If you want to diversify your retirement savings, you might wonder, “What is self-directed Gold IRA?” It’s an account that lets you add physical gold to your retirement plan. Gold IRA investing can help protect your savings from inflation and market swings.

People often see gold as a safe choice for preserving wealth, especially during uncertain times. And let’s face it, when are we not in uncertain times? In fact, the World Gold Council’s Q3 2024 Gold Demand Trends report shows that gold demand reached its highest ever on record.

That’s why many people look to include physical gold in their retirement portfolios to lower risk.

This article covers how a Gold IRA works and why it might just be the missing piece in your retirement strategy.

Understanding self-directed IRAs

A self-directed IRA (SDIRA) lets you control your retirement investments and offers more options than a regular IRA. It enables you to use retirement funds to buy alternative investments like:

-

Real estate

-

Private companies

This type of retirement account gives you more ways to diversify and grow your portfolio.

To help simplify the key differences, here’s an overview comparing self-directed Gold IRAs with traditional IRAs:

| Feature | Self-directed Gold IRA | Traditional IRA (Paper assets) | Why it matters |

|---|---|---|---|

| Investment options | Physical gold & other alternative assets | Stocks, bonds, mutual funds | Shows expanded choices in SDIRA vs traditional holdings |

| Control | Holder directs investment decisions | Custodian/broker limits options | Highlights investor autonomy in SDIRA |

| Storage | Metals stored in an IRS-approved depository | Not applicable; assets held electronically | Clarifies custody rules for physical metals |

| Diversification | Adds tangible asset exposure | Focuses on financial instruments | Helps readers see diversification value |

How does a Gold IRA work?

A Gold IRA is specifically a self-directed IRA account that invests in gold bullion coins or bars. You might also hear this type of account referred to as a precious metals IRA or even a Silver IRA. They all mean the same thing — retirement accounts that hold physical metals.

The way it works is you’ll choose a custodian who manages the account on your behalf. They’ll buy and sell gold or other precious metals per your instructions.

IRA custodians

All retirement accounts require an administrator who manages the funds. It doesn’t matter if you own traditional assets or gold bullion. You’ll need a company that handles this responsibility. Your Gold IRA custodian’s role is to:

Keeps your investments safe: Custodians take care of storing your gold and other precious metals.

Handles transactions: Custodians process transactions like contributions or rollovers and keep detailed records. They don’t give investment advice and they simply follow your directions to buy or sell investments.

Handling paperwork: They prepare tax documents like Forms 1099-R and 5498 and provide account statements showing your transactions and holdings.

Following IRS rules: Custodians also make sure your Gold IRA account meets IRS guidelines and watch for transactions that could impact your tax benefits.

Physical gold and precious metals

You can hold physical gold, silver, platinum, and palladium in your gold or precious metals IRA. But, you can’t just buy any metals because the IRS has rules around which coins or bars qualify. The guidelines for gold bullion include:

Purity: Gold coins or bars must be at least 99.5% pure. Collectible coins do not qualify.

Manufacturer: The gold bullion must come from NYMEX- or COMEX-approved refiners or national mints:

Here are examples of approved coins and bars:

Coins:

-

American Gold Buffalo

-

Austrian Philharmonic

-

British Gold Britannia

-

Canadian Gold Maple Leaf

Bars:

-

PAMP Suisse Gold Bars

-

Valcambi Gold Bars

-

Royal Canadian Mint Gold Bars

-

Credit Suisse Gold Bars

-

Perth Mint Gold Bars

Precious metals dealers

Your self-directed IRA custodian does not sell gold. Instead, you’ll work with a precious metals dealer like Swiss America to decide which gold you want to buy. From there, you direct your custodian to buy the metals on your behalf.

Once the custodian buys your metals, they’ll direct the dealer to ship them to an IRS-approved depository for safe storage. You can’t actually take physical possession of your metals until you reach retirement age because the IRS considers this a distribution.

Storage

Your custodian can provide a couple of options for storage:

Allocated storage: With this option, your metals stay separate from other investors. They’re labeled as yours, giving you direct ownership of specific gold coins or bars. Many investors like this option even though it comes with higher fees.

Unallocated storage: This approach stores your metals with other investor’s assets but remains under custodian control. This option has lower fees, but you won’t own specific items. Instead, you own a share of the total pool.

Insurance fees

Most approved depositories include insurance as part of their storage service. This protects your metals from theft, loss, or damage. Storage fees usually include this cost but some providers may charge it separately.

For higher-value holdings, you can upgrade your coverage to protect your full investment.

Advantages of a self-directed Gold IRA

Adding physical gold to your retirement account through a Self-Directed IRA can offer several advantages. Here’s how it can strengthen your financial strategy:

Diversification

Gold is an independent asset that acts differently from stocks and bonds. When stocks drop, gold often holds its value or even increases. This makes gold a good balance for your retirement portfolio, especially during times of market crashes, economic struggles, or currency problems.

Take these recent examples:

Great Recession: The 2008 financial crisis caused massive stock market turmoil but gold prices rose over 5% and continued to climb in the following years.

