Are you worried that inflation might shrink your retirement savings? Or concerned about market uncertainty affecting your wealth? A Gold and Silver IRA might be the solution. This account allows you to add physical precious metals to your portfolio while enjoying the tax advantages of a traditional IRA.

With the economy facing uncertainty and markets becoming more unpredictable, many investors are turning to gold and silver to protect their wealth. In this guide, we’ll explain what is a Gold and Silver IRA and what you need to know before investing in one.

Key features of a Gold and Silver IRA

A Gold and Silver IRA lets you add physical gold and silver to your retirement funds. This type of investment can help protect your savings against economic uncertainty and offer long-term growth potential.

You may also hear these retirement accounts referred to as Gold IRAs, precious metals IRAs or silver IRAs.

Physical metal holdings

One of the main advantages of a Gold and Silver IRA is that you can own real, physical metals instead of just relying on paper assets like stocks or mutual funds. These tangible assets can help protect your wealth from inflation, economic downturns, or currency devaluation.

Gold and silver often increase in value when traditional investments are not doing well, which helps spread out the risk in your portfolio.

Self-directed IRA

To invest in precious metals through an IRA, you’ll open a self-directed IRA (SDIRA). This type of account gives more flexibility, letting you decide how you want to invest your savings beyond the traditional stock market.

To set one up, you’ll need to choose an IRS-approved custodian. Their role is to manage your funds, buy and sell metals on your behalf and take care of storing your metals until you reach retirement age.

A Gold IRA account has setup and maintenance fees so you’ll want to compare costs from different custodians to find the best option for your retirement account.

Types of precious metals IRAs

Just like traditional IRAs, you can have a couple of different individual retirement account types. Precious metals IRAs have the same tax benefits for each type:

Traditional IRA: With a traditional precious metals IRA, you fund your retirement account with pre-tax money and you only pay taxes when you start to make withdrawals after the IRS-approved retirement age of 59.5.

Roth IRA: You add after-tax money to a precious metals Roth IRA and it grows tax free. Then, when you reach retirement age, if you’ve held the account for at least five years, you can make tax free withdrawals.

IRA eligible metals

The IRS has specific requirements for the metals you can include in a Gold or Silver IRA. This is to protect you from fraudulent or low-quality investments. Here are the options for retirement accounts:

IRA-approved gold

Minimum purity: Gold bullion must be at least 99.5% pure, except for American Gold Eagles, which can be 91.67% pure as per IRS rules.

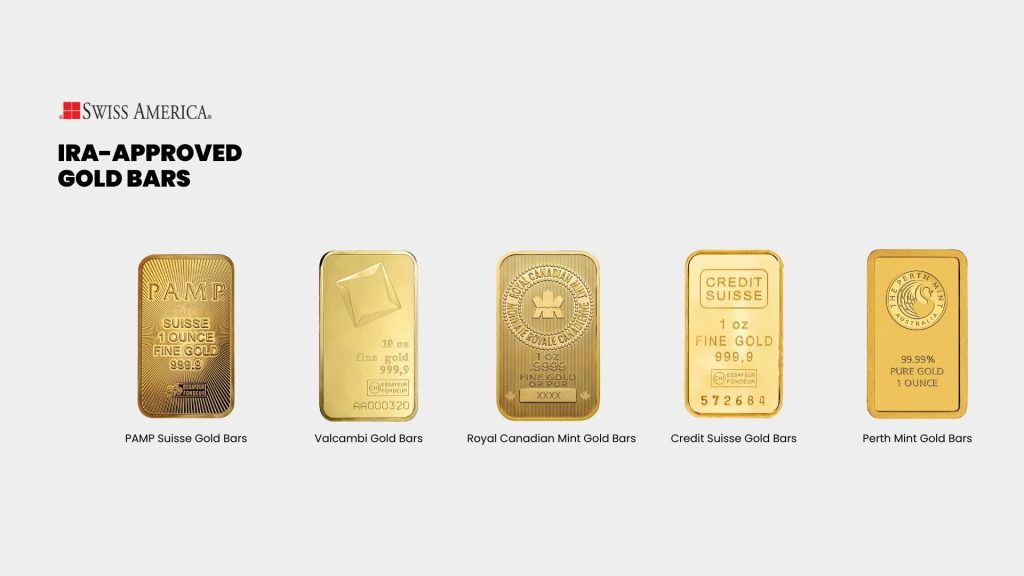

Examples of approved gold bullion:

