, the coin provided a solution. Initially the Mint only made one-ounce coins and it’s popularity grew so much that by 1980 it dominated 90% of the gold coin market.

The name “Krugerrand” combines “Kruger,” honoring former South African president Paul Kruger, and “Rand,” the national currency. During the 1980s, international sanctions affected the Krugerrand due to South Africa’s apartheid policies, leading the United States to ban imports in 1985.

The coin became associated as a symbol of apartheid, which led to boycotts and a loss of popularity. Competing coins like the Canadian Gold Maple Leaf and American Gold Eagles to gain market share. After the U.S. removed sanctions in 1991, the Krugerrand’s reputation slowly recovered, but it never regained its former dominance in the gold market.

The coin contains 91.67% gold and 8.33% copper, which makes it very durable but it doesn’t meet the gold purity requirements for a Gold IRA. The front of the coin has a portrait of Paul Kruger, and the back has a springbok, which is a national symbol of South Africa.

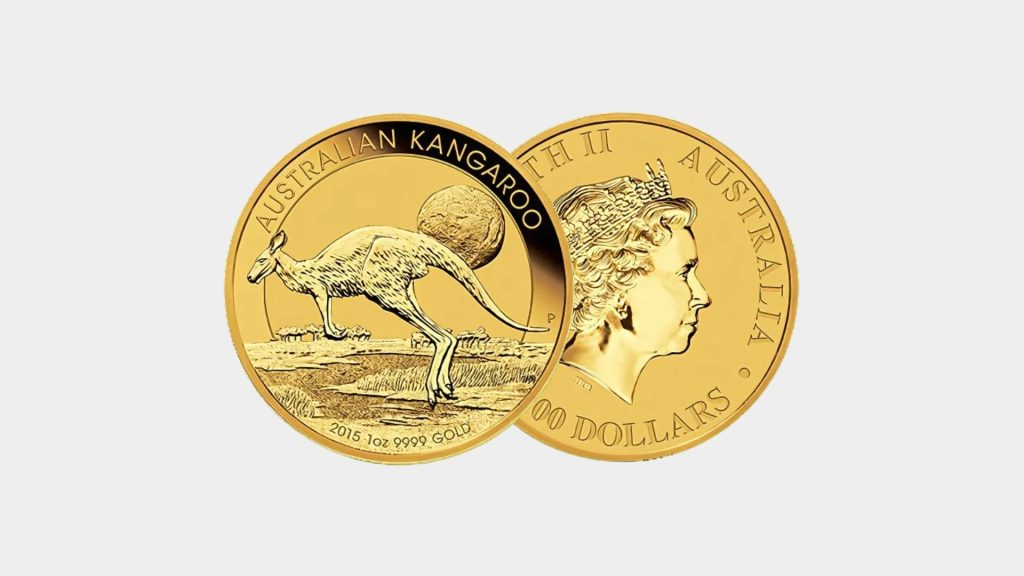

Australian Gold Kangaroo

First minting: 1986

Purity: 99.99%

Sizes: 1/20 oz, 1/10 oz, 1/4 oz, 1/2 oz, 1 oz, 2 oz, 10 oz, and 1 kg

IRA eligible: Yes

The Perth Mint introduced the Australian Gold Kangaroo coin in 1986. It had a portrait of Queen Elizabeth II on the front and an Australian gold nugget on the back. In 1989, the Perth Mint replaced the nugget with a kangaroo, and people started calling the coin the “Gold Kangaroo”.

You’ve always been able to buy the coin in several sizes and the design on the back of smaller denominations changes each year to have kangaroo designs. The 1-ounce coins maintain a consistent kangaroo image.

Austrian Gold Philharmonic

First minting: 1989

Purity: 99.99%

Sizes: 1 oz, 1/2 oz, 1/4 oz, 1/10 oz

IRA eligible: Yes

The Austrian Mint first produced the Austrian Gold Philharmonic coin in 1989. The coin has a design of a pipe organ from the Musikverein concert hall on the front, along with inscriptions indicating its weight and face value. The back displays several musical instruments, including violins, a cello, a bassoon, and a harp, with the inscription “Wiener Philharmoniker.”

The Philharmonic became Europe’s best-selling investment coin and achieved global recognition. The World Gold Council named it the best-selling gold coin in the world for several years.

Gold Britannia

First minting: 1987

Purity: 99.99%

Sizes: 1 oz, 1/2 oz, 1/4 oz, 1/10 oz

IRA eligible: Yes

The Royal Mint started producing the Gold Britannia coin in 1987. The government wanted a British bullion coin that could compete with other coins like the South African Krugerrand.

The coin has a design of Britanna standing with a trident and shield. The back has the effigy of the reigning monarch, which is currently King Charles III.

Mexican Libertad

First minting: 1981

Purity: 99.9%

Sizes: 1 oz, 1/2 oz, 1/4 oz, 1/10 oz, 1/20 oz

IRA eligible: Yes

Banco de México and the Mexican Mint produce the Mexican Libertad gold coin. The front has the Mexican national coat of arms with an eagle on a cactus. The back shows the Winged Victory statue, symbolizing Mexican independence, with the volcanoes Popocatépetl and Iztaccíhuatl in the background.

