In our weekly podcasts, we cover the latest trends that impact gold investing. That includes everything from de-dollarization to BRICS to broader economic concerns. Central banks and investors have been piling into gold over the last few years. There’s too much uncertainty out there, and people want something tangible they can count on.

So, how did we get here? What’s the real relationship between gold, the presidency, and U.S. economic policy?

This article covers how presidential decisions, from Hoover to today, helped shape gold’s role in the financial system.

Gold and executive policy

Presidents do not set gold prices, but their policies make an impact. This includes:

- Currency rules

- Spending programs

- War decisions

- Central bank influence

Here’s a high-level summary of what 17 presidents did or didn’t do that changed gold’s place in the U.S. economy.

| President | Main action or event | Effect on gold | Broader context |

|---|---|---|---|

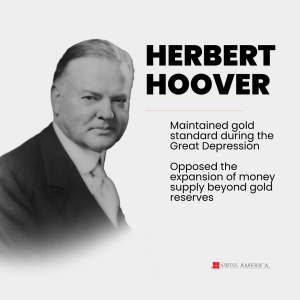

| Herbert Hoover | Maintained classical gold standard | Constrained economic response as gold-backed dollars | Executive gold policies and the Gold Reserve Act |

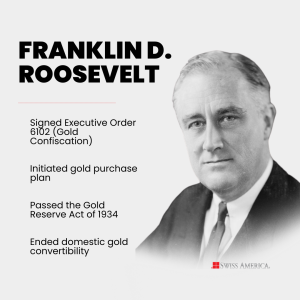

| Franklin D. Roosevelt | U.S. held global gold and led the post-war monetary system | Ended public gold convertibility; revalued gold | Removed gold from public use and supported New Deal finance |

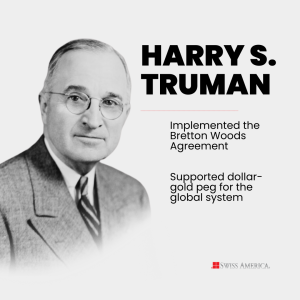

| Harry S. Truman | Bretton Woods system | Dollar tied to gold only for foreign governments | Attempted to stabilize the fixed price |

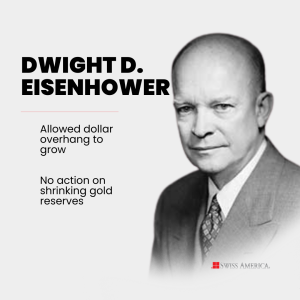

| Dwight D. Eisenhower | No major policy change | Gradual drop in U.S. gold reserves | Rising pressure on Bretton Woods |

| John F. Kennedy | London Gold Pool support | Repealed the gold ownership ban | Delayed stress on the Bretton Woods system |

| Lyndon B. Johnson | Massive spending, deficits | Increased global pressure on gold reserves | Growth of imbalances in fixed system |

| Richard Nixon | Closed the gold window | Ended official dollar convertibility to gold | Shift to fiat currency system |

| Gerald Ford | Created the Gold Commission | Restored private gold ownership | Ended 40+ year restriction |

| Jimmy Carter | High inflation era | Gold surged in price | First major modern bull market |

| Ronald Reagan | Created Gold Commission | No return to gold standard | Gold prices fell as inflation eased |

| George H.W. Bush | Focus on tech, peace | Little direct gold policy influence | Gold less central in economy |

| Bill Clinton | Allowed gold in IRAs | Expanded access | Gold less of I a macro focus |

| George W. Bush | Post-2001 instability | Gold less of a macro focus | Reaction to low rates and debt |

| Barack Obama | Fed QE and crisis response | Gold hit highs | Hedge in financial uncertainty |

| Donald Trump (Term 1) | Trade wars and COVID stimulus | Gold above $2,000 | Safe haven amid policy uncertainty |

| Joe Biden | Inflation and policy mix | Gold rose with inflation fears | Central bank buying and global shifts |

| Donald Trump (Term 2) | Tariffs, fiscal policy | Gold spiked further | Continued hedge demand |

Herbert Hoover

When Herbert Hoover took office in 1929, the country was still on the classical gold standard. That meant every dollar in circulation had to be backed by a specific amount of physical gold. So if the government wanted to print more money or expand credit, it had to have enough gold in reserve to support it. This worked fine in stable times, but it became a huge problem when the economy fell apart.