American Eagle Bullion Coins

American Buffalo Coins

Canadian Maple Leaf Coins

British Gold Britaina

Austrian Philharmonic Coins

Gold bars manufactured by a government mint or refiner approved by groups like COMEX, LME, or LBMA.

IRA-approved silver

Minimum purity: 99.9%

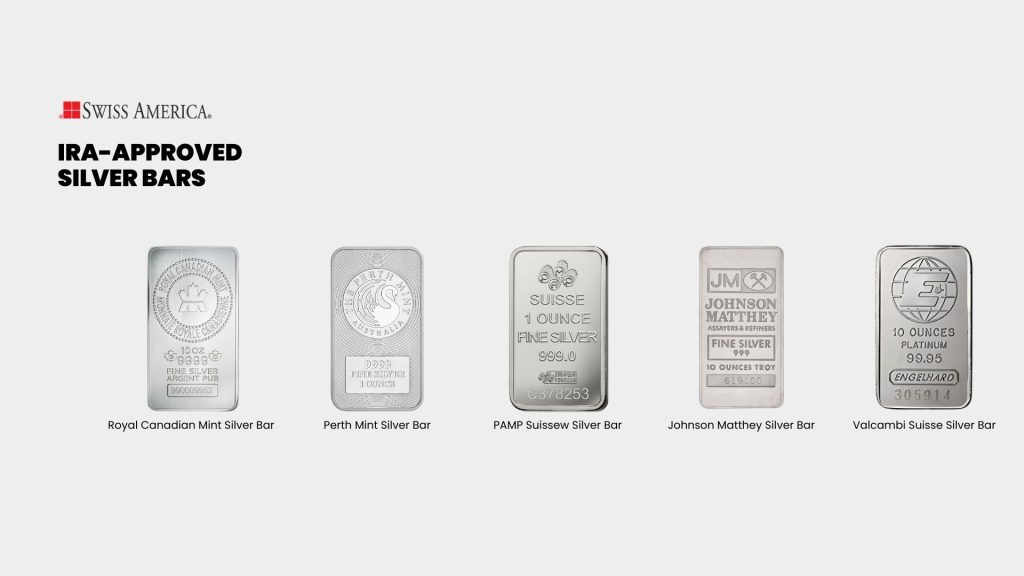

Examples of approved silver bullion:

Canadian Maple Leaf Coins

Australian Kookaburra Coins

Austrian Philharmonic Coins

- Mexican Silver Libertad

Silver bars of any size from government mints or approved refiners that meet the purity standards.

IRA-approved platinum

Minimum purity: 99.95%

Examples of approved platinum bullion:

