Precious Metals IRAs allow you to hold physical gold as part of your retirement savings. With gold recently reaching $3,500 an ounce and J.P. Morgan Chase projecting it could climb to $4,000 by mid-2026, including gold and silver in your portfolio may help reduce risks during times of economic uncertainty.

What are Precious Metals IRAs?

Precious Metals IRAs are self-directed retirement accounts that let you move beyond stocks and bonds and invest in precious metals. You may also hear this type of account referred to as a Gold IRA or Silver IRA.

Gold IRAs follow the overall tax rules and IRS structure of traditional and Roth IRAs.

Types of Precious Metals IRAs

There are three main types of Precious Metals IRAs. Which one you have depends on your income and how you earn it.

Traditional Precious Metals IRA

This retirement account uses pretax dollars. Your money grows tax-deferred, and you pay income taxes when you take withdrawals in retirement. Most people with earned income can open this type of account. You may be able to deduct your contributions, depending on whether you or your spouse has a retirement plan at work.

Roth Precious Metals IRA

A Roth Gold IRA uses after-tax dollars, so there’s no tax deduction when you contribute. The benefit comes later because qualified withdrawals in retirement are tax-free. There are income limits for Roth IRAs, so if you earn above a certain amount, you may not be able to contribute directly.

SEP Precious Metals IRA

A SEP IRA is for self-employed people or small business owners. You make contributions to this retirement account with pretax dollars. The limits are higher than with traditional or Roth IRAs, and you pay taxes when you take withdrawals in retirement.

What precious metals can you buy?

The Internal Revenue Service seeks to protect investors from scams and verify that you’re getting quality physical metals that you can easily sell in the future. Approved precious metals include gold, silver, platinum, and palladium that meet these requirements:

- Purity: Gold must be 99.5% pure, silver 99.9%, and platinum/palladium 99.95%.

- Form: Bullion coins, bars, or rounds.

- Manufacturer: The metals must come from accredited refiners or government mints.

Example coins include the American Gold Eagle and the Canadian Maple Leaf. Popular refiners for bars and rounds include PAMP Suisse and Valcambi. When you are ready to hold gold in your account, precious metals dealers like Swiss America can show you the different options available.

Storage rules for precious metals IRAs

The IRS has strict rules for where you need to keep precious metals physical assets inside of individual retirement accounts. You can’t keep gold or other metals at home or in a personal safe. If you do, the IRS counts it as a withdrawal, which means you will owe taxes and possibly an early withdrawal penalty if you are under retirement age.

Instead, the IRS requires you to store precious metals at a depository. These are secure facilities that include insurance coverage to protect your investment. Examples include Delaware Depository or Texas Bullion Depository.

What are the tax rules for Gold IRAs?

Tax rules for Gold Individual Retirement Accounts include:

Contribution limits and deductions

The maximum amount you can contribute in 2026 is $7,500 if you’re under 50 or $8,600 if you’re 50 and over. One of the tax advantages of a traditional IRA is that you might be able to deduct your contributions and reduce your taxable income. You can find the IRS rules directly on their website to see if you meet the specific qualifications.

As mentioned above, with a Roth IRA, you can’t deduct your contributions since they’re made with after-tax dollars.

Distribution and withdrawals

Distribution rules are the same as those of a traditional brokerage account IRAs. Once you reach the retirement age of 59 1/2, you can start taking withdrawals from your Gold IRA account. You can choose an in-kind distribution, where the dealer ships your gold directly to you, or you can have them sell the metals and take the cash instead.

If you have a traditional IRA or SEP IRA, you’ll need to start taking required minimum distributions (RMDs) at age 73. If you have a Roth IRA, there aren’t RMD requirements, so you can keep your physical gold and other precious metals in the account indefinitely if you want.

Costs and fees of Precious Metals IRAs

A physical Gold IRA may have higher costs than a traditional IRA. Fees you can expect include:

- Account setup fee: A one-time fee to open your account with a custodian.

- Annual maintenance fee: This yearly fee covers the custodian’s cost to manage your account and handle reporting to the IRS.

- Storage fee: A fee for keeping your metals in an IRS-approved depository. The cost depends on the amount of metal you own and the storage facility you choose.

- Dealer markup: When you buy physical gold coins or bars, the price is higher than the current spot price. This extra cost is called a premium and varies by product and dealer.

Pros of investing in precious metals

People turn to physical gold or other precious metals to diversify their wealth from the ups and downs of other investments. That’s why personal finance experts usually recommend holding 5% to 15% of your retirement portfolio in metals. The pros of holding precious metals include:

Inflation protection

Ever since 2022, you’ve probably noticed your money doesn’t go as far. Since there’s only so much gold in the world, its limited supply and built-in value mean it tends to rise when the dollar weakens. That makes it one of the simplest ways to keep your purchasing power intact and hedge against inflation.

Safe haven asset

People turn to gold and other physical metals when they’re worried or there’s economic uncertainty. Right now, we have tariffs, higher interest rates, and geopolitical conflicts, which is why gold is up over 44% over the past year.

No counterparty risk

Ever since 1971, when President Nixon ended the gold standard, gold has been completely separate from the U.S. dollar. When you own it, you don’t rely on a bank, the government, or anyone else. Its value stands on its own.

Easy to sell

Investment-grade coins or bars are easy to sell. They’re recognized everywhere around the world, and you can always sell them back to your precious metals dealer when ready.

Cons of investing in precious metals

There’s always drawbacks to any investment. Here’s what you should consider if you’re looking to purchase gold or other metals with your self-directed IRA:

No income

Gold doesn’t generate income, so you won’t see dividends or cash flow. It’s more of a defensive asset, which means holding it in your retirement account could mean missing out on growth you might get from other investments.