What the economy lacked

After the 1929 crash, the economy really needed more money flowing, more credit available, and government spending to stabilize demand. But the gold standard didn’t allow for that kind of flexibility. If the government created more money than it had gold to back it, it would be breaking the rules of the system.

Instead of increasing the money supply, things started to contract. Banks failed. Loans disappeared. Businesses couldn’t get credit. People stopped spending. And prices began to fall.

This led to:

- Deflation: As prices and wages dropped, debts grew. Imagine owing someone $1,000, but your income keeps shrinking. That’s what was happening on a massive scale.

- Gold hoarding: People were scared, so they started pulling gold out of the banking system and hoarding it. That made the gold reserves shrink even more, tightening the money supply further.

Hoover’s commitment to gold limited the government’s ability to respond, and that failure to act deepened the collapse.

Franklin D. Roosevelt

Roosevelt took office in March 1933, in the depths of the Great Depression. The U.S. banking system was collapsing. There were massive bank failures, severe deflation, and widespread gold hoarding by the public.

The gold standard tied the government’s hands. The money supply couldn’t expand unless the government added more gold to back it, which made it nearly impossible to respond to the crisis.

Banking reforms and gold policies

To address the system issues, Roosevelt took these actions:

- Banking system: The government closed all banks for one week and passed the Emergency Banking Act which prohibited gold exports and forbade banks from paying out in gold.

- Gold confiscation: In April 1933, Roosevelt signed Executive Order 6102. This order made it illegal for Americans to own most forms of gold, including coins, bars, and certificates. People had to turn in their gold to the Federal Reserve in exchange for paper dollars. Failure to comply carried fines up to $10,000 or up to 10 years in prison.

- Gold purchase plan: In late 1933, the government began buying gold at higher prices to devalue the dollar and raise commodity prices, a move somewhat tied to an early form of currency reset.

The Gold Reserve Act of 1934

This act gave the federal government full control over the nation’s gold reserves.

It also revalued gold from $20.67 to $35 per ounce, effectively devaluing the dollar and allowing the Treasury to increase the money supply. The profits from this revaluation helped fund New Deal programs aimed at economic recovery.

Key impacts:

- Ending domestic convertibility: Americans could no longer exchange paper dollars for gold. While the gold standard technically remained for international settlements, it was over for the public.

- Public trust: FDR’s policies ended personal control over gold. The government pulled it from circulation and stayed out for over 40 years. The idea that the government could seize gold or alter its value left a deep impression, shaping how many investors still view gold and government power.

Harry S. Truman

Harry Truman took office in 1945 after FDR’s death, just as World War II came to an end.

The U.S. was in a dominant position. It held about two-thirds of the world’s gold reserves and emerged as the top global economic power. As the world rebuilt, economic stability became a top priority, and gold was at the center of that effort.

The Bretton Woods System

Participants signed the Bretton Woods agreement in 1944, with the system implemented under Truman. The central tenets of this agreement included:

- Dollar-gold link: The U.S. dollar was tied to gold at $35 per ounce.

- Global peg: Other countries pegged their currencies to the dollar instead of holding gold.

- Exclusive redemption: Only foreign governments and central banks could trade dollars for gold.

- U.S. dominance: By holding the gold and issuing the reserve currency, the U.S. controlled the system’s foundation.

The U.S. gained major influence around the world, especially during the early Cold War years, by promising to convert dollars into gold.

Dwight D. Eisenhower

The post-WWII economy was booming. The U.S. was growing fast, inflation was low, and American industry was leading the world.

As the U.S. expanded its role on the world stage through foreign aid, military presence, and overseas investment, more dollars started flowing out of the country.

Foreign governments began redeeming those dollars for physical gold. Bit by bit, U.S. gold reserves started to shrink. This wasn’t a crisis yet, but it was the start of a trend that would eventually challenge the foundation of Bretton Woods.

The dollar overhang

By the late 1950s, the global economy held more dollars than the U.S. had gold to back them. This was the beginning of what’s known as the “dollar overhang” which was a growing gap between the number of dollars in circulation worldwide and the gold reserves meant to support them.

Eisenhower saw the imbalance but didn’t take major action. At the time, it seemed manageable. But the longer it went unresolved, the more pressure it put on the system.