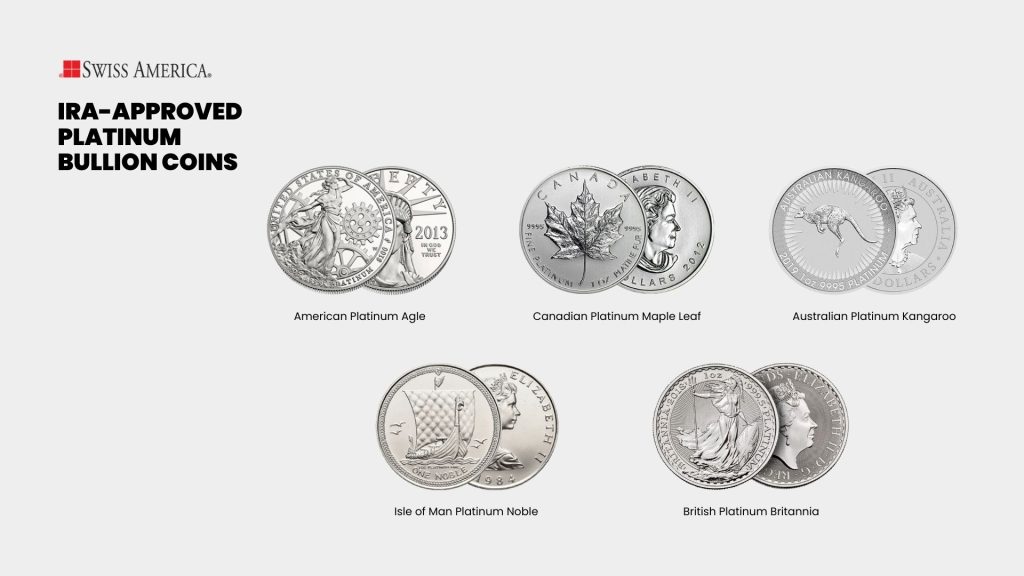

- Platinum American Eagle Coins

- Canadian Maple Leaf Platinum Coins

- Australian Platinum Kangaroo Coins

- Isle Of Man Platinum Noble

- British Platinum Britannia

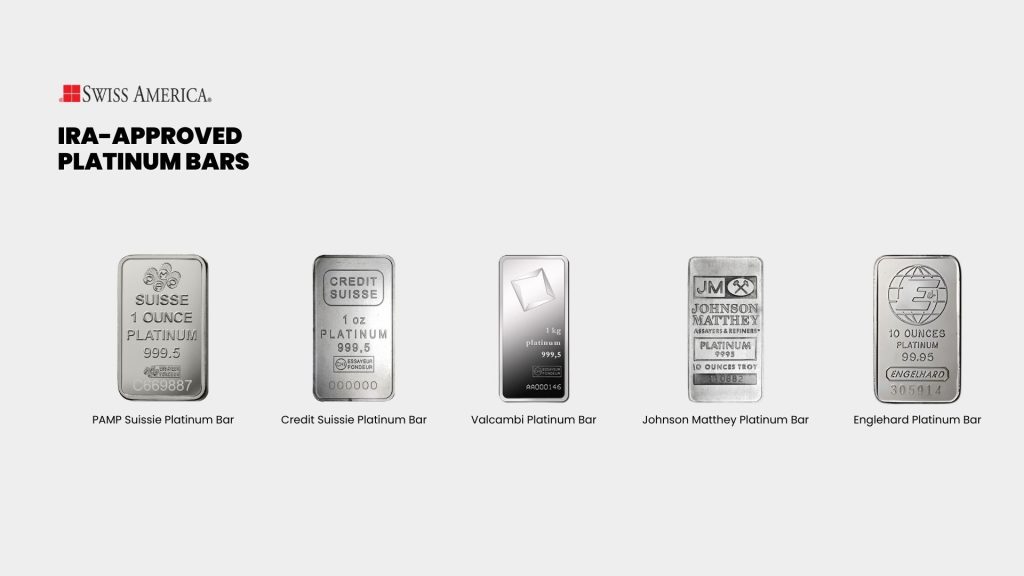

Platinum bars from government mints and approved refiners.

Storage and insurance

You can’t take physical possession of your gold or other precious metals until you reach retirement age. This is because the IRS considers possession as a distribution.

Instead, your custodian stores your precious metals in an IRS-approved depository. These secure facilities have procedures like 24/7 surveillance, armed security, and restricted access.

Depositories also include insurance coverage for your metals. Check what coverage your depository provides, and consider additional private insurance if necessary to protect your assets from theft, fire, or natural disasters.

Benefits of a Gold and Silver IRA

A Gold and Silver IRA has several advantages that can strengthen your retirement strategy. Here’s how:

Diversification

You’ll often hear experts recommend that you hold 5%-15% of your savings in gold and potentially other metals. The reason is that these physical assets act differently than stocks and bonds. When there’s a crisis or economic uncertainty, precious metals can thrive.

This is because investors seek safety from assets like gold as a way to protect their money. We’ve seen this over and over again. For example:

COVID-19 Pandemic (2020): Gold prices jumped during the pandemic because investors feared what might happen to the economy.

