Want to shield your retirement from market chaos? Learn how to set up Gold IRA and protect your financial future with precious metals.

A Gold IRA isn’t your typical retirement account. It lets you hold physical gold and precious metals to protect your nest egg from market swings and inflation.

Ready to secure your retirement with something that’s stood the test of time? This article covers the steps to take control of your financial future.

Understanding Gold IRAs

A Gold IRA is a retirement account where you can hold physical gold and other precious metals like silver, platinum, and palladium. You might also hear people call these accounts precious metals IRAs, Silver IRAs, or gold and silver IRAs. They all mean the same thing in that you use retirement account money to buy and hold tangible metals.

Just like traditional IRAs have an administrator, Gold IRAs also have a precious metals custodian who manages the account on your behalf.

Gold IRAs vs traditional and Roth IRAs

From a tax perspective, all of the same rules apply to Gold IRAs as you see with traditional accounts. For example, you can have a Gold traditional IRA that you fund with pre-tax dollars, or you can have a Gold Roth IRA that you fund with after-tax dollars.

The annual contribution limits are the same, and the IRS rules about qualified withdrawals and required minimum distributions are also the same as with traditional IRAs.

The main differences between a precious metal IRA and a traditional IRA include:

Types of assets

With a Gold IRA, you hold precious metals, not paper assets. Traditional IRAs might have gold mutual funds, stocks, or Gold ETFs, but these are not actual tangible assets. A gold or precious metals IRA only holds physical gold bullion and other metals.

The benefit of a tangible asset is that it owns something that has intrinsic value and doesn’t rely on the stock market. For many investors, this brings peace of mind since the asset actually exists and isn’t just on paper.

Diversify your retirement funds

Traditional and Roth IRAs rely on the stock market, which can be unpredictable. When you hold physical gold in an IRA, you now have a completely independent asset. It doesn’t rely on any company’s performance, interest rates, or government policies.

This independence helps reduce the risk to your retirement savings.

Gold IRA investing with multiple account types

A Gold IRA doesn’t need to replace your existing retirement accounts. You can keep your existing traditional or Roth IRA as part of a balanced portfolio. One way to do this is to move a portion of your savings from these accounts into a Gold IRA.

Another way is to roll over funds in accounts from any previous employers like a 401(k), 403(b), or TSP.

The only caveat is that the IRS contribution limits apply to all of your accounts combined. For 2026, this amount is $7,500 if you’re under 50 and $8,600 if you’re 50 and older.

Storage

You can’t take physical possession of your precious metals until you reach retirement age. This is because the IRS considers possession a distribution that has tax implications.

Your custodian takes care of storing your metals in an IRS-approved depository until you reach retirement age of 59.5.

Benefits of physical gold and other precious metals

Investing in a Gold IRA provides advantages that can strengthen your overall retirement strategy. Here are some key benefits:

Inflation hedge

Another key difference between Gold IRAs and traditional IRAs is that people usually hold Gold IRAs to protect their savings from inflation.

Since 2022, the compounding effects of inflation mean that goods and services now cost over 15% more than they did two years ago. Meanwhile, during this same timeperiod, the price of gold rose almost 47%. So, if you owned gold during these years, you protected and actually grew your wealth compared to just holding cash.

Check out our comparison chart to see gold’s performance against inflation over the last 24 years:

No counterparty risk

Since gold is an independent asset, it doesn’t depend on external factors. For example, even if any of these fail:

-

Your internet connection

-

Your bank

-

A company’s earnings

Your gold still retains its value.

Safe haven asset

Many investors see gold as an “insurance policy” to protect their savings in case something goes wrong. Why? Because whenever there’s bad news or a crisis, people turn to gold.

For example, consider these recent events:

Great Recession: In 2008, the global financial crisis caused stock market turmoil but gold prices jumped over 5%.

COVID-19 Pandemic: The pandemic hit in March 2020, and stock markets crashed. Meanwhile, gold reached all-time highs later that year.

2024 uncertainty: Investors worry about persistent inflation, what the Federal Reserve plans to do with interest rates, and the latest economic data. Fear and uncertainty make people seek safety, which is why gold is up over 30% for the year.

