If you have a TSP, can you convert a portion of it to a Gold IRA? If you are leaving or plan to leave service, the answer is yes, and it’s not that hard to do.

The Thrift Savings Plan (TSP) is the largest defined contribution plan in the United States. If you’re among the 4.9 million participants, you might be curious about how to explore investment options beyond the plan’s defined choices.

What if you want to invest in alternative assets like gold or other precious metals? How exactly can you do that?

This article covers how you can convert some (or all) of your TSP to Gold IRA. Simply knowing that you have this option and flexibility can impact your overall retirement planning and the path you choose to follow.

TSP to Gold IRA

TSPs are retirement savings plans available for federal employees and military members. You can save for retirement via tax-deferred or after-tax contributions. The investment options available are more limited, and as one Reddit user stated:

“We are not given many options because a number of Federal Employees oversee regulations for major segments of our economy and manage contracts with private industry. Thus, there is a concern about insider information and rulings to favor certain companies and sectors.”

Once you separate from service or reach the age of 59.5, you can convert your TSP and now access more investment options. One is to move some of your retirement funds to a physical Gold IRA.

What is a Gold IRA?

A Gold IRA involves converting your existing retirement account into a self-directed IRA so you can invest in other options besides traditional market assets like stocks and bonds. This conversion gives you a way to invest your retirement savings into other asset classes like:

Gold and other precious metals

Real estate

Crypto

Forex

Reasons to Convert Your TSP to a Gold IRA

Why consider converting your TSP to a Gold IRA? Based on our experience working with investors for over 40 years, here are some common reasons:

Diversification

One major reason investors choose Gold IRAs is to diversify their assets. Holding everything in stocks and bonds means being entirely dependent on those markets’ performance.

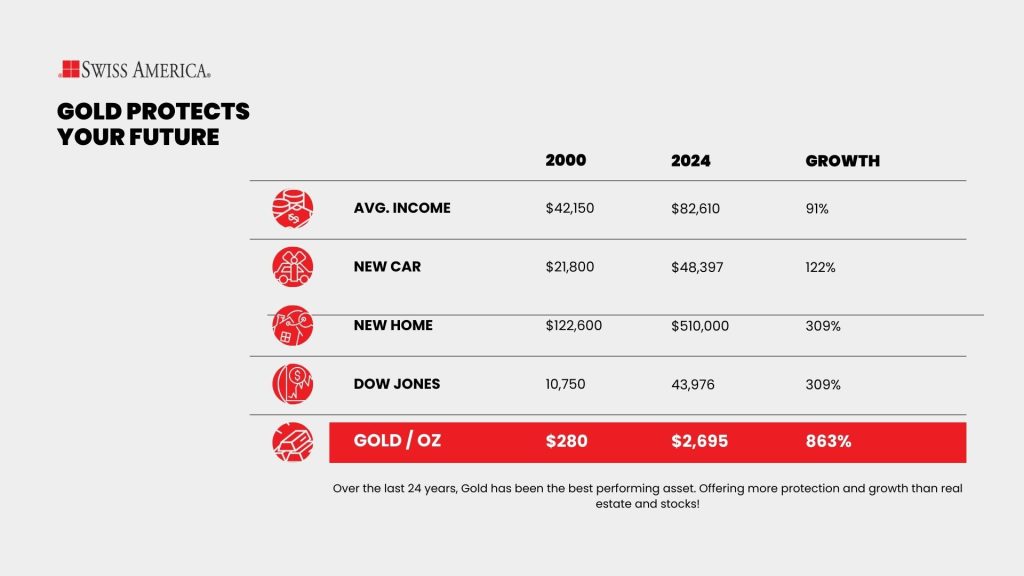

Gold behaves differently. It doesn’t rely on the same metrics as the stock market, often performing well in times of market downturns and chaos. It’s also not tied to any country’s currency. This means inflation or currency devaluation has no bearing on the value of your gold.

Gold gives you a way to protect a portion of your retirement portfolio by not having all your “eggs in one basket.”

Inflation Hedge

Gold, silver, and platinum are excellent hedges against inflation.

All of these metals are scarce resources, and there’s only so much available. This is very different from paper currency, which the government can print at any time. And when they do, it means you need more money to buy the same goods and services than you could a year, two years, or ten years ago.