John F. Kennedy

Kennedy stepped in with growing concern about the balance of payments deficit and a steady decline in U.S. gold reserves. The dollar was still the global standard, but confidence was beginning to fade.

The London Gold Pool

In 1961, Kennedy’s Treasury helped form the London Gold Pool, a coordinated effort with European central banks to manage and stabilize the price of gold. If prices started to rise above $35 on the open market, central banks would flood the market with gold to push the price back down.

The disconnect between paper dollars and physical gold kept growing. Kennedy didn’t create the crisis, but his policies helped delay the inevitable. The end of gold convertibility was getting closer, even if few people saw it at the time.

Lyndon B. Johnson

Johnson’s agenda included massive government spending, funding the Vietnam War and Great Society programs without raising taxes. The result was inflation, bigger deficits, and growing international doubts about the dollar’s gold backing. I

The spending meant more dollars piled up overseas, while the U.S. gold supply didn’t change. That imbalance gave foreign governments a reason to start demanding gold in exchange for their dollars, with France being one of the most aggressive.

By 1968, the U.S. was forced to pull out of the London Gold Pool, ending coordinated global price control and setting the stage for the final collapse of the gold standard under Nixon.

Richard Nixon

By the time Nixon took office, the global monetary system was on the verge of collapse. Inflation was rising, trade deficits were widening, and foreign governments were cashing in their dollars for gold at an unsustainable pace.

By 1971, foreign governments had drained U.S. gold reserves to critical levels. Confidence in the dollar was unraveling fast, and the framework that had held up since Bretton Woods was barely holding together.

The Nixon Shock

On August 15, 1971, Nixon made a bold and controversial move. He closed the gold window, ending the U.S. promise to redeem dollars for gold held by foreign governments.

This single act broke the final link between gold and the dollar. The U.S. currency became fully fiat, no longer backed by any physical asset, just the authority and promise of the government. Impacts included:

- Gold pricing: Nixon abandoned the fixed gold price of $35 per ounce. Gold was now free to trade on the open market without government controls. Within just a few years, the price more than doubled.

- Gold sentiment: Investors began to view gold as a way to protect themselves from the risks of government-controlled currency. What had once been the foundation of the system became an outsider asset.

Gerald Ford

Gerald Ford stepped in during a rough stretch. Nixon had just resigned, inflation was climbing, and the U.S. was in a recession.

On December 31, 1974, President Ford signed legislation that repealed FDR’s 1933 ban on private gold ownership. The change took effect immediately. It came as a rider to the International Development Association Appropriations Act of 1975 and officially ended the restrictions established by Executive Order 6102.

For the first time in over 40 years, Americans could legally buy, sell, and hold gold bullion and coins.

Inflation drives gold demand

During Ford’s presidency, inflation remained a real threat. Economic uncertainty and dollar weakness pushed more people toward gold as a form of protection.

Gold became a tool for individual investors looking to shield themselves from the financial instability around them.

Jimmy Carter

Jimmy Carter became president during a brutal economic environment. Inflation was high, growth was slow, and unemployment was rising. This damaging mix of stagflation shook confidence in the dollar and the broader financial system.

At the same time, global events like the Iranian Revolution and the energy crisis only added to the fear. Economic weakness at home and instability abroad drove investors toward safety, and gold was at the center of that flight.

Gold surges

When Carter took office, gold was trading around $130 an ounce. But by early 1980, it had exploded past $800. That massive move was a reaction to inflation, geopolitical chaos, and deep public anxiety. This was the first major gold bull market powered by retail investors in the modern era.

Precious metals dealers, mutual funds tied to gold, and private vaulting services saw growth in demand.

Ronald Reagan

Ronald Reagan took over just as the inflation crisis was peaking. Reagan campaigned on free-market ideas, sound money principles, and a smaller federal footprint. Paul Volcker, still Fed Chair from the Carter era, stayed in place and continued pushing aggressive rate hikes to stamp out inflation.

The Gold Commission

Early in his presidency, Reagan created the U.S. Gold Commission to explore the idea of returning to a gold standard. The commission came to the conclusion not to return to gold.

Volcker’s policies started to work, inflation cooled, and interest rates stayed high. That shift in the economic backdrop took the pressure off gold. Prices fell steadily throughout Reagan’s presidency. By the time he left office, gold had dropped below $400 an ounce.