In fact, Goldman Sachs recently encouraged their investors to hold gold as protection from current unknowns and stated:

“Gold is our strategists’ preferred near-term long (the commodity they most expect to go up in the short term), and it’s also their preferred hedge against geopolitical and financial risks.”

Choosing the right IRA company

Of course, for your precious metal IRA to be a good experience, you also need to choose the best company that meets your needs. Here’s what to look for:

Compare IRA companies

Not all IRA companies are the same. Start by checking out potential precious metals dealers and comparing their services. Focus on companies with experience in Gold IRAs and a strong reputation. A good company should be transparent about its pricing and have a history of high-quality service.

Questions to ask:

-

How long have they been in business?

-

Do they specialize in Gold IRAs or handle all types of retirement accounts?

-

Are customer reviews mostly positive?

-

Do they offer educational resources or have a helpful support team?

Understand fees

Like all retirement assets, you’ll have management fees from the account administrator. These fees can add up and impact your returns over time.

For precious metal IRAs, these include setup, management, and annual storage fees. Check with the custodian to see if they charge fixed or variable fees on your account balance.

IRS-approved

Your custodian should have IRS approval and follow all regulations. Confirm by asking questions like:

-

Will they store your metals in an IRS-approved depository?

-

Do they provide regular updates on your account and holdings?

-

Do they handle annual reporting for your individual retirement account?

Funding your Gold IRA

Here are different ways to add funds to your Gold IRA:

Direct transfer from an existing IRA account

You can fund your Gold IRA by transferring money directly from your current IRA. This method moves funds between custodians without you handling the money, so there are no taxes or penalties.

To start, contact your current IRA custodian and your Gold IRA custodian. They’ll work together to complete the transfer. Make sure the funds go directly between custodians so the IRS doesn’t treat it as a withdrawal.

Rollover from a 401(k) or other retirement accounts

You can also fund your Gold IRA by rolling over money from an employer-sponsored retirement account as long as you no longer work for that employer. You can use the direct transfer process to make this happen.

Contact your plan administrator and direct them to transfer the funds to your Gold IRA custodian.

There’s also an indirect method where the administrator sends the funds to you, but this is a more complicated approach. First, the IRS requires them to hold 20% of the total amount, but you have to place the entire amount into your new IRA. That means you’ll need to come up with the 20% from somewhere else.

You’ll also need to make this full deposit within 60 days. Then, when you file taxes for that year, you can report this on your return to receive the 20% back. Once the IRS confirms you deposited the full amount, they’ll issue a tax credit against your return.

Selecting precious metals

You can’t just buy any metals with your retirement funds. The IRS sets standards on which metals qualify. The reason is to protect your retirement account from scams, fraud, or inferior products.

So, what metals qualify? You can buy gold, silver, platinum, and palladium bullion. For each of these metals, the rules are:

Gold bullion

Qualified gold should be at least 99.5% pure and come from government mints or approved manufacturers. You can buy gold bullion in either coins or bars.

Examples of IRA-approved gold bullion coins:

-

American Gold Buffalo

-

Austrian Philharmonic

-

British Gold Britannia

-

Canadian Gold Maple Leaf

Examples of approved bars:

-

PAMP Suisse Gold Bar

-

Valcambi Gold Bar

-

Royal Canadian Mint Gold Bar

-

Credit Suisse Gold Bar

-

Perth Mint Gold Bar

Silver bullion

Eligible silver must be at least 99.9% pure. The other rules are the same as with gold bullion.

Examples of IRA-approved silver bullion coins:

-

Canadian Silver Maple Leaf

-

Austrian Silver Philharmonic

-

Australian Silver Kangaroo

-

Mexican Silver Libertad

Examples of approved bars:

-

Royal Canadian Mint Silver Bar

-

Perth Mint Silver Bar

-

PAMP Suisse Silver Bar

-

Johnson Matthey Silver Bar

-

Valcambi Suisse Silver Bar

Platinum

Platinum bullion must be at least 99.5% pure. The other rules are the same as for gold bullion.