Since 2020, we’ve experienced inflation of about 22%, which has led many investors to look for assets to help preserve their wealth. The chart below shows the Congressional Budget Office’s report on inflation during this time period.

Meanwhile, the price of gold has increased by over 78%. So, while the value of cash diminished due to inflation, if you invested in gold, you found a way to preserve your wealth. The value of precious metals like gold, silver, and platinum rises and gives you a “moat” against inflation.

Economic Stability

Another reason to consider a gold IRA conversion is economic stability. Precious metals tend to perform well during times of chaos and crisis.

Recent events like:

Russia-Ukraine war

Tensions in the Middle East

Persistent concerns about the economy

All drive investors towards gold and other precious metals to provide some stability against chaos and potential crises.

Steps to convert your TSP to a Gold IRA

How do you go about converting your TSP into a Gold IRA? Here’s how you can make this change:

Find a Gold IRA company

Start by choosing a Gold IRA dealer who can help you decide which gold, silver, and platinum to buy. You want to work with a company that’s been in business for decades – not just a few years. Look at reviews, testimonials, and Better Business Bureau ratings.

The last thing you want is to have bad customer support or work with a company that’s a scam.

Pick a precious metals custodian

Next, you’ll choose a precious metals custodian who acts just like the administrator you work with to handle your thrift savings plan investments. The custodian’s role is to buy and sell assets at your direction. They’ll also handle ongoing management, which includes secure storage in a third-party depository.

If you don’t have a custodian in mind, the team at Swiss America can help you work with Gold Star Trust to set up and transfer funds.

You’ll open a self-directed IRA account with the custodian. To do this, fill out an application and provide identification and information about the thrift savings plan funds you want to roll over into a gold or precious metals IRA.

Transfer retirement funds

The next step is to transfer your retirement savings from your current TSP account into the self-directed IRA. Contact your TSP administrator and ask them to help you with a direct rollover of your TSP account.

They’ll issue funds directly to your self-directed IRA account.

You do have an option for an indirect rollover, but note that this has more room for error and the possibility of missing deadlines, which can cause immediate tax liabilities. Indirect rollovers just mean that you ask the administrator of your TSP retirement accounts to issue a check to you. You then give the check to your IRA provider within 60 days to avoid tax implications and penalties.

Buy gold and silver coins or bars

Now that your TSP funds reside in your self-directed IRA account, it’s time to buy your metals! The IRS has rules about which precious metals investment options qualify for retirement plan savings:

Purity: The physical gold you buy must be at least 99.5% pure, silver 99.9% pure, and platinum 99.95% pure.

Manufacturing: Gold coins, bars, and rounds must come from an accredited refiner or manufacturer. Regulating bodies like NYMEX and LBMA recognize these companies.

Not allowed: You can’t use retirement money to buy collectible gold like numismatic coins.

Here’s a comparison of the most common rollover paths and Gold IRA account types you might consider:

| Option | What it is | Tax & withdrawal notes | Best for |

|---|---|---|---|

| Direct TSP → Traditional Gold IRA | Roll funds directly to a self-directed IRA that buys physical metals | Pre-tax rollover; taxes upon retirement withdrawals | Those who want tax-deferred growth like their TSP |

| Direct TSP → Roth Gold IRA | Move funds from a Roth TSP into a Roth Gold IRA | After-tax rollover; qualified retirement withdrawals are tax-free | Investors wanting tax-free gains in retirement |

| Partial rollover | Move only part of your TSP to a Gold IRA | Allows diversification while keeping some TSP funds | Federal workers wanting a mix of stability & metals |

| Indirect rollover | TSP pays you, and you deposit into a Gold IRA within 60 days | Risk of tax penalties if the deadline is missed | Investors are confident they can manage timing |

Considerations and potential challenges

Moving from a TSP to a Gold IRA can be simple and very straightforward, but there’s a few areas to keep in mind:

Tax implications

We already mentioned that if you don’t use a direct rollover, you run the risk of not meeting deadlines and paying taxes and penalties. Assuming that’s not an issue, the other tax considerations depend on the type of account you have:

TSP to traditional IRA

If you contribute to your TSP today using after-tax dollars, you’ll roll the money into a traditional Gold IRA. This account works just like what you have today in that your money grows tax-deferred, and you only pay taxes when you withdraw upon retirement.