George H. W. Bush

George H. W. Bush took office as the U.S. economy was slowing. The country entered a mild recession in the early 1990s, with growth cooling, deficits rising, and federal debt starting to climb.

At the same time, the Cold War ended. With no clear global rival, attention shifted to U.S. economic leadership, and in this environment, gold fell out of focus. Optimism around tech and the strength of the dollar kept investor attention elsewhere.

The Gulf War

When the Gulf War began in 1990, gold saw a quick jump as investors reacted to Middle East instability. But the war was short, U.S. success was clear, and gold gave up those gains almost as quickly as it made them.

Federal deficit

The federal deficit kept growing. Bush’s administration added to the national debt without sparking concern at the time, but it was part of a longer pattern.

Bill Clinton

Bill Clinton took office during one of the strongest economic stretches in recent U.S. history. The 1990s saw high growth, low inflation, and the explosive rise of the tech sector.

By the end of the decade, the federal budget was running a surplus, something almost unheard of in modern politics. Confidence in the dollar was high, and most of Wall Street saw gold as irrelevant.

The Washington Agreement

In 1999, European central banks signed the Washington Agreement on Gold, limiting their own gold sales to avoid dumping too much onto the market. The central banks’ goal was to prevent excessive selling from creating instability.

Western central banks were leasing out gold and selling into the market in ways that kept prices suppressed.These practices artificially distorted the free market and put even more pressure on gold.

Introduction of Gold IRAs

In 1997, Clinton signed the Taxpayer Relief Act I, which officially allowed certain types of gold and silver coins and bars inside self-directed IRAs.

Paper assets

The 1990s became the height of paper wealth culture. Stocks were king. Digital assets and tech startups replaced anything physical or tangible.

George W. Bush

George W. Bush entered the presidency just as the dot-com bubble was collapsing. Then came the 9/11 attacks, which reshaped U.S. foreign policy and launched the War on Terror.

The U.S. committed to massive military campaigns in Afghanistan and Iraq. At the same time, the Federal Reserve cut interest rates sharply, the government increased spending, and confidence in fiat money started to erode again.

Gold’s new bull market

Gold had bottomed out at around $255 an ounce in 2001. From there, it began a steady climb that would carry it to over $900 by 2008.

The catalysts were:

- Global instability

- Ultra-low interest rates

- Ballooning debt

- Concerns about the dollar’s long-term value

Gold was back on the radar as a hedge against risk and monetary excess.

The 2008 financial crisis

When the housing bubble burst and major banks began to fail, panic set in. Gold demand surged as investors rushed toward safety.

Central banks responded with zero interest rates and quantitative easing. This flooded the system with cheap money and weakening currencies in the process. Gold moved sharply higher as trust in the financial system unraveled.

Gold access

During this time, new gold investment tools started to gain traction. Gold-backed ETFs, Gold IRAs, and even digital gold platforms gave investors more ways to own and trade gold than ever before.

Barack Obama

Barack Obama took office in the middle of the worst financial meltdown since the Great Depression. Banks were failing, unemployment was soaring, and the Federal Reserve was already deep into emergency mode, rolling out bailouts, slashing interest rates to zero, and launching massive quantitative easing programs.

Public trust in Wall Street, the banking system, and fiat currency was at a low point.

Gold reaches record highs

From around $900 an ounce in 2009, gold climbed to over $1,900 by August 2011.

Investors were worried about inflation and collapse. There were debt ceiling showdowns in Congress, exploding federal deficits, and non-stop money printing. Demand poured in from both retail buyers and institutions. Gold IRAs, physical bullion, and gold-backed funds all saw record interest.

Debt and QE

During Obama’s two terms, the national debt doubled, eventually crossing the $20 trillion mark.

The Federal Reserve pumped trillions of dollars into the economy, inflating financial assets and stretching the balance sheet. In that environment, gold looked like one of the few anchors left in a system flooded with paper.

Price pullback

By 2013, the Fed started talking about tapering its bond purchases. Rate hikes were on the table again. That shift in tone pulled gold back from its highs, and by 2015, it had fallen below $1,200 an ounce.

Donald Trump (Term 1)

Donald Trump’s administration brought trade wars, tax cuts, and an unpredictable mix of fiscal and monetary messages. The term would end with the global shock of COVID-19 and the most aggressive government spending spree in U.S. history.