Examples of IRA-approved platinum bullion coins:

-

Canadian Platinum Maple Leaf

-

Australian Platinum Kangaroo

-

Isle of Man Platinum Noble

-

British Platinum Britannia

Examples of approved bars:

-

PAMP Suisse Platinum Bar

-

Credit Suisse Platinum Bar

-

Valcambi Platinum Bar

-

Johnson Matthey Platinum Bar

-

Engelhard Platinum Bar

Here’s a quick glance at the IRS-approved precious metals you can hold in a Gold IRA:

| Metal | Minimum purity | Common IRA-approved coins | Common IRA-approved bars |

|---|---|---|---|

| Gold | 99.5% | American Gold Eagle, Canadian Maple Leaf | PAMP Suisse, Valcambi |

| Silver | 99.9% | American Silver Eagle, Mexican Silver Libertad | Perth Mint, Royal Canadian Mint |

| Platinum | 99.5% | American Platinum Eagle, British Platinum Britannia | PAMP Suisse, Credit Suisse |

| Palladium | 99.95% | Canadian Palladium Maple Leaf | Valcambi, Engelhard |

Setting up a self-directed Gold IRA

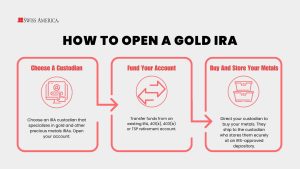

To set up your Gold IRA, the steps are:

Step 1: Choose a custodian

Start by choosing a custodian. We mentioned above that fees can vary, so it pays to compare pricing. Once you’ve picked a company, you’ll then open a self directed IRA account.

Step 2: Fund Your IRA

The next step is to fund your IRA. As we mentioned, you can move money from an existing IRA, 401(k), or other retirement accounts or contribute new funds.

Step 3: Buy and store metals

Once the money is in your account, you can start buying IRS-approved metals. Work with a precious metals dealer to decide which metals to buy. Direct your custodian to buy the metals and then your gold dealer will ship them to the IRS depository per your custodian’s instructions.

Managing your Gold IRA

To manage your Gold IRA, stay updated on market trends and adjust your investments when needed. Watch gold prices, economic changes, and global events that might impact your holdings. Regularly check your portfolio to make sure it matches your long-term goals.

If the market changes because of economic problems or inflation, rebalance your investments. You can work with your IRA custodian or a financial advisor to make changes, like adding more gold, diversifying, or adjusting your strategy based on your goals and risk level.

Swiss America for your Gold IRA

When it’s time to find a precious metals dealer for your retirement savings, consider working with the Swiss America team. With over 40 years in the industry, we’ve helped thousands of clients invest in physical precious metals.

Take advantage of our educational resources, including detailed guides, regular podcasts, and up-to-date news, to better understand your investment options. We offer expert guidance and transparent pricing so you can make the best decision for your needs.

Once you own gold, you can use our easy online portal to track your holdings at any time. You can also access real-time market values and get quotes for selling your gold, silver, or platinum back to us if needed.

Gold IRA final thoughts

Setting up a Gold IRA is a great way to protect your retirement savings and add stability to your portfolio. It gives you a way to reduce your exposure to market volatility while enjoying the tax advantages of an IRA.

If you want to know more about securing your retirement with gold, request our free Gold IRA kit today!

How to set up Gold IRA: FAQs

Is gold a good investment for retirement?

Gold can be a smart choice for retirement since it helps protect your savings from inflation and market ups and downs. Adding gold to your portfolio is a way to spread out risk and add some stability.

What is the minimum deposit for a gold IRA?

The minimum deposit for a Gold IRA from Swiss America is $5,000.

How much can you put in a gold IRA?

Precious Metals IRAs have the same contribution limits as regular IRAs. In 2026, these limits are $7,500 per year if you’re under 50 and $8,600 if you’re 50 or older. There’s no limit if you’re rolling over money from another retirement account.

Note: The information in this post is for informational purposes only and should not be considered tax or legal advice. Please consult with your own tax professionals before making any decisions or taking action based on this information.