Global financial crisis (2008): The value of gold rose in 2008 when the stock market and real estate assets dropped.

Recent price rally (2025): Gold prices continue to rise as investors are unsure about the current economic environment.

Hedge against inflation

Gold and silver can provide a hedge against inflation. Physical gold and other precious metals are real assets with limited supply and ongoing demand. When the purchasing power of the dollar drops, it costs more to buy goods and services, including gold and other metals.

When this happens, your metals rise in price which helps to hold the value of your money.

The constant challenge of currency-dependent economies is that governments can always print more money, which decreases the value per dollar.

This makes a precious metals IRA a smart option for long-term investors who are worried that inflation will erode the purchasing power of their retirement funds.

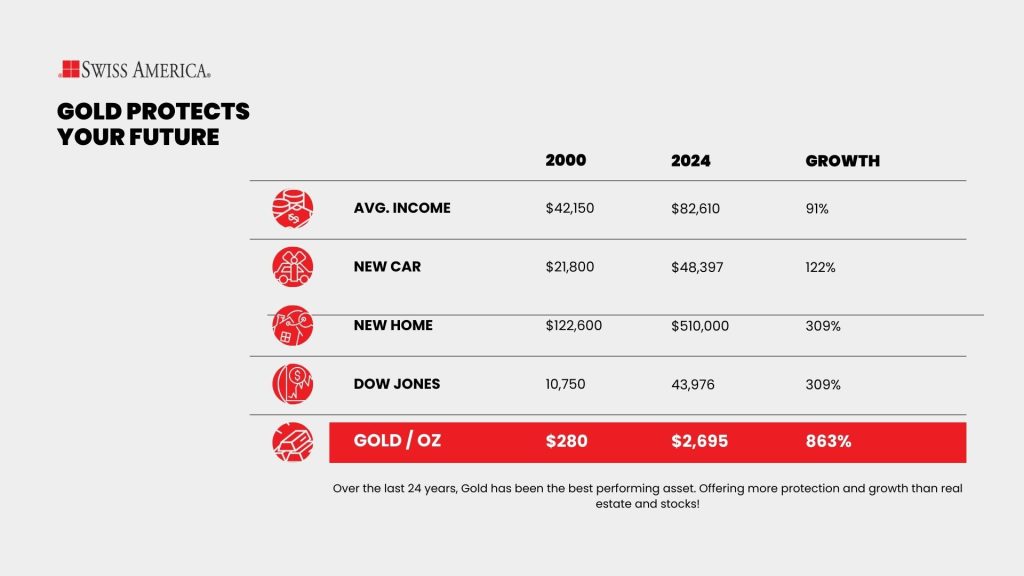

Take a look at the chart below, which shows how gold protects your future:

Potential for growth

People usually invest in metals for safety and “insurance,” but they also offer growth potential.

As demand grows, the price increases, which can lead to strong returns. Gold tends to be more steady, but silver and platinum both have strong industrial uses that drive demand.

The challenge is that both of these metals can also be more volatile than gold. So, you have the potential for greater returns but also more risk than physical gold.

How to start investing in a Gold and Silver IRA

Here’s how to get started with precious metals IRAs:

1. Open a self-directed IRA

Choose your IRA custodian and open a self-directed IRA account. Look for custodians with experience in Silver and Gold IRAs and compare pricing to find the best option. Ask about their fees for setup, maintenance, storage, and any transaction charges.

If you don’t already have a custodian in mind, precious metals dealers like Swiss America can provide recommendations.

2. Fund the IRA

After setting up your precious metals IRA, you need to fund it. Here are ways to do this:

Contribute directly

If you’re setting up a new account, you can make direct contributions. Just like traditional IRAs, the IRS sets annual limits on how much you can add.

In 2024 and 2025, the limit is $7,000 if you’re under 50 and $8,000 if you’re 50 and older.

Rollover or transfer

If you have an existing employer retirement account like a 401(k), 403(b), or TSP and you’ve left your employer, you can roll over all or a portion of those funds into a precious metals IRA.