Here’s a quick look at the top gold coin options:

| Coin | Purity | Common sizes | Gold IRA eligible |

|---|---|---|---|

| American Gold Eagle | 91.67% | 1 oz, 1/2 oz, 1/4 oz, 1/10 oz | Yes |

| American Gold Buffalo | 99.99% | 1 oz | Yes |

| Canadian Maple Leaf | 99.99% | 1 oz, 1/2 oz, 1/4 oz, 1/10 oz, 1/20 oz | Yes |

| South African Krugerrand | 91.67% | 1 oz, 1/2 oz, 1/4 oz, 1/10 oz | No |

| Australian Gold Kangaroo | 99.99% | 1 oz, 1/2 oz, 1/4 oz, 1/10 oz, others | Yes |

| Austrian Gold Philharmonic | 99.99% | 1 oz, 1/2 oz, 1/4 oz, 1/10 oz | Yes |

| Gold Britannia | 99.99% | 1 oz, 1/2 oz, 1/4 oz, 1/10 oz | Yes |

| Mexican Libertad | 99.9% | 1 oz, 1/2 oz, 1/4 oz, 1/10 oz, 1/20 oz | Yes |

Things to consider when buying gold coins

No matter which physical gold coins you decide to buy, keep these considerations in mind:

Market demand

You’ll want to buy gold coins that provide protection against inflation and grow your savings. All of the coins mentioned are solid investment options that have consistent market demand.

Be careful with collectible coins which are a completely separate category of coins. For example, Chinese Gold Panda coins or the 1933 Saint-Gaudens Double Eagle coin may hold historical significance, but they aren’t investment-grade gold bullion, so you run the risk of overpaying.

A precious metal dealer like Swiss America can help you understand the best gold coins to buy that meet your specific goals and needs.

Premiums

When you look up the current price of gold, this is the spot price. When you’re ready to actually buy, you’ll find that gold coin prices are higher than spot. This difference is the premium and it covers the costs of distribution and shipping.

When you go to buy your first gold bullion coin, check with dealers to get the best pricing possible.

Liquidity

The more people recognize a coin, the easier it is to sell. Plus, all of the coins on our list have security features to protect you from counterfeit coins. These include things like small print that you can only see with a magnifying glass or hidden images that appear under certain light conditions.

You can also protect yourself from scams and fake coins by buying only from reputable dealers.

Gold coins vs other precious metals

We get questions all the time from investors about buying gold coins versus other metals like silver or platinum. Here’s our quick comparison:

Gold vs silver coins

The question here is if gold investments are better than silver. The major difference between these two is that gold is a more stable asset. It’s the metal that:

Central banks turn to when they want to protect their country’s money.

Investors buy when they’re worried about the economy or the latest stock market downside.

People stock up when there’s a crisis, and they fear the unknown.

Silver is more volatile. It has a different type of demand that’s more about industrial uses and less about a safe-haven asset. Some investors like the dynamic nature of silver pricing because they might be able to make a higher return.

You can hold both metals in your IRA. Just note that the qualifications for silver are different than those for gold.

Gold vs platinum coins

Platinum is an interesting metal. Sometimes, it costs more than gold, like in 2008 when it was more than twice the price of gold. It’s also rarer than gold, and it has more industrial uses, so if there are supply constraints, it can rise in price.

If you want to diversify your holdings, owning both might be a good option. You can also hold platinum bullion coins in your precious metals IRA.

Strategies for buying and selling gold coins

If you’re investing in gold coins or bars, it’s best to take a long-term approach. Gold doesn’t pay dividends or generate cash flow, which is why investors consider it more like an “insurance policy” as a way to protect wealth. Other things to keep in mind:

Market trends

Gold is up over 28% from where it was in January 2024, and you may wonder if now is a good time to buy. The reality of investing in gold, or any other asset for that matter, is that you can’t always predict the best time to buy. However, you can look at what the market is doing or what experts say. For example, Goldman Sachs recently stated:

“Gold is our strategists’ preferred near-term long (the commodity they most expect to go up in the short term), and it’s also their preferred hedge against geopolitical and financial risks.”

Choosing a gold dealer

As we mentioned above, working with a reputable dealer helps protect you from scams or fake coins. How do you decide which dealer to work with? Consider things like:

Longevity: Look for dealers who have been around for decades so you know they aren’t scam companies trying to sell gold coins. Swiss America has been in business for over 40 years, which means you can count on our reputation and ability to support you no matter what happens in the market.

Customer reviews: Take a look at the customer reviews and get a sense of how the company supports its customers. The Swiss America team consistently rates highly for customer satisfaction and experience.

Educational resources: If you’re looking at buying gold, silver, or platinum, choose a dealer that offers several free materials to help you make the best decision. Swiss America offers resources like our free Gold IRA kit, regular podcast episodes, and weekday market news updates to support your investment decisions.

Credentials: Check the gold dealer’s credentials to make sure they’re involved in respected industry organizations. Swiss America’s credentials include membership in organizations like the American Numismatic Association, Industry Council for Tangible Assets, and Numismatic Guaranty Corp.

Final thoughts about the best gold coins for investment

For investing, you can’t go wrong with any of the gold coins on our list. If you do plan to use retirement funds, all of the coins qualify except South African Krugerrands.

To learn more about gold coins from Swiss America, connect with one of our experts today!

Best gold coins to buy for investment: FAQs

Which gold is best to buy for investment?

Physical gold bullion coins or bars that meet IRS requirements are the best investments. This is because you actually own a tangible asset versus paper gold investments like mutual funds or stocks.

What is the purest gold coin to buy?

The Canadian Gold Maple Leaf is the purest gold coin you can buy. It has a purity level of “five-nines” which is 99.999%.

Who is the best company to buy gold coins from?

Swiss America is the best company to buy gold coins from because it has been in business for over 40 years and has helped thousands of happy customers with their precious metals investments.

Note: The information in this post is for informational purposes only and should not be considered tax or legal advice. Please consult with your own tax professionals before making any decisions or taking action based on this information.