No matter what type of retirement account you have, there are always costs involved—including Gold IRAs. These Gold IRA fees cover management and administrative expenses, just like the brokerage and transaction fees you’d expect with stocks and bonds. It’s all part of managing your retirement investments.

Nobody likes unexpected fees, so here’s a clear look at the costs you need to know when setting up a Gold IRA.

Gold IRAs and fees

A Gold IRA allows you to hold physical gold coins or bars in a retirement account. It could be a brand new account you open, or it could be a rollover of some of the funds in existing accounts like 401(k), 403(b), TSP, or existing IRA.

The first-year administrative fees for a gold or precious metal IRA account can start around $250.00. From there, your ongoing administrative costs depend on the custodian and other factors but can be as low as $190 per year.

You also have the costs of the metals themselves and the premiums that you pay over the spot price.

Types of Gold IRA fees

Here’s an at-a-glance overview of the types of fees you can expect:

Gold IRA Fee Summary

| Fee type | Description |

| Account setup | One-time fee to set your account. |

| Annual maintenance fee | Recurring annual fee for account administration. |

| Segregated storage | Annual fee for storing your metals separately from others. |

| Non-segregated storage | Annual fee for storing your metals with other investors. |

| Buy, sell, exchange | Fee for buying, selling, exchanging metals within your account. |

| Cashier’s check or wire transfer | Fees for funding logistics. |

| Various other fees like late fees, paper statements, termination fee, etc. | Various fees. |

Details of the common fees Gold IRA companies charge for gold or precious metals IRAs include:

Setup fees

Your IRA custodian may charge a one-time fee to cover the initial setup and paperwork for your account. These fees typically range from $50 to $300, depending on the custodian. If you’re not sure which one to go with, we often work with Gold Star Trust, which charges a $50 establishment fee.

Maintenance fees

Maintenance fees are recurring charges for managing your Gold IRA account. They can vary depending on the IRA custodian company and the services it offers. These support annual reporting and administration of your precious metals IRA.

Fees range between $75 and $300 per year. Gold Star’s annual fee is $90.

Storage fees

You can’t store precious metals at home or in a safe deposit box. IRS regulations require that your custodian store them in an IRS-approved depository, which means you’ll pay storage fees.

You can also choose from two different storage options:

Commingled storage: Your physical precious metals get mixed in with the metals of other retirement accounts.

- Segregated: The depository keeps your gold and other precious metals separate from other investor’s metals.

Some custodians charge storage fees as a percentage of your physical gold or other precious metals’ value. Others charge fixed annual fees.

For example, Gold Star Trust charges $100/year for commingled and $150/year for segregated storage.

You also might find special promotions for precious metal IRAs where custodians offer storage for free for a specific timeframe.

Transaction fees

Transaction fees include charges for buying, selling, or transferring approved precious metals within the IRA. You might see fees of $20 to $195 per transaction.

Gold Star Trust does not charge fees for buying, selling, or exchanging gold bullion or other precious metals.

Wire transaction and funding fees

You might have additional fees for the actual transfer of funds into your account. This can include wire, ACH, or cashier’s check fees. These also vary by custodian. For example, Gold Star’s fees include:

Wire fee: $50

One-time ACH: $15

Cashier’s check: $50

Insurance

The storage fees usually include insuring your metals held in the depository against risks like theft or fire. Just in case, check with the custodian to confirm if there are any additional fees for this.

Factors influencing Gold IRA fees

Besides the normal fees, a few other factors that can impact costs include:

IRA company policies

Just like traditional IRAs through brokerage firms, each custodian sets its own policies and fees. It pays to shop around and compare costs to find the best option for your precious metal IRA.

Some custodians may also offer added benefits, like online account management or better customer service, which might be worth the extra costs for your experience.

Type of precious metals

The specific metals you hold in your Gold IRA don’t usually impact custodian fees. But, if your custodian charges storage fees based on the account value, you might pay more for the same amount of physical gold vs silver.

Account holder preferences

As we mentioned above, if you choose segregated storage, most depositories charge higher fees for this separation. You might also have higher fees for other scenarios, like shipping your metals to you once you reach age 59.5.

Comparing Gold IRA fees

If you work with Swiss America as your precious metals dealer, you’ll find our expert team can help provide guidance on custodians so you make the best choice. With our forty years in the Gold IRA industry, we have a good handle on market options.

Here’s a quick comparison of a few custodians:

Gold Star Trust: Low overall fees and a 4.5 rating out of 5.0 on Trustpilot.

IRA Financial: Easy-to-understand fees for many types of individual retirement accounts. 4.8 out of 5.0 rating on Trustpilot.

Strata Trust: With a 4.8 out of 5.0 rating on Trustpilot, Strata provides a simple fee structure.

Strategies to minimize Gold IRA fees

We know you want to get the best pricing possible. After all, the less you spend on fees, the more you can buy approved precious metals for your IRA. Here’s a few tips to evaluate options:

Compare costs

When you go to open your self-directed IRA, asking about the fee structures can help you uncover potential hidden costs. This includes finding out about:

What are the initial setup fees for the IRA?

Are there any annual maintenance fees, and how much are they?

What storage fees should I expect, and do they differ by storage type?

Are there any transaction fees for buying or selling metals within the IRA?

Is there a termination fee for closing the account or moving to a different custodian?

Choose flat fees

Look for custodians that offer flat fees instead of fees on assets. Flat fees help you know what to expect, no matter how much your account grows. You don’t want to suddenly pay more when you hold physical gold just because you add more assets.