Likewise, if you already have a traditional IRA, you can transfer all or a portion to your self-directed IRA.

The best way to do this is to use a direct transfer which sends the money directly from your current fund administrator to your custodian. This approach allows you to avoid any taxes or penalties.

3. Choose a precious metals dealer

Once the money is in your individual retirement account, now you can decide which metals to buy. Custodians don’t sell metals, so you’ll work with a trusted gold dealer.

Look for a dealer that’s been in business for decades and has several positive customer reviews. You’ll also want to work with someone who can guide you on which coins or bars qualify for your precious metals IRA.

4. Buy and store precious metals

Once you’ve decided which metals you want to buy, your custodian makes the purchase on your behalf. Your dealer then ships the metals to a depository per your custodian’s guidance.

From there, a dealer like Swiss America gives you a way to view your account value and market status through an online portal.

Considerations and risks

A precious metal IRA can be a great investment, but just like investing in traditional assets, you should be aware of the risks, which can include:

Market volatility

Many investors consider precious metals investments to be safer than stocks but their prices can still waver. Consider market conditions like:

Higher interest rates: When other safe investments like high-yield savings accounts have a higher return, investors don’t buy as much gold, which can affect pricing.

Industrial demand: A decrease in demand for goods that rely on silver, platinum, and palladium can reduce prices. For example, renewable energy is one of the biggest drivers of silver demand. While it has limited supply, if something changes or if other precious metals can better support manufacturing needs, silver pricing might drop.

Storage costs

As we mentioned above, your custodian stores your metals in a third-party depository, which means you’ll have storage fees. There’s two options for storage:

Segregated storage

This option gives your precious metals their own dedicated space. The depository assigns a unique identification number to track and identify your specific assets easily. If you go with this option, it costs more for annual storage fees.

Commingled storage

This approach stores your metals with other investors’ assets in a shared space. The depository still tracks and assigns the metals to you, but they aren’t separate.

Regulatory compliance

Be sure to follow the IRS regulations for Gold and Silver IRAs. This includes working with a custodian, buying qualified metals, and complying with storage requirements.

You’ll also have all the same tax rules you see with normal IRAs like how much you can add each year and when you can make withdrawals.

Why Swiss America

As compare Gold IRA companies, consider these key factors:

Experience

Check how long the company has been in business. Consider Swiss America’s 40 years of experience and our ability to weather market ups and downs.

Credentials

Work with a dealer affiliated with reputable third-party organizations that uphold industry standards. Swiss America is a proud member of the American Numismatic Association, the Industry Council for Tangible Assets, Numismatic Guaranty Corporation, and several other respected groups.

Resources

Top Gold IRA companies offer tools and educational materials to help you make the best decisons for your retirement savings. Swiss America provides weekday news updates, regular podcasts, and free resource guides to support your investment journey.

Precious metals IRA final thoughts

A Gold and Silver IRA can be a smart way to protect your retirement savings from inflation and market volatility. You can gain the benefits of a stable, tangible asset while still enjoying the tax advantages of a traditional IRA by adding precious metals to your portfolio.

Ready to explore how a precious metals IRA can enhance your retirement strategy? Get your copy of our free Gold IRA kit with all the details today!

What Is A Gold and Silver IRA?: FAQs

How does a gold and silver IRA work?

This type of IRA lets you include physical silver and gold coins or bars in your retirement account. You open the account with a custodian, buy approved metals, and keep them in a secure storage facility. You’ll also get tax benefits depending on the type of your IRA.

Is a precious metal IRA a good idea?

A precious metal IRA could be a good choice if you’re looking to protect your savings from inflation and economic downturns.

Is a gold IRA tax free?

A Gold IRA isn’t completely tax-free, but it comes with tax advantages. In a traditional Gold IRA, you might be able to deduct your annual contributions and you only pay taxes when you make withdrawls in retirement. With a Roth Gold IRA, qualified withdrawals are tax-free.

Note: The information in this post is for informational purposes only and should not be considered tax or legal advice. Please consult with your own tax professionals before making any decisions or taking action based on this information.