COVID-19 Pandemic: In March 2020, as the pandemic hit and stock markets crashed, gold initially fell but quickly rebounded and reached all-time highs later that year.

2024 uncertainty: 2024 has been a year of uncertainty with presidential elections, inflation concerns, and economic concerns. This type of market makes people seek safety which is why gold is up over 30% for the year.

Analysts like Goldman Sachs encourage their investors to hold gold as protection from global trade wars and concerns about the U.S. national debt. In a recent article they shared:

“Gold is our strategists’ preferred near-term long (the commodity they most expect to go up in the short term), and it’s also their preferred hedge against geopolitical and financial risks.”

Inflation hedge

Inflation eats away at the value of money because as more of it gets printed or circulated, it buys less over time. Gold doesn’t have this problem. It’s scarce, and we can’t just create it on demand, which keeps its value steady.

Gold isn’t tied to a single government or economy, so it doesn’t get hit as hard when policies weaken a currency. That’s why people have turned to gold for centuries as a solid and reliable way to protect wealth when inflation starts climbing.

Tax advantages

A Precious Metal IRA gives you all the tax advantages you see with traditional accounts for your retirement funds. Benefits depend on which type of account you have:

Traditional IRAs

You make contributions to a Traditional Gold IRA with pre-tax dollars. This lowers your taxable income and it allows your investments to grow tax-deffered. Once you reach retirement age, you’ll pay income taxes on the distributions, but you might be in a lower tax bracket and pay less.

The IRS contribution limits for 2026 are $7,500 for people under 50 and $8,600 for people 50 and older. With this account type, you’ll also have minimum required distributions once you reach age 73.

Roth IRAs

If you set up a Roth Gold IRA, your contributions are with after-tax dollars. At any time, you can withdraw your contributions tax-free and without penalty. Then, once you reach retirement, you can withdraw the proceeds tax-free as long as you’ve held the account for five years.

Roth Gold IRAs have the same annual contribution limits as Traditional Gold IRAs.

A key benefit of this account is that you don’t have minimum required distributions, and you can also pass on your physical metals to your heirs tax-free.

Considerations and risks

A Gold IRA gives you many benefits, but there are also considerations to keep in mind as you make your decision on whether or not to invest in gold:

Market volatility

People think of gold as a safe investment, but its price can still go up and down. Bullion prices may drop in the short term during strong economic times or when interest rates rise. That’s why it’s good to consider gold as a long-term strategy and a way to diversify your risk.

Fees

Like any other investment, be aware of the fees associated with precious metal IRAs. These include custodian management and storage fees.

It also includes the premium that you’ll pay the gold dealer for your metals, which supports manufacturing, distribution, and shipping costs.

It pays to compare pricing and shop around for the right Gold IRA custodian and physical precious metals dealer.

How to set up a Gold IRA

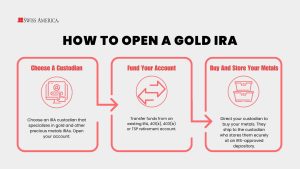

You can set up your Gold IRA in 3 easy steps:

Step 1 Pick a self-directed IRA custodian

Choose a custodian and open your account.

Step 2: Fund your account

Add money to your account. If you have a 401(k), 403(b), or TSP from a previous employer, you can roll over any of these accounts to a Gold IRA. You can also roll over an existing IRA to a precious metals IRA.

Or, you can create a new retirement savings account and fund it.

Step 3: Buy and store your metals

Work with your gold dealer to decide which metals you want to buy and then direct your custodian to purchase them on your behalf. From there, your custodian handles secure storage until you reach retirement.

Swiss America for your Self-Directed IRA

If you decide to invest in a Gold IRA, consider Swiss America as your gold dealer partner. For more than 40 years, we’ve helped investors understand the precious metals market with steady guidance and practical expertise.

Our approach is to provide personalized support to help you feel confident in your investment decisions. That’s why we provide educational resources like our in-depth guides, free Gold IRA kit, and regular podcasts.

We offer transparent and competitive pricing, so you always know what to expect. In addition to gold, we also support investors looking to buy silver and platinum bullion for their precious metals IRAs.

Gold IRA investing final thoughts

A Self-Directed Gold IRA is a great way to protect and grow your retirement savings with a tangible asset. It can help lower risk, protect against inflation, and provide the tax benefits of a traditional IRA.

If you want to learn more about how this account can work for you, contact Swiss America today! Our team can help you understand the process so you can make decisions for your retirement account.

What is self-directed Gold IRA: FAQs

What is the minimum deposit for a gold IRA?

The minimum deposit for a Gold IRA from Swiss America is $5,000.

What is the average return on a gold IRA?

Returns on a gold IRA depend on gold’s market performance, which can fluctuate. Historically, gold has been a stable asset, offering protection during economic downturns, but it doesn’t generate regular income like stocks or bonds.

How is gold taxed in an IRA?

The IRS taxes gold in an IRA just like traditional IRA investments. If you have a traditional Gold IRA, you won’t pay taxes until you withdraw your funds in retirement.

Note: The information in this post is for informational purposes only and should not be considered tax or legal advice. Please consult with your own tax professionals before making any decisions or taking action based on this information.