Gold prices

From 2017 to 2019, gold traded in a steady range between $1,200 and $1,500 an ounce. Trade tensions and shifts in Fed policy gave it some tailwind, but momentum was slow.

Then 2020 hit. The pandemic triggered panic across markets, and gold shot past $2,000 for the first time ever.

COVID and stimulus

In response to the COVID-19 shutdowns, the government rolled out trillions in stimulus. The Federal Reserve slashed rates to zero, restarted quantitative easing, and opened up emergency lending windows.

Demand for gold skyrocketed as a hedge against currency risk, economic instability, and unchecked policy intervention.

Interest rates

As inflation picked up and rates stayed near zero, real yields dropped into negative territory.

This created an ideal environment for gold. With cash losing value and traditional savings offering no return, gold looked like one of the few safe places left to preserve long-term purchasing power.

Joe Biden

Joe Biden took office as the U.S. was still dealing with the aftershocks of COVID-19. The government and the Federal Reserve pumped trillions into the economy, supply chains were a mess, and the money supply had exploded.

Inflation quickly became the biggest economic story. Mounting inflation forced the Federal Reserve to change course and respond with the most aggressive rate hikes since the early 1980s.

Inflation spikes

By mid-2022, inflation had climbed above 9%, which was the highest in decades. Gold responded quickly, rising to around $2,050 an ounce as investors scrambled for safety.

De-Dollarization

On the international front, countries like China and Russia began shifting away from the U.S. dollar and buying gold instead of Treasuries.

By 2022 and 2023, central banks were buying gold at record levels. Biden’s foreign policy, including sanctions and capital controls, accelerated the move toward physical reserves.

Digital currency

The administration also began exploring the idea of a central bank digital currency. That sparked debate over surveillance, control, and the future of personal financial freedom.

Donald Trump (Term 2)

Donald Trump entered his second term in 2025 with an aggressive economic plan that included universal tariffs, major tax cuts, and deep deregulation. This plan came against a backdrop of rising debt, trade friction, and simmering global tensions.

Markets immediately focused on his clashes with the Federal Reserve, as Trump pushed for rate cuts to offset the impact of tariffs. The mix of economic nationalism, political unpredictability, and mounting fiscal pressure increased investor anxiety.

Tarrifs

Trump’s universal tariffs triggered an instant reaction. Gold prices spiked, climbing past $3,300 and eventually approaching $3,500 an ounce.

Investors viewed gold as the cleanest hedge against trade chaos and global uncertainty. With each new tariff threat or deadline, gold pushed higher.

We spoke about tariffs, strategy, and implications on our podcast:

Dollar weakness

At the same time, the U.S. dollar had one of its worst starts since the 1970s. Fears of unchecked fiscal policy, expanding deficits, and monetary policy all weighed on the currency.

As the dollar weakened, gold gained even more traction. Globally, it has once again become the preferred safe haven as a clear alternative to paper promises and central bank experimentation.

Tax cuts and debt

Trump’s new tax package, nicknamed the “Big Beautiful Bill,” extended cuts and added fresh spending. The projected impact is another $4 to $5 trillion added to the national debt.

For gold investors, that was another reason to stay long. Rising deficits, combined with slower growth and policy uncertainty, made hard assets more attractive than ever.

Where gold stands now

Gold has reasserted itself with new all-time highs above $3,300 to $3,500 an ounce. The move is grounded in macro instability, inflation risk, and deepening distrust in both policy and currency systems.

Global central banks continue to add to their gold reserves. Analysts expect the trend to hold through 2026. Gold is front and center, a core holding in portfolios that are built for resilience, not just returns.

About Swiss America

Since 1982, we’ve been helping investors protect their wealth with gold, silver, and platinum. Clients rave about our service and trust us to help them with a wide range of options, including outright purchases, Gold IRAs, and Numismatic coins. We’re committed to helping you understand gold investing with resources like:

- Industry articles

- In-depth guides

- Free Gold IRA kit

- Regular podcast

- Knowledgable staff

You can be confident in the quality of our metals, knowing our commitment to industry standards and membership in top professional organizations.

Connect with our team today to learn more about gold investing and how it can protect your wealth from whatever comes next!

The information in this post is for informational purposes only and should not be considered tax or legal advice. Please consult with your own tax professionals before making any decisions or taking action based on this information.