Key ages for your retirement savings:

Age 59.5: You can begin taking withdrawals without penalties. Before this age, you’ll have a 10% early withdrawal penalty, plus you’ll pay regular income tax.

Age 73: Required Minimum Distributions (RMDs) begin, so you’ll have to start taking minimum withdrawals annually.

The benefit of these retirement accounts is that when it’s time to start taking money out, you might be in a lower tax bracket and potentially pay less income tax. This tax-deferred growth helps you increase your overall retirement savings.

IRS tax rules for adding funds to your IRA in 2026 are:

You can roll money from your TSP at any amount, but the maximum you can add to your traditional IRA in 2026 is $7,500.

If you’re 50 or older, your max is $8,600.

Roth TSP to Roth IRA

If you set up a Roth TSP, this means you fund the account with after-tax dollars. You can continue this exact same process with a Gold Roth IRA. When you’re ready to withdraw funds in retirement, you benefit from tax-free withdrawals.

Important Roth IRA rules:

No Required Minimum Distributions (RMDs) during your lifetime.

Your beneficiaries must take RMDs from inherited Roth IRAs.

You can make tax-free withdrawals if you’ve had the account for at least 5 years and you’re 59½.

If you want to keep adding to the account, you’ll follow the same IRS guidelines per year for the maximum amounts we mentioned above.

Remember that there are income limits for contributing directly to a Roth IRA, but these limits don’t apply when converting your TSP to a Gold IRA.

Prohibited transactions

Since you’re using funds to buy physical precious metals, you won’t actually be able to take possession of the metals until retirement age. This is because any kind of distribution (like storing metals at home) falls under a taxable event.

To avoid this, your gold dealer sends your metals directly to your Gold IRA custodian for secure storage.

Cost considerations

Just like all investment options like mutual funds, individual stocks, or ETFs, you should be aware of the costs and fees. Both your custodian and gold dealer have small fees to set up a new Gold IRA or to support ongoing maintenance.

Here’s what you can expect:

Custodian fees

Gold Star Trust fees include $50 to set up the account, $90 per year for annual maintenance, and $100 for secure storage. So, after the first year, you are looking at $190 per year.

Dealer fees

Swiss America has a one-time establishment fee to help set up your traditional or Roth account. The fee depends on the amount of funds you transfer, with the average amount around $250.

Why choose Swiss America for your Gold IRA

When you are ready to add gold to your investment portfolio, here are the reasons why thousands of investors choose Swiss America:

40+ years in business: Since the early 1980s, we’ve successfully guided investors through numerous economic cycles and market shifts. Our decades of experience make us a seasoned, trustworthy precious metals partner.

Happy customers: Our large base of satisfied clients enjoy timely delivery of high-quality metals, responsive and knowledgeable customer service, and consistent performance that meets or exceeds expectations.

Expert advice: We offer expert guidance on secure storage, precious metals IRAs, gold-to-silver ratios, portfolio integration, and market trends. Catch one of our regular podcasts, check out our in-depth guides, or speak with one of our experts to get the information you need to make investment decisions.

Transparency: We offer competitive rates and clear pricing, so you always know exactly what you’re paying for your precious metals investment. And, once you have your Gold IRA account, you can see market value at any time using our online portal.

TSP gold final thoughts

Moving your thrift savings plan savings into a Gold IRA gives you a way to diversify your investments with a tangible asset. Gain peace of mind knowing that you’re taking a step to protect your wealth from economic uncertainty, crisis, and chaos.

To learn more about rolling over your retirement savings into a Gold IRA, get your copy of our free Gold IRA kit today!

TSP to Gold IRA: FAQs

Can you invest in gold with a TSP account?

You can’t own physical gold in a TSP account but you can roll over TSP funds into a self-directed IRA so that you can access a broader set of investment options like gold or silver.

Can you buy gold with TSP?

You can buy physical gold with TSP funds if you roll them over into a self-directed IRA. This IRA allows you to invest in more options than the traditional TSP funds.

Can I move money from my TSP into an IRA?

Yes, you can move money from your TSP to an IRA provider. You’ll set up an account with the IRA company first and then ask your administrator to send the funds. Once you have funding available, you can then buy alternative assets like physical gold, silver, or platinum.

Note: The information in this post is for informational purposes only and should not be considered tax or legal advice. Please consult with your own tax professionals before making any decisions or taking action based on this information.