Fees

Depending on the company you work with, a Gold IRA might have higher fees than traditional investments. This includes custodian account fees, storage fees for the metals, and premiums above the spot price when you buy coins or bars in your self-directed IRA.

Market volatility

Precious metals prices can change. They often rise during uncertainty but can just as easily pull back, which means your account value will fluctuate.

More complex setup

It takes extra coordination between you, the custodian, and the gold dealer. There might also be an initial purchase requirement. For example, Swiss America’s minimum purchase requirement to get started with a Gold IRA is $5,000.

Here’s a quick overview of the pros and cons of a Gold IRA:

| Pros | Cons |

|---|---|

| Hedge against inflation | No income or dividends |

| Safe haven during uncertainty | Higher fees than traditional IRAs |

| Diversifies your portfolio | Market prices can be volatile |

| Easy to sell globally | More complex setup process |

What to look for in Gold IRA companies

The Commodity Futures Trading Commission (CFTC) regulates trading in precious metals. So you’ll want to only work with dealers and custodians who follow industry standards. Other areas to evaluate include:

- Track record: Look for a Gold IRA company like Swiss America that has decades of experience and positive customer reviews.

- Upfront costs: The custodian you choose should provide details on fees for account setup, storage, and annual maintenance fees.

- Education and support: The dealer should help you understand details about investing in precious metals and the various options available.

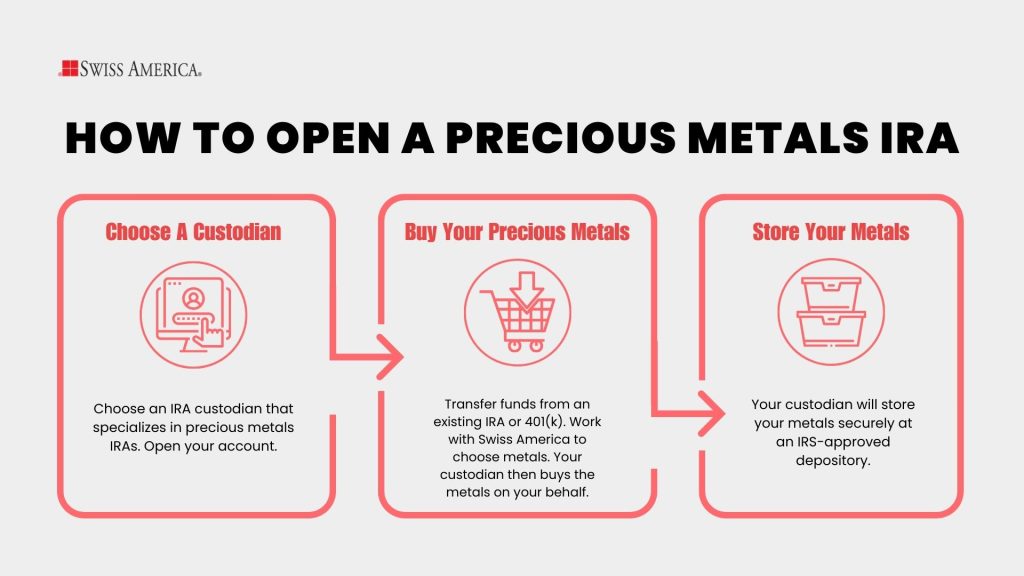

Steps to set up a precious metals IRA

You can set up a Gold IRA retirement account in three steps:

Step 1: Open an account with a custodian

Work with a reputable precious metals dealer to choose a self-directed IRA custodian like Equity Trust or Gold Star Trust. Their role involves managing your funds, buying and selling on your behalf, and verifying that your account follows IRS rules.

Step 2: Fund the account

Fund your account. You can roll over money from an existing IRA, 401(k), or simply add new funds from outside savings.

Step 3: Buy and store your metals

Work with your dealer to pick IRS-approved physical precious metals. Your custodian finalizes the purchase and sends your metals to an approved depository for secure storage.

Resources for Precious Metals IRAs

Besides gold dealer educational resources, you can also learn more about investing in precious metals with your retirement savings from resources like:

- IRS: The IRS website explains the official rules for contribution limits, withdrawals, taxes, and what types of metals qualify for IRAs. This is the best place to confirm current regulations.

- U.S. Mint: You can find details on approved coins and bars at the U.S. Mint website.

- Better Business Bureau: The BBB lets you look up ratings and reviews for custodians, dealers, and storage facilities to verify a company’s reputation before you open an account.

- World Gold Council: The World Gold Council tracks global gold demand, prices, and trends. It’s a good resource for understanding the gold market and how it changes over time.

Is a Gold IRA right for you?

Should you move forward with a Precious Metals or Gold IRA? The answer depends on how confident you feel about your current portfolio. Do you expect more economic uncertainty ahead? Do you think future crises or stock market swings could affect your savings? If so, a Gold IRA may be a smart way to help protect your wealth.

Connect with the Swiss America team today to learn about the best Gold IRAs for your specific needs.

Precious Metals IRAs: FAQs

Is a precious metal IRA a good idea?

If you want to diversify your investments beyond the stock market and hold gold with your retirement account while also enjoying all the tax benefits of a traditional IRA, it can be a good idea.

What is the average return on a Precious Metals IRA?

According to Statista, over the last 54 years, the average annual return on gold is 8.62%.

How to add precious metals to IRA?

Open a self-directed IRA with an approved Gold IRA custodian, fund the account, choose IRS-approved metals, and store them in a secure depository.

The information in this post is for informational purposes only and should not be considered tax or legal advice. Please consult with your own tax professionals before making any decisions or taking action based on this information.