Limit transactions

If you go with a custodian that charges transaction fees, reduce the number of transactions you make. You can also consider paying fees with your personal funds instead of your IRA funds.

Choose paperless

Go for e-statements so you don’t have to pay paper statement fees. For example, Gold Star Trust has a $25 annual paper statement fee and a $10 paper statement reprint fee. You could avoid these easily with e-delivery of your account information.

Benefits of Gold IRAs

The reasons that Gold IRAs continue to grow in popularity is because of:

Tax advantages

If you use a retirement account to buy precious metals, it gives you a way to hold a tangible asset while also enjoying all the same tax benefits as traditional IRAs. You have a couple of different account type options:

Gold IRA: You invest in this account with pre-tax dollars, and your funds grow tax-deferred. You only pay taxes when you withdraw your metal or funds at the retirement age of 59.5. This gives you a chance to grow your savings and then withdraw at potentially a lower tax bracket during retirement.

Gold Roth IRA: These IRAs get funded with after-tax money. The tax advantages here are that you benefit from tax-free growth and when you withdraw at retirement age, you don’t owe taxes on these investments.

Portfolio diversification

Using a self-directed IRA to buy precious metals gives you access to a broader range of investments than a traditional IRA. Since gold, silver, and platinum all have different market demands and cycles, this helps you not have all your “eggs in one basket.”

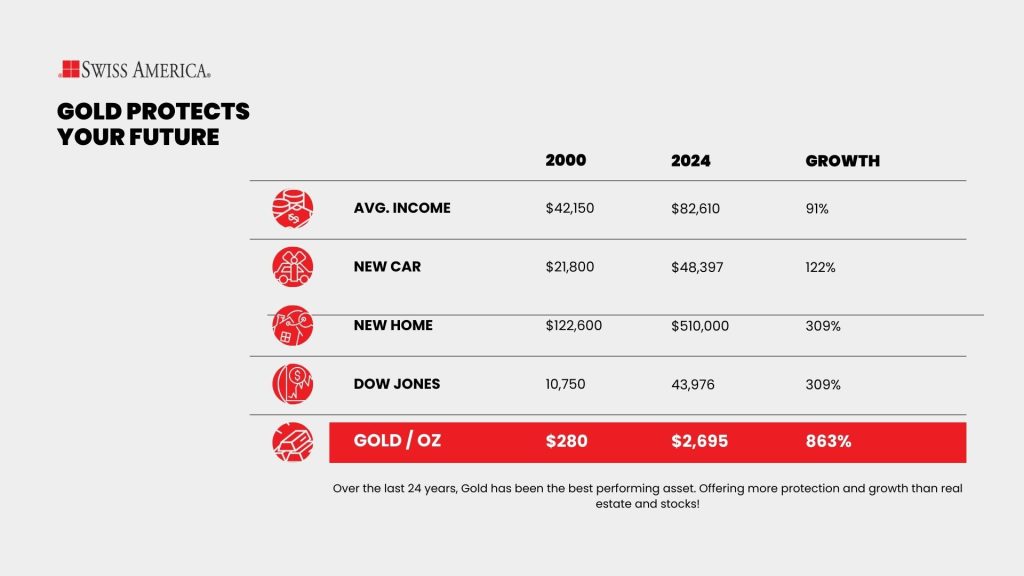

Diversification can mean that your metals perform well during times of chaos, crisis, or inflation. Consider the comparison below of gold’s performance to inflation:

Wealth protection

A huge benefit of gold is that it’s like an insurance policy for your wealth. How does it protect you? First, it’s a scarce resource. We can’t just go make more. So, when there’s higher demand, it drives up the price because of this limited supply.

Second, it’s not tied to any country’s currency. When things go wrong, like inflation or currency devaluation, gold holds steady. In fact, this is why central banks bought more gold than ever before and 81% plan to increase their reserves.

Gold pricing is at all-time highs, and recently hit $3500 an ounce as of this writing. The central banks’ buying spree combined with concerns about the U.S. debt and the economy, all lead people towards physical gold.

Choosing the right IRA company

When you go to buy gold for your IRA, the custodian does not sell the metals, so you need a dealer. How do you choose the right one? Look for a dealer with experience, great reviews, and a focus on education. Swiss America has been around since the 1980s, with thousands of satisfied clients and a range of educational resources to help you make investment decisions.

You also want transparent pricing and easy account access. With Swiss America, pricing is clear, you can track your investments online, and our gold trade program lets you sell back to us anytime for added flexibility.

Gold IRA costs final thoughts

Gold IRAs come with a range of fees that can impact your investment. From setup to storage, these costs can add up quickly. Comparing options and choosing a custodian that aligns with your needs is the best way to minimize these expenses.

Gold is a great diversification tool and a way to protect your wealth in uncertain times. Be aware of the costs upfront, cut out what you don’t need, and work with a custodian who provides transparent pricing. Every decision today impacts your financial security tomorrow.

To learn more about investing in a Gold IRA, check out our free Gold IRA kit here.

Gold IRA fees: FAQs

What is the downside of a Gold IRA?

The downside of a Gold IRA is that gold and other precious metals don’t provide income like stocks or bonds. Most investors hold metals as insurance and protection against market swings, crises, or inflation.

What is the minimum deposit for a Gold IRA?

The minimum deposit for a Gold IRA from Swiss America is $5,000.

Can you withdraw from a Gold IRA?

Once you reach the retirement age of 59.5, you can withdraw without IRS penalties by either selling or having your metals shipped to you.

Note: The information in this post is for informational purposes only and should not be considered tax or legal advice. Please consult with your own tax professionals before making any decisions or taking action based on this information.